INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Data center server shipments are set to plummet by up to 20% this year, but some of the companies that make them will be laughing all of the way to the bank, as their revenues are set to increase anyway due to the demand for more sophisticated artificial intelligence hardware.

In its latest Cloud and Data Center Market Update, Omdia identified a trend it has labeled “hyper heterogeneous computing,” in which servers are packing more silicon chips to handle AI workloads, thus driving up their cost.

While server shipments are forecast to dip by between 17% and 20% in 2023, revenue is expected to grow by between 6% and 8%, the research outfit said.

With the hyper heterogeneous computing trend, more servers are being configured with co-processors in order to optimize their performance for specific workloads, Omdia said. For instance, servers with integrated AI accelerators are becoming increasingly popular. A prime example is Nvidia Corp.’s DGX server, which can be configured with a choice of that company’s H100 or A100 graphics processing units. Other AI accelerators include Amazon Web Services Inc.’s inference hardware, which ships with the company’s customized Inferentia 2 coprocessors.

Other kinds of coprocessors are also included in the trend, including Google LLC’s video transcoding servers for media processing tasks, which can feature up to 20 Video Coding Units or VCUs.

According to Omdia, this accelerating trend will see CPUs and coprocessors account for more than 30% of data center spending by 2027, compared to less than 20% a decade ago.

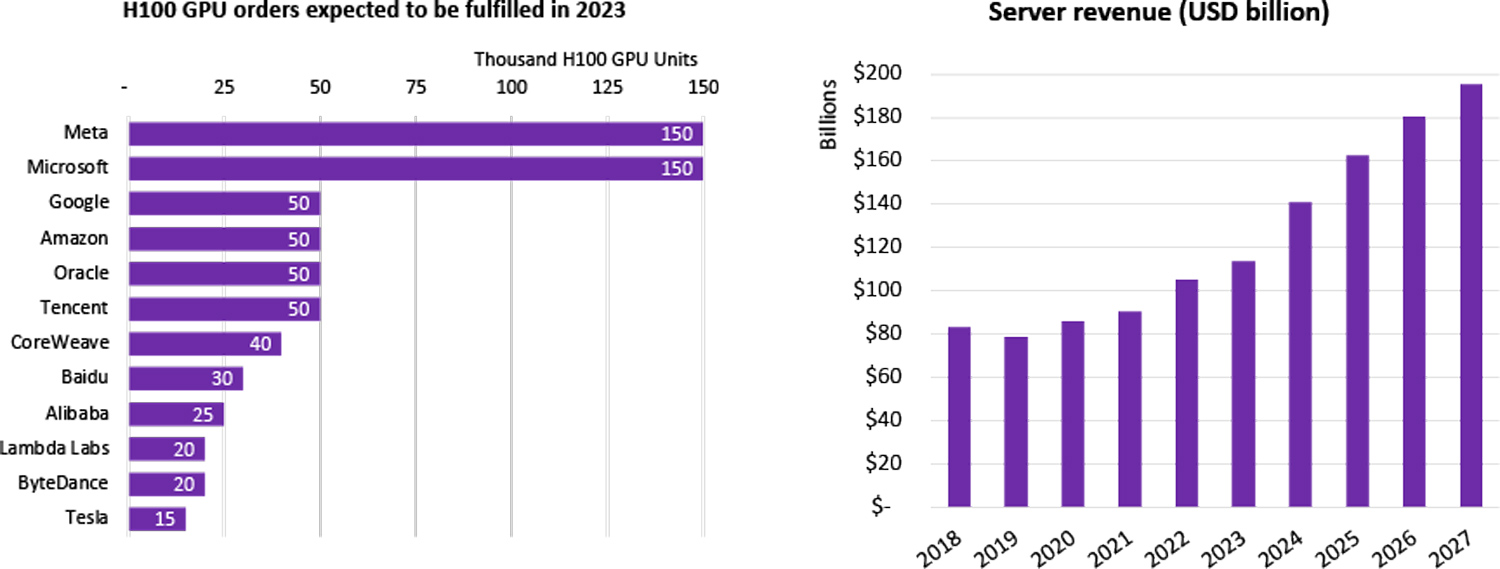

Microsoft Corp. and Meta Platforms Inc. are the leading buyers of coprocessors, with both companies expected to receive more than 150,000 of Nvidia’s H100 GPUs by the year’s end, triple the number that Google, Amazon and Oracle Corp. will get their hands on.

The report also reveals that the demand from cloud hyperscalers is such that it’s having a negative impact on more traditional server makers such as Dell Technologies Inc., Hewlett-Packard Enterprise Co. and Lenovo Group Ltd. Those companies are reportedly struggling to fulfill orders for GPU-powered servers due to Nvidia’s supply issues, with lead times of between 36 and 52 weeks.

With the growing demand for more powerful servers, data center operators are also spending more money on power and cooling infrastructure, Omdia reported. Revenue from rack power distribution gear jumped 17% in the first half of the year, while spending on cooling technologies increased 7%. Within that last segment, spending on direct-to-chip liquid cooling systems is expected to rise by 80% this year.

Omdia said the trend for data center operators to buy fewer, but much more powerful server systems is expected to accelerate in the next few years, and it is forecasting overall spending in the sector to grow by 10% every year between now and 2027, when it will surpass $195.6 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.