AI

AI

AI

AI

AI

AI

Welcome to this special Breaking Analysis, where we look back and grade ourselves on our 2025 enterprise technology predictions.

This is the time of year when we get a flood of predictions from public relations and other thought leaders. As you know, we publish predictions every January: TheCUBE Research does a set, we do a set with the Data Gang (Tony Baer, Sanjeev Mohan and the crew), and Eric Bradley of Enterprise Technology Researc and I do our Breaking Analysis predictions. We’ll do those again in January after the new ETR data comes out.

But today is about grading our 2025 calls.

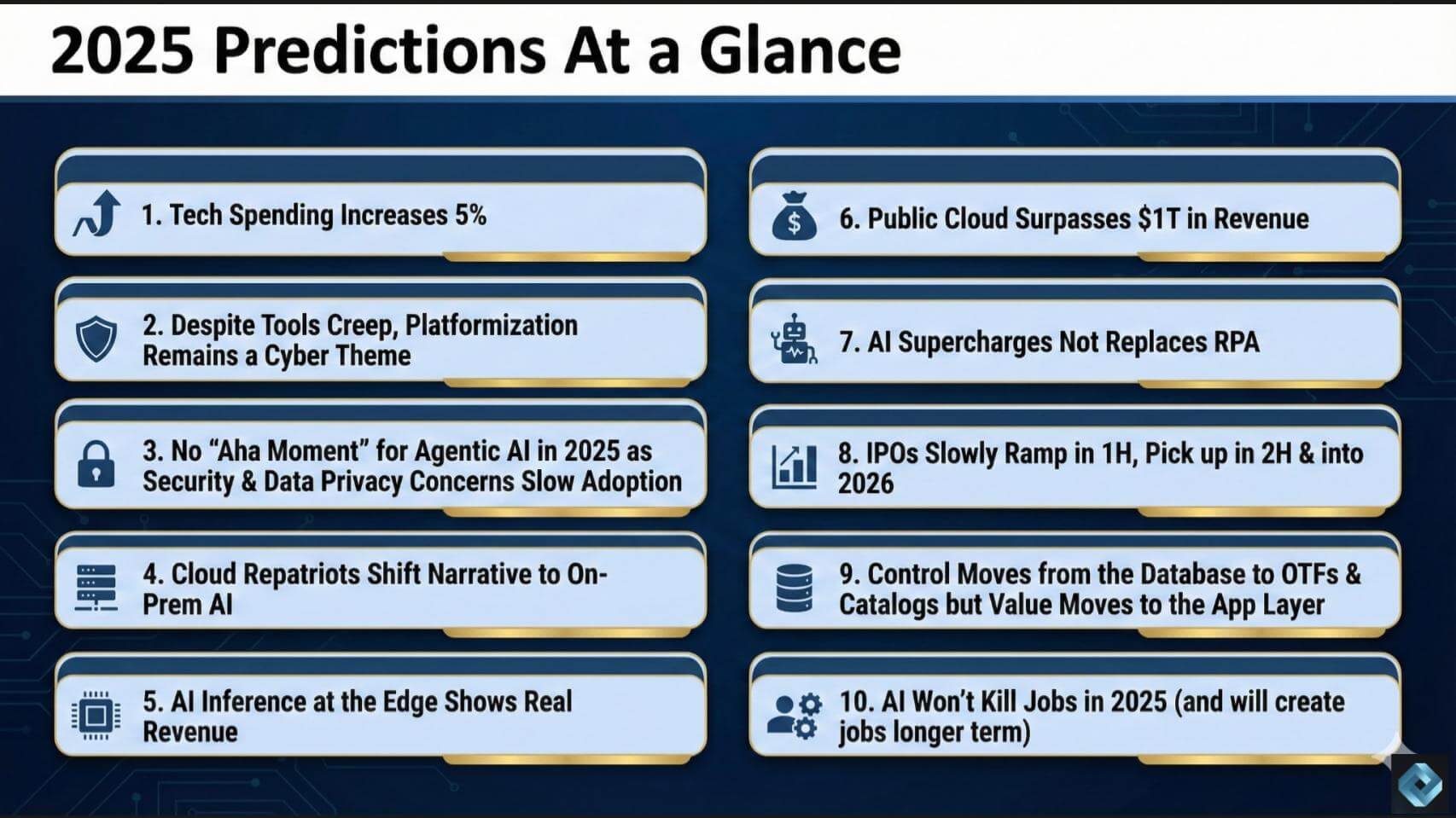

