BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

The blockchain-based prediction market startup Kalshi Inc. said today it has closed on a bumper $185 million funding round led by the cryptocurrency-focused venture capital firm Paradigm, bringing its value to $2 billion.

The round, which was first reported by the Wall Street Journal, also saw participation from Sequoia Capital, Multicoin Capital and Citadel Securities Chief Executive Peng Zhao.

Separately, the Journal reported that Kalshi’s biggest rival Polymarket, officially known as Adventure One QSS Inc., is on the verge of clinching its own, $200 million funding round led by Founders Fund, though that deal is not yet finalized.

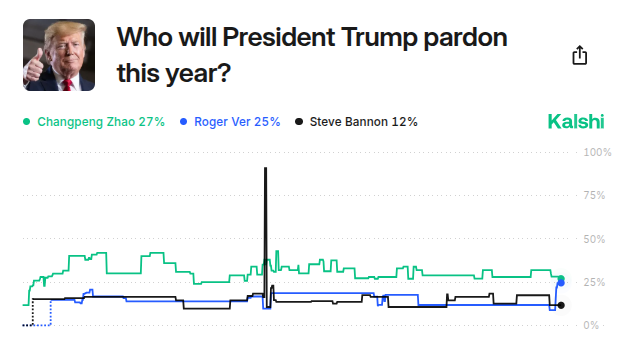

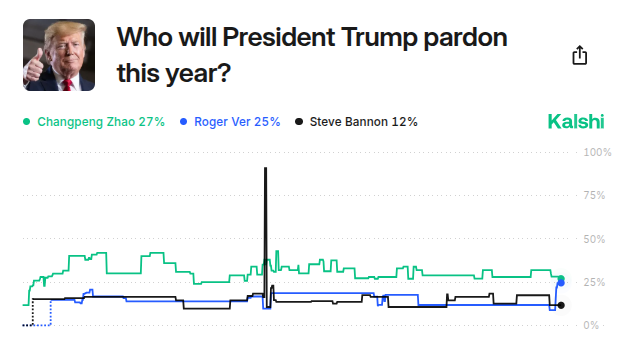

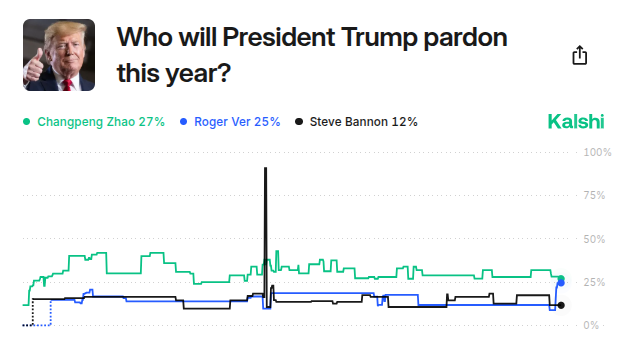

Kalshi and Polymarket both offer prediction markets powered by blockchain, enabling users to place bets on the outcome of events such as political elections, soccer matches and court cases. For instance, Polymarket is currently offering odds on whether Israel and Hamas will announce a ceasefire before the end of July, as well as the NBA’s top five draft picks.

These kinds of markets, known as event contracts, have become hugely popular since the U.S. presidential election last year. They have stirred intense debate too. Proponents argue that they provide a more accurate way to predict real-world outcomes than traditional pollsters, because they rely on people putting their money on the line, with their odds stemming from the wisdom of the crowd. It’s said they provide an unbiased view into people’s opinions.

On the other hand, critics argue that prediction markets are basically the same as gambling, encouraging people to act irresponsibly, and call for them to be regulated.

Kalshi is regulated to an extent, having won a court battle with the U.S. Commodity Futures Trading Commission last year. That decision allowed it to list contracts on the outcome of the presidential election, which had previously been blocked by the regulator. That helped Kalshi’s popularity no end, leading to a surge in betting just weeks before Donald Trump and Kamala Harris went head-to-head at the polls.

Since then, Kalshi has pushed hard into sports prediction markets, and says about 80% of its trading volume stems from these.

Gambling regulators in Nevada and New Jersey have tried to clamp down on Kalshi’s sports markets, arguing that they should be regulated at the state level. Kalshi disagrees, saying its CFTC license gives it the right to offer sports event contracts in every U.S. state.

“There’s a fine line between predictions and gambling, but Kalshi has played that very successfully while expanding its portfolio of events people can place bets on,” said Holger Mueller of Constellation Research Inc. “Technology wise, both Kalshi’s and Polymarket’s platforms are very interesting, and they appear to be one of the best commercial use cases of blockchain seen so far.”

Tarek Mansour, co-founder and chief executive of Kalshi, told the Journal that the money from today’s round would help to scale up its technology team, with the goal being to integrate its platform with more brokers. Its markets are already available through Robinhood Markets and Webull, and it’s planning more than a dozen new integrations, the CEO said.

The money will also help Kalshi in its struggle for popularity with Polymarket, which was accused of violating U.S. trading regulations and responded by blocking its citizens from its platform. But it’s now said to be in discussions with the CFTC to try to gain legal access to U.S. bettors. Polymarket is also restricted in markets such as the U.K., Belgium, France, Ontario, Poland, Singapore, Taiwan and Thailand.

Kalshi and Polymarket both need to satisfy regulators, because although their decentralized, crypto-based markets might appeal to those who decry such restrictions, big-money investors prefer to make less risky bets.

The Journal says Founders Fund’s interest in Polymarket could mean it’s getting close to agreeing a deal with the CFTC and therefore permission to operate in the U.S. Elon Musk appears to think so too, for his social media platform X Corp. recently announced it’s partnering with Polymarket, saying the platform is now its “official prediction market.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.