INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Investors bailed on the chipmaker Advanced Micro Devices Inc. in late trading today after the company offered a revised estimate for its fiscal 2024 data center revenue that fell short of expectations.

AMD’s stock was down more than 7% in the after-hours trading session, even though it delivered to expectations in the quarter just gone.

The company reported earnings before certain costs such as stock compensation of 62 cents per share, in line with analysts’ forecasts, while revenue grew 2%, to $5.5 billion, just ahead of the Street’s $5.48 billion target. All told, AMD delivered net income of $123 million, up from a $127 million loss in the same period one year earlier.

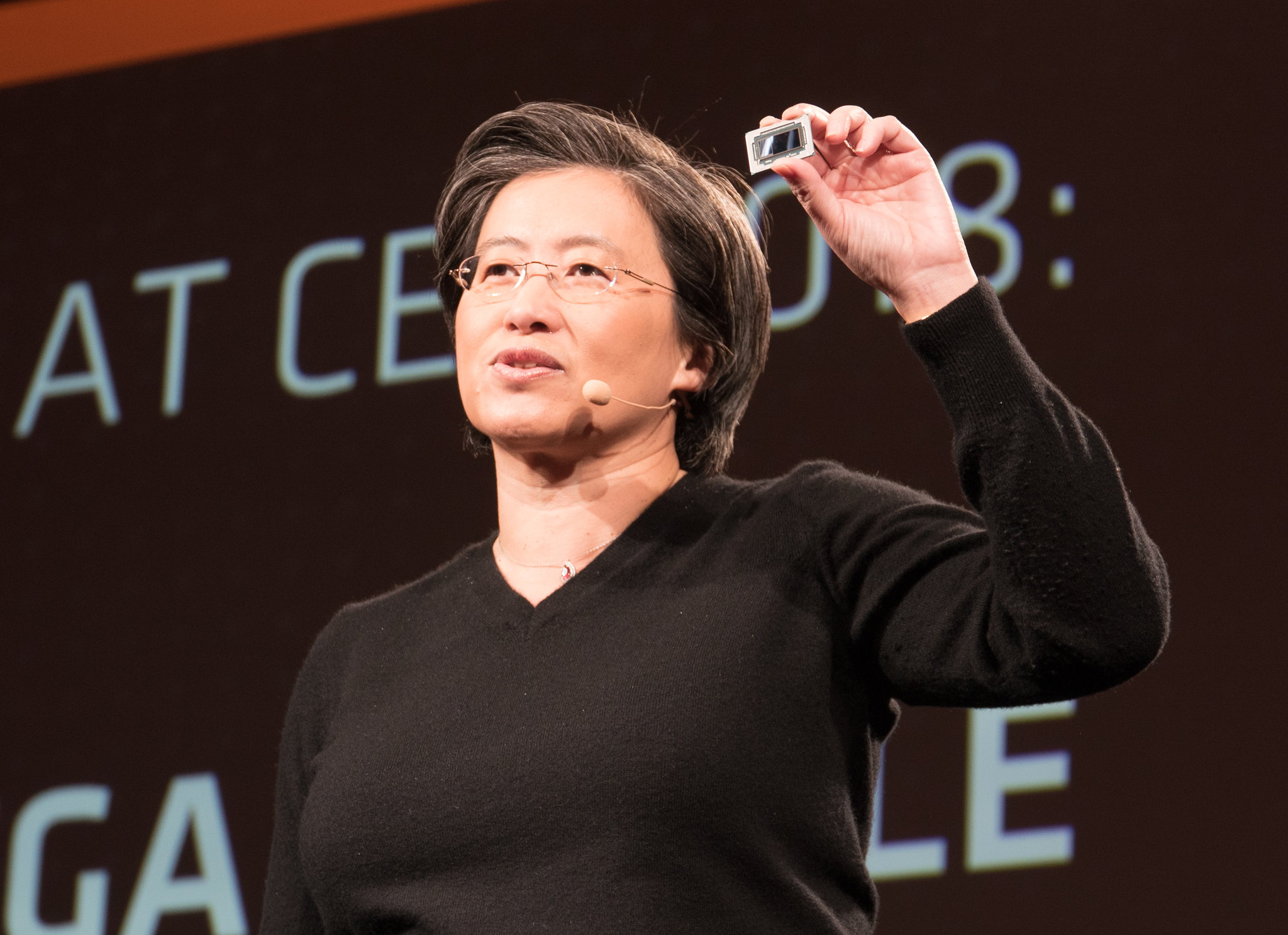

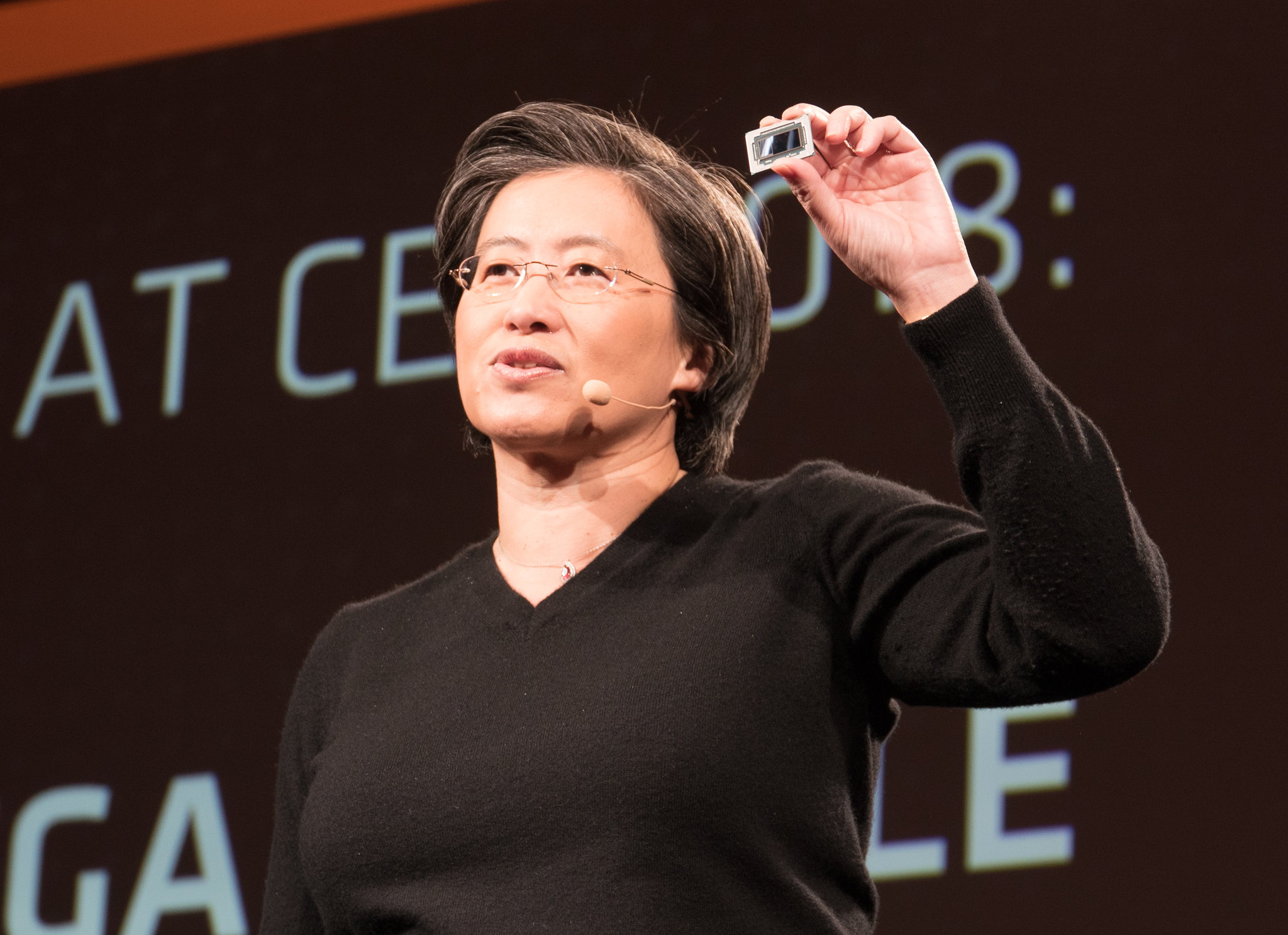

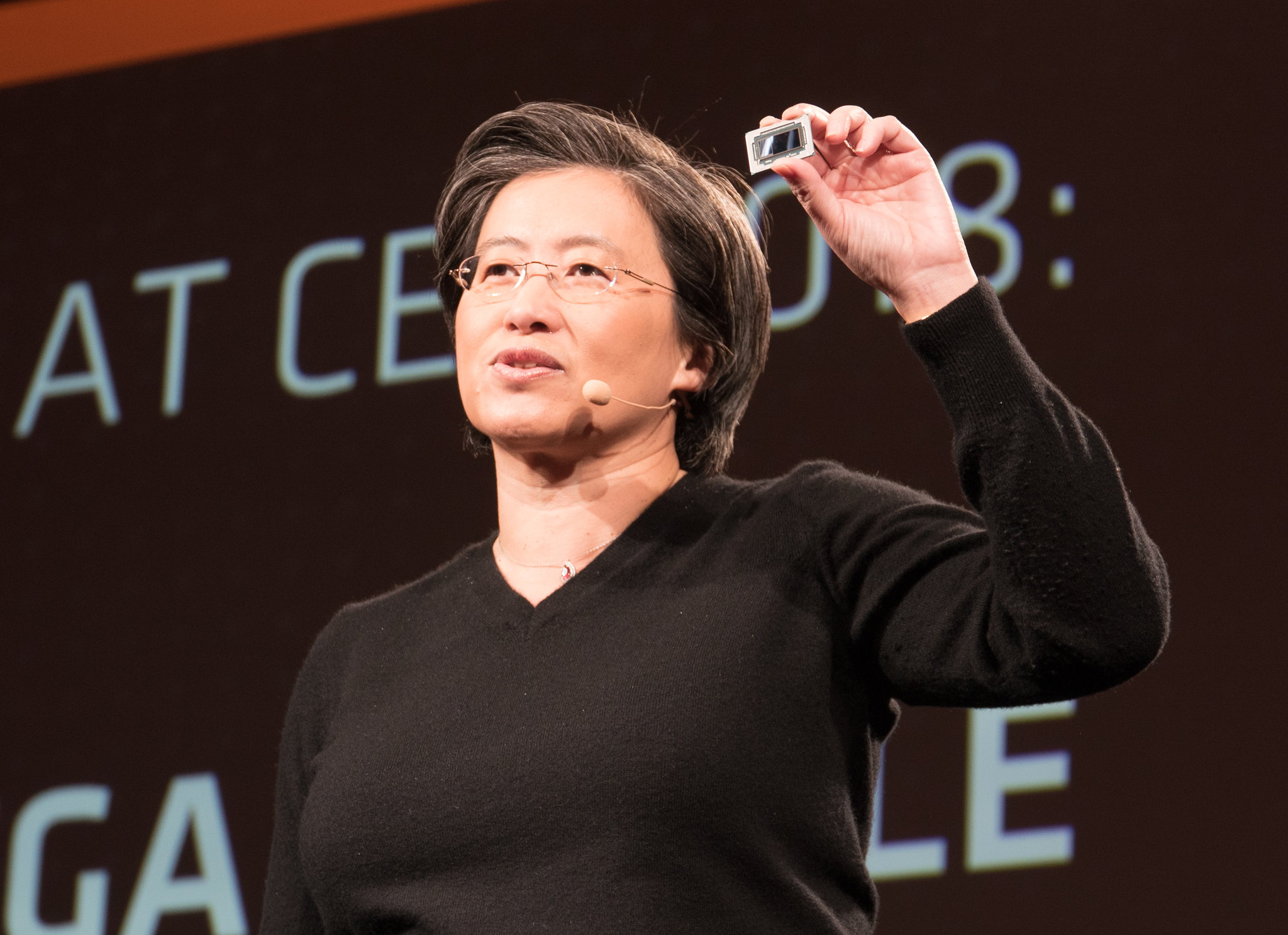

AMD Chief Executive Lisa Su (pictured) said in a statement that the company benefited from strong growth in its data center business unit, where sales rose by 80%, as well as its client computing segment, where revenue increased by 855.