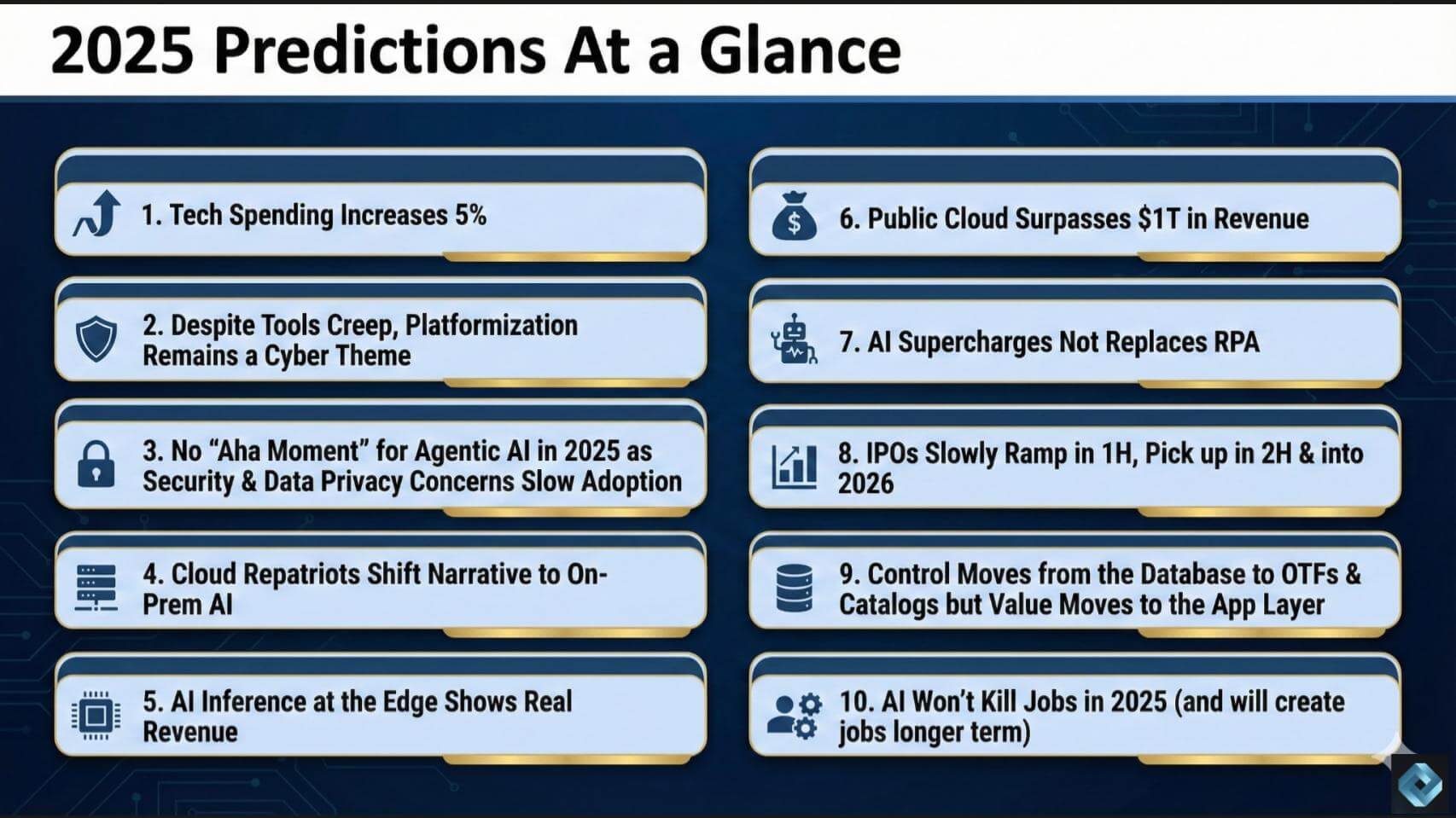

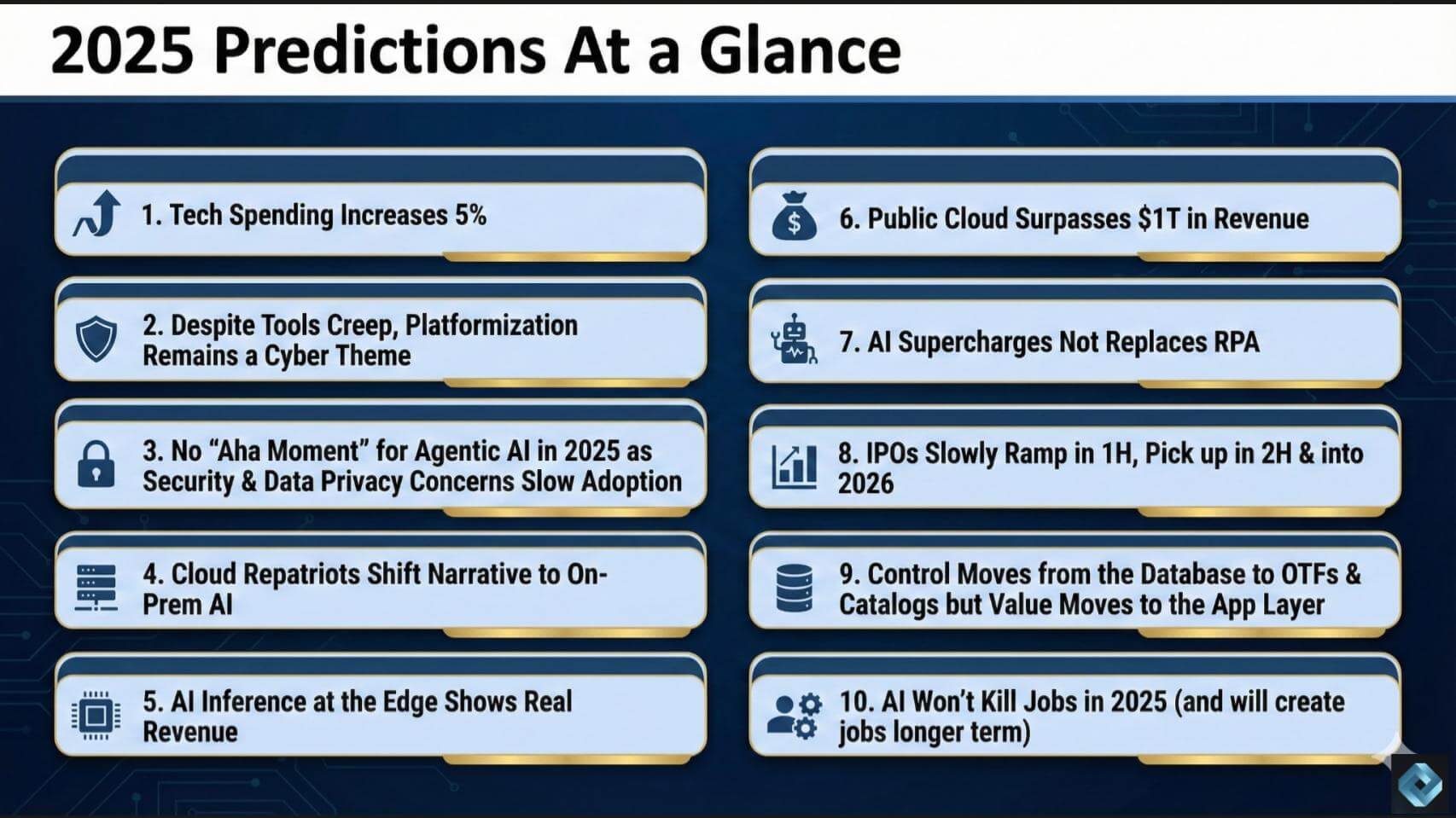

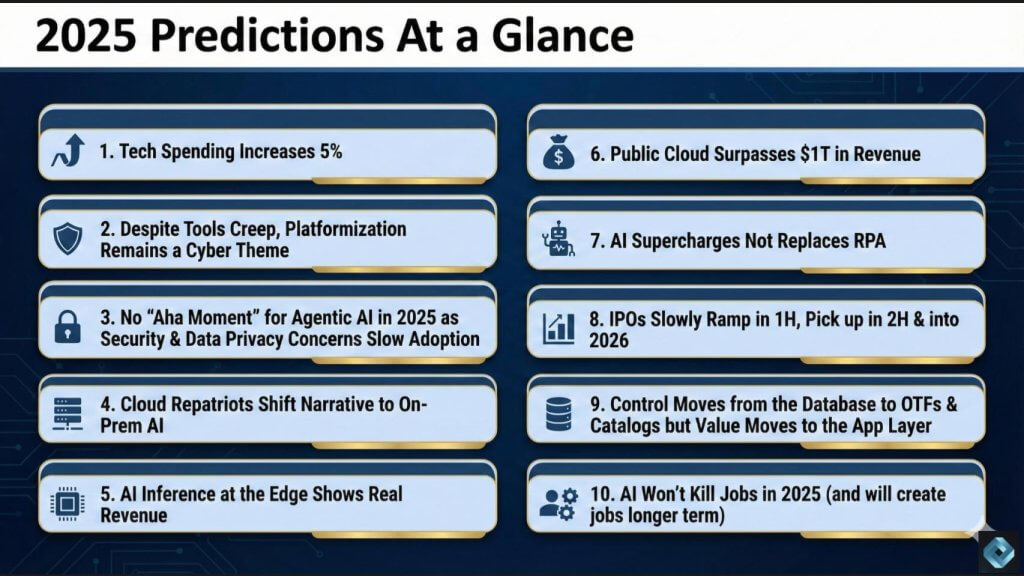

Below we show all of our 2025 enterprise tech predictions in one slide. They range from tech spending (we always do one there) to agentic artificial intelligence to cloud, and then markets, data and AI.

