INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Shares of the chipmaker Intel Corp. traded almost 4% lower late today after the company revealed that it’s reorganizing the way it reports its finances to showcase the performance of its nascent chip foundry business.

In a filing with the U.S. Securities and Exchange Commission, Intel stated that the foundry business recorded an operating loss of $7 billion in fiscal 2023, despite generating $18.9 billion in revenue. That’s a much wider loss than the $5.2 billion Intel’s chip factory delivered in 2022, when it delivered $25.7 billion in sales.

It’s the first time that Intel has publicly broken out financials for its foundry business. The company is unlike many other chipmakers in that it not only designs but also manufactures its own silicon products, and traditionally it has only reported the final sales to investors. Other chipmakers, such as Advanced Micro Devices Inc. and Nvidia Corp., simply design their chips but outsource the manufacturing to partner foundries such as Taiwan Semiconductor Manufacturing Corp.

In the past, Intel used its factories only to build its own chips, but under a plan initiated by Chief Executive Pat Gelsinger, it has pivoted to making chips for other chip firms too. The foundry business has therefore been recast as a separate business unit within the company. It’s thought that Intel’s decision to do this is what enabled it to secure almost $20 billion in government funding via the U.S. CHIPS and Science Act last month, as it has pledged to make the U.S. a more significant player again in the chip manufacturing industry.

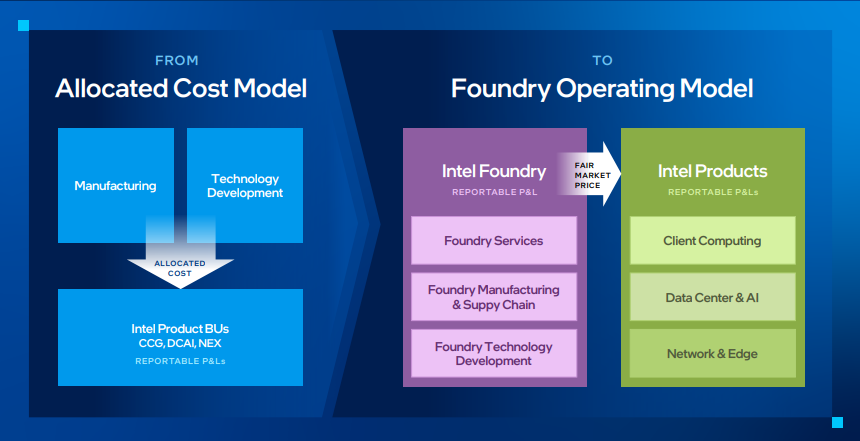

The majority of Intel’s foundry revenue comes from itself, as the bulk of chips it manufactures are still its own. However, with the reorganization, the foundry business is effectively treating Intel the same as any other customer.

As part of the reorganization of its finances, Intel has restructured its product business units to report their numbers in the same way as “fabless” chipmakers like AMD and Nvidia typically do. Those companies have to account for their manufacturing expenses as a business cost.

The newly reorganized Products division, which derives most of its revenue from personal computer and server chips, delivered $11.3 billion in operating income on sales of $47.7 billion last year.

Intel’s new business model

The foundry business is running at a loss and it will take some time to fix, Intel revealed. It said it anticipates the foundry’s losses will peak in fiscal 2024 before improving to break even at roughly midway between now and the end of the decade. It has previously announced Microsoft Corp. as a flagship customer of the foundry business, with more than $15 billion worth of revenue already booked.

“Intel Foundry is going to drive considerable earnings growth for Intel over time,” Gelsinger said on a call with investors. “2024 is the trough for foundry operating losses.”

Intel is, in a sense, going fabless like its rivals, but Holger Mueller of Constellation Research Inc. said it’s not yet clear if investors will value its chip product business in the same way as they view the likes of AMD and Nvidia. “The difference is that Intel currently needs to finance the losses of its fab business, and this emphasizes how it’s doing that,” the analyst said. “Alternatively, it could also mean Intel might be planning to spin off the fab business at some later stage. But the numbers aren’t great, and they mean Intel is not producing price-competitive chips. Hopefully, its forecasts will come true and the old Intel will roar back with some much-needed competition in the chipmaking industry.”

In an in-depth analysis of Intel’s foundry business in February, theCUBE Research analyst Dave Vellante noted that the transition is a “strategic pivot” that will be “essential for its success” in the ultra-competitive semiconductor manufacturing sector.

“By addressing past shortcomings through clear operational divisions, enhanced customer service and a commitment to technological advancement, Intel is making strides toward rebuilding trust and establishing itself as a legitimate player in the foundry space,” Vellante said. “This shift is critical for Intel’s ambition to compete with established foundries like TSMC and for the broader semiconductor industry’s health and dynamism.”

In a note to clients, Morgan Stanley analyst Joseph Moore explained that Intel is effectively running the foundry business as a separate entity from the chip design business, meaning that the foundry interacts with Intel just as it would with any other customer. “Other than the financial goals, the thought here is that this will make the foundry business better — by allowing them to service one of the largest customers in the world in a relationship approximating other foundry relationships,” he said.

Intel told investors that the current lack of profitability in the foundry business stems from the “weight of past decisions” as well as the “slow” adoption of extreme ultraviolet lithography technology, which is used to make the most advanced chips on the market today.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.