INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Arista Networks Inc. comfortably beat expectations today as it delivered its fourth-quarter financial results, showing impressive revenue growth and offering a strong forecast for the current quarter.

Arista’s stock initially gained 3.5% in extended trading before pulling back slightly for a 1% gain. The stock had risen 2% earlier in the day.

The company reported net income for the quarter of $427.1 million, up from $239.3 million a year earlier. Earnings before certain costs such as stock compensation came to $1.41 per share, well ahead of Wall Street’s target of $1.21 per share. Revenue rose by 55% from a year earlier, to $1.28 billion, well ahead of the analysts’ consensus estimate of $1.2 billion.

Arista also reported full-year earnings of $4.27 per share on revenue of $4.38 billion, up 48% from a year before.

The company is seen as a rising star in the computer networking industry. It sells premium network equipment such as high-speed switches that speed up communications between racks of computer servers in data centers.

The bulk of its switches are sold to hyperscale data center operators such as Google LLC, Meta Platforms Inc. and Microsoft Corp. Arista also sells enterprise campus switches to smaller companies that run their own on-premises data centers, where it competes more directly with Cisco Systems Inc.

The second aspect of Arista’s business is network management and security software and services. It sells software that’s used by companies to keep their networks running smoothly and identify the causes of faults, monitor user experiences and tackle security threats.

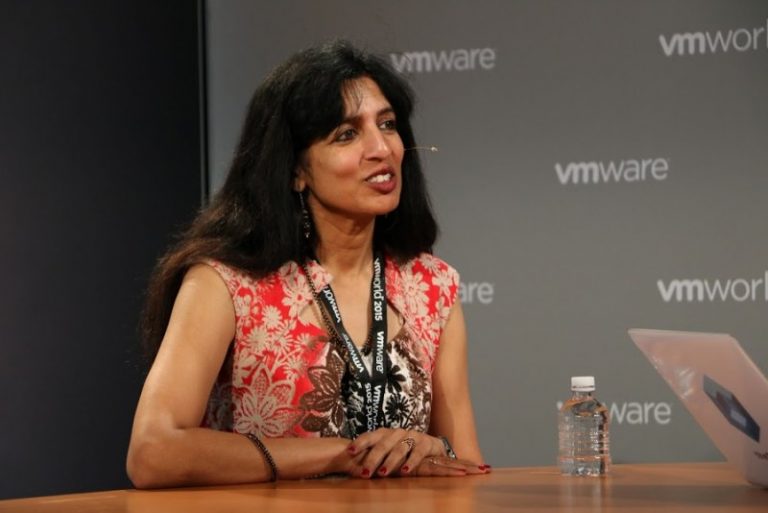

Arista President and Chief Executive Jayshree Ullal (pictured) said in a statement that the company’s success is based on its innovative network transformation platforms that enable data-driven cloud networking. “Despite having to navigate industry wide supply chain challenges, FY22 was a year of record performance exceeding expectations in growth, revenue and profitability,” she said.

Holger Mueller of Constellation Research Inc. told SiliconANGLE that Arista once again showed that there’s room for growth in the networking market, even if its rivals are struggling. “With its full-year revenue up by almost 50% from a year ago, it is clear that Arista has avoided the same headwinds that have slowed down virtually everyone else in the enterprise hardware and software space,” he said. “Arista’s management team has balanced innovation, costs and go-to-market very well, and investors will be hoping this continues as it heads into the new financial year.”

Arista seems confident that it can continue to grow its revenue rapidly, despite the slowing economy. For the first quarter of fiscal 2023, it’s targeting revenue of between $1.27 billion and $1.33 billion, way ahead of Wall Street’s forecast of $1.21 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.