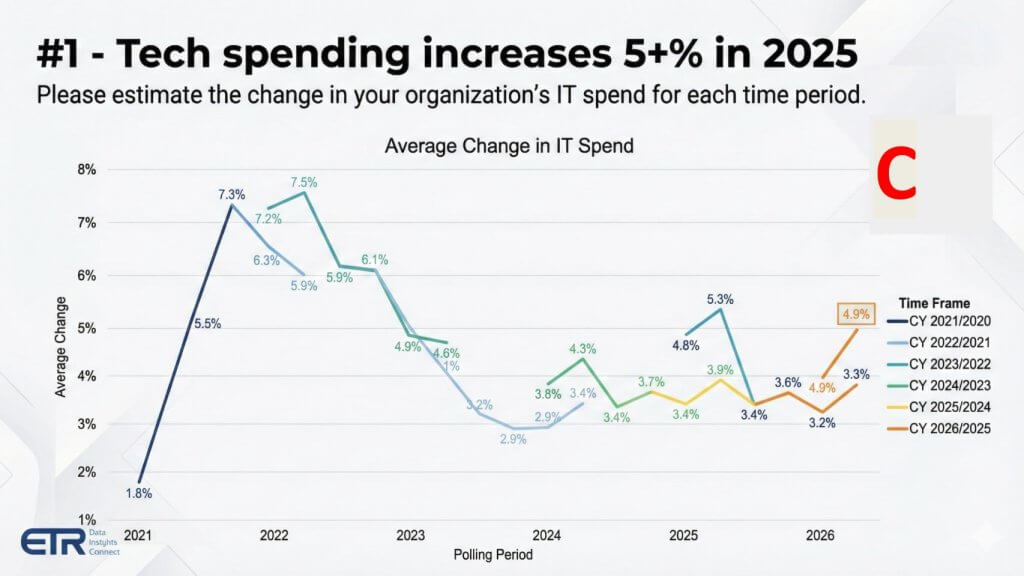

Our prediction was that tech spending increases 5% in 2025. We entered the year with information technology decision makers expecting 5.3% growth. But throughout 2025 — amid tariff concerns and economic uncertainty — we saw a pretty sharp drop to about 3.4%. Expectations bumped up to 3.6%, then back down, and basically stayed in the 3% range.

Now we’re entering 2026 with expectations around 4.9% or 5%. But we give ourselves a C here because we missed. Generally speaking, we think IT spending — budgets, as reported by IT decision makers — will come in at low single digits, roughly 3% to 4%.

When you look at IDC numbers, you’ll hear double-digit growth, but that includes all the CapEx going in to the data center build. That is not IT spend. Here, we track IT spending in the sense of budget increases reported by IT decision makers. And if you look at what happened post-COVID, expectations were over 7%. As interest rates rose, tech spending expectations dropped — pretty clearly inversely proportional.

So: C.

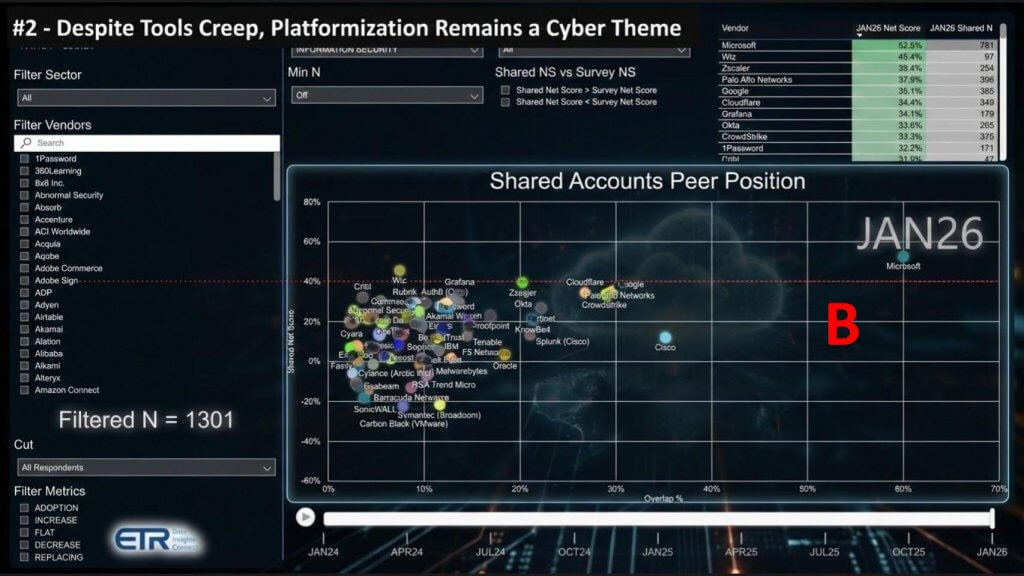

We gave ourselves a B here.

