APPS

APPS

APPS

APPS

APPS

APPS

Shares in both PayPal Holdings Inc. and Robinhood Markets Inc., who financial technology leaders, fell by just over 7% in late trading despite both companies reporting earnings and revenue beats in their quarterly financial reports.

For its fiscal second quarter ended June 30, PayPal reported earnings before certain costs of $1.16 per share, up 24% from 93 cents per share in the same quarter of last year. Revenue rose 7%, to $7.3 billion. Analysts had expected adjusted earnings of $1.15 on revenue of $7.27 billion.

Adjusted operating income in the quarter rose 20%, to $1.6 billion, and total payment volume rose 11%, to $376.5 billion. PayPal processed 6.1 billion payment transactions in the quarter, up 10%. The company had 431 million total active accounts as of the end of June, up from 429 million at the same time in 2022, with customers on average undertaking 54.7 payment transactions on a trailing 112-month basis, up 12% year-over-year.

The main highlight in the quarter was PayPal signing an exclusive partnership with KKR & Co. Inc. for European buy now, pay later or BNPL receivables on June 20. The transaction, which is expected to close in the second half of 2023, will see private credit funds and accounts managed by KKR purchase up to €40 billion ($43.78 million) of current and future BNPL loans originated in the U.K. and other European countries. Upon closing, Paypal expected around $1.8 billion in proceeds.

For its fiscal third quarter, PayPal expects adjusted earnings of $1.22 to $1.24 per share on revenue of about $7.4 billion. Analysts were expecting $1.22 per share and $7.33 billion.

Although the main figures were seemingly positive, it was a line item that disappointed investors. Fortune reported that analysts appeared more focused on the company’s operating margin, which has raised concerns in previous quarters. The company’s margin of 21.4% missed expectations of 22%.

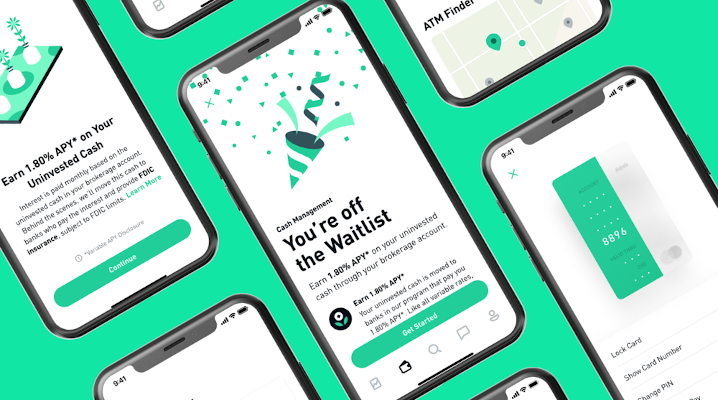

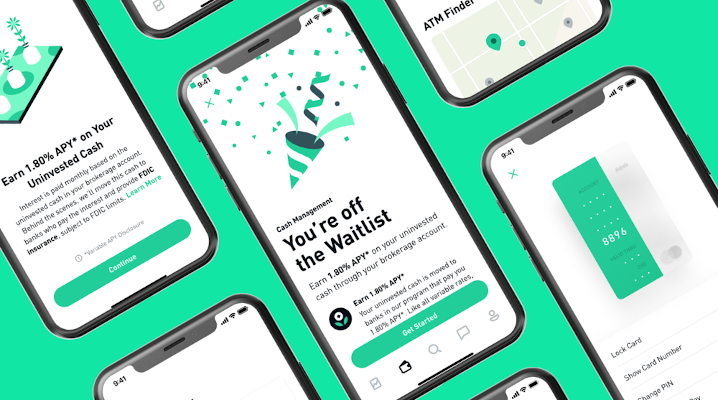

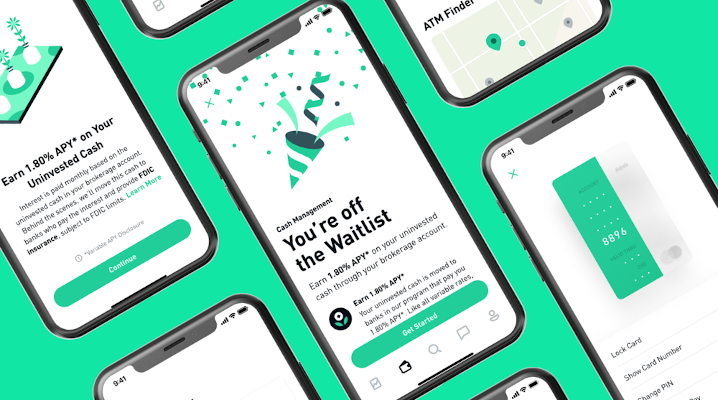

Robinhood also posted positive results in its fiscal second quarter, with the company reporting its first-ever profitable quarter.

For the second quarter that ended June 30, Robinhood reported net income of $25 million or three cents per share, a significant contrast to a loss of $295 million, or 34 cents per share, in the same quarter of last year. Revenue jumped 53%, to $486 million. Analysts had been expecting an adjusted loss of a penny on revenue of $472.94 million.

Although Robinhood’s headline figures were up as the company managed to reduce its operating expenses — down $484 million sequentially to $466 million — the number of people using the company’s service to trade also fell. Overall transaction-based revenue declined 7% in the quarter, to $193 million, with options trading down 5%, cryptocurrency trading down 18% and equities trading down 7%. Likewise, monthly active users fell by 1 million, to 10.8 million.

Highlights in the quarter included Robinhood Retirement continuing to see strong adoption, with IRA assets to date nearing $1 billion. Customers also continued to take advantage of the Robinhood Gold cash sweep program, which now offers a 4.9% yield.

For its full fiscal year, Robinhood now expects total operating expenses for the full-year 2023 to be $2.33 billion to $2.41 billion, lower at the midpoint by $45 million on its previous outlook.

Like PayPal, the headline figures were positive, but Robinhood investors were unhappy with the decline in trading volume and active customers.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.