INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Shares of the computer graphics chip heavyweight Nvidia Corp. sank in after-hours trading today after the company said it will slow down its pace of hiring and apply stricter controls on its spending.

The news came after Nvidia delivered fiscal first-quarter results that beat expectations. However, the company cited a “challenging macroeconomic environment” as the reason for lower-than-expected guidance for the next quarter.

The company reported net income of $1.61 billion in the quarter on record quarterly revenue of $8.29 billion, up 46% from a year ago. Earnings before certain costs such as stock compensation came to $1.36 per share. Wall Street had been expecting Nvidia to report adjusted earnings of $1.29 per share on sales of $8.11 billion, so it was a comfortable beat.

What worried investors, though, was Nvidia’s guidance. For the second quarter, Nvidia said it’s expecting revenue of approximately $8.1 billion, plus or minus 2%. The company explained that its forecast was much lower than Wall Street’s target of $8.54 billion because of “Russia and the COVID lockdowns in China,” which are likely to cause a collective shortfall of about $500 million in sales. The lower forecast prompted investors bail on the company, with Nvidia’s stock losing more than 6% of its value after-hours, erasing a gain of 5% earlier in the day.

Nvidia’s reasoning for its lower forecast mirrors that of Cisco Systems Inc., which said last week that it too is facing serious supply challenges as a result of lockdowns in Shanghai that have affected its ability to secure critical components. Following that announcement, Cisco’s stock endured its biggest single-day drop in over a decade.

Nvidia Chief Financial Officer Colette Kress said in a conference call that the company estimates that “the impact of lower sell-through in Russia and China to affect our Q2 gaming sell-in by $400 million. Furthermore, we estimate the absence of sales to Russia to have a $100 million impact on Q2 in data center.”

