INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Artificial intelligence chip startup Etched.ai Inc. said today it’s looking to rival Nvidia Corp. and become a market leader in dedicated AI chips, after closing on a hefty $120 million early-stage round of funding.

The two-year old startup was founded by a couple of Harvard university dropouts, who believe they have just what it takes to challenge Nvidia – a specialized chip that’s designed to power AI models known as “transformers,” which sit at the heart of OpenAI’s ChatGPT and other chatbots.

Today’s Series A round was led by Primary Venture Partners, and saw participation from several high-profile individual investors, including former PayPal Inc. Chief Executive Peter Thiel and Replit Inc. CEO Amjad Masad. The company didn’t disclose a valuation following today’s round, but was previously valued at $34 million in March 2023, when it closed on a $5.4 million seed investment.

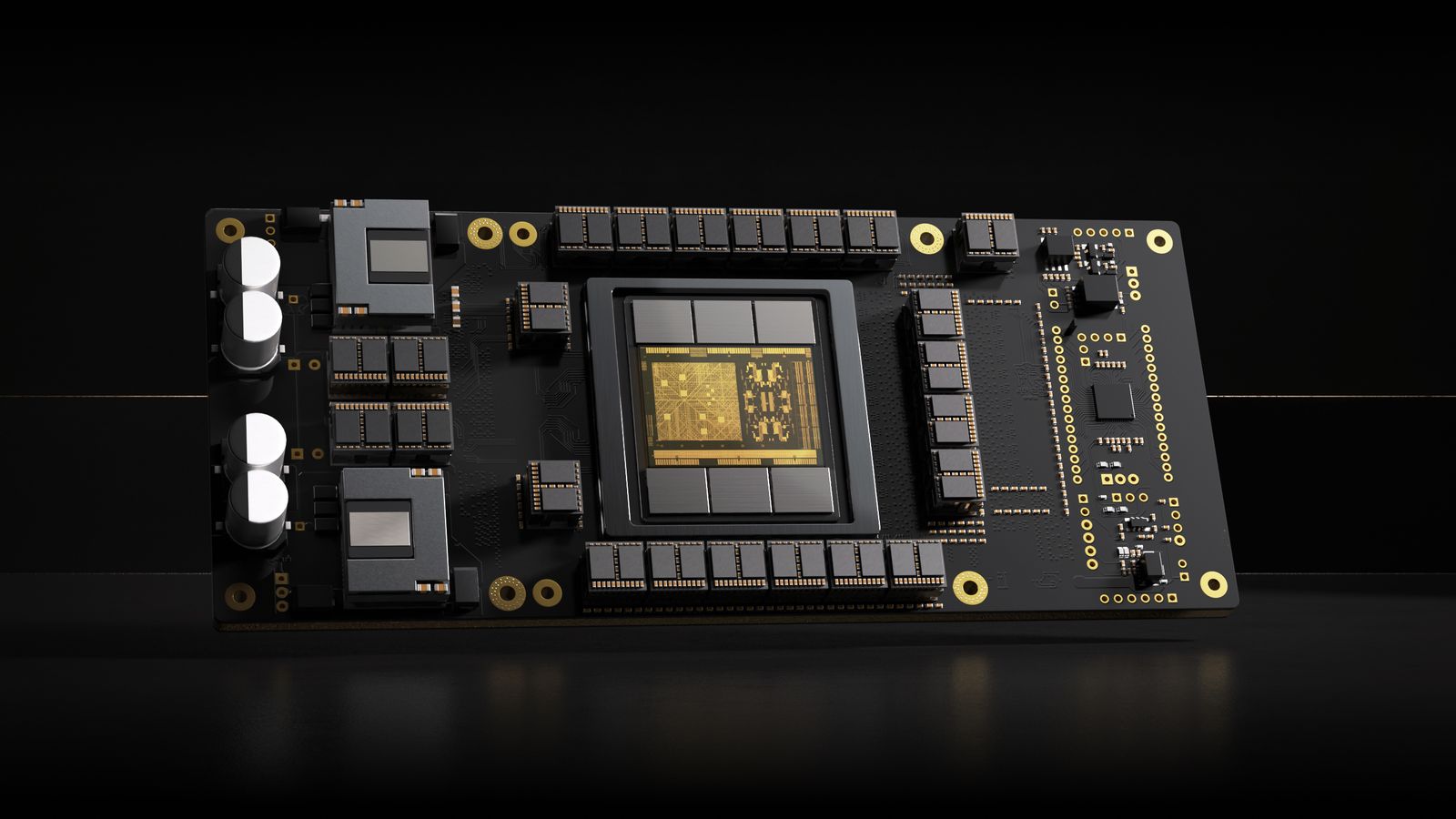

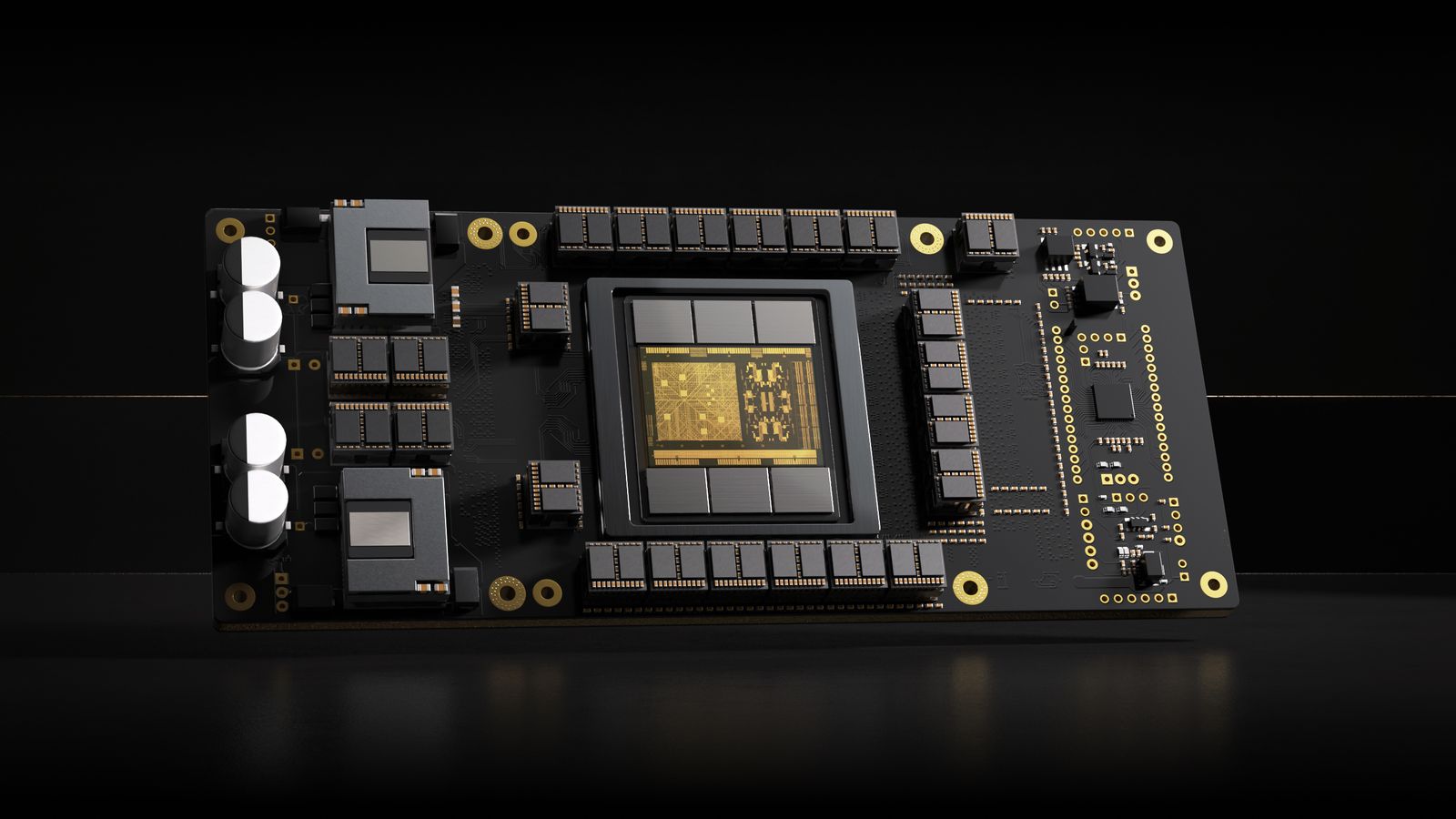

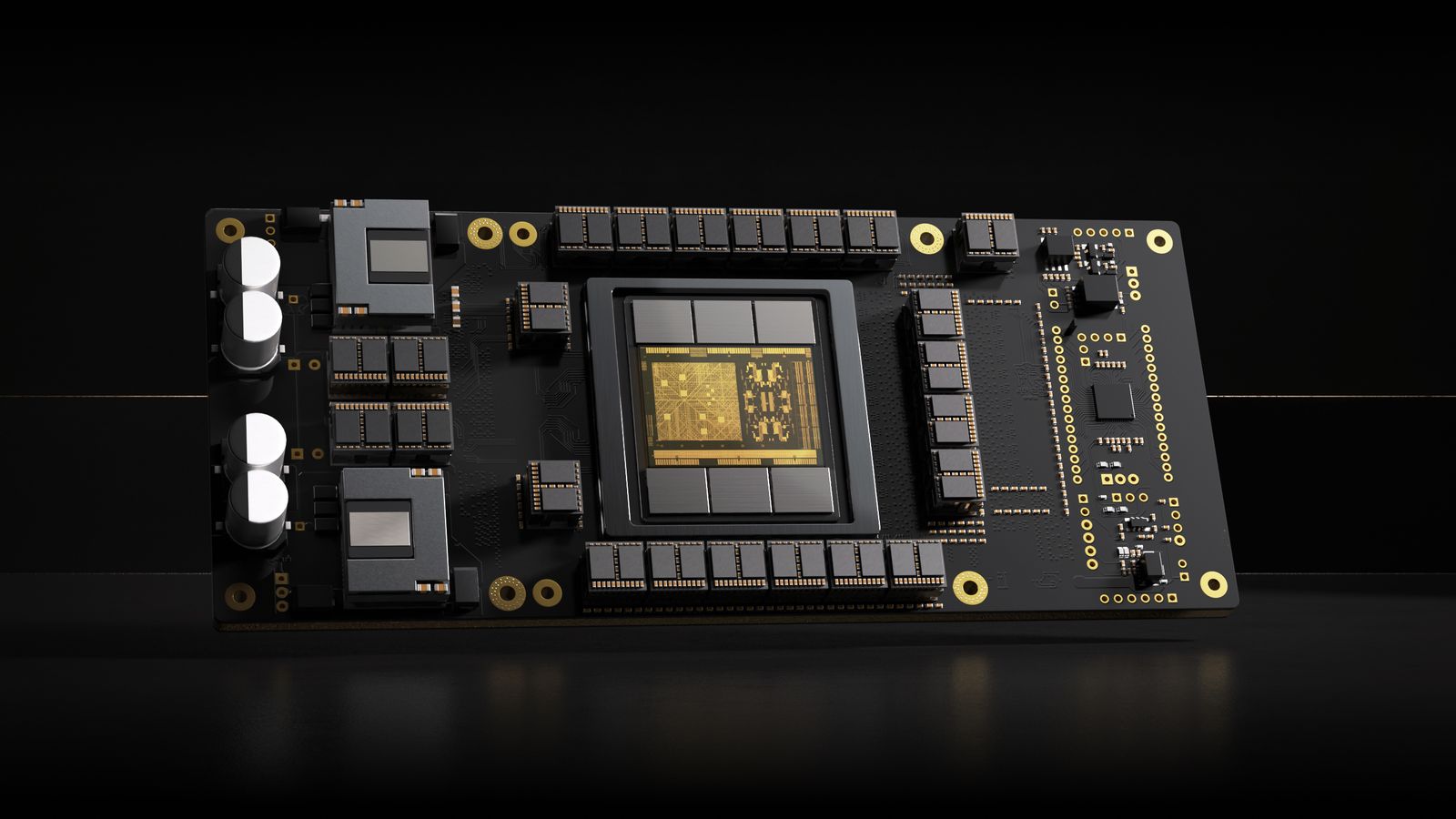

Etched, founded in 2022 by its CEO Gavin Uberti and Chief Technology Officer Chris Zhu, has already made its first product. Called Sohu, it’s a dedicated AI chip that’s designed to train, deploy and optimize transformer models, which are the kinds of large language models that power not only ChatGPT, but Anthropic PBC’s Claude and Google LLC’s Gemini, as well as image generators such as DALL-E and Stable Diffusion.

The Sohu chip is an application-specific integrated circuit – a kind of chip that’s customized to run a specific application. The primary objective of ASICs is to achieve a specific functionality with the utmost possible efficiency. This efficiency can be in terms of power consumption, performance, cost, or a combination of these factors. By designing an ASIC to perform a specific function, it is possible to optimize its design to achieve the best possible performance for that function.

