CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

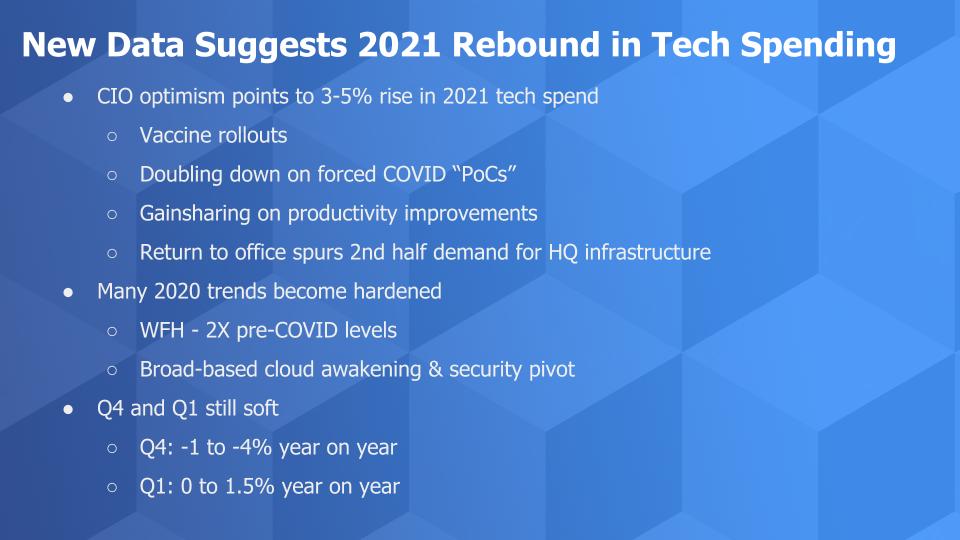

A range of new data now suggests that tech spending will be higher than we previously thought for 2021.

COVID-19 learnings, a faster-than-expected vaccine rollout, productivity gains and broad-based cloud leverage lead us to raise our outlook for next year. We now expect a 3% to 5% increase in 2021 technology spending, roughly double our previously forecasted growth rate.

In this Breaking Analysis we’ll share new spending data from our partners at Enterprise Technology Research and take a preliminary look at which sectors and companies are showing momentum heading into next year.

The latest data from ETR and theCUBE community suggests that the accelerated pace of the vaccine rollout, pent-up demand for normal operations and learnings from COVID will boost 2021 tech spending higher than previously anticipated.

A key factor we’ve cited is that the “forced march” to digital transformation due to the pandemic, created a massive proof of concept for what works and what doesn’t in a digital business. CIOs are planning to bet on those sure things to drive continued productivity improvements and new business opportunities.

Speaking of productivity improvements, nearly 80% of respondents in the latest ETR survey indicate that productivity either stayed the same or improved over the past three months. Of those, the vast majority (more than 80%) cited improvements in productivity. This has been a common theme throughout the year and points to continued remote work structures being the norm for large swaths of employee populations.

That said, the expectation among CIOs is that many workers will return to the office in the second half of the year. We expect that to drive new spending in the infrastructure needs of company headquarters, which have been neglected over the past 10 months.

Despite the expectation that many workers will return to the office, 2020 has shown us that working remotely is here to stay for a much larger number of employees than was the case pre-pandemic. ETR survey data shows that number will approximately double over the longer term.

As well, cloud computing became a staple of business viability in 2020. Those that were up the cloud adoption ramp benefited greatly. Those that weren’t, learned fast. Along with remote work, cloud necessitated new thinking around network security and, as we’ve reported, identity access management, endpoint security and cloud security were the beneficiaries. Companies such as Okta Inc., CrowdStrike Holdings Inc. and Zscaler Inc., among others, continue to ride those waves. Larger established companies such as Cisco Systems Inc., Palo Alto Network Inc., F5 Inc., Fortinet Inc. and others have major portions of their business that are also benefiting from the shift in network traffic.

Now despite all the momentum in the market and the expected improvements in 2021, these tailwinds are not expected to be evenly distributed — far from it. We expect the fourth quarter to remain soft relative to last year and first-quarter 2021 will be flat to up slightly. Remember, the COVID impact was definitely felt in March based on the earnings we saw so there may be upside in Q1 given that organizations are still being cautious in Q4.

