BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

The stablecoin market is rapidly maturing into one of the most consequential sectors of the digital asset economy.

After years of uncertainty, regulatory friction and media skepticism, stablecoins are no longer a speculative curiosity. Rather, they are foundational to the next chapter of programmable finance. Our research suggests that the convergence of policy shifts, institutional adoption and new economic use cases has thrust stablecoins into the spotlight. In short: crypto’s ChatGPT moment has arrived, and its name is stablecoin.

In this Breaking Analysis, we answer your questions about stablecoins. We’ll cover what stablecoins are and why they’re relevant. We’ll also dig into where they fit in the crypto value chain and what the public policy shifts mean to the industry. Specifically, we’ll look at the genius act and what it portends for crypto and what’s next with the Clarity Act. We’ll also dig into what this all means for U.S. Treasuries and finally what the risks are to this whole movement.

To help frame this, we’re going to draw on an interview from our NYSE CUBE studio that John Furrier did with Tom Lee as part of our CUBE + NYSE Wired Crypto Trailblazer series (below). Tom Lee is managing partner and the head of research at Fundstrat Global Advisors. He is by far my favorite guest from TV programs such as CNBC and provides next-level analysis on markets and financial trends. For a long stint he was JPMorgan Chase & Co.’s chief equity strategist and is the chairman of Bitmine Immersion Technologies, which is a blockchain tech and digital asset management firm. So we’ll insert commentary from that interview throughout this episode.

Here’s the TL;DR on these questions:

Despite all the enthusiasm, which is awesome, we’ve seen this before where the regulatory pendulum swings toward less oversight, which invariably leads to bad behavior and often market meltdowns.

Let’s dig in a little more to each of these questions.

Stablecoins are digital assets pegged to the value of fiat currencies – most commonly the U.S. dollar. Unlike cryptocurrencies such as bitcoin or Ethereum or Solona, which are highly volatile, stablecoins maintain a steady price by being backed with reserves, in fiat, other cryptocurrencies or algorithmic mechanisms. Think of stablecoins as the grease in the wheels of crypto markets, enabling real-time trading, payments and, increasingly, on-chain financial services.

According to Tom Lee, stablecoins and the recent change in attitude of from public policy has created the “ChatGPT moment for crypto” and has become a catalyst for broader institutional acceptance – and a growing revenue engine for banks and platforms alike.

[Watch Tom Lee explain his point of view on the ChatGPT moment for stablecoins]

The stablecoin business has become the ChatGPT moment for crypto. It’s widely been adopted by consumers and merchants. And now banks want to offer stablecoins. Most of that’s taking place on Ethereum. – Tom Lee on theCUBE + NYSE Wired

Why Ethereum?

For those not familiar with the premise behind Ethereum, let’s explain briefly. Bitcoin is often referred to as a store of value or digital gold. You buy it and hold it. But it doesn’t really have much utility in terms of enabling new technologies or supporting the development of nascent markets such as decentralized apps or dApps, or supporting the exchange of goods and services via smart contracts.

Bitcoin is not programmable. Ether is. The primary programming language for developing smart contracts on the Ethereum blockchain is called Solidity. It’s an object-oriented language, purpose-built for creating smart contracts that run on the Ethereum Virtual Machine or EVM. Its syntax is much like C++, Python and JavaScript, which makes it relatively easy for developers who are familiar with these languages.

Of course, generative artificial intelligence will make programming Ethereum even easier. So Ether’s founders such as Vitalik Buterin and Anthony Di Iorio (a CUBE alum by the way), had the vision of creating a blockchain platform that was programmable and could execute smart contracts to build decentralized applications. And this is all gaining new momentum in the market.

Stablecoins represent a bridge between the traditional financial system and the decentralized future. Their relevance stems from four factors as shown below:

But let’s dive in a bit deeper:

[Watch Tom Lee explain the economics behind stablecoins and staking]

Stablecoins are a hugely profitable business. Circle is showing it, because they don’t pay interest and they’re earning 4% on their reserves.… Coinbase is very profitable…. Ethereum treasury companies are very profitable.” – Tom Lee

Stablecoins operate as the foundational layer of liquidity in the crypto ecosystem. They are integral to decentralized finance or DeFi, centralized exchange or CEX operations, and emerging use cases such as tokenized real estate and equities — although we’re less bullish on real estate as an asset backer for stablecoins because of its inherent lack of liquidity. But over time that will perhaps evolve. In Lee’s words, Ethereum has become “the biggest macro trade for the next 10 years,” in part because it is the dominant substrate for stablecoin deployment and smart contract innovation.

