INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Semiconductor industry giant Applied Materials Inc. delivered mixed results in its latest quarter and offered guidance that came in just shy of expectations, sending its stock lower in extended trading today.

The chip manufacturing equipment maker reported second-quarter earnings before certain costs such as stock compensation of $2.39 per share, beating Wall Street’s consensus estimate of $2.31. But revenue of $7.1 billion, up 7% from the same period one year ago, came in just below estimates of $7.13 billion.

All told, Applied Materials generated a profit of $2.13 billion in the quarter, up from $1.72 billion in net income in the year-ago period.

Looking at the current quarter, the company said it’s targeting revenue of $7.2 billion at the midpoint of its range, slightly trailing the consensus view of $7.22 billion. Investors balked at those numbers, sending the company’s stock down more than 5% after-hours.

Applied Materials’ results are seen as a key barometer of demand in the semiconductor industry, because it’s one of the world’s biggest suppliers of the sophisticated machinery used by computer chipmakers. It supplies chip manufacturing hardware to industry leaders including Samsung Electronics Co. Ltd., Intel Corp., GlobalFoundries Inc. and Taiwan Semiconductor Manufacturing Co.

Those customers generally order machinery in advance of the opening of new production lines, or before upgrading existing ones. Therefore, if Applied Materials does well, it’s usually a sign that the chip industry roller coaster is on an upward trajectory.