This is a quick snapshot from the January 2026 survey — preliminary data. The reason to focus on it is that red dotted line at 40%. Last year, more companies were above that 40% line — Zscaler Inc., Palo Alto Networks Inc., I think even Cloudflare Inc. Now they’re below it. Only Microsoft Corp. and Wiz Inc. are above that 40% line today.

That suggests some consolidation. The Wiz acquisition is another indicator. Palo Alto Networks and CrowdStrike Holdings Inc. are clearly having success with consolidation, and what Palo Alto Chief Executive Nikesh Arora calls “platformization” in security.

At the same time, practitioners still keep bringing in new tools. This week we had Obsidian Security Inc. on with CEO Hasan Imam, and we discussed why the market “needs another security company.” They’re focused on agentic within software-as-a-service — securing agents inside SaaS platforms — which is growing. That’s a niche the major platforms may not fully attack today, so the need for additional tools remains.

Net: Signs of consolidation, but not to the degree we originally predicted. B.

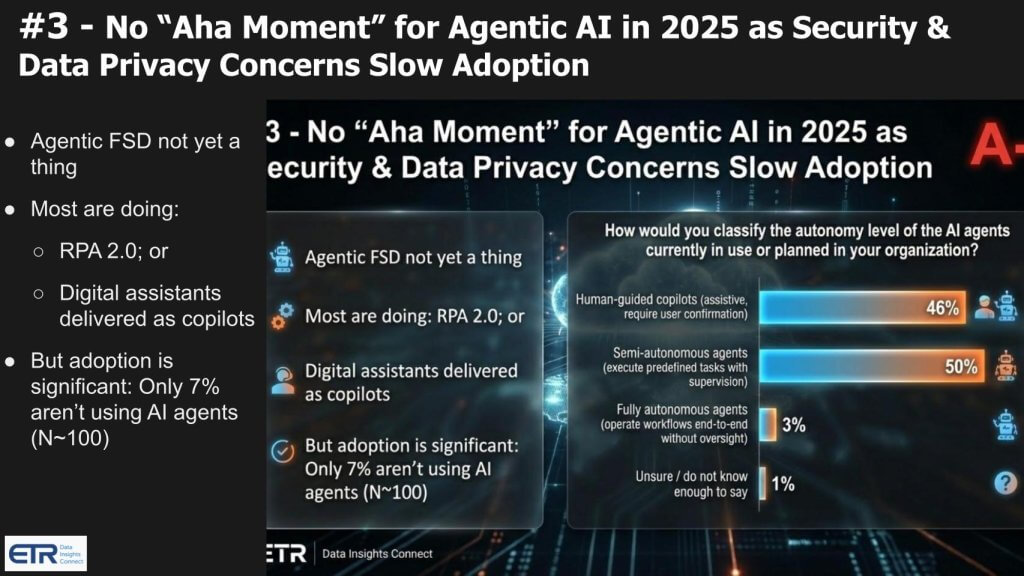

We gave ourselves an A- here.

This is new ETR data on autonomy levels for AI agents. The reality is: It’s still mostly human-guided copilots and semi-autonomous agents. Copilots — Microsoft’s especially — are the big deployment story. Fully autonomous agents operating end-to-end workflows are very limited.

“Full self-driving” agentic isn’t a thing yet. Most of what’s happening is closer to robotic process automation on steroids — RPA 2.0 — digital assistance as copilots, rather than true “systems of agency.”

Adoption is significant (in a previous survey, only 7% weren’t using AI agents), but the way they’re being used is still often quasi-deterministic. We said last year this would be the year of agent-washing more than true agentic usefulness. George Gilbert jokes there are more agent chatbots than fleas on a camel’s back. We’ll take the A-.

