AI

AI

AI

AI

AI

AI

Dataminr Inc., a startup that helps organizations quickly detect risks such as cyberattacks, has raised $85 million in debt funding to enhance its technology.

The company announced the deal today. Some of the debt financing, which came from NightDragon and HSBC, was provided as a convertible loan. This is a type of loan that the lender can optionally turn into equity. NightDragon plans to set up an investment vehicle that will allow Dataminr to raise $100 million in additional convertible debt from third-party backers.

Previously, the software maker closed a $475 million equity funding round in 2021. The Series F round valued it at $4.1 billion.

Dataminr provides an artificial intelligence platform that helps companies track real-time events. According to the company, its software processes billions of publicly available data points every day to find developments of interest. This information lends itself to a wide range of use cases.

A delivery company could use Dataminr to detect lane closures that might require its drivers to take detours. Cybersecurity teams, in turn, rely on the software to spot emerging hacking campaigns that may target their organizations. Additionally, Dataminr says that its platform is used by more than 100 U.S. government agencies.

“When seconds matter and truth is obscure, Dataminr is helping the world’s leading organizations and governments make smarter, more informed decisions in real-time by pushing the boundaries of what’s possible with AI,” said NightDragon founder and Chief Executive Officer Dave DeWalt.

Under the hood, Dataminr’s platform is powered by more than 50 proprietary AI models. Some are designed to analyze multimodal data. Others are large language models optimized for text processing.

