CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Rippling, a startup with a popular cloud-based workforce management platform, today disclosed that it has raised $500 million in funding.

Existing backer Greenoaks Capital was the lead investor and reportedly increased its stake by 4%. The round keeps the startup’s valuation at the $11.25 billion it was worth following a previous $250 million raise last May. In total, it has received about $1.2 billion from investors since launch.

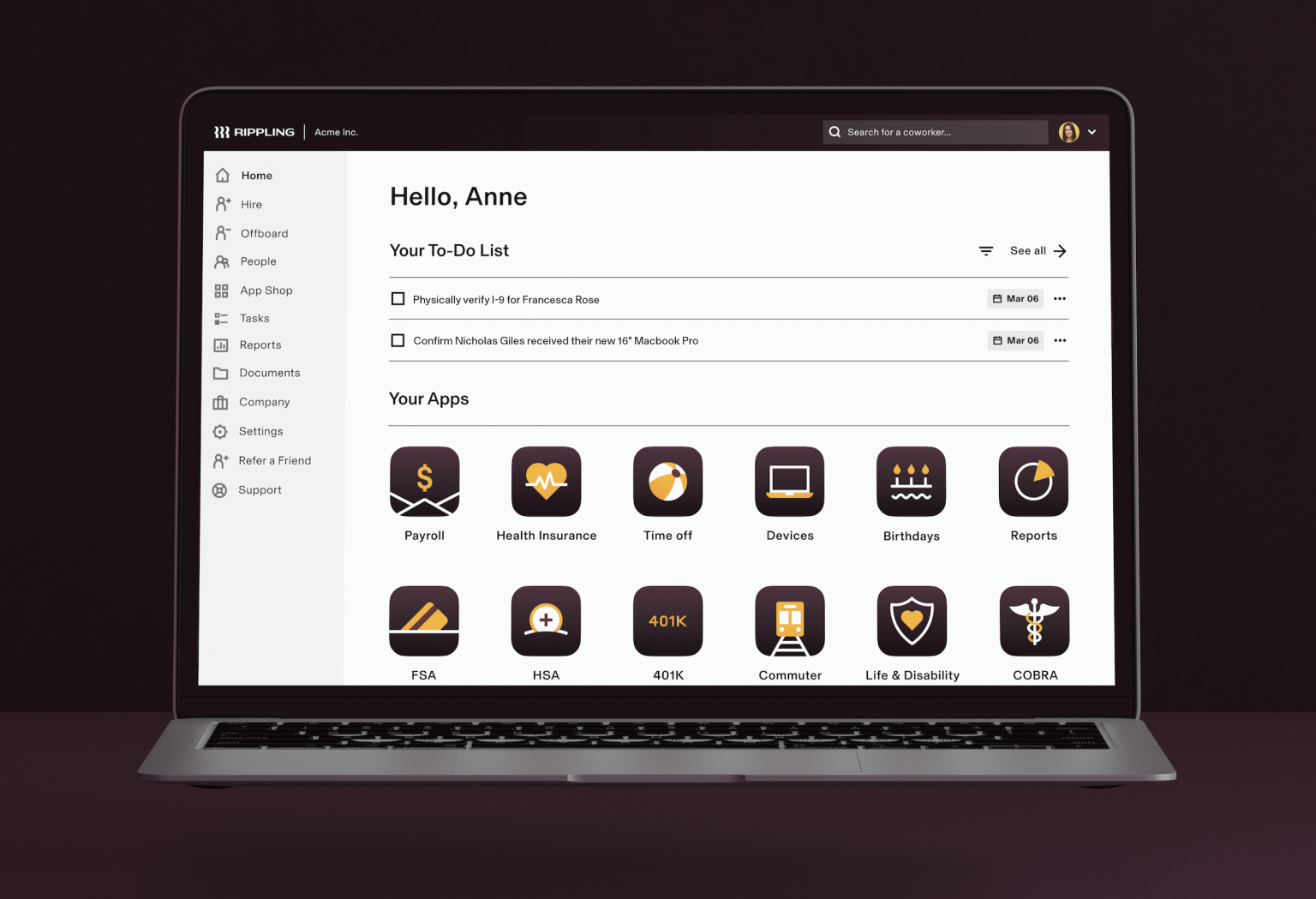

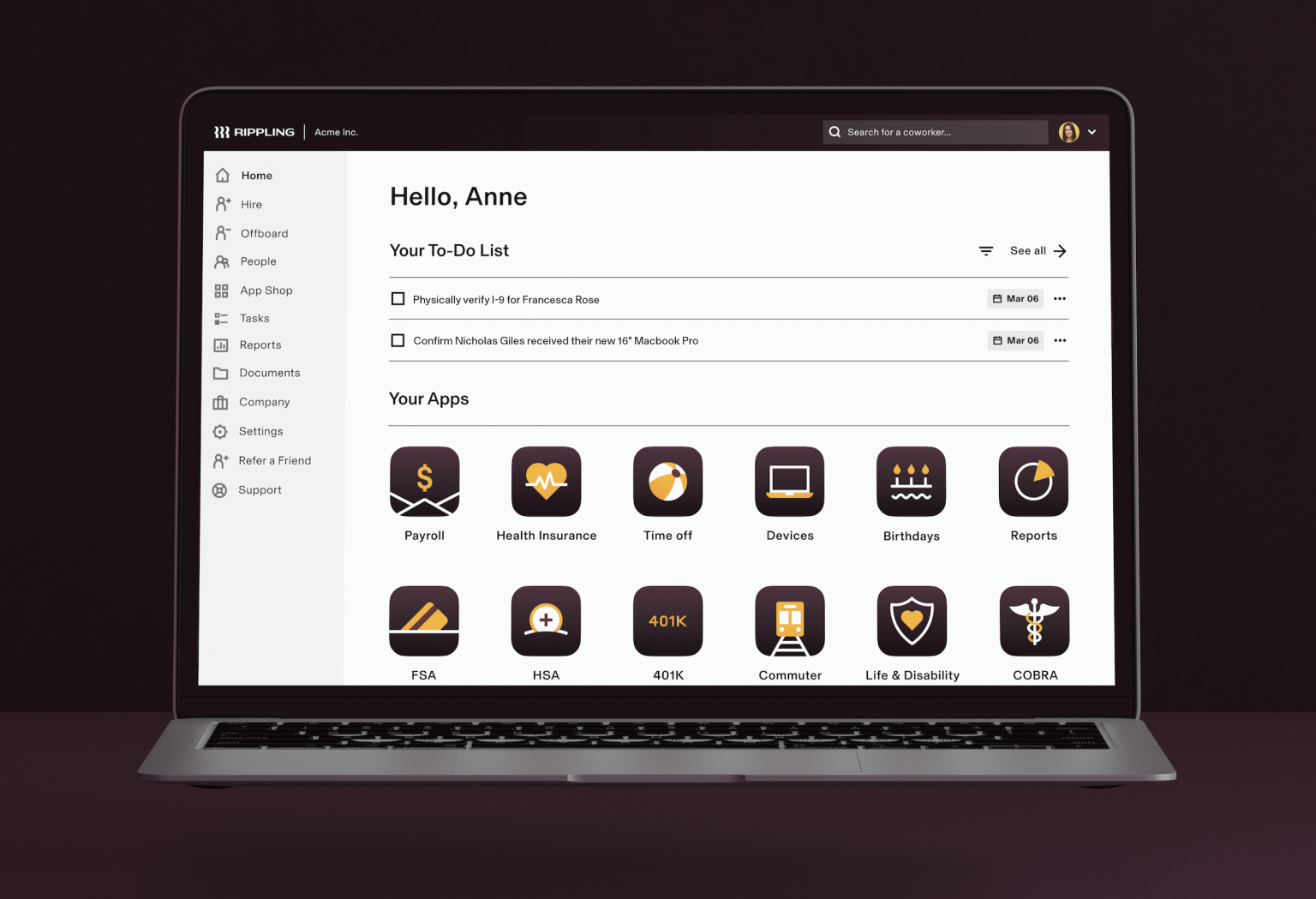

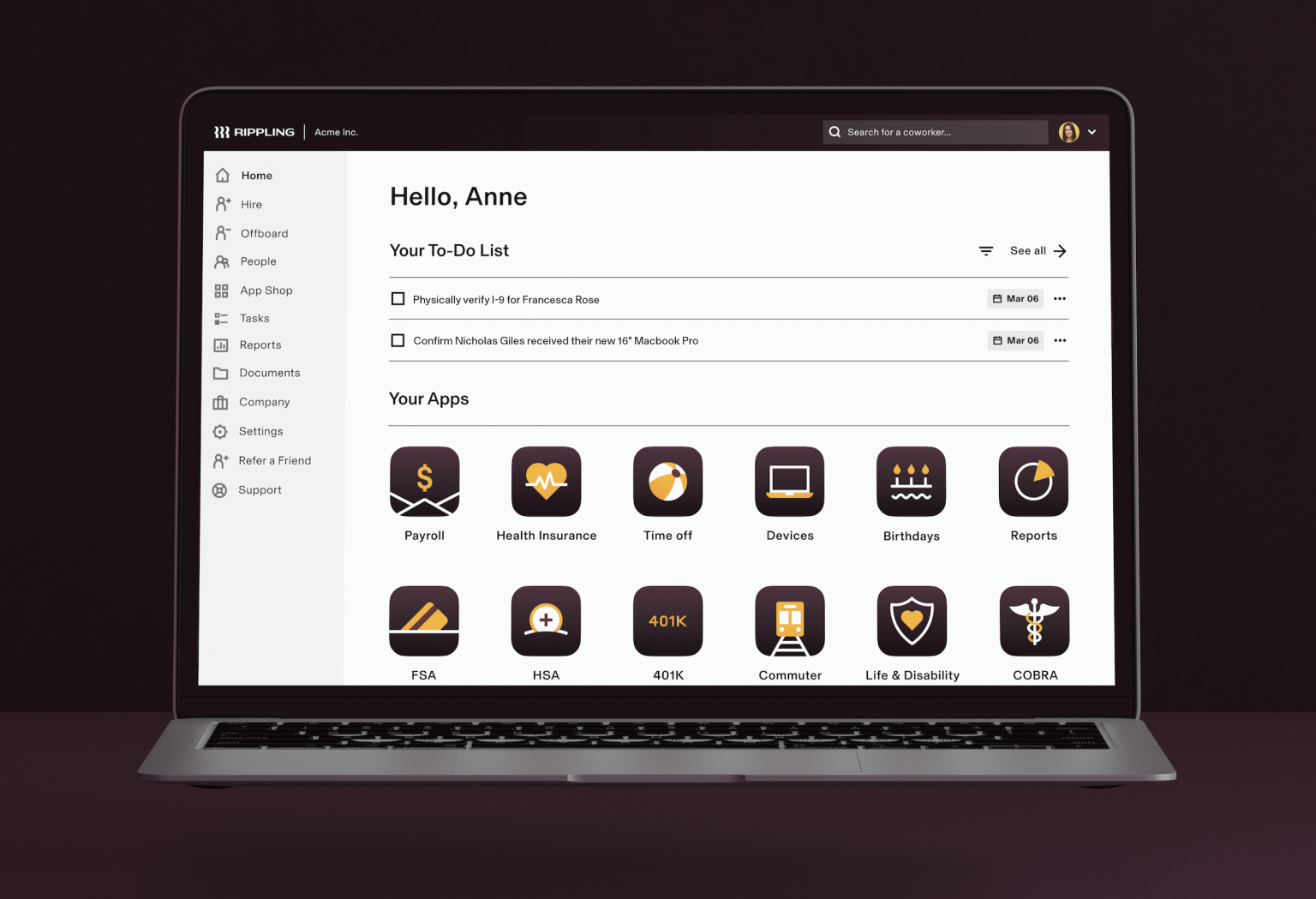

Rippling, officially Rippling People Center Inc., provides a cloud platform that human resources teams use to perform their day-to-day work. The platform provides features for carrying out payroll administration tasks and enrolling employees in health insurance. Additionally, it includes a workflow tool for automating related data entry chores.

