EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

Pretty much as expected, Google LLC unveiled a wide array of new phones, smart speakers, earbuds, a tiny camera and more in yet another bid to become a premium supplier of consumer devices.

Underlying the sharp new designs and cutting-edge hardware, however, Google sought to set itself apart from veteran competitors such as Apple Inc. and Samsung by applying its artificial intelligence and machine learning prowess. Uttering the phrase “hardware, software and AI” repeatedly, Google executives made the case that what will be most important in the next era of smart devices is not the devices but the smarts.

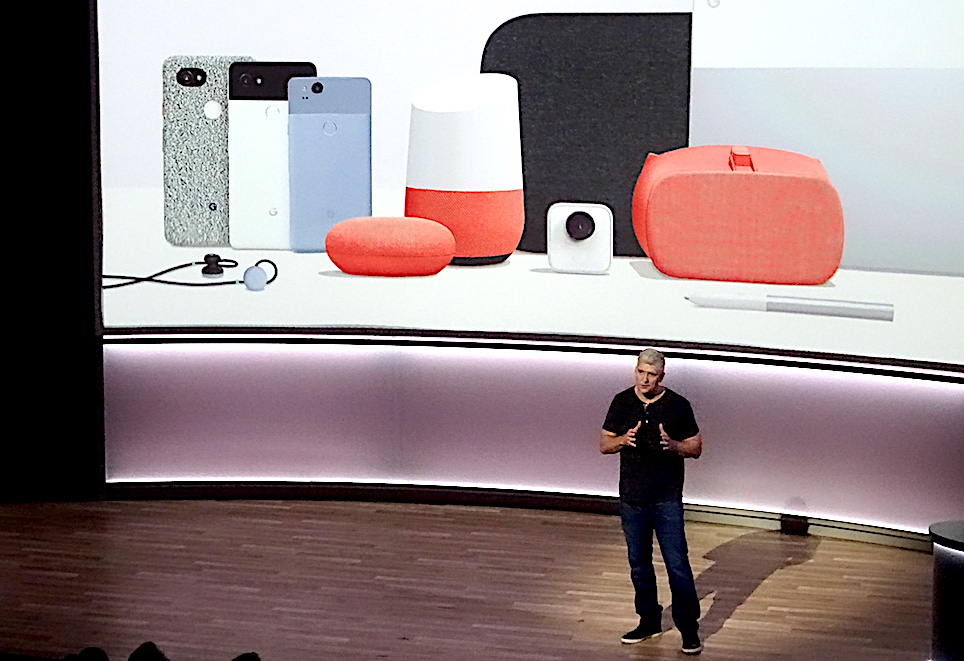

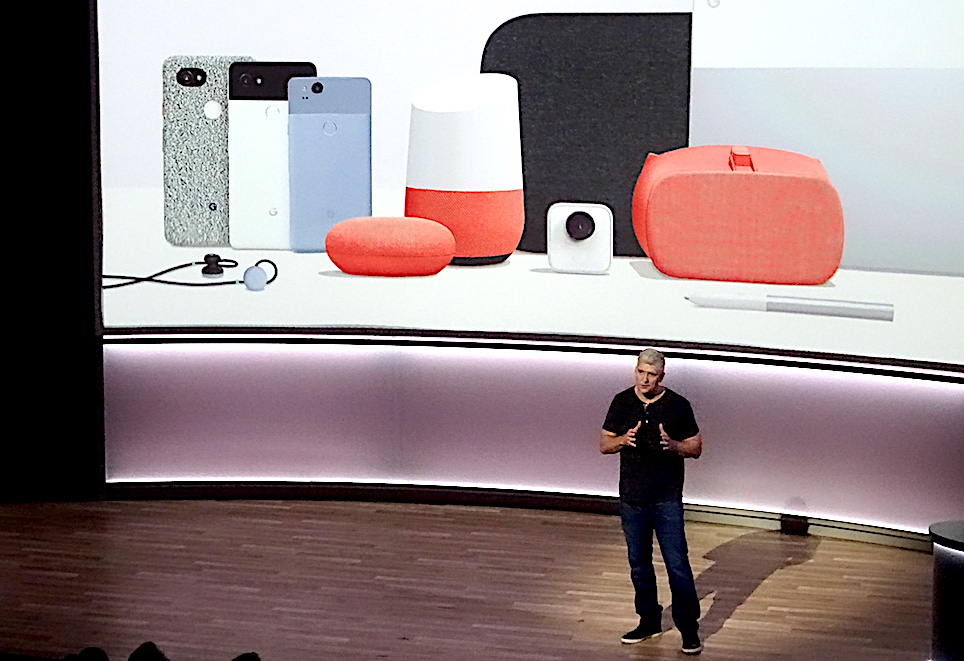

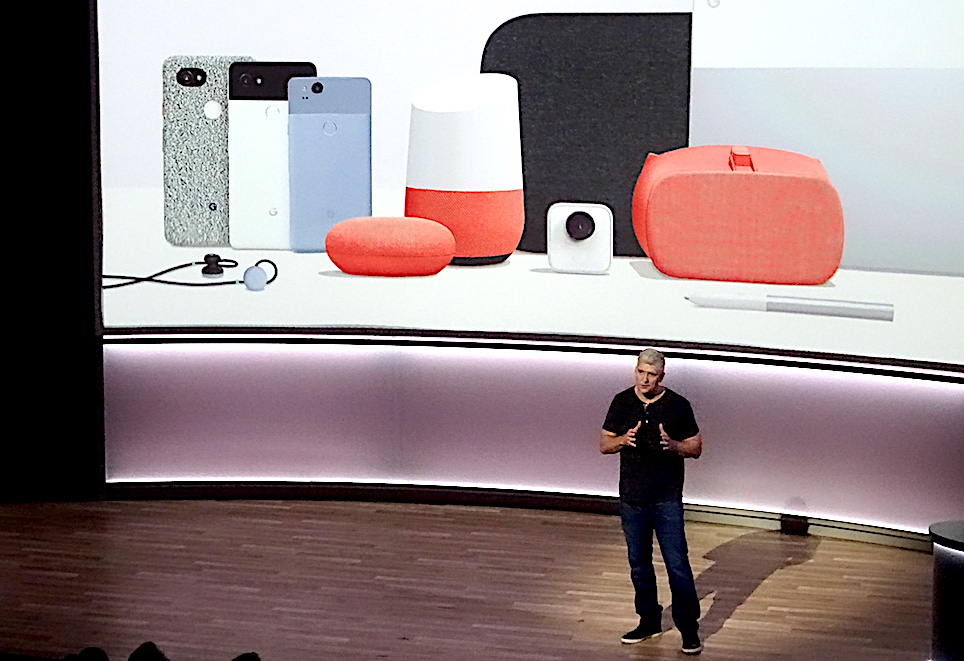

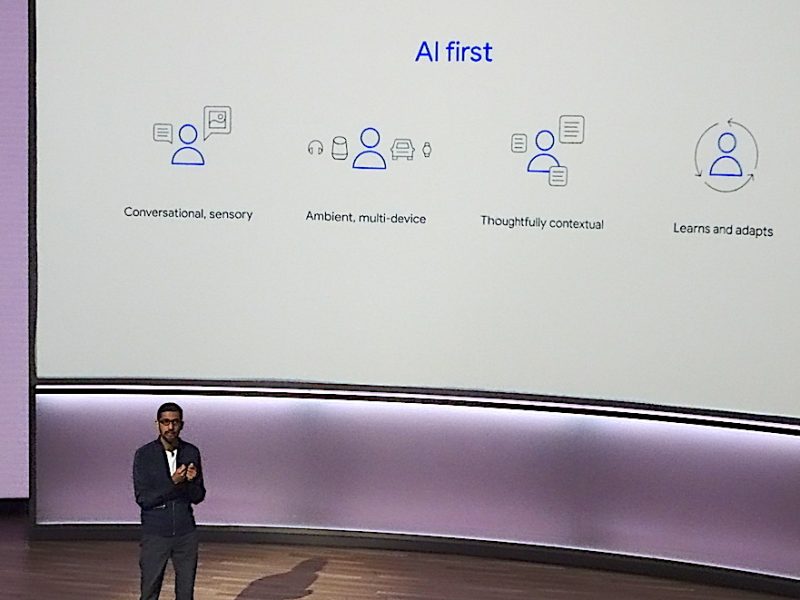

“We’ve been working hard continuing our shift from a mobile-first to an AI-first company,” Chief Executive Sundar Pichai (pictured, below) said at a press and employee event in San Francisco to debut the devices. Rick Osterloh (above), Google’s senior vice president of hardware, said that matters because the playing field for hardware components is leveling off, so it’s the experiences rather than the hardware that matters the most. And those experiences, from language translation to smart photo processing to devices that anticipate what people will want to do next, are driven by machine learning and AI.

“We’re taking a very different approach at Google,” he said, one that looks to meld AI, software and hardware from the outset. “We’re seeing huge breakthroughs in the kinds of experiences we provide to users.”

Still, hardware matters, and Google managed to weigh in with its versions of many of today’s most popular tech products, most but not all of them expected. (If you want all the details, there’s no lack of them here.)

* Two new Pixel phones, the five-inch Pixel 2 starting at $649 and the six-inch Pixel 2 XL starting at $849, that Google boasts got the highest rating ever for a smartphone camera from DxOMark Mobile. It also features an edge that when squeezed brings up Google’s AI Assistant.

