INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Astera Labs Inc., a startup that supplies networking chips to cloud operators, today filed for an initial public offering on the Nasdaq stock exchange.

The news comes about a year after the company closed a $150 million funding round backed by Intel Corp.’s venture capital arm. The investment valued Astera at $3.15 billion. Earlier this month, The Information reported that the forthcoming public offering could give the company an initial market capitalization of up to $4 billion.

Astera said in its IPO filing that it counts “all the major” hyperscale cloud operators as customers. Those customers use the company’s chips for, among other tasks, powering their artificial intelligence infrastructure.

An AI-optimized server rack includes not only graphics cards but also central processing units, storage drives, networking gear and a range of other components. Those components are often linked together using copper cables based on a technology called PCIe. PCIe cables are only capable of transmitting traffic over a distance of a few feet, which constrains cloud operators in how they can design their server racks and data centers.

The reason for the technology’s limited transmission range is that network traffic flows through copper in the form of electric signals. As those signals zip through a PCIe cable, their accuracy declines. Past a certain distance, signal accuracy drops to such an extent that transmitting network traffic becomes impractical.

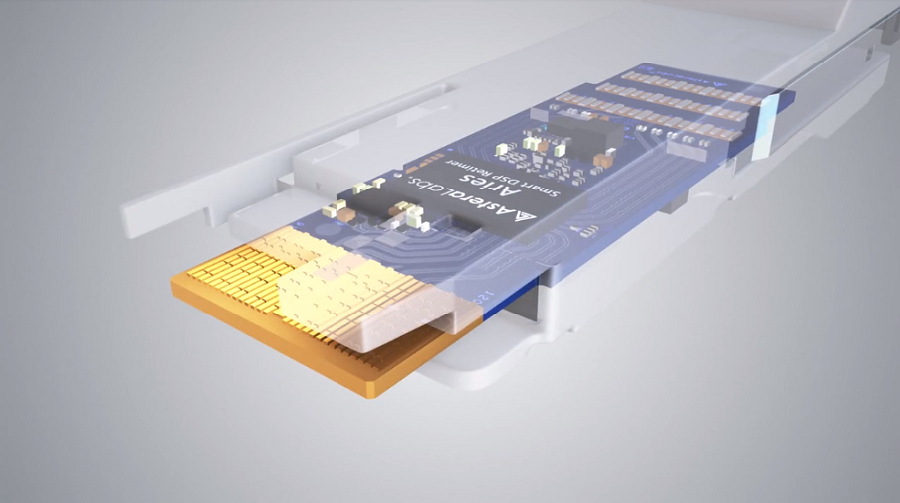

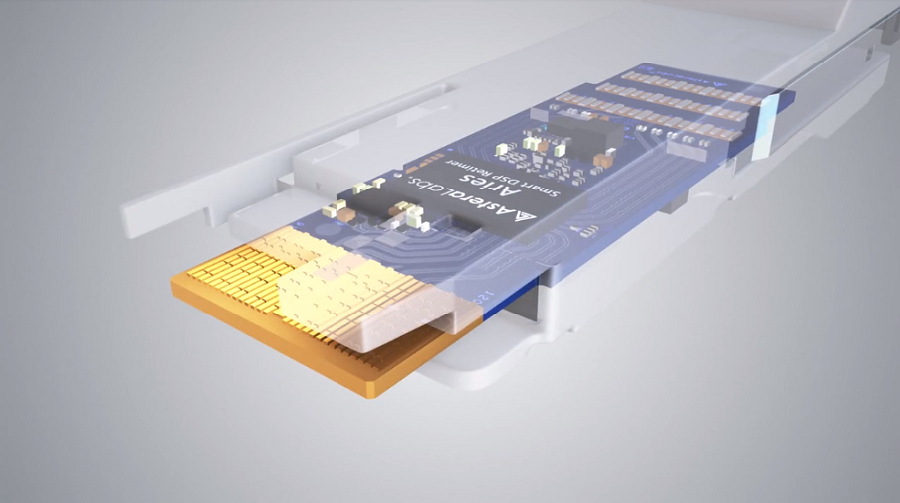

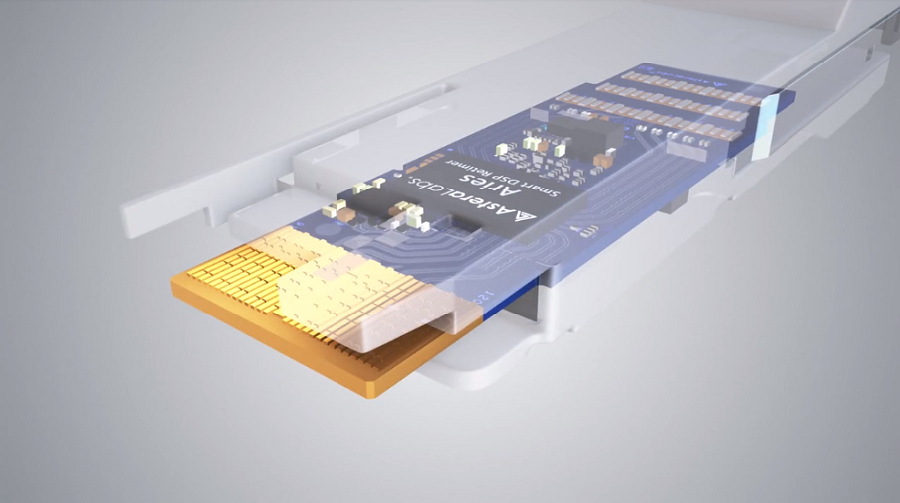

Santa Clara, California-based Astera has developed a chip called Aries that can be embedded into PCIe cables to extend their range. The chip does so by filtering the errors that find their way into data traffic while it travels across a PCIe link. After removing the interference, Aries replaces the original signal with a fresh copy and forwards it to the destination system.

The company says its silicon can triple the range of data center PCIe cables to more than 22 feet. That increased reach gives cloud providers more flexibility in how they design their AI hardware. For example, a data center operator could place certain components that are linked together by a PCIe cable farther apart than would otherwise be possible.

Astera sells a second chip series called Taurus that likewise focuses on extending the range of network links. It’s optimized for use not in PCIe environments, but rather the Ethernet cables used to connect servers with switches and switches with each other. Taurus makes it possible to transmit data over a distance of up to 9.8 feet.

The third product line, Leo, is a collection of memory controllers. Those are specialized chips that manage the movement of data in and out of a server’s onboard RAM. Astera says that the controller series allows multiple processors to share a single pool of memory, which is useful for AI environments where a large neural network is distributed across multiple graphics cards.

The company says that it has sold millions of chips to its hyperscale customers since launch. In 2023, strong demand sent Astera’s revenues rising 44.9% year-over-year to $115.8 million. During the same time frame, the chipmaker managed to slash its annual loss from $58.3 million to $26.3 million.

As a public company, Astera plans to maintain its financial momentum by developing new products and enhancing its three existing chip lines. Astera hinted in today’s IPO filing that it may also explore acquisitions. The company estimates that its total addressable market will reach $27.4 billion by 2027.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.