INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Shares of Arista Networks Inc. traded higher in late trading today after the networking company forecast strong third-quarter revenue that surpassed Wall Street’s expectations.

Arista said it’s anticipating strong demand for its networking gear from both cloud computing infrastructure providers and artificial intelligence applications.

The strong forecast came after the company posted solid second-quarter results, with earnings before certain costs such as stock compensation coming to $2.10 per share, nicely ahead of Wall Street’s target of $1.94 per share. Revenue for the period rose 16%, to $1.69 billion, surpassing the $1.65 billion analyst target.

All told, Arista delivered a net profit of $665.4 million, up from a $491.9 million profit in the same period one year ago. Investors liked what they saw, and Arista’s stock gained 3% in extended trading.

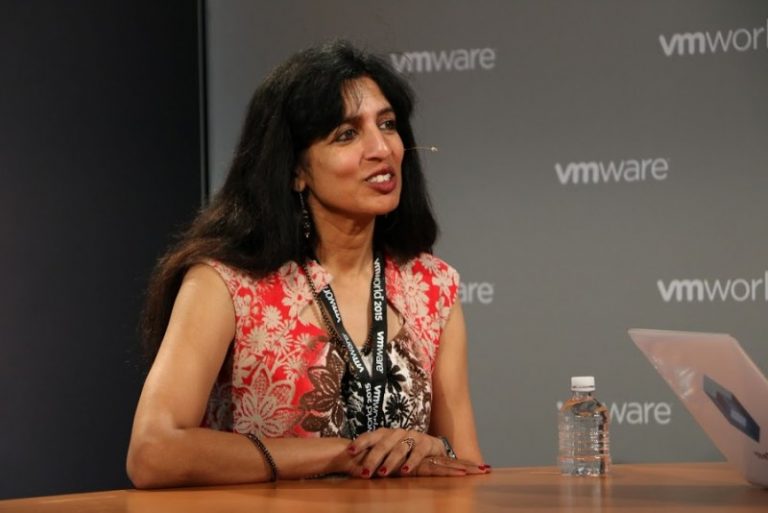

Arista Chairperson and Chief Executive Jayshree Ullal (pictured) said the company surpassed an important milestone during the quarter, celebrating its 10th year as a public company. “Our Q2 2024 financial results demonstrated Arista’s powerful combination of growth, profitability and best-of-breed platforms,” she said.

Arista is a key rival to the much larger Cisco Systems Inc. in the computer networking industry, focused on selling premium gear such as high-speed switches that accelerate communications between racks of computer servers in corporate data centers.

The company sees third quarter revenue of between $1.72 billion and $1.75 billion, the midpoint of which is just ahead of Wall Street’s estimate of $1.73 billion.

The optimistic guidance underscores Arista’s growing presence in the networking sector, which has benefited from the strong enterprise demand for powerful new generative artificial intelligence applications. Those apps need a rapid communications infrastructure to operate, and that’s exactly what Arista provides.

In a blog post last month, Ullal talked about this demand, saying AI training models in particular are reliant on a “lossless, highly available network to seamlessly connect every GPU in the cluster to one another and enable peak performance.” Trained AI models also need a reliable network to connect to end users and deliver fast responses, she said.

“As a result, data centers are evolving into new AI Centers where the networks become the epicenter of AI management,” Ullal continued.

Constellation Research Inc. analyst Holger Mueller said Arista is firmly focused on prepping for the AI era of networking, and growing nicely while it does that. Part of the reason for its growth is its excellent cost control, he said.

“Jayshree Ullal and her team managed to transfer the company’s revenue growth into pure profit,” Mueller pointed out. “Sales grew by around $160 million, and its bottom line did more or less the same. The result was a 50-cent increase in earnings per share, so investors are happy.”

While Arista is clearly benefiting from the AI demand, its rival Juniper Networks Inc. has struggled to take advantage of the opportunity. Although it said customers are beefing up their investments in its AI network offerings, that company disappointed investors with lower-than-expected sales and profit.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.