INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Nvidia Corp.‘s shares rose almost 5% in extended trading after the company reported better-than-expected earnings and revenue, with its data center business growing 73% year-over-year.

The growth was impressive enough that investors were even willing to forgive Nvidia’s guidance miss, and its stock rose 4% after-hours.

The company reported first-quarter earnings before certain costs such as stock compensation of 96 cents per share, beating the analyst forecast of 93 cents. Revenue for the period came to $44.06 billion, up 69% from a year ago, and ahead of the $43.31 billion expected. That helped propel Nvidia’s net income to $18.8 billion for the quarter, up from $14.9 billion in the year-ago period.

With respect to guidance, Nvidia came up short, but the forecast was not entirely unexpected. The company said it’s looking at about $45 billion in current-quarter sales, trailing Wall Street’s target of $45.9 billion. But even so, investors probably suspected the company might come up short, for Nvidia explained that its guidance would have been around $8 billion higher if not for the U.S. government’s latest export restrictions on advanced chips being sold to China.

In April, the U.S. government told the company it would need to obtain a special export license to sell any more of its H20 graphics processing units to Chinese customers, effective immediately. The H20 chip is a specialized, scaled-down version of the company’s older H100 and H200 GPUs, based on the Hopper architecture that dates back to 2023.

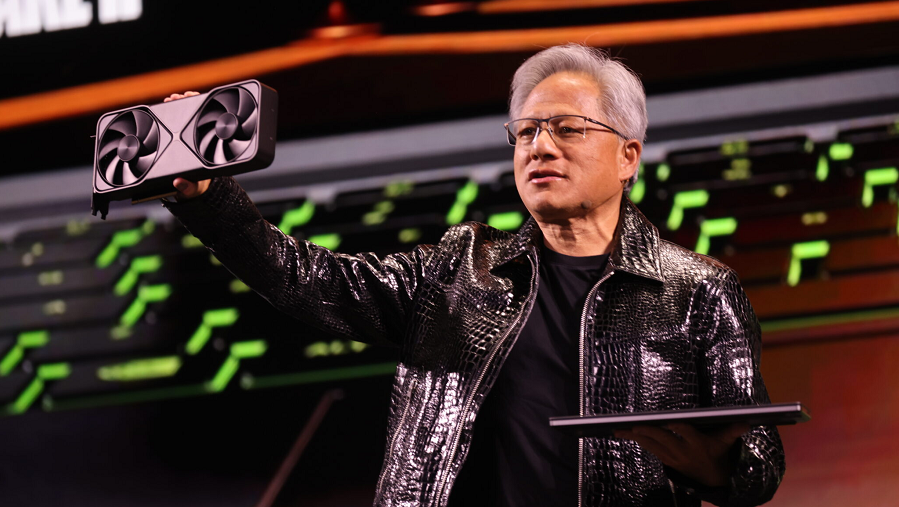

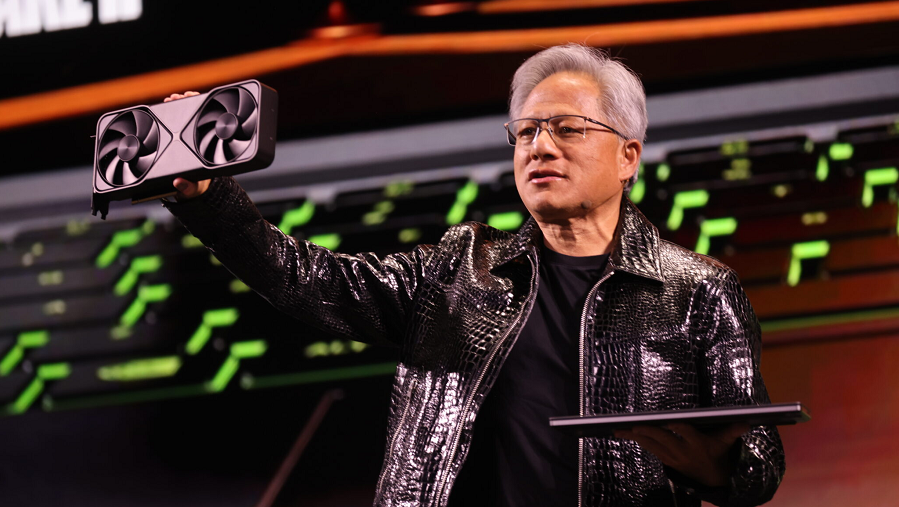

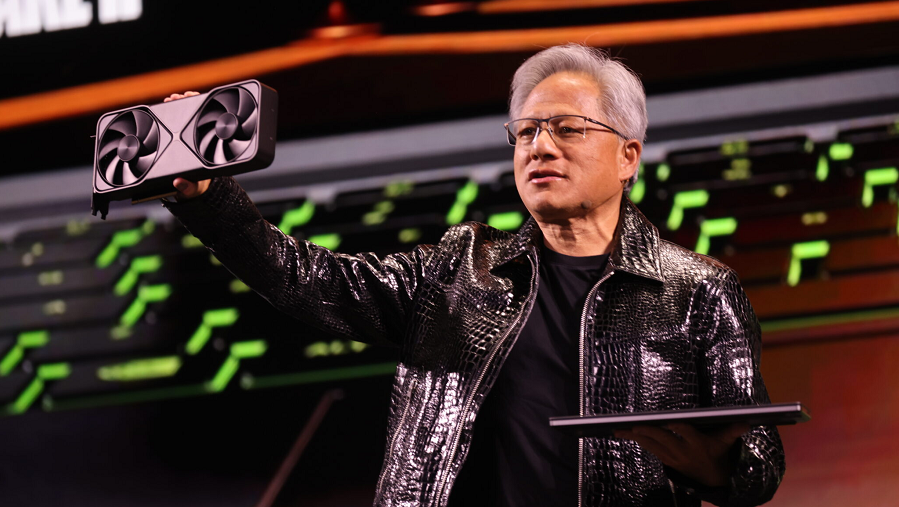

The new restrictions, which were heavily criticized by Chief Executive Jensen Huang (pictured), forced the company to write off $4.5 billion in inventory. This month, Nvidia said it had to walk away from about $15 billion in planned sales because of the restrictions.

According to Chief Financial Officer Collette Kress, the company’s gross margin would have been 71.3% in the previous quarter, rather than 61%, if not for the China-related charges.

On a conference call today, Huang told analysts that the $50 billion market for artificial intelligence chips in China is “effectively closed to U.S. industry.” He added that the H20 export ban has “ended our Hopper data center business in China.”

Though the company is unlikely to sell any more Hopper-based chips to Chinese customers, unconfirmed reports said it hasn’t entirely given up on the market. Earlier this week, a report by Reuters quoted anonymous sources familiar with the company’s plans as saying that it’s now racing to develop yet another, even more scaled-down GPU for China, based on its newer Grace Blackwell architecture. But it’s not clear if Nvidia will be able to develop a new chip that satisfies the U.S.’s strict regulations on shipments to China, and there’s no word on when such a chip might be ready for export.

Despite these problems, Nvidia is still growing aggressively. It’s benefiting from enormous demand from hyperscale data center operators such as cloud computing providers as well as large enterprises that continue to snap up as many of its GPUs as possible, in a frenzy to power advanced generative AI and agentic AI applications.

“Global demand for Nvidia’s AI infrastructure is incredibly strong,” Huang told analysts. “AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate.”