* Google Home Mini, a smaller $49 Home device that makes it easy and relatively economical to put several around the house.

* Google Home Max, a $399 music speaker with two full woofers that adjusts based on where it’s placed in the room to sound best.

* Google Pixelbook, a high-performance “convertible” 12.3-inch Chromebook, starting at $999, that can be folded to become a laptop, a tablet and a TVlike display. Weighing only a kilogram and 10 millimeters thick, it sports Assistant and has an accompanying $99 pen that can be used to circle words or images to get more information instantly.

* Google Clips, a tiny camera with a clip, “coming soon” for $249, that uses machine learning on the device itself to look for stable shots of people you know and other shots it learns over time that you like.

* Pixel Buds, Google’s $159 take on bluetooth earbuds, which notably can be tapped and held to bring up the Assistant, allowing things such as instant language translation.

* A new $99 Daydream View smartphone-based augmented-reality headset with new options and more content behind it.

Google executives certainly showed off the design of the hardware, but focused most on the experiences they enable — everything from offering Voice Match so the Google Home devices know who’s speaking and can greet them in the morning with the news they want and when their first appointment is. It also is offering new Pixel users a way to try out Google Lens, which uses machine learning to allow you to tap on an icon on the smartphone when pointed at, say, a work of art to see who the artist is.

Google executives certainly showed off the design of the hardware, but focused most on the experiences they enable — everything from offering Voice Match so the Google Home devices know who’s speaking and can greet them in the morning with the news they want and when their first appointment is. It also is offering new Pixel users a way to try out Google Lens, which uses machine learning to allow you to tap on an icon on the smartphone when pointed at, say, a work of art to see who the artist is.

“It’s radically rethinking how computers should work,” Pichai said “Computers should adapt to how people live their lives.”

Pichai suggested that four features will mark the new era of computing: People should be able to interact with computing in a natural and seamless way, computing should be ambient, it needs to work in context of particular people, and computers need to learn constantly over time. “We’re at a unique point in time when we can bring AI and software and hardware together to solve problems for users,” he said.

It was clear he was trying to answer persistent doubts about what Google is trying to accomplish with its hardware. Its phones generally have received good reviews for their straight Android software with none of the annoying “extras” carriers and some device makers slap on top of it. In partnership with devices makers such as HTC Corp. and LG Corp., the company has put out credible high-end devices, especially at last year’s hardware event where it introduced its first Pixel phones and Home smart speaker.

But none ever seems to make much headway in the smartphone or smart speaker markets against leaders such as Apple, Samsung and Amazon.com Inc. More to the point, it has been uncertain Google wants to bother with becoming a market force. Instead, it has seemed to want to provide only guideposts for what other device makers could do, with each new capability such as better cameras and improved voice recognition providing more reams of data from which Google can extract money in some way or another.

That strategy finally appears to be changing, though it still might take some time to play out. In late September, Google acquired HTC’s smartphone team of 2,000 engineers who worked on the Pixel, signaling a seriousness that seemed to go out the window when Google sold off its expensive Motorola Mobility acquisition in early 2014. Now, Osterloh, a former Motorola executive himself, insists Google intends to make a real business, not just a showcase out of its hardware, including its Pixel phones. “We hope to be selling products in high volumes in five years,” he told The Verge in an interview.

The reason for Google’s newfound focus may be that the proliferation of mobile devices of many kinds, with new form factors and capabilities, threatens to provide an opening — for Amazon especially — to invade or erode Google’s core advertising market. Smart speakers and phones provide both massive amounts of data on people and a way to reach them, putting Google’s lock on search, its cash cow, under threat. So Google needs to step up, on its own or in various levels of partnership with device makers, to make a bigger splash in the mass consumer market.

Will all of this work? That’s still an open question until the devices start rolling out the rest of this year and consumers weigh in. But the new direction is apparent. “GOOG is clearly taking hardware more seriously,” Ben Schachter, an analyst with Macquarie Research, wrote in a note to clients. “After last month’s acquisition of HTC’s Pixel unit, and the impressive variety of products unveiled today, GOOG is combining its control of both software and hardware more similarly to that of Apple and Amazon. All parties involved want to own the ecosystem and drive users to their respective advertising, apps, and media.”

Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, said Google needs to show it’s offering something different from Apple and the others, while also matching them on the basic such as distribution.

“To gain market share against Apple or Samsung, Google will need to bring more differentiated features like world-view AR to the table and also significantly increase carrier and country distribution,” he said.

But he also noted that Google’s clear lead in applying AI to features that could be appealing to consumers gives it a foundation to build upon. On the Home front, for one, he said, “I do believe Google can catch Amazon as Google’s AI is superior to Amazon.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.