AI

AI

AI

AI

AI

AI

Tax preparation company H&R Block Inc. today introduced a conversational artificial intelligence chatbot designed to answer tax questions for tax filers preparing their own documents.

The technology uses generative AI, the same sort of intelligence that powers OpenAI’s chatbot ChatGPT, combined with H&R Block’s deep expertise in tax laws to provide real-time tax assistance. The chatbot is available in the company’s online DIY tax software, which allows users to talk to ask questions about how to get started filing their taxes, possible exemptions, issues they might run into and if it can’t handle that it will direct them to human experts.

“Individuals are increasingly exploring AI technologies for greater efficiency, but those tools are only reliable if developed with accurate information from trustworthy sources,” said Heather Watts, senior vice president of consumer tax products at H&R Block.

Watts said that too often, do-it-yourself tax filers rely on community forums and search results to get the information they to file their taxes, which can sometimes lead to misleading or incorrect information. This often means bad outcomes for those filers and that’s not a good experience.

“AI Tax Assist leverages H&R Block’s trusted tax expertise and generative AI technology to empower DIYers to file how and when they want with the confidence of knowing they have expert help if needed without paying more,” said Watts.

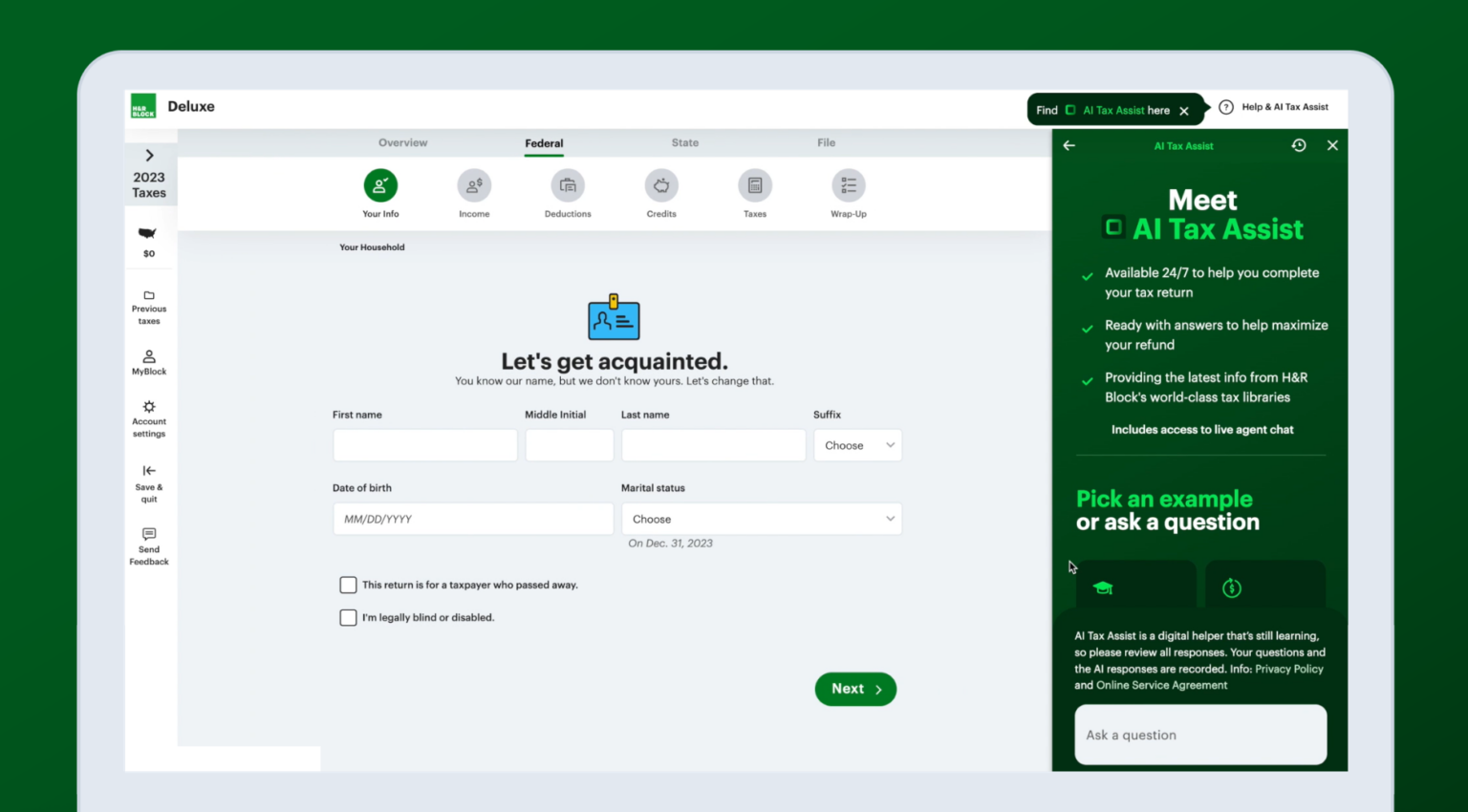

The AI Tax Assist lives in a panel on the side and is powered by Microsoft Corp.’s Azure OpenAI service, the company said. It was trained using an amalgam of the company’s knowledge from more than 60,000 tax professionals and knowledge regarding the current United States federal and state tax laws.

For users, it AI is designed to be a conversational experience that allows them to quickly stop by and ask questions such as getting information on tax forms, deductions and credits. It can also provide them swift, easy-to-understand guides on specific rules and help them navigate the complex sets of forms when they might have an edge case that may require a specialized understanding, such as if an individual is a gig worker or a small business owner.

The objective of the interface is to make it feel like the user is talking to one of the company’s accountants and receiving up-to-date, accurate information directly from the source. As a result, users can feel more comfortable and stay within the product and thus have a better experience. H&R Block did warn that the AI could still hallucinate, but users can still double-check with a human in complex or problematic situations.

In addition to helping with specific tax rules, the AI assistant can also provide direction as to which DIY product might be best for the individual filing situation. H&R Block said the AI Tax Assistant is not available in its free online filing app, but it’s available at no cost in the first tier of its online edition and above starting at $35.

Intuit Inc., the maker of TurboTax and QuickBooks, also released a generative AI-powered assistant for its products called Intuit Assist earlier this year. Intuit Assist can help users in TurboTax, the company’s tax preparation software, with questions about taxes and provide similar proactive insights and advice and real-time checks for accuracy and completeness for their filings.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.