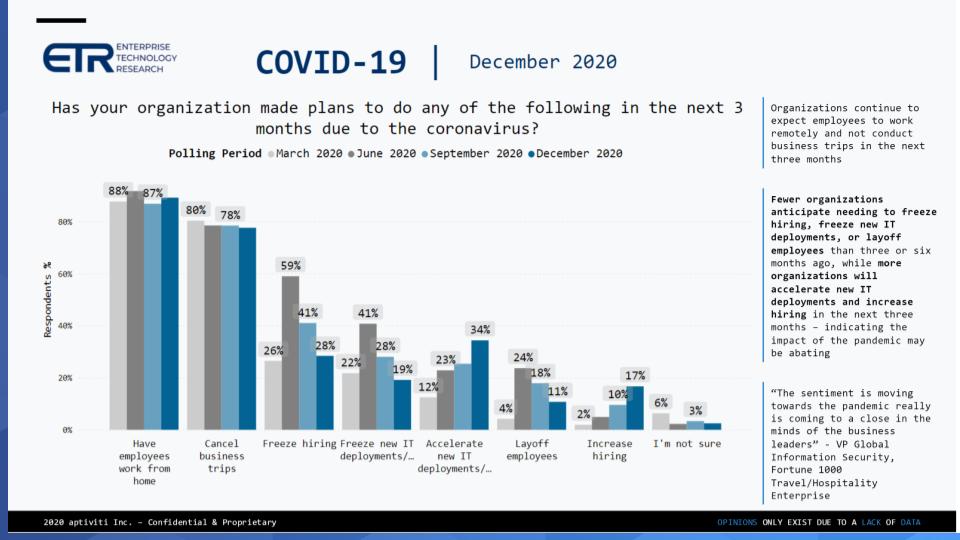

The chart below shows the responses to key questions around spending trajectories from March, June, September and December of this year.

It’s no surprise that there has been little change in the percent of companies reporting that workers are remote and business travel has been limited. But look at the other categories. We’re seeing a dramatic reduction in hiring freezes. The percentage of companies freezing new information technology deployments continues to drop.

Conversely, the percentage of companies accelerating new IT deployments is sharply up to 34% from the March low of 12%. And look at the headcount trends. The percentage of companies instituting layoffs continues its downward trend, while accelerated hiring is now up to 17%.

So there’s a lot to be excited about in these results.

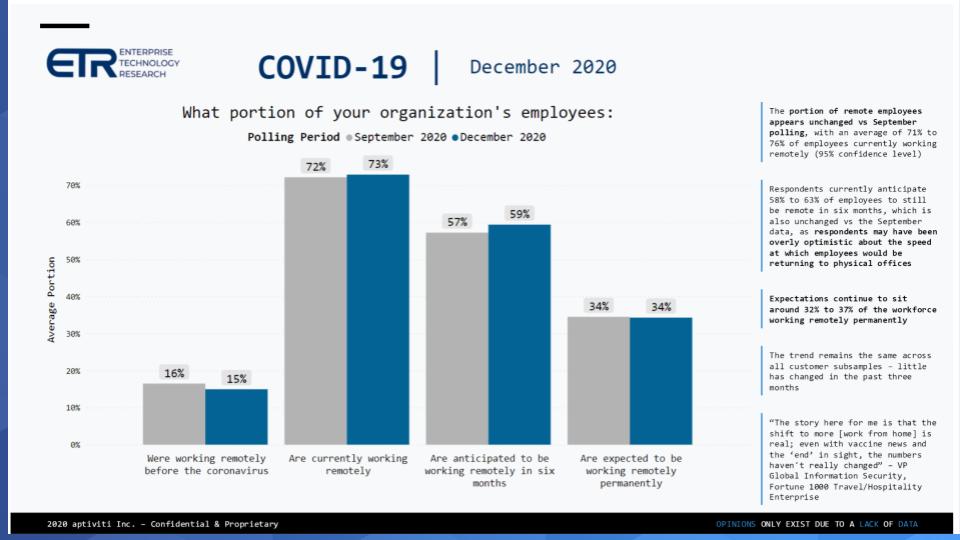

The chart below shows the work from home data and amazingly it’s from the September survey drill-down.

You can see CIOs indicate that, on average, 15% to 16% of workers were remote prior to the pandemic, that jumps to 72% to 73% currently and is expected to stay in the high 50s until the summer of 2021. Thereafter, organizations expect the number of employees that work remotely on a permanent basis to more than double to 34% long-term. By the way, many chief financial officers expect the number to be higher, especially those in the technology sector. They expect more than half of their workers to be remote and are looking to consolidate facilities costs.

