BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Technology giant IBM Corp. today announced the launch of a new blockchain digital asset platform for financial institutions and regulated businesses.

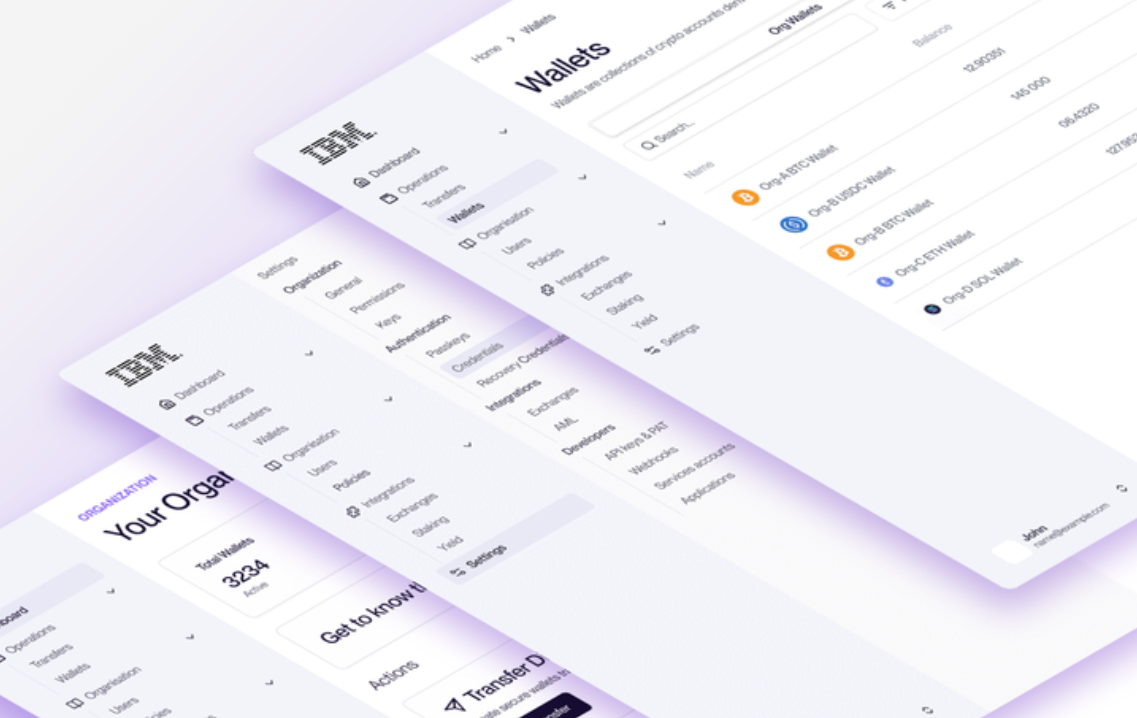

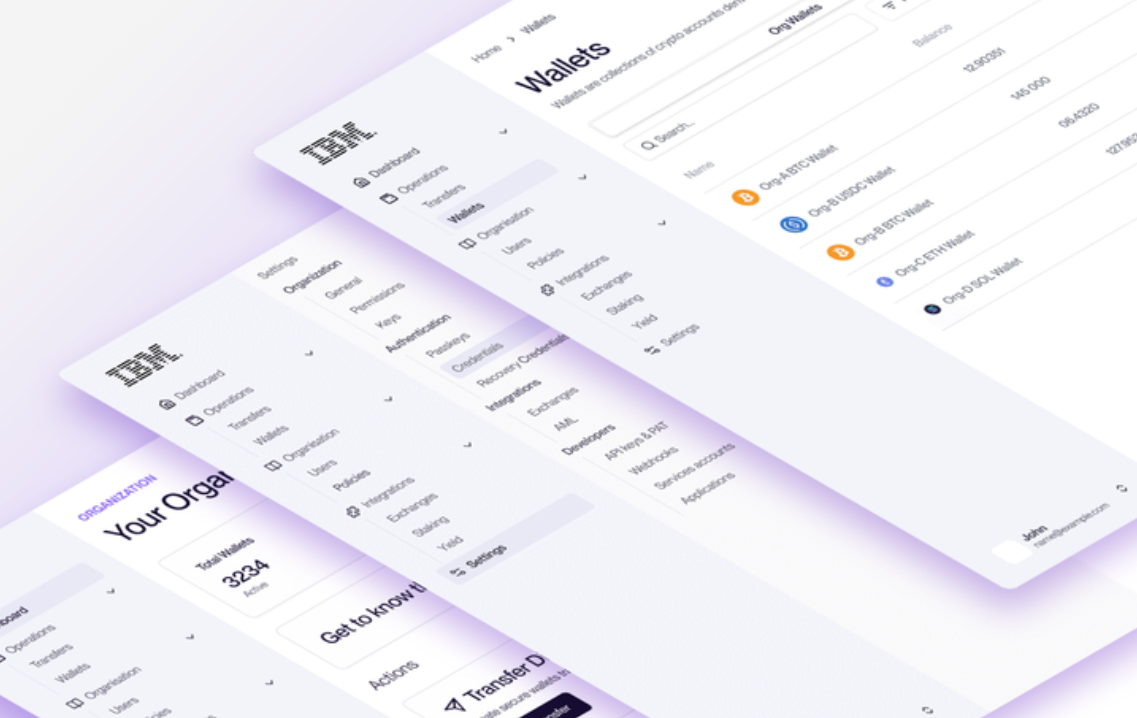

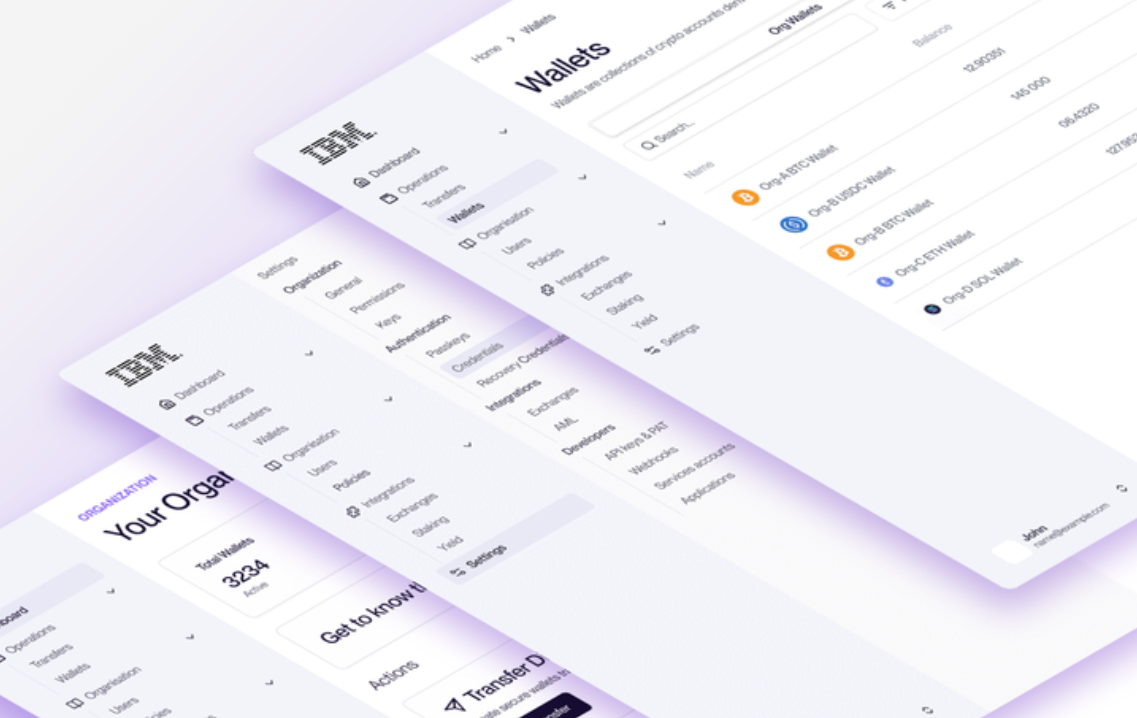

The new platform, called Digital Asset Haven, will provide banks, corporations and governments a secure management of cryptocurrencies such as bitcoin, Ethereum, stablecoins and tokenized assets.

IBM developed the platform in collaboration with Dfns SAS, a digital wallet infrastructure provider for financial technology and enterprise clients. Digital wallets act as secure storage for blockchain-based assets and tokens. Wallets don’t hold the assets themselves, but they manage the private keys required to access and transfer cryptocurrencies, enabling users to buy, sell and trade them securely.

Dfns manages more than 15 million wallets for over 250 clients, offering services that meet complex compliance, performance and security requirements.

Blockchain technology powers cryptocurrencies and tokens through a decentralized, secure and transparent ledger system that records every transaction. It creates a shared, immutable record of ownership and transfers using cryptography, removing the need for a central authority such as a bank. Each transaction is linked to the previous one, making it extremely difficult to alter without detection.

Digital Asset Haven provides lifecycle management for blockchain transactions, from automation and routing to monitoring and settlement across more than 40 public and private blockchains. It also integrates third-party tools for identity verification and financial crime prevention to support Know Your Customer and anti-money-laundering compliance.

