INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Intel Corp.’s turnaround continued making progress, as the company repored strong sales growth in its core personal computer chip business and lower costs from layoffs and other cuts implemented over the past year.

The struggling chipmaker, which has fallen far behind rivals such as Nvidia Corp. in the artificial intelligence race, reported a strong revenue beat today. Sales for the third quarter came to $1.65 billion, easily surpassing Wall Street’s target of $13.14 billion.

The company also reported earnings before certain costs such as stock compensation of 23 cents per share, though it explained that this figure is not comparable to analysts’ estimates. That’s to account for shares currently held in escrow, which will be released to the U.S. government later as part of its $8.9 billion investment in the company. The Trump administration’s investment was announced in August, when it agreed to buy 433.3 million shares at $20.47 per share.

Intel also reported net income of $4.1 billion, rising from a $16.6 billion loss in the year-ago quarter.

In its press release, Intel warned investors that there is “limited precedent for the accounting treatment of such transactions,” in reference to the U.S. government’s stake. It said it has met with Securities and Exchange Commission officials to seek approval for its accounting approach, but hasn’t received it yet because of the government shutdown, so it may need to revise its results.

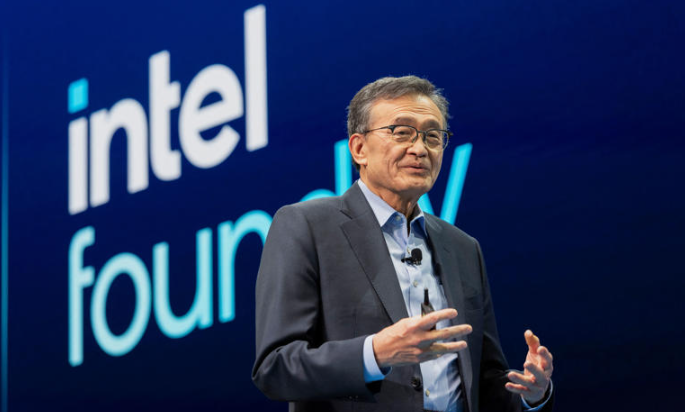

Still, the results so far look extremely positive, and on a conference call with analysts, Intel Chief Executive Lip-Bu Tan (pictured) reiterated the “steady progress we are making to rebuild the company.” He added that his priority is to continue making the company more efficient. “We have a long way to go, [but] we are taking the right steps,” he added.

Intel Chief Financial Officer David Zinsner told analysts on the call that the company has been burning through its inventory of central processing units for PCs much faster than expected. He explained that businesses are now rushing to purchase new laptops equipped with the latest version of Microsoft Corp.’s Windows operating system, now that support for Windows 10 has ceased. “Demand is much stronger than we anticipated when we planned our supply for the year,” he said.

Today’s results broke a streak of sixth successive quarterly losses for Intel, and investors were clearly delighted with the company’s efforts. In the late-trade session, the company’s stock rose more than 7%, adding to a 4% gain earlier in the day.

In the year to date, Intel’s stock has gained more than 85%, though virtually all of those gains have come since August, when the company first revealed the U.S. government’s plan to take a 10% stake in it. The stock got another strong boost in September when Intel announced that its rival Nvidia would invest $5 billion and had also agreed to buy thousands of its x86 CPUs to power its data center servers.

Those investments have boosted confidence in Intel’s long-term potential, coming after a years-long decline. The deal with the Trump administration suggests that the government won’t allow Intel to fail, while Nvidia’s investment gives the company an opportunity to get a bigger foothold in data centers.

Still, Intel isn’t out of the woods yet. Tan, who only took over the helm of the company in May, has implemented some dramatic changes as he attempts to revamp its product lines, slash operating costs and try to attract customers for its struggling contract chip manufacturing business. Intel Foundry revenue for the quarter came to $4.2 billion, down 2% from a year earlier, so there’s clearly still work to be done.

Intel also faces stiff competition in its core PC and data center server markets from Advanced Micro Devices Inc., which sells competing CPU products. Data center chip sales came to $4.1 billion in the quarter, down by a single percentage point from a year ago.

Holger Mueller of Constellation Research Inc. said he also has concerns, even though Intel did well to deliver a profit at last. He pointed out that the year-over-year comparisons are a little skewed because they figure in a $5 billion restructuring charge, and said growth is still somewhat sluggish, with the client computing group the only major business to show promise.

“The data center group and the foundry business both went backwards in the quarter, and Intel also slashed 20% off of its research and development budget, which is a bit of a concern to me,” the analyst said. “It’s not clear yet where the growth drivers will come from, if not from further R&D. Data center revenue will be the key metric to watch for the next few quarters.”

Fortunately, Zinsner told analysts he’s hopeful of a rebound in data center CPU sales in the coming quarters, saying that so-called hyperscalers need to upgrade their older server systems with new CPUs to enhance their focus on AI inference workloads. Intel specializes in CPUs, which are needed in AI servers to perform various secondary tasks so that the graphics processing unit can focus on compute operations only. Intel has not been able to compete with Nvidia in the GPU industry, which has seen explosive growth recently due to the AI boom.

However, as more companies switch from AI experimentation to putting it in production, there is a growing need for inference chips that ideally need to be coupled with CPUs. In addition, CPUs are often viewed as more practical chips for smaller AI models than GPUs, because of their increased power efficiency. Zinsner told analysts that using a GPU to power a small language model “is like taking your Ferrari out to get groceries,” hence the need for more CPUs.

During the quarter, Tan continued to implement his aggressive cost-cutting program, reducing the company’s employee headcount from 101,400 three months ago to just 88,400. The headcount is now down 29% from a year ago, Intel said.

Looking to the fourth quarter, Intel called for revenue of between $12.8 billion and $13.8 billion, the midpoint of that range matching Wall Street’s consensus estimate of $13.4 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.