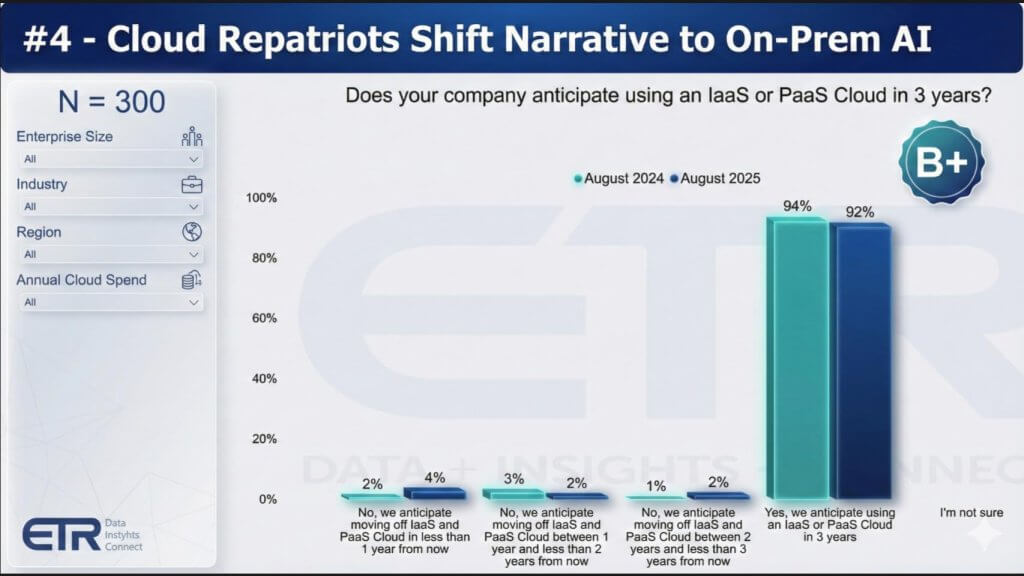

We gave ourselves a B+.

We still don’t see repatriation as a major trend — it remains single-digit in terms of its popularity among shops. If you look at the percentage of customers investing in infrastructure-as-a-service and platform-as-a-service, it continues to grow and continues to outpace on-prem.

ETR did a drill-down survey of 140 respondents: Thinking about total workloads at your company, irrespective of deployment location, how has the number changed and how will it change? Cloud workloads continue to grow, and people aren’t decreasing cloud workloads.

B+.

C+ is probably generous.

We said edge computing would be a significant trend in 2025. The narrative is definitely there. We’re seeing some deals — such as Nvidia Corp. with Nokia Corp. at the GPU Technology Conference in Washington, D.C. John Furrier has talked about hyperconverged at the edge and new architectures processing data closer to the source for latency. There’s lots of talk about robotics and physical AI.

But it hasn’t taken off to the extent we hoped. The silicon players are all talking about it, but the real revenue still isn’t quite there. So: C+.

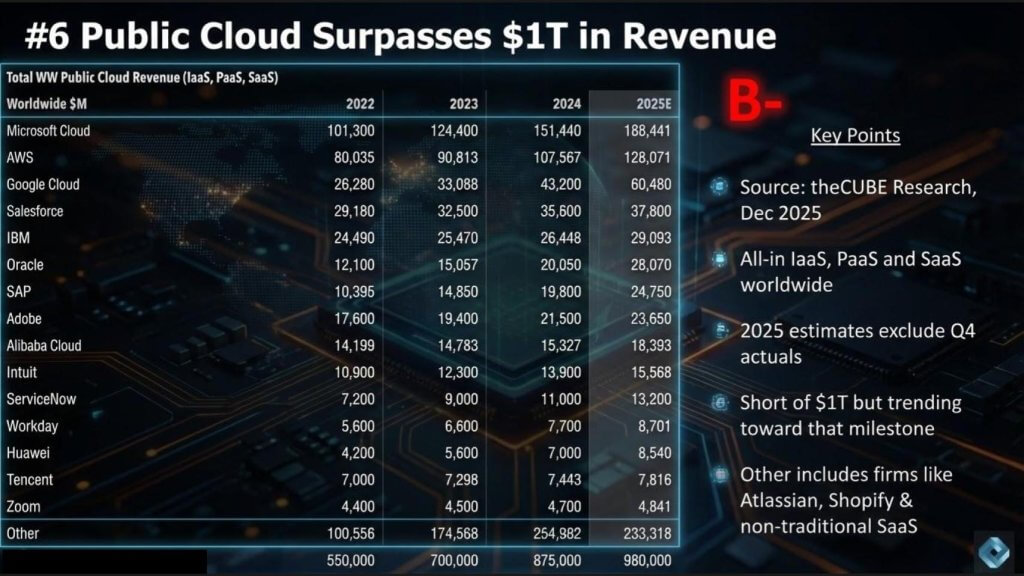

These are our preliminary estimates for IaaS, PaaS and SaaS. We have Microsoft leading cloud with $188 billion in 2025 — higher than many forecasts, but we think they can get there when you add it all up.