Ethereum is programmable. It is really robust… Wall Street is coming in and saying, ‘I want to tokenize a dollar.’ That’s the stablecoin. – Tom Lee

The transition from the Biden-Gensler regime to the Trump-Sacks-Atkins leadership marks a clear and deliberate pivot in U.S. crypto policy – from an enforcement-first posture to a market- and crypto-friendly framework aimed at better clarity and sparking innovation.

Under President Biden, former SEC Chair Gary Gensler – as you’ve heard us complain many times on theCUBE Pod — pursued an aggressive enforcement agenda, asserting that most digital assets qualified as securities under existing law. His tenure was marked by high-profile lawsuits, regulatory ambiguity and a chilling effect on U.S.-based crypto innovation. The Gensler era framed the industry largely through the lens of investor protection and systemic risk. That’s not all bad, by the way, but they had zero focus in our opinion on innovation and U.S. competitiveness and absolutely no vision of the future.

By contrast, the Trump administration’s appointments of David Sacks as the AI and Crypto Czar and Paul Atkins, who was confirmed as SEC Chair in April 2025, has introduced a dramatic shift in tone, substance and vision. Sacks is an entrepreneur and innovator, while Atkins is a known proponent of light-touch regulation and market-driven oversight. Under this regime we expect the following:

The new administration is:

In our view, this leadership transition signals a green light for financial institutions, fintechs and crypto-native firms seeking to operate within clear, predictable rules. It also aligns the U.S. more closely with jurisdictions such as the U.K., United Arab Emirates and Singapore, which have already implemented forward-leaning crypto frameworks. But importantly, because stablecoins will be backed by the world’s reserve currency, it creates a virtuous dynamic cycle for the USD and Treasuries.

This is why Tom Lee calls stablecoins and the recent legislation the “ChatGPT moment for crypto.”

As we enter the second half of 2025, we believe the regulatory bottleneck that once constrained U.S. crypto leadership is finally breaking loose. And our view, this will usher in a new era of digital asset legitimacy, capital formation and competitive positioning for the dollar.

Attitudes toward crypto have shifted dramatically. What was once considered fringe is now mainstream. Wall Street is not only buying crypto assets but building infrastructure around them.

The legitimization is not only regulatory – it’s cultural. The listing of crypto firms such as Bitmine, or BMNR, on the NYSE, as Lee noted, sends a powerful signal that traditional finance sees crypto as credible.

[Here’s Tom Lee’s take on the credibility of crypto and why the NYSE]

