CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Startup Cable Tech Inc. has secured $11 million in funding for its namesake cloud platform, which helps banks more effectively detect financial crime.

U.K.-based Cable announced the Series A round on Thursday. Stage 2 Capital, Jump Capital and returning backer CRV provided the funding. Their investment brings Cable’s total outside financing to $16.3 million.

Banks use automated software controls to detect financial crime such as money laundering. To test that the controls work as intended, regulatory compliance teams manually analyze financial records for signs of illicit activity. If issues are found, a bank can determine that its automated detection workflows require improvement.

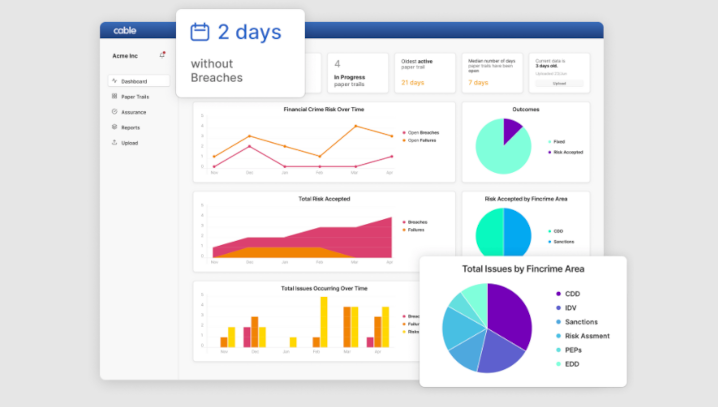

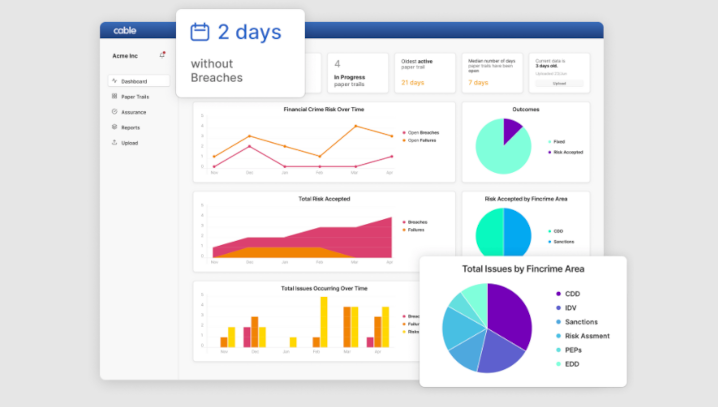

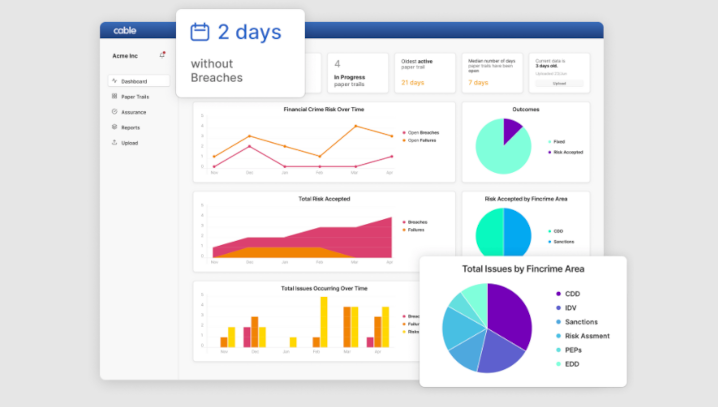

Cable’s platform promises to automate much of the manual work involved in the task. The platform analyzes the effectiveness of a company’s financial controls and automatically generates a report that summarizes key findings. For each control, it produces a score ranging from 0 to 100 that indicates how effectively it’s implemented.

The platform also helps banks monitor other aspects of their financial crime prevention programs. It provides a dashboard that tracks what types of financial crime are detected most often, how frequency they occur and related metrics. The dashboard also provides data about the efficiency of a bank’s issue remediation workflow.

Many banks integrate their infrastructure with third-party fintech products. A financial institution might, for example, allow customers to connect credit cards issued by a fintech startup to their bank accounts. Before adding an integration with an external service, banks must ensure that the offering meets cybersecurity and regulatory requirements.

Cable says its platform streamlines the task. Banks can use the platform to collect information about fintech companies’ regulatory compliance controls, as well as manage the data review process.

The platform also provides collaboration features to ease compliance teams’ work. Managers can assign risk mitigation tasks to specific team members, as well as prioritize risks based on their severity. And it provides a tool that makes it possible to generate reports quickly about a bank’s cybercrime prevention program for executives and regulators.

“The need for Cable’s automated effectiveness testing has never been more pressing than right now, given the extreme volatility of the current regulatory and banking environment,” co-founder and Chief Executive Natasha Vernier wrote in a blog post. “Regulatory compliance and effective controls are front and center in regulators’ minds, especially in the financial crime space.”

Cable’s revenue reportedly grew fivefold in the year leading up to its newly announced funding round, off an undisclosed base. According to the startup, the proceeds from the round will go toward accelerating go-to-market and product development initiatives. The company will hire more employees to support the effort.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.