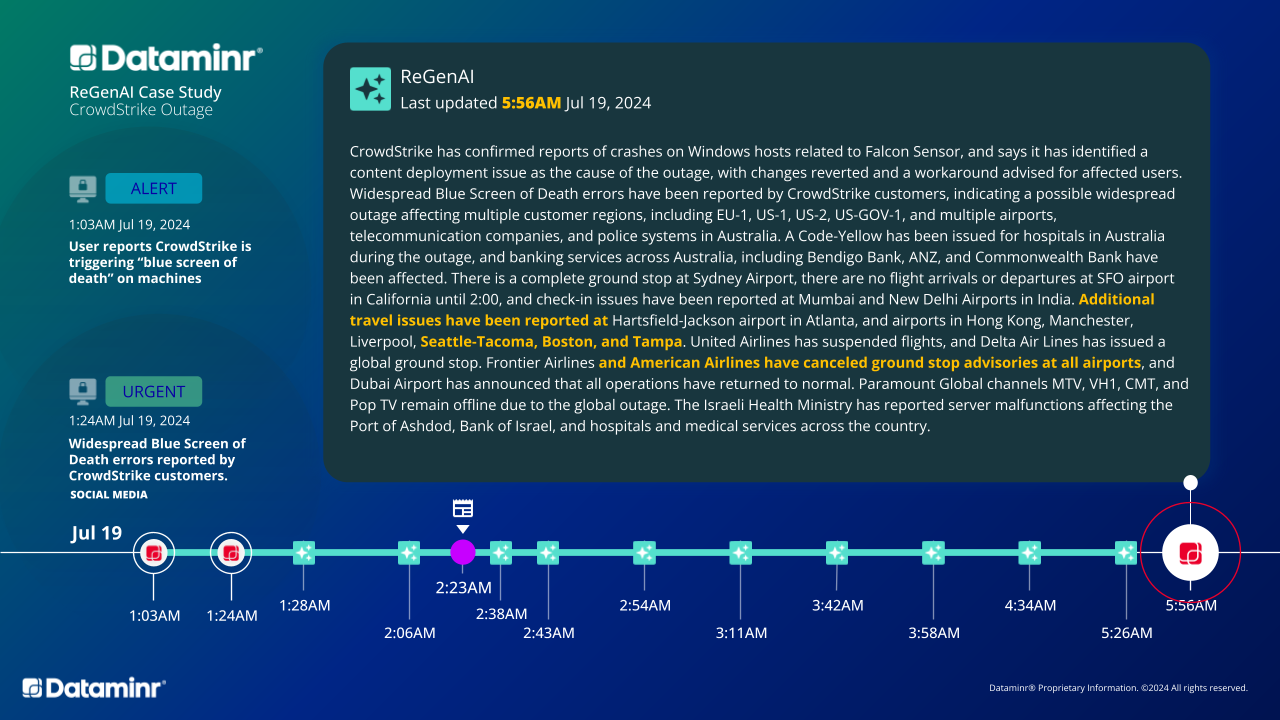

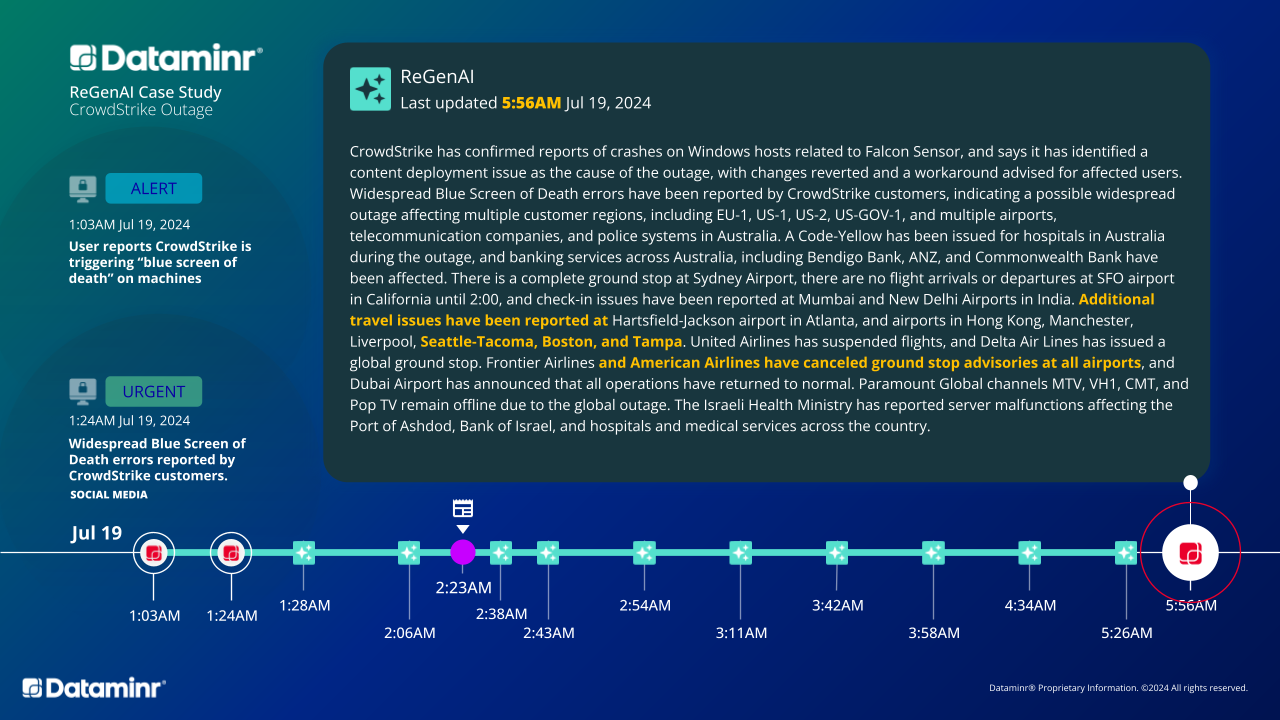

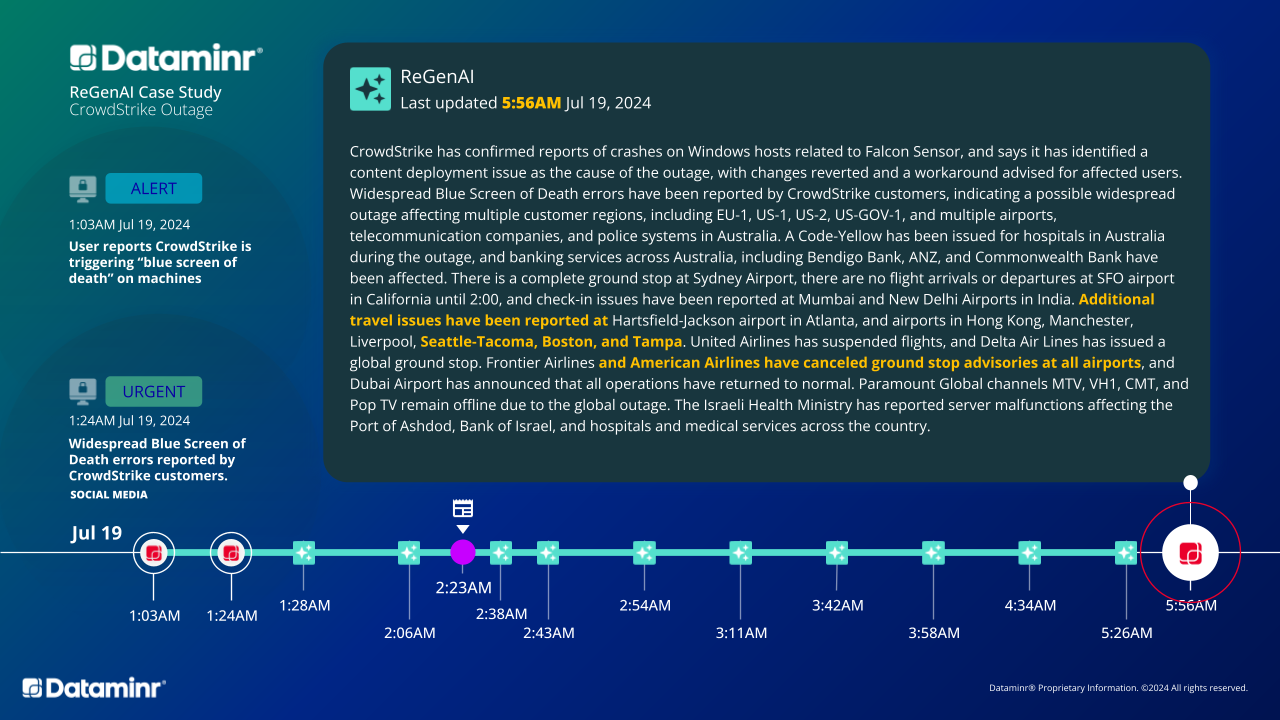

One of Dataminr’s newest models, ReGenAI, can produce a report about an important event and add more details as they become available. After last year’s CrowdStrike Holdings Inc. outage, ReGenAI quickly generated an incident summary based on early customer complaints. It then gradually added new information about the cause and impact of the malfunction.

The financing round announced today will enable Dataminr to further extend its feature set. The development effort is set to place to place particular emphasis on the company’s AI capabilities.

Next month, Dataminr will roll out an AI tool called Context Agents. It will enable the company’s platform to provide more relevant information about breaking events. Further down the road, Dataminr plans to add AI features capable of predicting what might happen next.

In parallel with the new engineering investments, the company will expand its international go-to-market teams to support sales growth. Dataminr disclosed on occasion of the financing round that it’s already approaching $200 million in annualized recurring revenue.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.