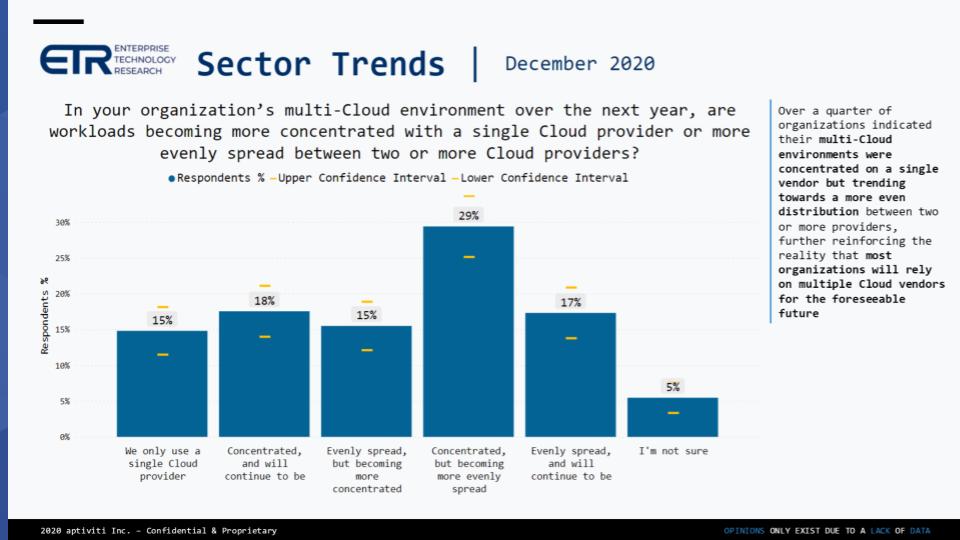

Conventional wisdom says the world is hybrid and multicloud is the norm. But it’s nuanced. What does that really mean?

The chart above shows responses to how organizations see multicloud evolving. It’s interesting to note the ETR callout, which concludes that the narrative around multicloud is real– and it is. But there’s a flip side to this data in that as many customers have or are planning to concentrate cloud workloads more.

And this actually makes some sense. Sure, virtually every major company uses multiple clouds. But more often than not, they concentrate work on a primary cloud. CIO strategies generally are not evenly spread across clouds – the data show that’s the case for fewer than 20% of respondents. Rather, organizations will generally apply an 80/20 or 70/30 rule for their multicloud approach – meaning they pick a primary cloud on which most work is done and they use alternative clouds as a hedge, or for specific workloads, or for data protection purposes.

And if you think about it, optimizing on a primary cloud allows organizations to simplify their security and governance and consolidate their skills. At this point in the cloud evolution, it seems CIOs feel that more value will come from leveraging the cloud to change their operating models than from broadly spreading the wealth to reduce risk or to tap specialized capabilities.

Moreover, in thinking about Amazon Web Services Inc. and Microsoft Corp., each can make a strong case for mono-cloud. AWS has more features than any other cloud and as such can handle most workloads. Microsoft can make a similar argument for its customers that have an affinity for Microsoft software. In doing so, the buyer can minimize complexity and simplify security and governance, buoyed by the belief that competition will keep prices competitive.

The key for multicloud in our view will be the degree to which technology vendors can abstract the underlying cloud complexity and create a layer that floats above the clouds and adds incremental value. Snowflake Inc.’s Data Cloud is one of the best examples of this. Clearly VMware Inc. and Red Hat have aspirations at the infrastructure layer. Pure Storage Inc. and NetApp Inc. are larger storage players and have similar visions.

Qumulo Inc. and Clumio Inc. are two other examples with promising tech but much smaller installed bases. Cisco, Dell Technologies Inc., IBM Corp. and Hewlett Packard Enterprise Co. have lots to gain and lots to lose in this regard so multi-cloud is an imperative for these leaders. But for them, it’s much more complicated because of their vast portfolios.

Notably, Dell has VMware and IBM has Red Hat, which are key assets that can be leveraged for multicloud. HPE has a channel and a large installed base. But all of these firms have to spread research and development much more thinly than a Snowflake, for example.