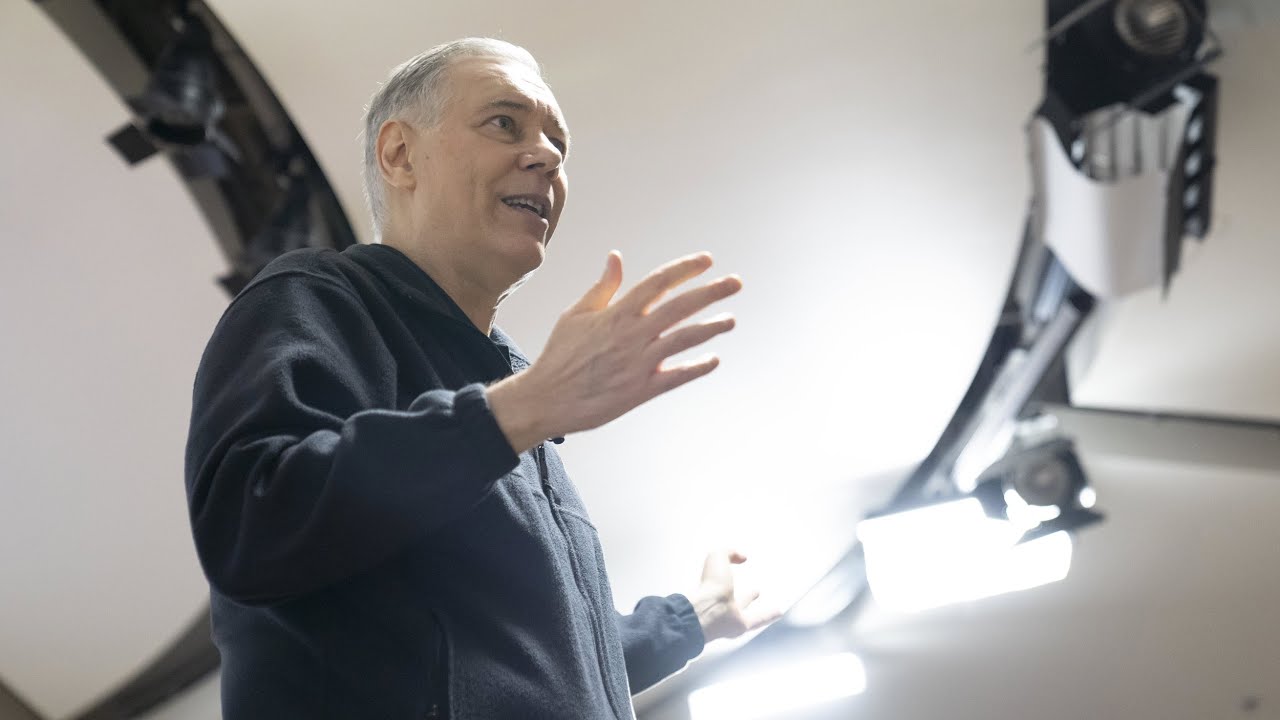

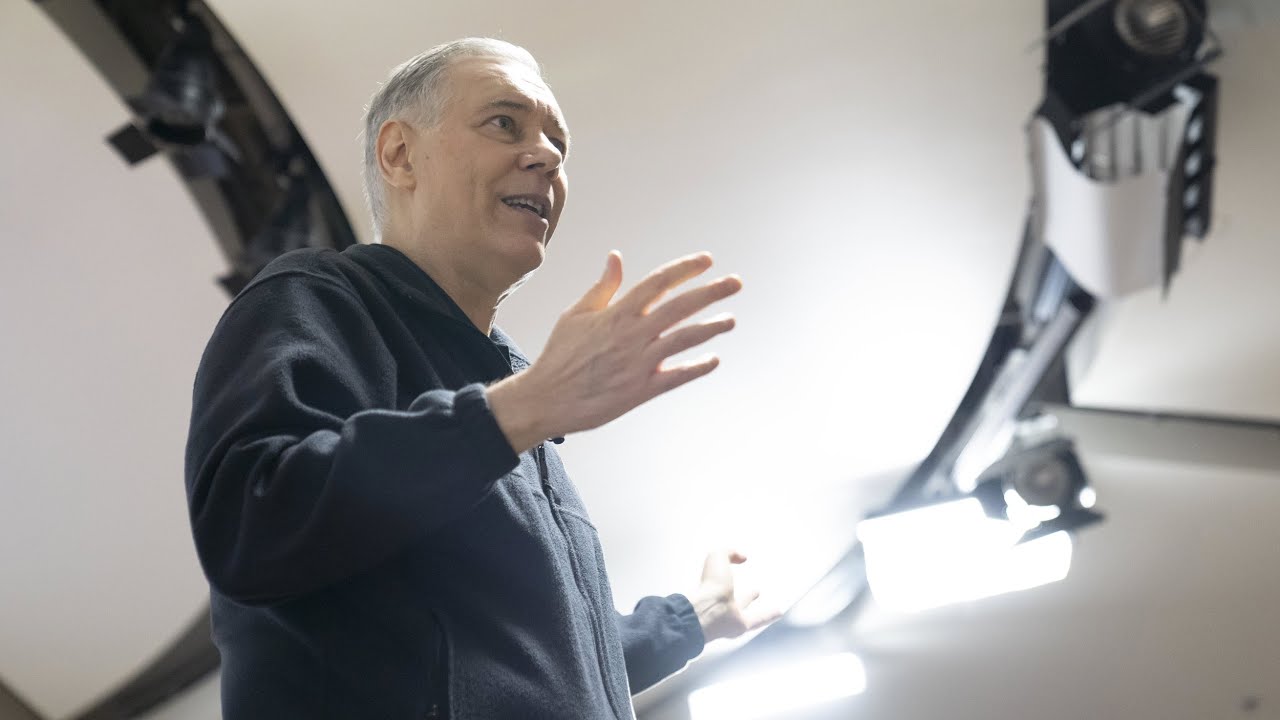

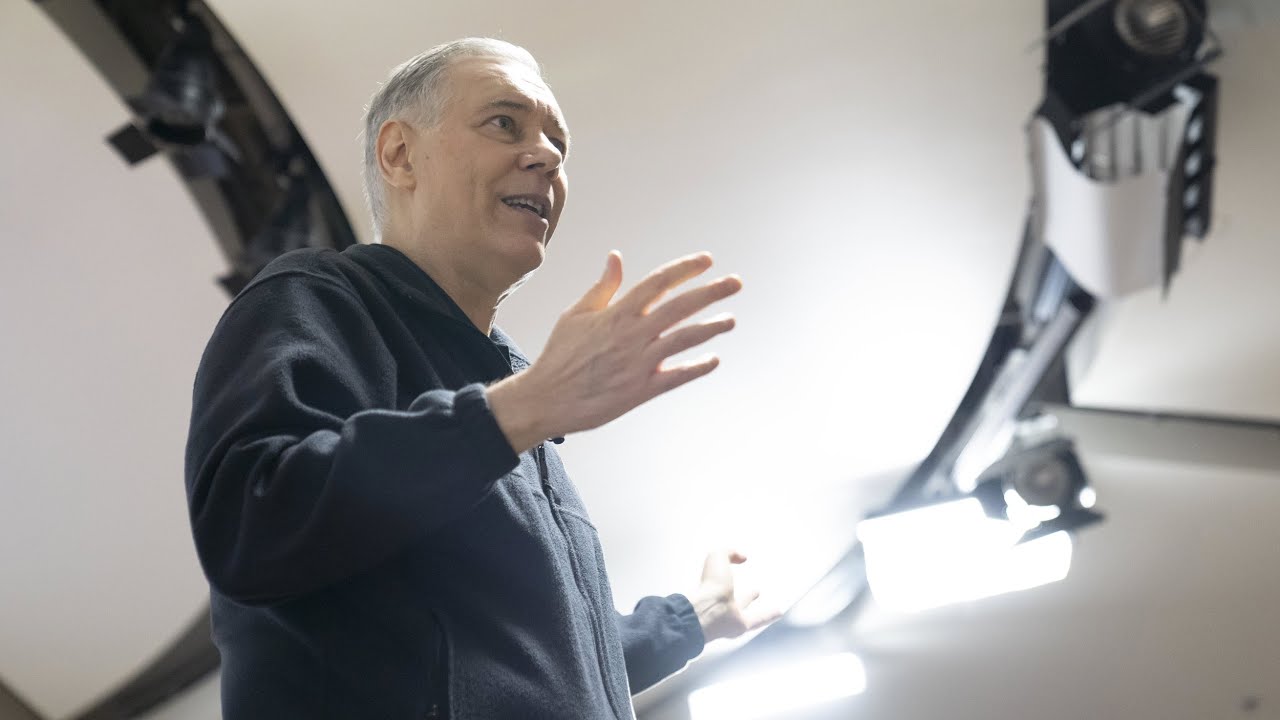

Applied Materials Chief Executive Gary Dickerson (pictured) told analysts that high-performance and energy-efficient AI computing remains the biggest driver of semiconductor innovation at the moment. “Applied is working closely with customers and partners to accelerate the industry’s roadmap,” he added.

Investors seem especially concerned about how relations between China and the U.S. will affect Applied Material’s future results. China is the company’s largest market segment, but since early April it has been caught up in a tense trade war with the U.S. The countries have slapped hefty tariffs on one another’s exports, only to reduce the rates temporarily amid negotiations on a new trade agreement.

Semiconductor equipment was given an exemption from those tariffs, but White House officials have warned that might change in future, if no deal with China is agreed to. The U.S. has threatened to impose an industry-specific tariff on semiconductors and electronics, but it’s anyone’s guess if such a scenario will actually materialize.

For now, there is a huge amount of uncertainty, and that is reflected in the company’s cautious guidance, Dickerson said in a conference call. The CEO insisted that the company has not seen any change in demand thus far, adding that customers are still increasing their investments to meet demand for AI semiconductor products.

Dickerson said in response to a question that he will not comment on the prospect of a semiconductor tariff, and instead asked investors to focus on the longer-term growth trends for the industry.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.