Yvette Schmitter, a consultant with Fusion Collective, told SiliconANGLE that the hit to Nvidia’s business from the latest export controls on China is unlikely to stop the company in its tracks anytime soon. “It’s staring down an $8 billion hit from export controls, yet still forecasts nearly $45 billion in quarterly sales, because apparently the loss of the H20 revenue is just a rounding error when you’re building an empire,” she said.

That said, she believes Nvidia’s executive team will have plenty to keep them occupied over the next few months. “The company faces the delicate art of juggling geopolitical landmines, scrappy competitors and that stubborn China market, all while ensuring that all roads still lead to Nvidia in the sprawling world of AI infrastructure,” she said.

Still, the company remains in an incredibly strong position. Sales in Nvidia’s biggest business unit, the data center division, rose 73% from a year earlier, to $39.1 billion, and now account for 88% of the company’s total revenue. Officials said that large cloud hyperscalers such as Microsoft Corp., Amazon Web Services Inc. and Meta Platforms Inc. accounted for just under half of the total data center revenue. Also, $5 billion of sales in the unit were related to Nvidia’s InfiniBand networking products, which are used to connect thousands of GPUs into enormous clusters to power the most demanding AI workloads.

Kress told analysts that the company was enjoying brisk sales of its latest Grace Blackwell GPUs. She said Microsoft has already “deployed tens of thousands of Blackwell GPUs, and is expected to ramp to hundreds of thousands” in the coming months, largely thanks to its close relationship with AI leader OpenAI.

AI isn’t the only growth avenue for the company, either. Nvidia reported that its gaming division, which was once its largest business but is now dwarfed by the data center unit, saw revenue increase 42% during the quarter. All told, it delivered $3.8 billion in sales of chips used for PC graphics cards and games consoles such as the new Nintendo Switch 2.

Nvidia also has a small but growing business selling chips for automotive and robotics applications, and that unit saw sales rise 72%, to $567 million, in the quarter. The company attributed growth there to increased demand for chips for self-driving cars. Meanwhile, the professional virtualization business, which sells chips for high-powered workstations used for 3D design applications, saw revenue increase 19%, to $509 million.

Constellation Research Inc. analyst Holger Mueller said it’s no surprise that Nvidia is continuing to fire on all cylinders, beating expectations again even with the new export license headaches.

“Nothing seems to be able to stop Jensen Huang and company, and with its recent deals in the Middle East, Nvidia is planting the seeds for several hundred billion in future revenue from sovereign cloud deployments there,” Mueller said. “With all of Nvidia’s data center revenue riches, it doesn’t even need its other business segments to do well to keep shareholders happy. However, some may ask why the automotive business is not growing faster, it should be really taking off by now.”

Thanks to the after-hours bump, Nvidia’s stock is now almost flat in the year-to-date, and less than 5% below its record high of 148.59 reached on Jan. 6.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.