BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Digital asset operations platform startup Utila Inc. announced today that it has raised $18 million in new funding to scale up global operations to meet demand for its institutional multiparty computation wallets and expand its research and development efforts.

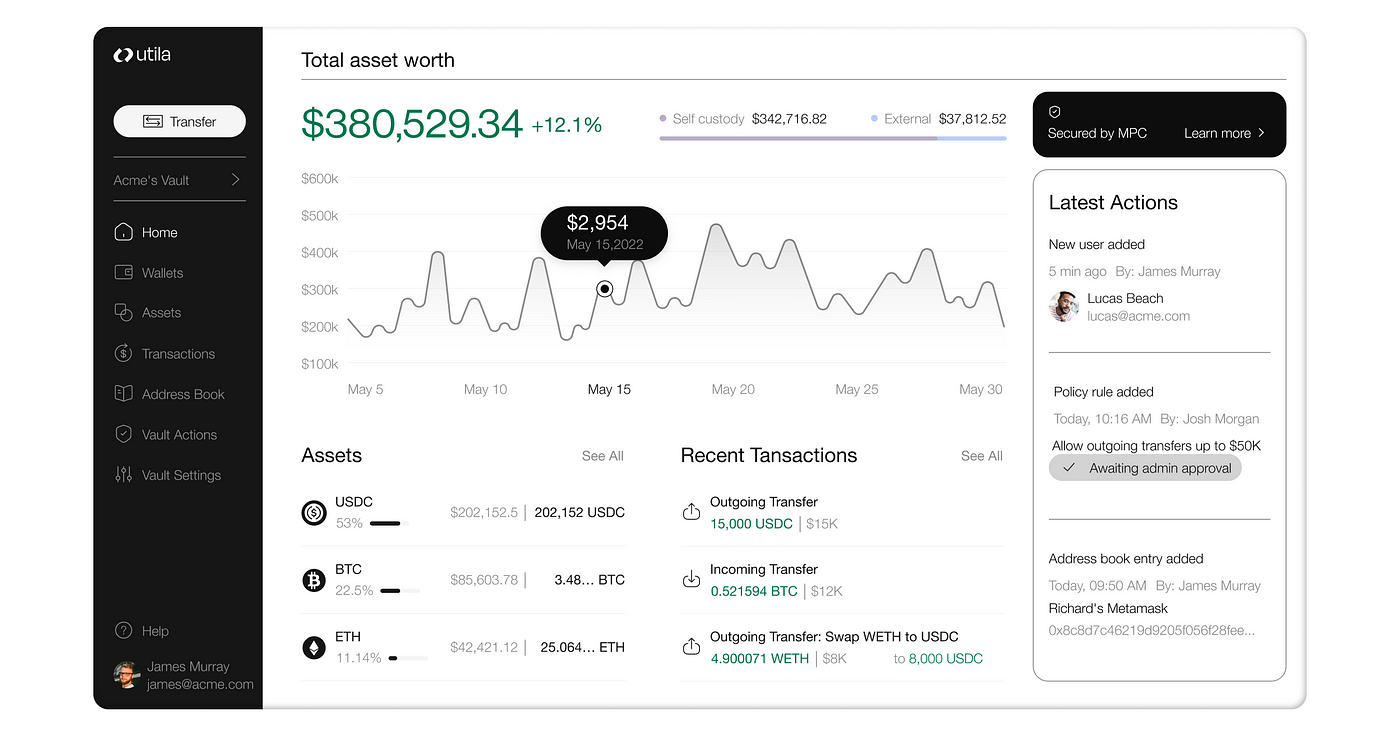

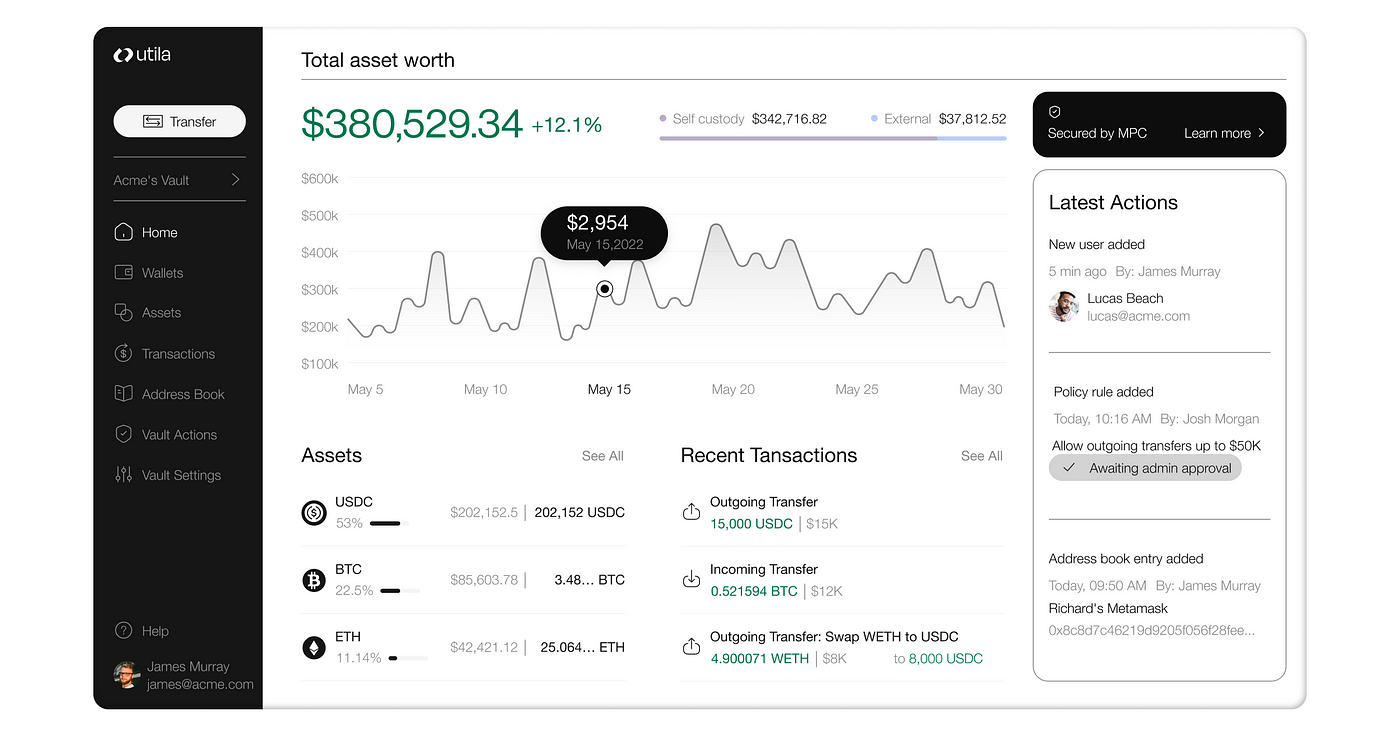

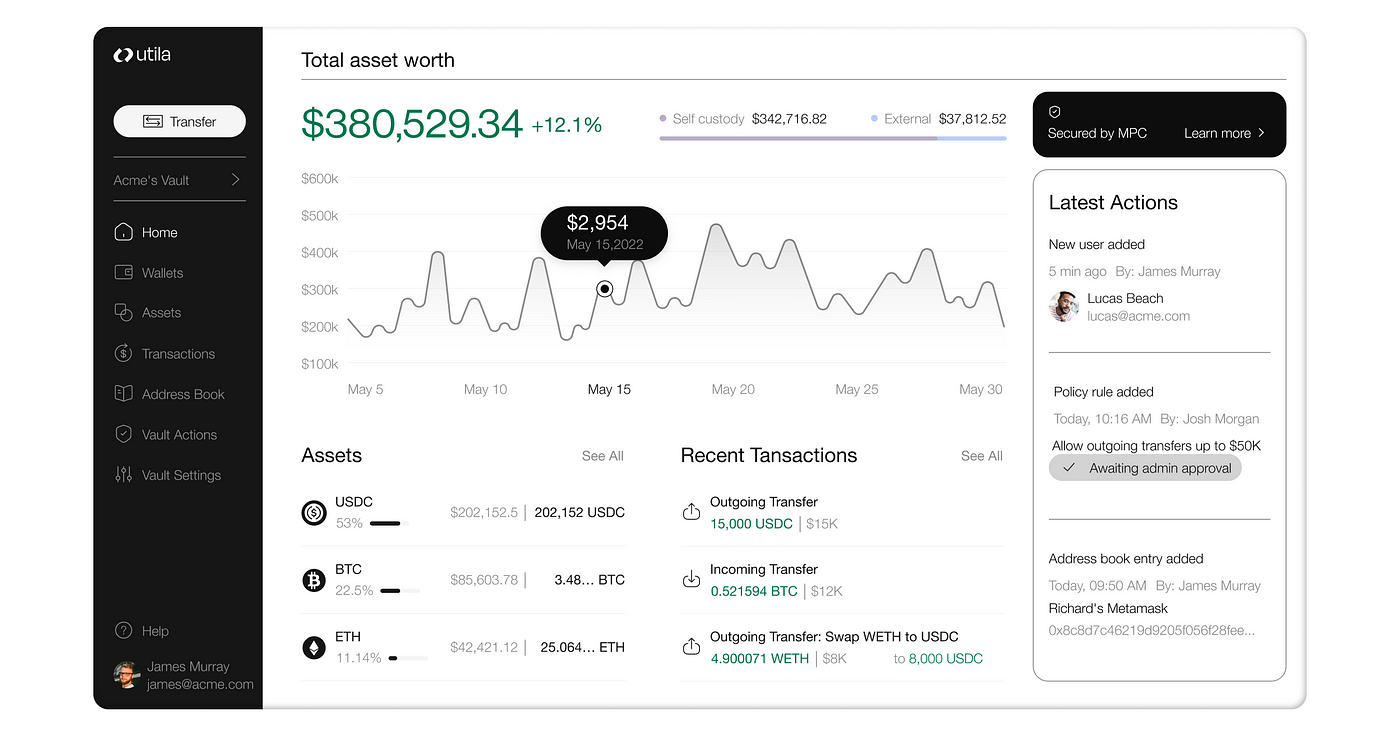

Founded in 2022, Utila is an institutional digital asset operations platform that enables organizations to securely manage and build on digital assets. Utila provides enterprise-grade, secure MPC wallets that ensure military-grade security against key mismanagement and potential threats. MPC wallets employ multiparty computation technology or MPC to enhance security by distributing private key operations across multiple parties, ensuring no single entity has complete control.