The company reportedly closed its newly announced $500 million round unusually quickly. It began fundraising last Friday morning, in response to the news that financial regulators had shuttered Silicon Valley Bank. It signed the paperwork that made the deal official the following Monday.

Companies that rely on it for payroll administration use the startup’s platform to pay their employees. Rippling, in turn, relied on Silicon Valley Bank to issue employee payments. Following the bank’s closure, a number of Rippling customers experienced payment delays and the startup was reportedly concerned broader interruptions could follow.

In response, the startup last Friday began raising the funding round that it announced today. The plan was to use the funds to help the companies that use its platform pay their employees.

Over the weekend, before Rippling closed the round, the U.S. government backstopped Silicon Valley Bank deposits. The U.S. Treasury Department announced on Sunday that clients would receive full access to their funds on Monday. Nevertheless, Rippling decided to proceed with the round and closed it on Monday morning.

Alongside its core payroll and benefits management features, Rippling offers several other workforce management tools. For information technology teams, the startup provides a tool that makes it easier to manage employee access to internal applications. For accounting departments, it offers the ability to issue corporate payment cards to workers.

Rippling has also added a variety of other features to its platform in recent years. Those investments in product development helped the startup achieve rapid rapid growth. Rippling Chief Executive Officer Parker Conrad told Reuters today that the startup is generating more than $100 million in annual recurring revenue and growing at a rate of over 100% annually.

According to Reuters, Rippling estimates that this week’s funding round could be its last before going public. However, the startup reportedly doesn’t yet have “specific plans” for a stock market listing.

THANK YOU