In the case of Sohu, it has been designed to run transformers at maximum efficiency. It was built using Taiwan Semiconductor Manufacturing Corp.’s most advanced four-nanometer process, and the startup claims it can deliver enhanced inferencing performance compared to Nvidia’s graphics processing units and other AI chips. It does this while drawing less energy too, the company said.

In an interview with TechCrunch, Uberti said Sohu is an “order of magnitude faster and cheaper” for transformer-based text, image and video generators than Nvidia’s upcoming Blackwell GB200 GPUs, which are yet to be released.

“One Sohu server replaces 160 H100 GPUs,” Uberti claimed. “Sohu will be a more affordable, efficient and environmentally friendly option for business leaders that need specialized chips.”

Uberti said the company partnered with TSMC to manufacture its chips, and explained that the Series A funding is needed to cover the high costs associated with taping out its chip designs with that company.

According to Uberti, the main innovation with Sohu is that it has a more streamlined inferencing hardware-and-software pipeline. He explained that because it cannot run anything else but Transformer models, his team was able to eliminate the hardware components not relevant to them. In addition, they could also remove the software overhead that comes with chips that can deploy and run other kinds of workloads.

In another interview with CNBC, Uberti said that as the AI industry evolves and grows, there will be a lot of demand for customized, power-efficient AI chips. While Nvidia’s GPUs are extremely powerful and versatile, their flexibility comes at a higher cost and more energy usage, he said.

Meet Sohu, the fastest AI chip of all time.

With over 500,000 tokens per second running Llama 70B, Sohu lets you build products that are impossible on GPUs. One 8xSohu server replaces 160 H100s.

Sohu is the first specialized chip (ASIC) for transformer models. By specializing,… pic.twitter.com/IndYfP2CN0

— Etched (@Etched) June 25, 2024

“We’re making the biggest bet in AI,” Uberti said. “If transformers go away, we’ll die. But if they stick around, we’re the biggest company of all time.”

Given the huge penetration of ASICs in other areas of computing, it was only a matter of time until someone took up the challenge of making an ASIC that’s targeted at transformers, said Holger Mueller of Constellation Research Inc.

“Etched.ai’s decision could be seen as somewhat risky, as there is the danger that transformers may one day be replaced by a superior model architecture, but at present there are more than enough transformer workloads around to justify the demand for something like Sohu,” the analyst said.

Nvidia is the undisputed king of the AI chip market, commanding around 80% of all sales. Since the generative AI revolution kicked off in earnest in late 2022, its stock has become the hottest property on all of Wall Street, with its value growing more than nine times over the last year. Earlier this month, Nvidia displaced Microsoft Corp. as the world’s most valuable company, at least for a few days.

But although Nvidia is a formidable opponent with untold resources, there are plenty of upstarts looking to take it on. Investors believe there’s room for more than one major AI chip supplier, and that has helped a host of semiconductor startups get attention. For instance, Cerebras Systems Inc., which has created a chip the size of a dinner plate, is reportedly gearing up for an initial public offering later this year. Tenstorrent Inc. is working on AI chips that leverage the open-source RISC-V architecture.

Other rivals include Taalas Inc., which is doing something very similar to Etched with chips customized to run specific neural networks. It closed on a $50 million funding round in March, and that was followed by edge AI chipmaker SiMA.ai Inc.’s $70 million round in April. Most recently, the South Korean startup DEEPX Co. Ltd. said last month it had raised $80.5 million to try to commercialize its own AI chips, which merge a set of circuits optimized for machine learning workloads with a four-core central processing unit.

The AI chip market is gearing up for a huge battle ahead, but Uberti claims Etched has a head start, with several unnamed customers having already placed orders for “tens of millions of dollars” worth of the company’s chips. The startup is also planning to launch the Sohu Developer Cloud platform in the coming weeks, which will enable prospective customers to preview its hardware and play around with customizations for their specific AI models. With the launch of that platform, Etched believes it will attract even more customers.

The host of startups looking to make their mark in the AI chip sector belies the fact that the semiconductor market is one of the toughest industries to break into. Chipmaking involves long development cycles, striking deals with a limited number of in-demand chip manufacturers, such as TSMC or Intel Corp., and a significant capital investment.

Fortunately for these startups, investors are hopeful that Nvidia won’t always enjoy the commanding market lead it has right now.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.