The Utlia platform offers a robust policy engine for user and transaction management that allows organizations to assign roles and set approval flows based on multiple parameters. Utila supports a wide range of integrations, including anti-money laundering services, banking, liquidity providers, exchanges, decentralized finance platforms, staking and disaster recovery solutions.

The platform is designed to be blockchain-agnostic and facilitates fast asset support for new blockchains and standards, giving flexibility and scalability to institutional clients. The platform also includes a tokenization engine that allows token issuers to mint, custody and transfer tokenized assets securely.

Other Utila services include business continuity with mirroring capabilities for institutions with existing setups to support operations without disrupting current workflows. Comprehensive insurance coverage adds an extra layer of protection against security threats, operational risks and potential asset loss.

Stablecoins have also become a significant focus of the company as their adoption continues to reshape the financial landscape. In 2024, stablecoin transfers surpassed $27.6 trillion, exceeding the combined transaction volume of Visa Inc. and Mastercard Inc., highlighting their growing role in global payments.

As the industry shifts from speculative trading to real-world financial applications, Utila is positioning itself to meet the increasing demand for secure and efficient stablecoin infrastructure.

“Utila’s mission is to be the leading institutional-grade wallet for this new era, which requires an entirely new set of product capabilities such as efficient gas management, scalable application programming interfaces, deep support for smart contract interactions and connectivity to banking rails,” said Bentzi Rabi, co-founder and chief executive officer of Utila.

Nyca Partners LP led Utila’s Series A round with participation from seed investors Wing Venture Capital and NFX Guild Management, as well as funds including Haymaker Ventures, Gaingels and Cerca Partners. Including the new funding, Utila has raised $35 million to date, including a round of $11.5 million in March 2024.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.