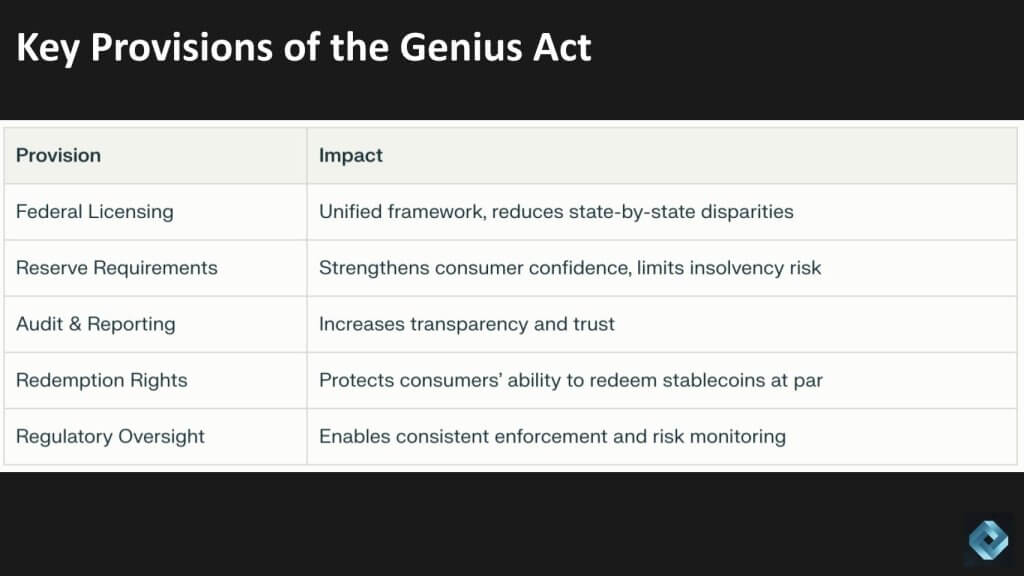

The GENIUS Act, which stands for the Guiding and Establishing National Innovation for U.S. Stablecoins Act, is a U.S. law establishing the first comprehensive regulatory framework for stablecoins. It aims to provide clarity and consumer protections within the stablecoin market, fostering innovation and potentially strengthening the U.S. dollar’s position as a reserve currency. The bill was signed into law on July 18 by President Trump.

Why Is the GENIUS Act Important and what are the key provisions in the act?

This is the first comprehensive federal stablecoin regulation – The U.S. has operated without a unified national law specifically governing stablecoins, leading to a patchwork of inconsistent state rules. The GENIUS Act aims to provide clarity and uniformity, reducing regulatory uncertainty for issuers, financial institutions, and consumers.

Consumer and financial system protections – By imposing reserve requirements and explicit rules for redemptions, the act ostensibly reduces risks such as issuer insolvency, bank runs and consumer losses that have been major concerns in the rapidly growing stablecoin market.

Encouraging responsible innovation – The act allows both banks and qualified nonbanks, including technology firms, to issue stablecoins, potentially fostering competition and innovation in digital finance. It seeks to balance growth in the stablecoin sector with safeguards for market integrity. This is somewhat controversial and we’ll address the risks later in this episode.

Addressing systemic risk and market integrity – Stablecoins are increasingly used in payment systems, remittances and decentralized finance. The act addresses systemic risks by ensuring that issuers are subject to ongoing supervision and that the underlying assets are transparent and secure.

The Clarity for Payment Stablecoins Act (aka the CLARITY Act) recently passed out of the House Financial Services Committee with bipartisan support. It defines payment stablecoins and sets reserve requirements, audit standards, and registration routes. This bill is critical because it differentiates stablecoins from securities and provides a lawful onramp for banks and fintechs to issue them.

If passed, the act will likely accelerate institutional adoption and reduce regulatory uncertainty, making it a foundational piece of the crypto policy framework.

The GENIUS Act and CLARITY Act are different.

GENIUS Act: Focuses narrowly on the regulation of payment stablecoins.

CLARITY Act: Provides a broader market structure for digital assets that are not stablecoins (for example, cryptocurrencies and tokens). The act seeks to clarify the distinction, regulatory treatment and supervisory roles for all digital assets that may be classified as commodities, securities or fall under other regulatory categories.

Stablecoins such as USDC (issued by Circle) are backed by short-term U.S. Treasuries and cash equivalents. The business model is simple but really powerful. The way it works is issuers collect deposits, invest them in T-bills yielding somewhere around 4% to 5%, and return none of that interest to holders.

As Tom Lee said in the earlier clip: “Circle doesn’t pay interest and they’re earning 4% on their reserves.”

This has created massive cash flow opportunities, making stablecoins functionally similar to money market funds, but with blockchain-native benefits – low friction movement of money, no trusted third party required, lower fees and immutability of the blockchain.

Stablecoins are becoming significant marginal buyers of U.S. Treasuries. As adoption scales, so does demand for T-bills. This supports Treasury market liquidity and extends dollar influence globally, particularly in emerging markets where dollar-pegged stablecoins often outcompete local currencies.

[Listen to Tom Lee explain this dynamic using Bermudian dollars as an example]

In our view, this reinforces U.S. economic sovereignty through digital financial infrastructure and represents an underappreciated geopolitical tailwind.

