INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Stack Infrastructure Inc., a company that builds data centers for cloud providers and other organizations, has secured $290 million in fresh debt financing.

The company raised the capital through a sale of securitized notes, or loans marketed to investors, that it announced today. The loans carry a 5.9% annual interest rate. The round is the third deal of its kind that Stack Infrastructure has closed since the start of the year. It previously raised $500 million through two securitized note transactions with similar terms.

Denver-based Stack Infrastructure was launched in 2019 by an affiliate of technology investment firm ICONIQ Capital. It has since raised about $2.59 billion in debt including today’s round and used the capital to build more than a dozen data centers worldwide. The company intends to build more facilities in the future, a plan that its latest $290 million cash injection should advance.

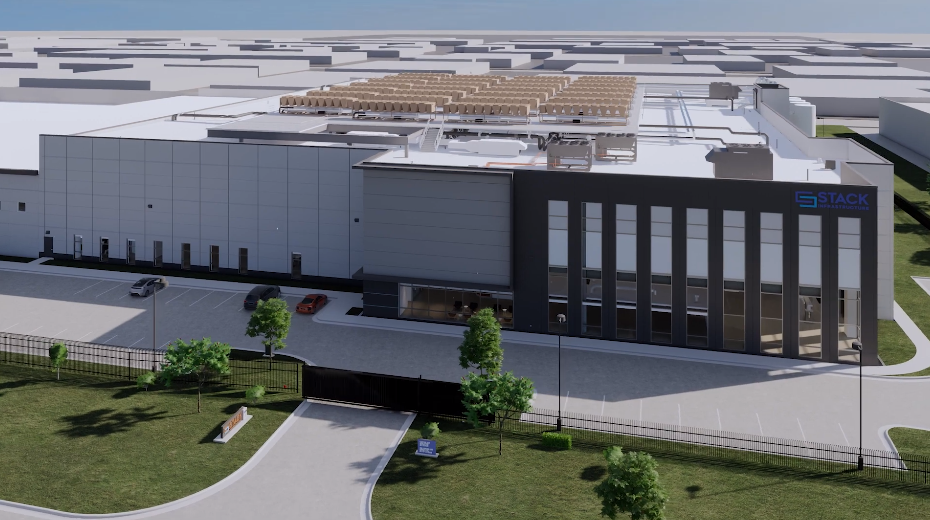

Stack Infrastructure builds made-to-order data centers for customers such as cloud providers. The company offers access to ready-to-use blueprints and an established supply chain that it says can speed up construction. For customers with less complex requirements, Stack Infrastructure provides the ability to rent space in existing data centers or buy empty facilities known as powered shells.

The company is expanding its real-estate footprint at a rapid clip. Since its previous debt financing round in August, it has inaugurated two new data center campuses.

The first campus, in Melbourne, Australia, features two data centers powered by a dedicated electrical substation. A few weeks ago, Stack Infrastructure inaugurated another new location in Toronto. It’s situated a few miles from Canada’s largest carrier hotel, a facility where multiple internet providers store servers to facilitate the transfer of data traffic between their networks.

Stack Infrastructure says that its construction roadmap includes “4.0+ GW of planned and potential” facilities around the world. One GW, or gigawatt, of electricity is enough to power about 750,000 households.

One of the largest projects in Stack Infrastructure’s pipeline is an Arizona data center campus expected to house five facilities. Those buildings are set to use up to 250 megawatts of power, or a quarter of a gigawatt. Stack Infrastructure also has plans to build data centers in Tokyo, Osaka, Seoul and several other cities.

Stack Infrastructure’s latest debt round comes at a time when broadening artificial intelligence adoption is driving increased demand for data center space. Earlier this year, TD Cowen financial analysts projected in a memo that the data center leasing market will “pick up in earnest in 2H23 and accelerate into 2024.”

The sales boost is expected to be driven partly by demand for facilities with liquid cooling equipment. Such gear can dissipate server heat using less power than traditional cooling equipment. That’s particularly valuable for AI-optimized servers equipped with graphics cards, which generate significantly more heat than central processing units.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.