INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated:

Computer chipmaker Advanced Micro Devices Inc. saw its share price jump almost 10 percent in after-hours trading today after it beat Wall Street’s sales and earnings targets in its first-quarter results.

The Santa Clara, California-based company posted earnings after certain costs such as stock compensation of 11 cents per share on revenue of $1.65 billion for the first quarter, well up from the 4-cent loss it reported a year ago. Wall Street was expecting AMD to report earnings of 9 cents per share on sales of $1.57 billion.

Investors cheered the news, buying up AMD stock in the after-hours session and lifting its share price by 9.5 percent. Update: On Thursday morning, shares were up more than 12 percent.

“AMD had a blowout revenue quarter, beating guidance and growing 40 percent year-on-year, which would make it the third straight quarter of double digit year-over-year revenue growth,” said Patrick Moorhead, chief analyst at Moor Insights & Strategy.

AMD builds processor chips for computer servers, data centers and personal computers, in addition to graphics processors and custom chips. The earnings call comes just a week after the company updated its product lineup with the launch of its second-generation Ryzen desktop chips for PC gamers and content creators, which are based on its new Zen architecture.

The company said its Zen architecture can process 52 percent more instructions per clock cycle than its previous-generation chips. The first Zen chips, released last year, were said to be the main factor in helping AMD return to profitability.

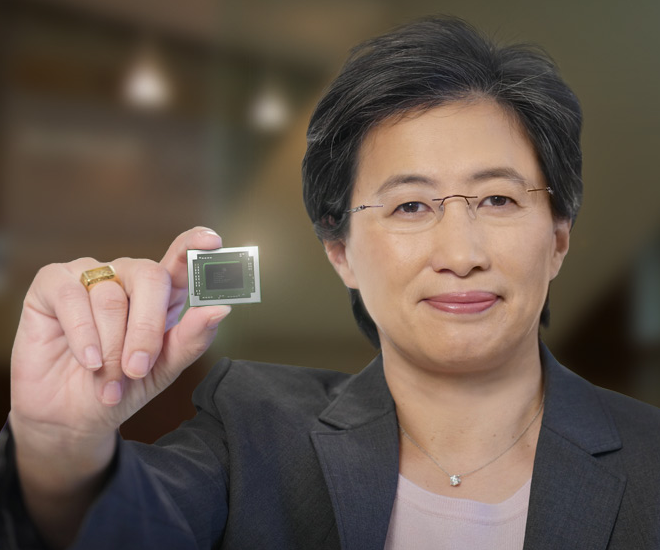

Strong sales of the Zen chips were the main reason for AMD’s solid first-quarter performance too. The company said its Computing and Graphics division, which encompasses both its computer chips and graphics processors, saw revenue of $1.12 billion, almost double a year ago. “PC, gaming and data-center adoption of our new, high-performance products continues to accelerate,” AMD Chief Executive Officer Lisa Su (pictured) said in a statement.

The stunning performance of the Computing and Graphics division helped to offset some less-than-encouraging numbers from AMD’s Enterprise, Embedded and Semi-Custom business unit, which makes chips primarily for data centers. That much smaller unit saw its revenue decline 12 percent, to $532 million.

“AMD reported especially good news in sales of PC- and graphics-related technologies,” said Charles King, an analyst with Pund-IT Inc. “If that acceleration continues, the quarters leading up to the all-important back-to-school and holiday sales cycles could be great for the company.

In addition, he said, “Strength in PCs and graphics also helped ease somewhat disappointing results in the data center/embedded/custom chip segment. Though some analysts believe that area will be bolstered later in the year as AMD’s Epyc server chips ramp, I believe a more cautious approach is warranted.”

Like other chipmakers such as Nvidia Corp. recently, AMD tried to downplay the impact of cryptocurrency mining on its bottom line. Although the Ryzen chips are chiefly designed for PC users, there’s a strong suspicion that a significant portion of its sales are from crypto enthusiasts buying them in order to mine digital currencies such as bitcoin and Ethereum.

“Another notable point is AMD’s attempts to undercut analyst assertions that as much as 20 percent of its revenues are being driven by GPU sales for bitcoin mining,” King said. “The company has asserted that the figure was in ‘approximately mid-single-digit percentage in 2017,’ but the ongoing volatility in cryptocurrency markets is likely to keep the issue front and center in the minds of AMD shareholders.”

As for the next quarter’s guidance, AMD is expecting big things again. The company forecast second-quarter revenue of $1.725 billion, up 50 percent from a year ago. Wall Street was looking for sales of just $1.57 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.