POLICY

POLICY

POLICY

POLICY

POLICY

POLICY

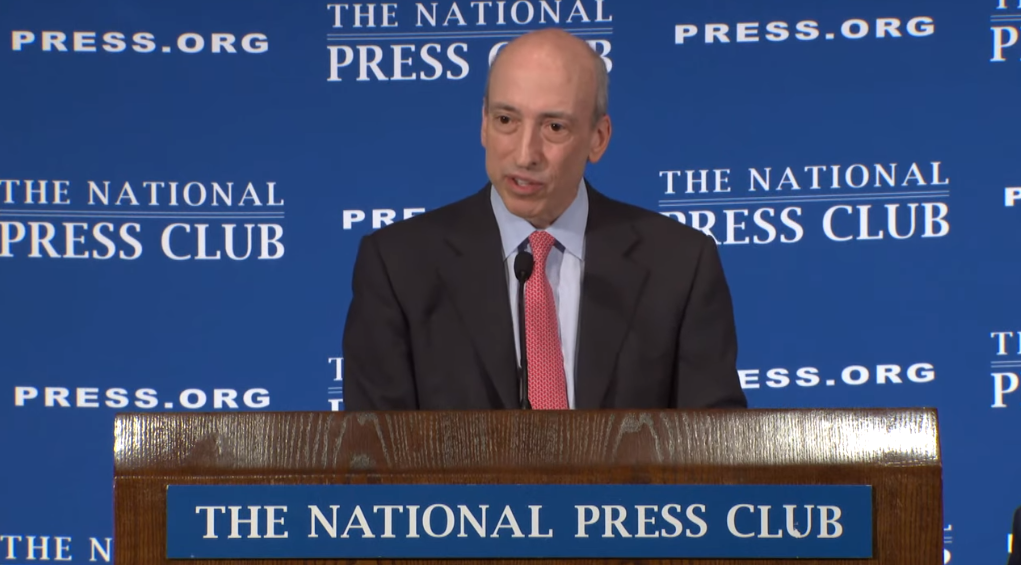

Gary Gensler, the chair of the U.S. Securities and Exchange Commission, has warned that artificial intelligence software could lead to a financial crisis if it’s not properly regulated.

Gensler shared his views during an interview with the Financial Times that was published on Sunday. He said AI could lead to a financial crisis as soon as the late 2020s or early next decade if effective regulatory guardrails are not put in place. Gensler added that a failure to implement the necessary AI rules in time would make a financial crisis “nearly unavoidable.”

“Maybe it’s in the mortgage market. Maybe it’s in some sector of the equity market,” he said.

A core focus of the concerns raised by Gensler is that enterprise-grade, cloud-based large language models are currently available from only a handful of tech companies. This limited product choice means that numerous financial institutions could end up using a single supplier’s AI model to make important decisions. If that one AI model makes a mistake, all the financial institutions using it could be affected, which may have a broad impact on the economy.

The matter of exactly how regulators such as the SEC would go about regulating AI is “frankly a hard challenge,” Gensler told the Financial Times. He said that merely updating existing financial regulations wouldn’t be sufficient to mitigate AI-related market risks fully. The reason, Gensler explained, is that existing regulations place relatively little emphasis on “horizontal” technologies such as AI, meaning technologies used by a large number of financial institutions.

Gensler pointed to the cloud-based nature of many machine learning products as another challenge. The AI models that financial institutions use to power their operations often run not on their on-premises servers, but rather infrastructure operated by a third-party tech company. That might complicate regulatory efforts.

Because there are so many moving parts involved, multiple federal agencies may have to join forces on regulating AI. Gensler told the Financial Times that he raised the topic at the Financial Stability Oversight Council, a government organization dedicated to tackling financial risks. The council includes representatives from multiple federal agencies including the SEC.

The SEC is not the only regulator taking a closer look at the market impact of AI. In July, the U.S. Federal Trade Commission opened a probe into OpenAI LP’s business practices. The European Union, meanwhile, is currently rolling out legislation that will place new regulatory requirements on OpenAI and other AI providers.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.