“This new, unified platform delivers the resilience and data governance they have been asking for, empowering governments and enterprises to build the next generation of financial services,” said Tom McPherson, general manager of IBM Z and LinuxONE.

IBM’s move further into the digital asset space comes as interest in cryptocurrencies rises among banks and enterprises. Much of this growth is driven by new regulations surrounding stablecoins, a class of cryptocurrency pegged to a fiat currency such as USD so that each token consistently trades for $1.

A major shift for the sector came in July with the passage of the GENIUS Act, the Guiding and Establishing National Innovation for U.S. Stablecoins Act, which gave financial institutions and businesses long-awaited regulatory clarity on how to use and offer stablecoin services.

Earlier this month, a coalition of international banks formed a partnership to explore stablecoin-like digital currencies. Members include Goldman Sachs Group Inc., Bank of America Corp., UBS Group AG and Banco Santander. In Europe, a consortium of nine banks, including ING and UniCredit, announced plans last month to launch a Euro-focused stablecoin.

The stablecoin market is currently led by Tether, which accounts for about $183 billion of the roughly $311 billion stablecoins in circulation, according to CoinGecko.

“For digital assets to be integrated into core banking and capital markets systems, the underlying infrastructure must meet the same standards as traditional financial rails,” said Dfns Chief Executive Clarisse Hagège.

IBM said Digital Asset Haven will be available via software-as-a-service in the last quarter of this year and is plans to support on-premises roll-outs in the second quarter of 2026.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.