This is theCUBE Research data, excluding calendar fourth quarter 2025 actuals. We’re at about $980 billion — short of the trillion. “Other” is big and includes companies such as Shopify Inc. and Atlassian Corp. and other nontraditional SaaS, which is why it’s so large.

We didn’t get to $1 trillion, but we’re close. B-.

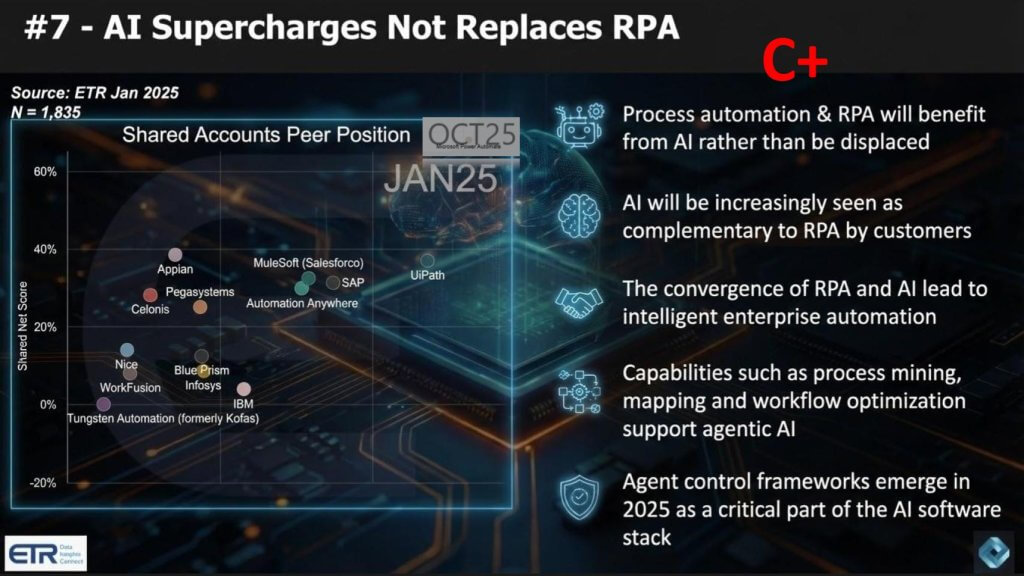

Our thinking was that the plumbing of RPA would be advantageous as core infrastructure for AI. In general, it didn’t really happen in a broad-based way.

We gave ourselves a C+ because there is some evidence. It makes logical sense that AI is complementary, and customers (for example at UiPath Inc. events) definitely see it that way. But it was not widespread.

We also felt parts of the prediction were directionally right: Agent control frameworks are emerging as a critical part of the AI software stack. There’s early activity around process mining, mapping and workflow optimization supporting agentic AI. Celonis SE is pushing this hard, and we’ve seen work from Salesforce Inc. and Palantir Technologies Inc. Still, this wasn’t a direct hit: C+.

We nailed this one.

The IPO market was tepid in the first half. Activity picked up in the second half, with plenty of crypto activity. We’ve also had conversations such as the one with Veeam Software Group GmbH (above), which we expect to go IPO (not calling the exact timing yet). Companies such as Snyk Ltd.and Veeam are in the conversation. We’ll see about Databricks Inc. and Anthropic PBC — there’s a lot of talk, but we’ll judge that in our final predictions post.

In general, this one was right on: A.