The bottom line is that multicloud has to be more than just plugging into and operating well on any cloud. It requires an incremental value proposition that solves a clear problem and at the same time, runs efficiently, meaning it takes advantage of cloud native services at scale.

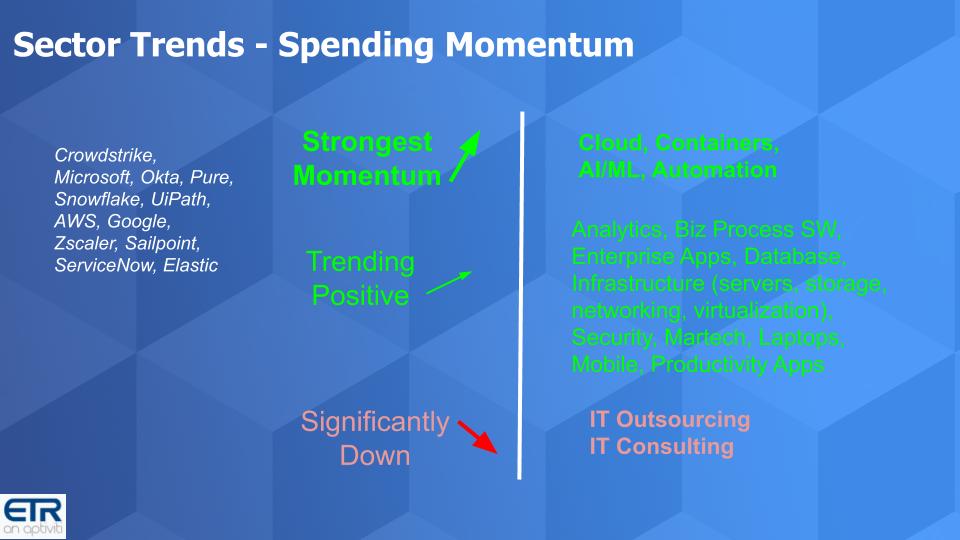

We’ve reported extensively that cloud, containers and container orchestration, artificial intelligence and automation are by far the hottest sectors from the standpoint of spending velocity, as measured by Net Score in ETR’s parlance.

But here’s the good news. As shown below, almost every other sector in the ETR taxonomy, with the notable exceptions of IT Outsourcing and IT Consulting, is showing positive spending momentum relative to previous surveys this year. Maybe not a shock but it appears that the tech spending recovery will be broadly based.

And it’s worth noting that there are several vendors that stand out and we show a number of them here. CrowdStrike, Microsoft, Okta, Pure and Snowflake are seeing highly accelerated momentum. UiPath Inc., which just announced its intent to go public, AWS, Google LLC, Zscaler, SailPoint Technologies Holdings Inc., ServiceNow Inc. and Elastic NV continue to trend up.

Maybe it’s a bit of a nonsequitur, but security is relevant to the trends we’ve been discussing – especially the move to cloud. We’ve reported extensively on the security business, basically updating you quarterly with our scenarios, the spending and technology trends and highlighting our four star companies – that is, those with spending momentum and significant market presence. And last year we put CrowdStrike, Okta, Zscaler and some others on the radar. And we’ve closely tracked the cyber businesses of larger companies such as Palo Alto, Cisco and more recently VMware.

The government hack that became news this week underscores the importance of this sector. It remains the most challenging area for organizations because failure is not an option, skills are short, tools are abundant, the adversaries are well-funded and very capable… and yet failure is common, as we saw this week.

There’s a misconception that cloud solves the security problem and it’s important to point out that it doesn’t. Cloud is a shared responsibility model. That means the cloud provider will secure the infrastructure, for example, but it’s up to you to configure things properly and deal with application security. It’s ultimately on you. And the example of S3 is instructive because we’ve seen a number of S3 breaches where the customer didn’t properly configure the S3 bucket.

We’re talking about companies such as Honda and Capital One — not just small businesses with little or no security chops. And generally it was because people who aren’t security experts were configuring things – maybe developers who weren’t focused on security and perhaps permissions were set too broadly. Whatever the issue, it took some breaches and subsequent education to increase awareness of this problem.

We see some similar trends occurring with new workloads, especially in cloud databases. It’s becoming so easy to spin up new data warehouses, for example, and we believe there are exposures out there because of a lack of awareness or inconsistent corporate governance. As well, even though important areas like threat intelligence and database security are important, security operations budgets are stretched thin and these areas specifically have taken a back seat to endpoint, identity and cloud security.

