CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Dynatrace Inc. ended today’s trading session with its shares down almost 4% after reporting quarterly results that exceeded the consensus estimate.

The Waltham, Massachusetts-based observability provider also upgraded its full-year revenue guidance.

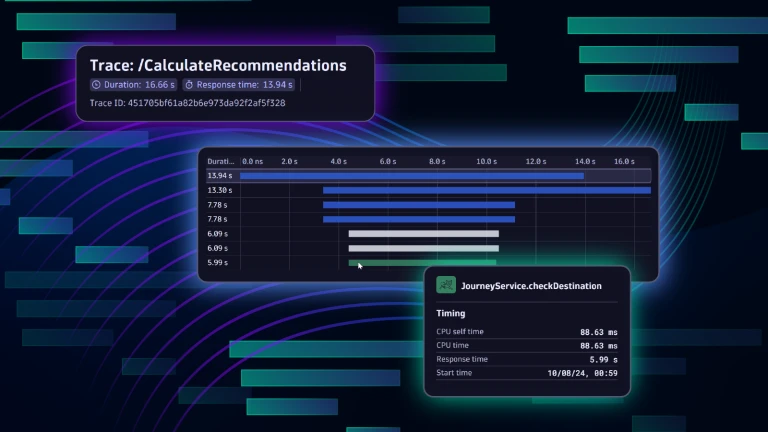

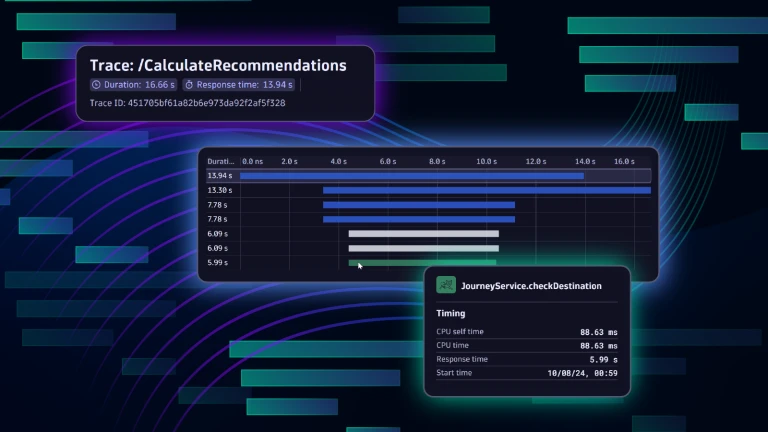

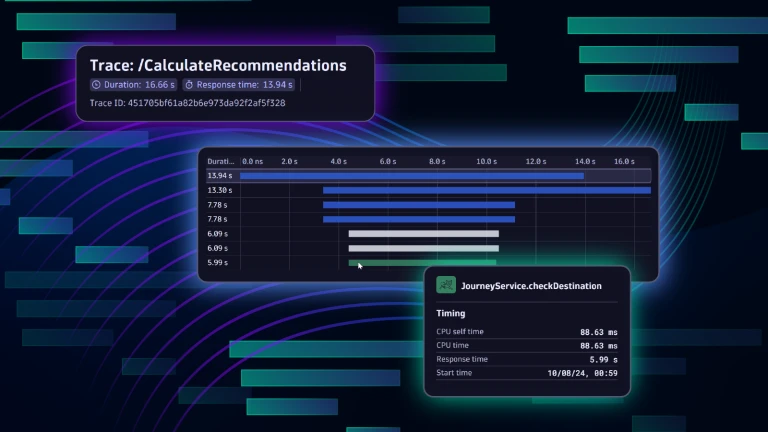

Dynatrace provides a platform that helps enterprises spot malfunctions and malicious activity in their technology environments. The software turns incident data into graphs to ease analysis. Dynatrace’s data visualization features also lend themselves to other tasks: Companies can create dashboards to track business metrics such as revenue growth.

Under the hood, Dynatrace’s platform is powered by a database called Grail. It was built specifically to store error logs, traces and other types of telemetry. Customers can analyze the data using Dynatrace’s custom DQL query language or have an artificial intelligence assistant called Davis find notable patterns automatically.

The software maker’s revenue grew 19% year-over-year to $418 million in its fiscal quarter ended Sept. 30. That’s about $12 million higher than the consensus analyst estimate. Dynatrace’s core subscription segment, which includes revenue from its observability platform, posted slightly faster year-over-year growth of 20%.

Last year, the company introduced a new subscription pricing model called DPS. It gives customers access to all the features of Dynatrace’s platform in exchange for a minimum annual spend commitment. At the end of the second quarter, DPS customers accounted for 30% of the company’s installed base and nearly 15% of its annual recurring revenue.

Because DPS provides access to Dynatrace’s entire feature set, trying new capabilities is simpler for customers. The company disclosed today that organizations subscribed to the plan are “leveraging twice the amount of capabilities” as users of its traditional software licenses. Dynatrace believes this increase in platform usage could boost its net retention rate, a metric that measures the extent to which customers increase their spending over time.

The company is also prioritizing feature development as part of its revenue growth strategy. In the second quarter, it introduced a set of dashboards for monitoring Kubernetes-powered infrastructure. They ease the task of tracking how much hardware is used by the software components in a Kubernetes cluster.

Dynatrace’s quarterly revenue momentum had a positive impact on its earnings. The company generated adjusted income from operations of $131 million, which breaks down to adjusted earnings of 37 cents per share. Analysts expected 32 cents per share.

The midpoint of Dynatrace’s sales guidance for the current quarter likewise exceeded expectations by 2.4%. Furthermore, the company boosted its full-year revenue forecast by 1%. Dynatrace now expects to close the 12 months ending March 31 with sales of $1.66 billion to $1.67 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.