AI

AI

AI

AI

AI

AI

Global equity management startup Slice Global Ltd. is looking to expand after closing on a $7 million seed funding round led by TLV Partners.

Today’s round also saw participation from R-Squared Ventures, Jibe Ventures and the international law firms Wilson Sonsini Goodrich & Rosati LLP and Fenwick & West LLP, plus several unnamed angel investors.

The startup explains that many companies are offering equity to their most talented employees as part of their compensation packages, but in today’s global job market this can be problematic. Issuing equity to employees across the world involves navigating constantly changing tax laws and regulations that differ from country to country, which means companies face a significant risk of noncompliance and financial penalties. But if they don’t solve these headaches, they’ll be less able to attract the talent they need to grow their business.

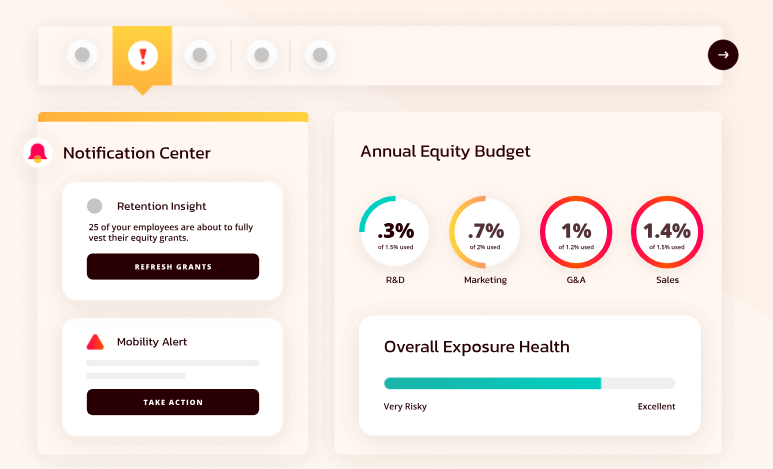

This is where Slice says it can help, providing the tools companies need to issue and manage equity to international employees in a compliant way, and helping them to navigate the continuously evolving tax codes and regulations in each jurisdiction. Its platform leverages generative artificial intelligence to do this, ensuring that all global equity operations are fully compliant and tax-optimized, helping companies to maximize the benefits of their equity plans.

Slice’s co-founders have the ideal background for navigating the minefield of global tax and equity laws. Chief Executive Maor Levran is a lawyer who was previously ranked as the world’s Top Tech Attorney by The Legal 500, while its Chief Technology Officer Aviram Berg is a skilled data scientist and engineer who formerly led the data management startup Dataloop Ltd. Its third co-founder, Chief Product Officer Yoel Amir, is an AI product management executive who forged his reputation at Salesforce Inc. and Google LLC.

Slice claims to be the first startup in the world to apply large language models to the problem of equity compliance. Its platform leverages algorithms that have been trained to learn and apply the specific tax codes and regulations around equity awards for every country. It works by actively monitoring, analyzing and implementing any changes to these rules in multiple countries, and covers all types of employee stock options. By leveraging Slice, companies can rest assured that any equity they issue to employees will be done in a compliant and legal way, meaning there’s no risk of financial penalties, according to the company.

Levran, who spent more than 13 years working as a corporate lawyer, said he has firsthand experience of the struggles companies face in granting and managing global equity to their international employees. “I recognized the almost impossible task they faced of understanding and applying the complex and constantly changing law and tax regulations in various countries, and know of individual fines reaching well over $200,000 due to mistakes being made,” he said.

Slice’s job is to prevent these fines, and it can be thought of as a kind of co-pilot for chief financial officers, Levran said, adding that it can handle months of complex work, that would normally be outsourced to local lawyers and tax advisors, in a matter of minutes. “This equates to a substantial saving on time and costs, and also helps avoid distress employees may experience over potential penalties,” he added.

Should any changes be made to the laws or regulations applicable to an employee’s equity, the platform will send a pre-emptive actionable alert to both the employee and their employer, allowing them to work out how to ensure they remain in compliance. At present, the platform supports 23 countries, including the U.S., the U.K., France, India, Australia, the Netherlands, Switzerland, Japan and Brazil, and the startup plans to add more to the list on an ongoing basis. By the end of the year, it hopes to scale to more than 100 countries.

Fenwick & West Partner Shawn Lampron said he has spent more than three decades working on compensation and benefits programs with global companies. “Seeing Slice’s international compliance capabilities in action was thrilling,” he said. “Slice simplifies the massive complexities associated with global compensation, automating an ever-changing process where the stakes for making a mistake are so high.”

Slice said it will use the funds from today’s round to further develop its platform to enable equity compliance in more legal jurisdictions. At the same time, it plans to implement its go-to-market strategies in both the U.S. and Europe to grow the adoption of its platform.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.