We bring this up because it’s a potential risk factor as we saw with the U.S. government attack, which was stealthy and wasn’t detected for months. Not to be a buzzkill, but the point is cloud enthusiasm has to be concomitant with security vigilance. Bad security practices trump good technology all the time.

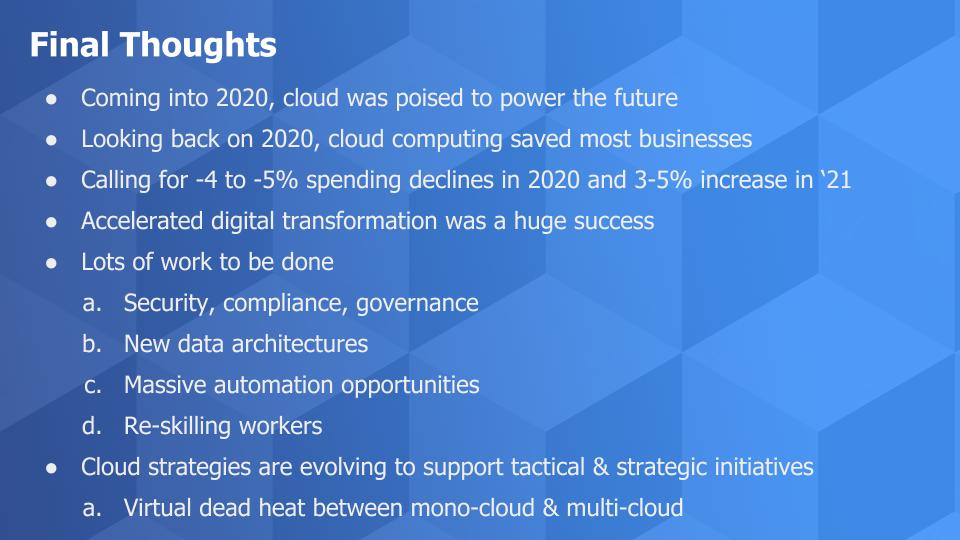

As we entered 2020, we said cloud was going to be the force that drove innovation – along with data and AI. As we look in the rearview mirror and put 2020 behind us, it was the cloud that enabled businesses to not only continue to operate, but actually increase productivity.

Nonetheless, we still see IT spending declines of 4% to 5% this year with an expectation for a tepid Q4. We see Q1 slowly rebounding but a swoosh-like recovery in the subsequent quarters– with tech spending rebounding in 2021 to a positive 3% to 5%.

Supporting our scenario, the pandemic forced a giant petri dish for digital and we see some real successes and learnings that organizations will apply in 2021. These include cloud, containers, AI and machine learning, and automation – for sure – along with upticks for virtually every other sector of technology, with the exception of outsourcing and consulting, which continue to be a drag.

Priorities must be focused on security and governance and further improvements in applying corporate edicts in a cloud world. We also see new data architectures emerging where domain knowledge becomes central to data platforms.

Automation is not only an opportunity, it’s become a mandate. Yes, we mean robotic process automation but also broader automation agendas beyond point tools. And importantly, it’s not just paving the cow path by automating existing processes, but rather rethinking processes across the organization for a new digital reality.

The work of Erik Brynjolfsson and Andrew McAfee on the Second Machine Age was prescient back in 2014 and the conclusions they drew are becoming increasingly important in the 2020s. Although machines have always replaced humans, for the first time in history it’s happening for cognitive tasks and a huge base of workers is going to be marginalized unless they’re retrained.

Education and public policy that supports this transition is critical and we would like to see a much more productive discussion that goes beyond the call to break up big tech. Rather, we’d call for governments around the world to partner with big tech to do good and help drive the re-skilling of workers for the digital age.

Cloud remains the underpinning of the digital business mandate but the path forward is not crystal clear. This is evidenced by the virtual dead heat between those organizations consolidated workloads on fewer clouds versus those hedging bets on a multicloud strategy.

One thing is clear: Cloud is the linchpin for our growth scenarios and will continue to be the substrate for innovation in the coming decade.

As always, we really appreciate the comments on our LinkedIn posts. You can always email david.vellante@siliconangle.com and DM @dvellante on Twitter. Also, you may want to check out this ETR Tutorial we created, which explains their spending methodology in more detail.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.