The data center business, which makes chips for servers, delivered $2.3 billion in sales, ahead of the $2.27 billion analyst target. Meanwhile, the client computing segment, which consists of chips for personal computers, generated $1.4 billion in sales, beating the analyst consensus view of $1.29 billion.

Su said in a conference call that the strength in the company’s data center business is a reflection of the strong demand for its MI300 graphics processing unit, which is designed to accelerate artificial intelligence workloads. “MI300 demand continues to strengthen,” she said. “Longer term, we are increasingly working closer with our cloud and enterprise customers as we expand and accelerate our AI hardware and software roadmaps and grow our data-center GPU footprint.”

The CEO told analysts on the call that the company has achieved expanded M100 deployments with hyperscale cloud companies such as Microsoft Corp., Meta Platforms Inc. and Oracle Corp., which are using the chip to “power generative AI training and inference for both internal workloads and a broad set of public offerings.”

Su added that AMD is also working with server makers such as Dell Technologies Inc., Hewlett Packard Enterprise Co., Supermicro Computer Inc. and Lenovo Group Ltd. to develop new systems based on the MI300. Volume production of those systems is expected to ramp up during the current quarter, she said.

“What we see now is just greater visibility to both current customers as well as new customers committing to MI300,” Su added. The growing interest in the MI300 means that it has become the “fastest-ramping product” in the company’s history, she said, generating over $1 billion in revenue in less than two quarters.

According to Su, the company now believes its data center GPU revenue will now exceed $4 billion in the fiscal year, well ahead of its previous guidance of $3.5 billion. However, it seems that some investors were hoping for a much bigger revised estimate, as the company’s stock nosedived immediately after Su’s comment.

Elsewhere in AMD’s business, the company is seeing weaker demand. For instance, the gaming unit, which sells chips for consoles, saw revenue fall 48% to $922 million. Meanwhile, revenue from the embedded segment, which consists of networking chips, dropped 46% to just $846 million. Wall Street had been eyeing revenue of $964 million and $941 million, respectively, in those two segments.

AMD’s results show that demand for regular central processing units remains somewhat soft, and it was a similar story to last week, when Intel Corp. showed weakness in all areas aside from AI chips.

That said, Su believes that the PC market will return to growth in the second half of the year, driven by an enterprise refresh cycle and higher demand for a new generation of so-called “AI PCs” that feature built-in AI processing capabilities.

Analyst Holger Mueller of Constellation Research Inc. said investors are clearly concerned that AMD is not really seeing any net positive from the current AI boom, with its data center and personal computer gains being offset by the losses in its gaming and embedded units. “The question is whether or not those declines are cyclical, or if AMD is maybe focusing a little too much on AI, at the expense of the other parts of its business,” Mueller said. “Lisa Su and her team will need to answer this in the second quarter.”

For the current quarter, AMD is forecasting sales of between $5.4 billion and $6 billion, in line with Wall Street’s forecasts.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.