BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Payment technology company Stripe Inc. is reportedly in talks to acquire fintech startup Bridge Ventures Inc. for $1 billion.

According to Forbes, the acquisition talks, which are still under discussion and subject to either party walking away, would be Stripe’s largest deal to date. Some of the sources referenced by Forbes also note that regulatory considerations such as licenses and compensation for employees, including Bridge founders Zach Abrams and Sean Yu, remained potential hurdles.

Neither Stripe nor Bridge has commented on the reported acquisition discussions.

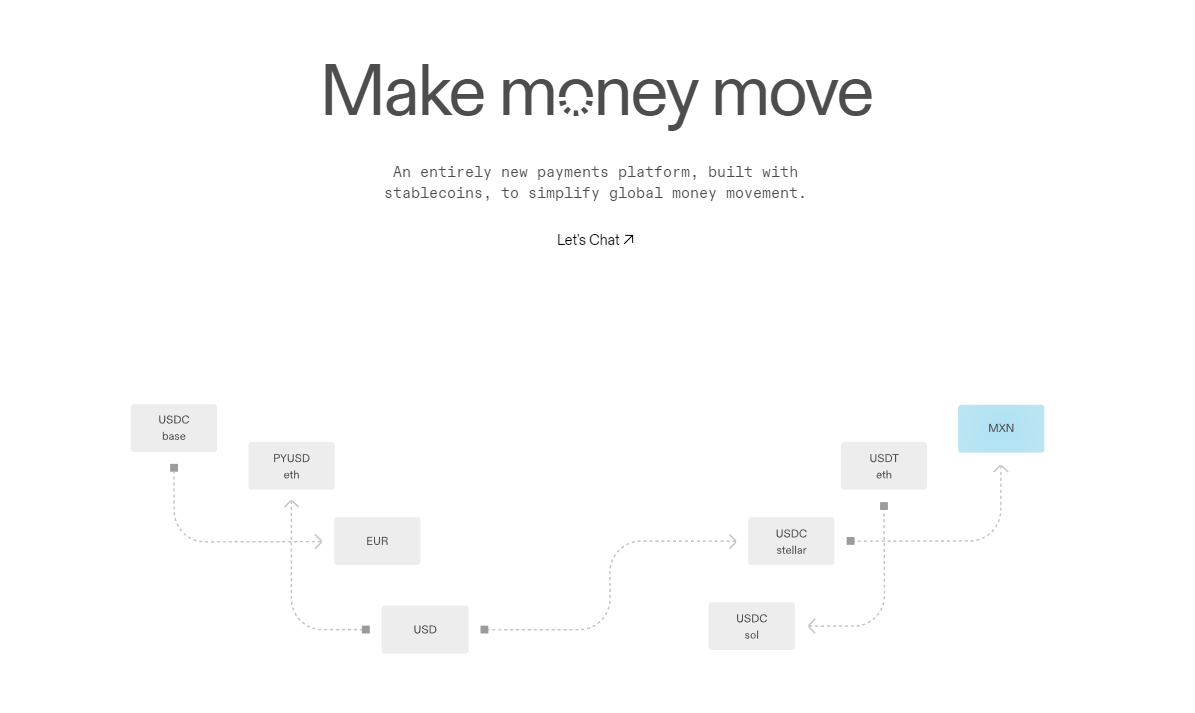

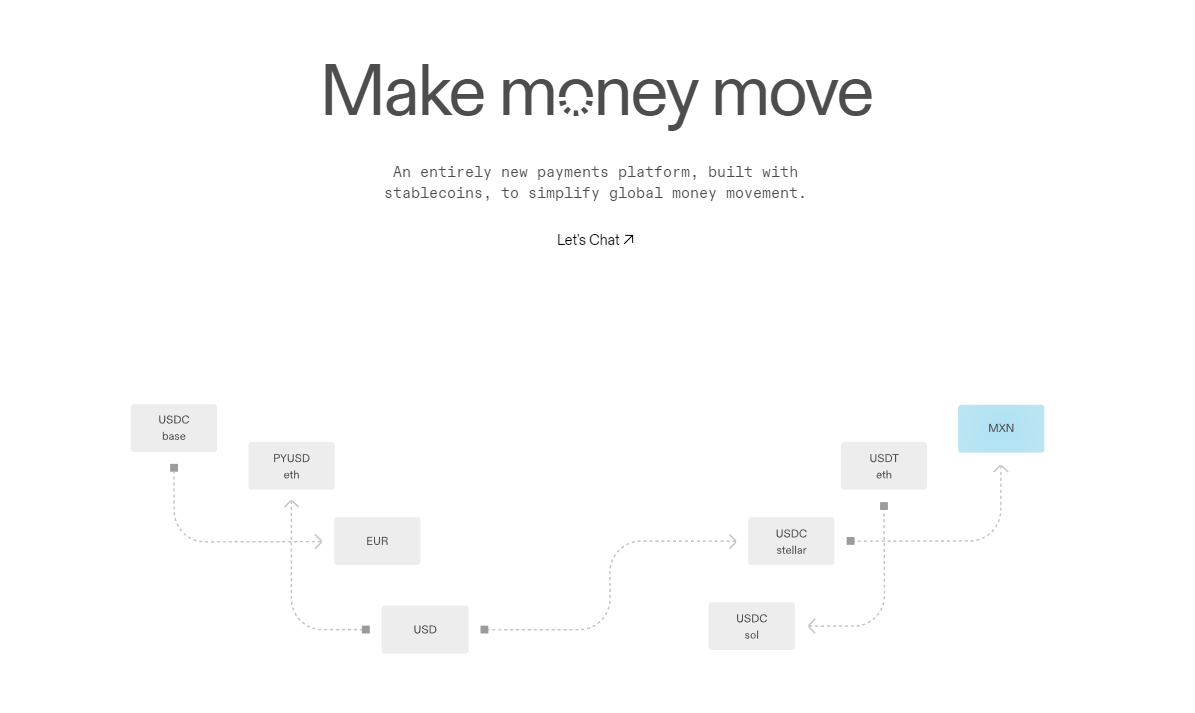

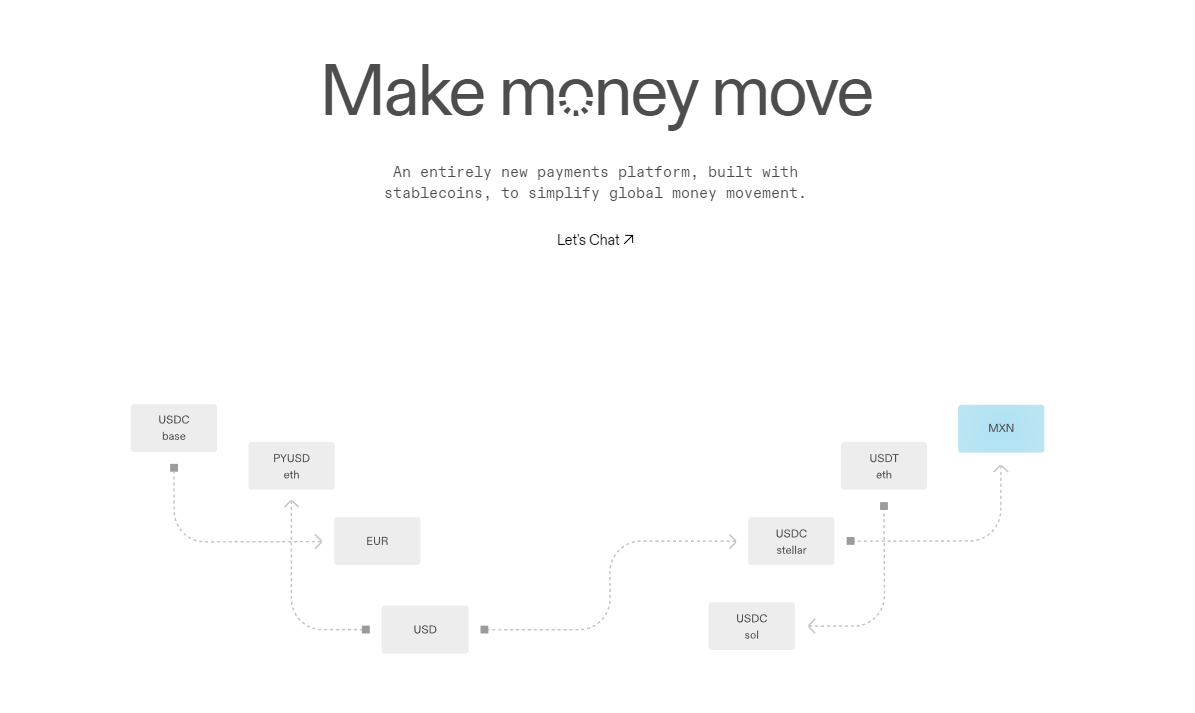

Founded in 2022, Bridge is building a global payment network that uses stablecoins to simplify and improve cross-border transactions. The company has as an aim to make moving money as fast and efficient as the internet by significantly reducing costs compared to traditional financial systems like SWIFT.

The Bridge platform has been designed to allow businesses, governments and aid organizations to send, receive and store stablecoins, such as USDC and Tether, to make it easier to manage payments across borders. The platform also provides infrastructure that developers can use to seamlessly integrate stablecoin payments into their applications.

Core to its offering, Bridge seeks to offer users economic choice by allowing them to save and spend in U.S. dollars or Euros using stablecoins. The flexibility in being able to do so is beneficial in regions where traditional banking services may be less accessible.

“We believe stablecoins will transform and improve global money movement,” the company writes on its website. “Bridge creates the infrastructure necessary for builders to take full advantage of this new medium.”

Coming into a potential acquisition, Bridge has raised $58 million, according to Tracxn, from investors including Sequoia Capital Operations, Ribbit Capital LP, Index Ventures and Haun Ventures LP. The company’s most recent round was raised at a $200 million valuation and Bridge has also reportedly received interest in raising a possible Series B round at a higher valuation.

Should a deal happen, the Bridge acquisition will enhance Stripe’s existing cryptocurrency services. Going back to 2022, Stripe announced the ability for companies to pay users in cryptocurrency through its payment processing platform and the company has offered various solutions since.

Aakash Sahney, head of product at Stripe Connect, spoke with theCUBE, SiliconANGLE Media’s livestreaming studio, in July, when he discussed how Stripe is working with Amazon Web Services Inc. to transform payment platforms for modern business. The potential acquisition of Bridge would expand on those services.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.