In short, the passage of the GENIUS Act has major implications for the U.S. Treasury market, primarily because it requires permitted stablecoin issuers to fully back their tokens with high-quality, liquid assets – most notably U.S. Treasuries and cash equivalents. Two things we’d call out in terms of the impact on US Treasuries:

First: This creates increased demand for Treasuries:

Stablecoin issuers are now mandated to maintain reserves in cash or short-term U.S. Treasury securities. As the stablecoin market grows, potentially into the trillions of dollars, these issuers will become significant purchasers of Treasuries. JPMorgan analysts have projected that stablecoin issuers could soon be among the largest buyers of Treasury bills, ranking alongside major foreign holders like China and Japan.

Second: This reinforces dollar and Treasury hegemony:

By establishing a robust regulatory framework and making U.S. dollar stablecoins more globally attractive, the law supports the continued centrality of U.S. Treasuries as a global safe asset. This could support the demand for dollars and Treasuries, especially for cross-border payments and international investors seeking regulatory certainty

Now let’s tie this into some Enterprise Technology Research data on the Fintech sector. We’ll do so with this two-dimensional graphic that shows a number of fintech platforms. Spending velocity on the platform is the Y axis and market penetration or Pervasion is on the X axis.

Let’s just focus in on Stripe’s leadership to make a point.

This ETR Peer Position chart from July 2025 shows Stripe with the highest Net Score (39.7%) and the broadest shared account footprint (11.5%) among fintech vendors — well ahead of legacy platforms such as Intuit, Fiserv and and Bill.com.

This positioning reinforces a key thesis in today’s Breaking Analysis: The crypto economy is rapidly merging with mainstream fintech infrastructure, and firms such as Stripe are emerging as a primary conduit.

In our view, this validates Tom Lee’s assertion that stablecoins are the “ChatGPT moment” for crypto, and that banks and fintechs are now racing to offer Ethereum-based stablecoin solutions – a narrative that Stripe is helping to put into operation at scale.

OK, all that said… Let’s look at some of the risks and criticisms on the other side of this legislation.

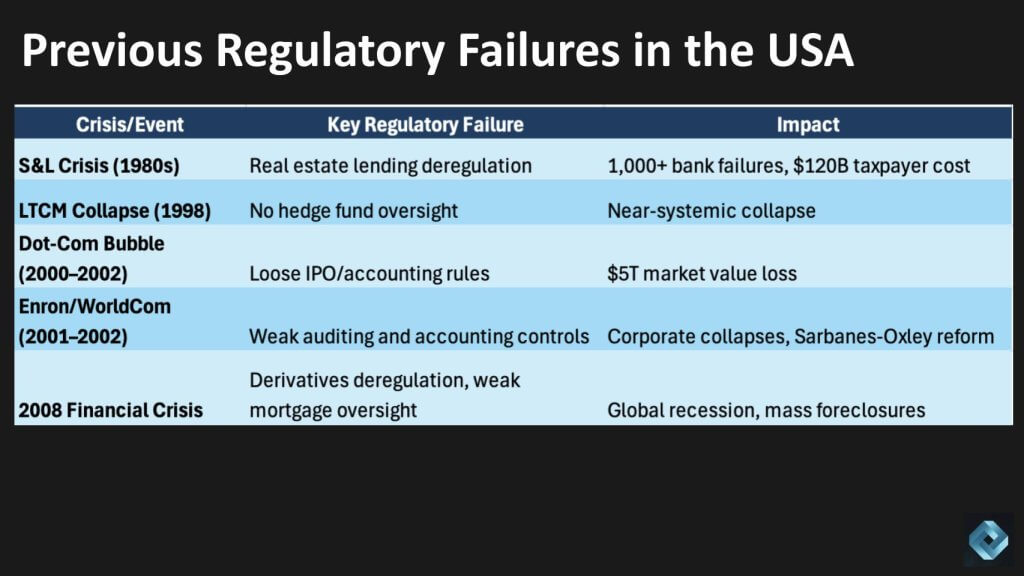

Though we’re really bullish on the recent changes in public policy toward crypto, we don’t want to ignore the fact that often relaxed regulation leads to financial meltdowns. Here’s a quick look at some of the disasters or crises over the past four to five decades.