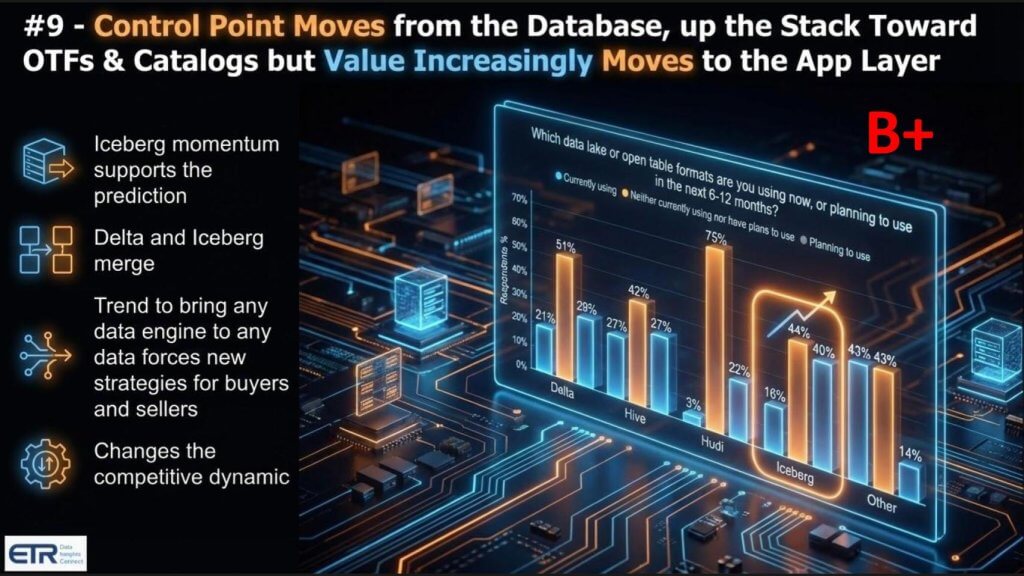

We gave ourselves a B+.

ETR flash survey data: Which open table formats are you using now or planning to use in the next sic to 12 months? Iceberg is the big winner. We called that.

But we have not seen value move to the application layer as fast as we expected, even as we saw a slow Delta and Iceberg convergence. There’s still a lot of talk around it, but it may be taking longer.

The idea of bringing any data engine to any data is clearly happening in buyer sentiment, and it changes competitive dynamics. We’re also seeing some collaboration around open table formats and semantics, which is positive.

Decent call, not a home run. B+.

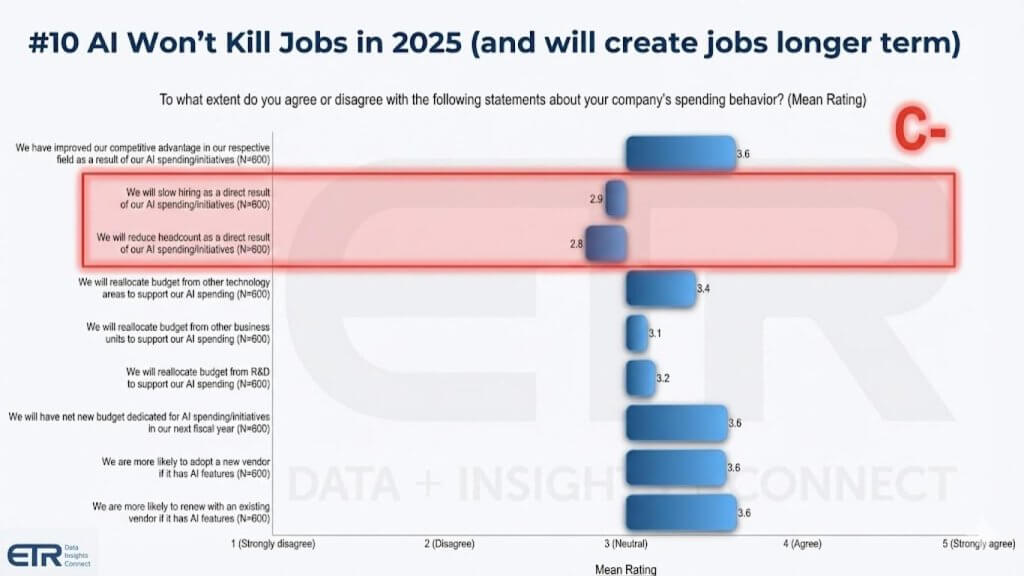

The longer term remains to be seen.

ETR survey results show small percentages saying they’ll slow hiring or reduce headcount as a direct result of AI spending. That was the expectation.

We gave ourselves a C- because there’s clearly a narrative in the industry that AI is taking jobs — especially entry-level jobs not being filled by recent college grads, purportedly because of AI. Whether that’s true is up for debate, but headlines certainly suggest it. Rebecca Knight and I debated this at an event (I think it was UiPath Fusion). She called it a crisis, and many people believe it is.

Recent college graduate unemployment is higher than the overall unemployment rate. You could argue AI is indirectly a factor — if nothing else via sentiment, as companies may be using AI as an excuse or simply trying not to over-rotate on hiring the way they did during COVID. We’ve seen tech companies reduce staff, including hyperscalers, and Amazon in particular overhired during COVID.

Direct or indirect, it’s not a clear-cut call. So we graded ourselves tougher: C-.

Overall, we give ourselves a B- for our 2025 predictions — better than the C+ we got last year.

When we do these predictions, we try to identify things that can be quantified or determined on a binary basis: “Yes, it happened,” “No, it did not.” We do give ourselves extra credit in certain cases.

That’s it for today. Thanks for watching, and look for our 2026 predictions in January. Eric Bradley and I will do our enterprise predictions, I’ll do data predictions with the Data Gang, and the theCUBE Research team will publish theirs as well.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.