The S&L crisis in the 1980s stemmed from the relaxation of real estate lending regulations and put over one thousands banks out of business at a taxpayer cost well over $100 billion.

The Long Term Capital Management collapse in 1998 can be traced back to the lack of hedge fund oversight and when LTCM went rogue the system nearly collapsed.

In order to do an initial public offering during the dotcom era, you had to have a Web domain and a prospectus – I’m oversimplifying but the accounting rules were lax, leading to trillions in lost market value.

Enron and Worldcom essentially had fraudulent accounting and that led to Sarbanes-Oxley.

And the 2008 financial crisis can be traced to deregulation in packaging crappy assets and derivatives, plus easy money lending policies that were overlooked by regulators, leading to a prolonged global recession.

For what it’s worth, the S&L crisis was pushed by Republicans under the Reagan administration. The lack of regulation that led to the Long Term Capital Management and Dotcom meltdowns were bipartisan as was the derivatives deregulation that led to the 2008 financial crisis – approved by Republicans in Congress and signed by President Clinton – and the weak accounting controls that led to the Enron and Worldcom fraudulent reporting was a W Bush-era initiative.

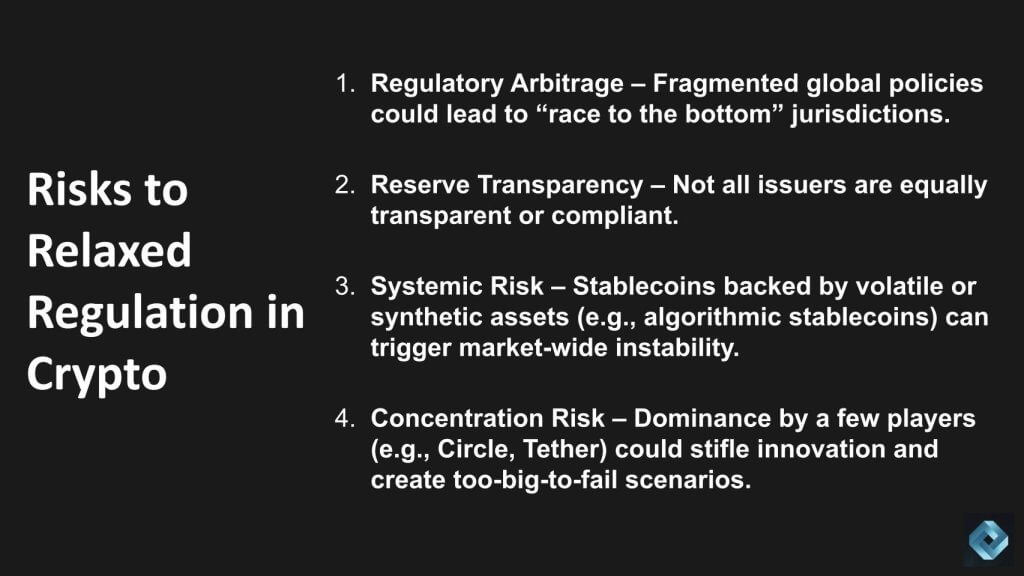

At any rate – despite the wonderful tailwinds, many feel the stablecoin ecosystem faces substantial risks:

Below we highlight four:

As Tom Lee explained, clear backing is essential. He said to John Furrier:

“As long as people are backing the reserves, there’s no risk.… That’s what the model is.” – Tom Lee

As he also noted the irony is that many existing fiat-pegged currencies (like the Bermudian dollar) operate with far less transparency or backing than modern stablecoins. Hence these stablecoins are more stable than many existing currencies.

Despite the risks, in our opinion, stablecoins are no longer the speculative playground of crypto insiders. They are becoming mainstream instruments of economic policy, institutional strategy and programmable finance. The regulatory fog is lifting and clarity is emerging. As lawmakers, investors and financial giants converge around stablecoins, we believe this is not merely a trend: It’s an inflection point.

Crypto has had many “moments.” This one feels different. In a tip of the cap to Tom Lee: This one has a yield.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.