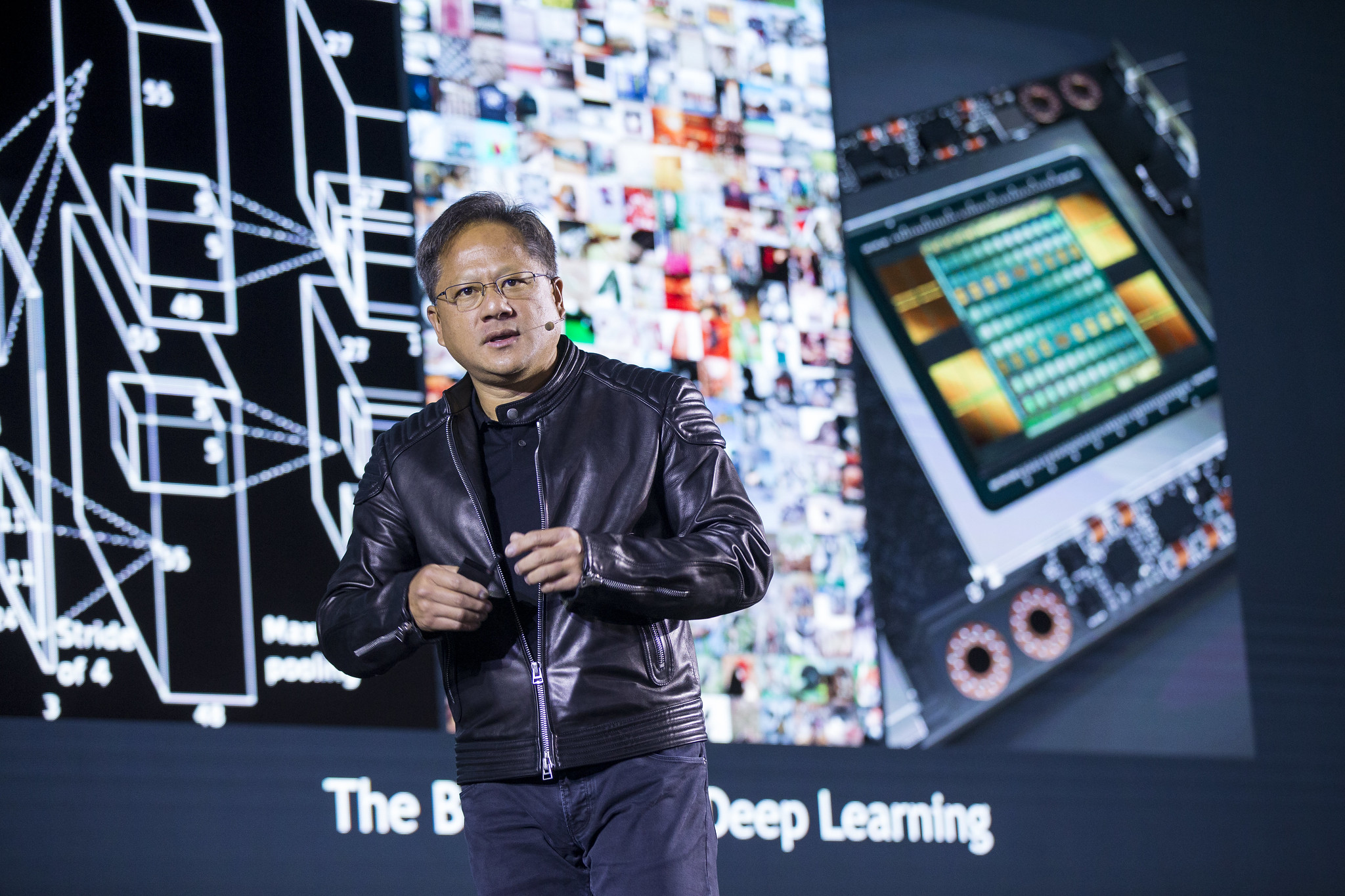

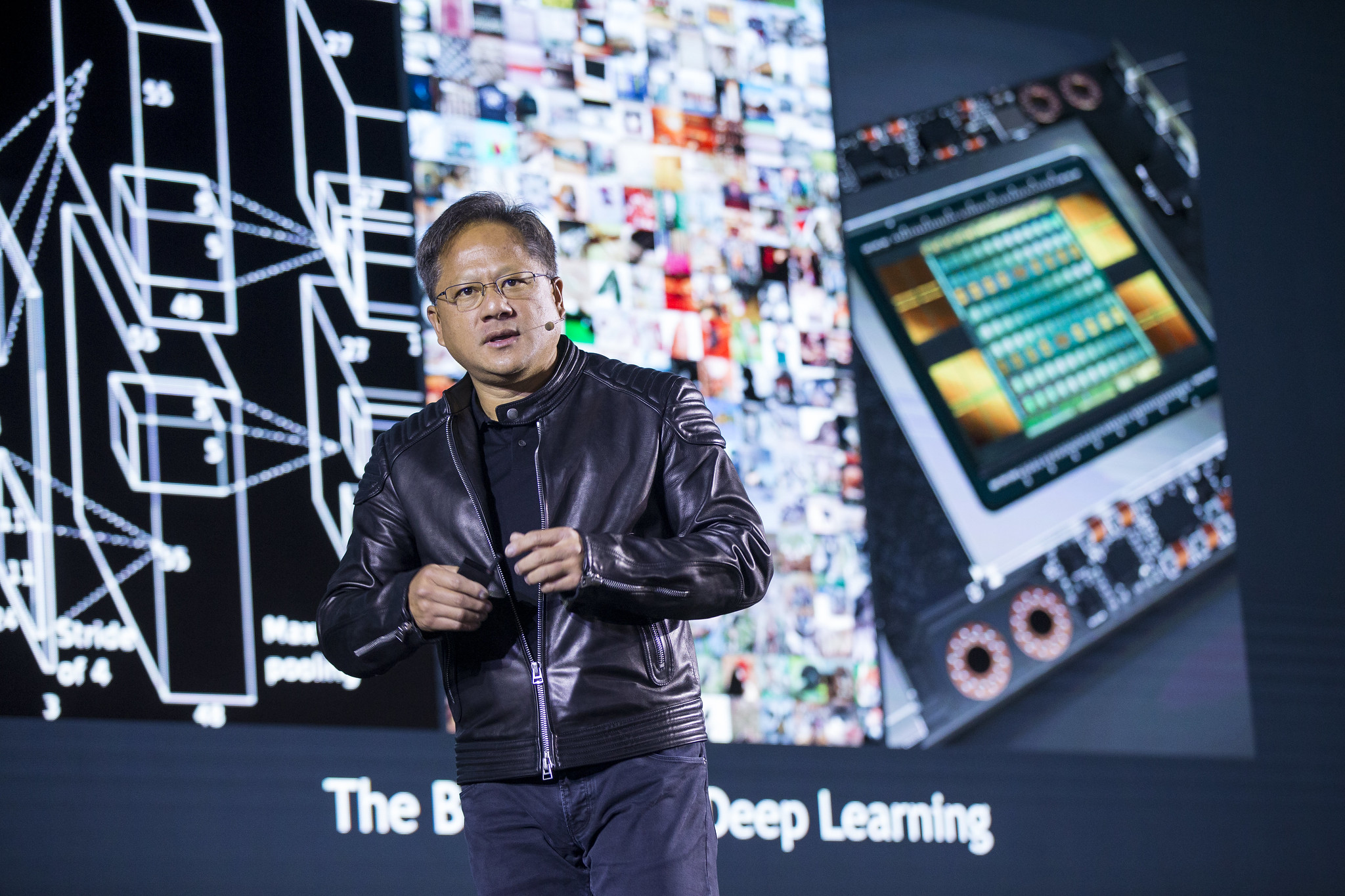

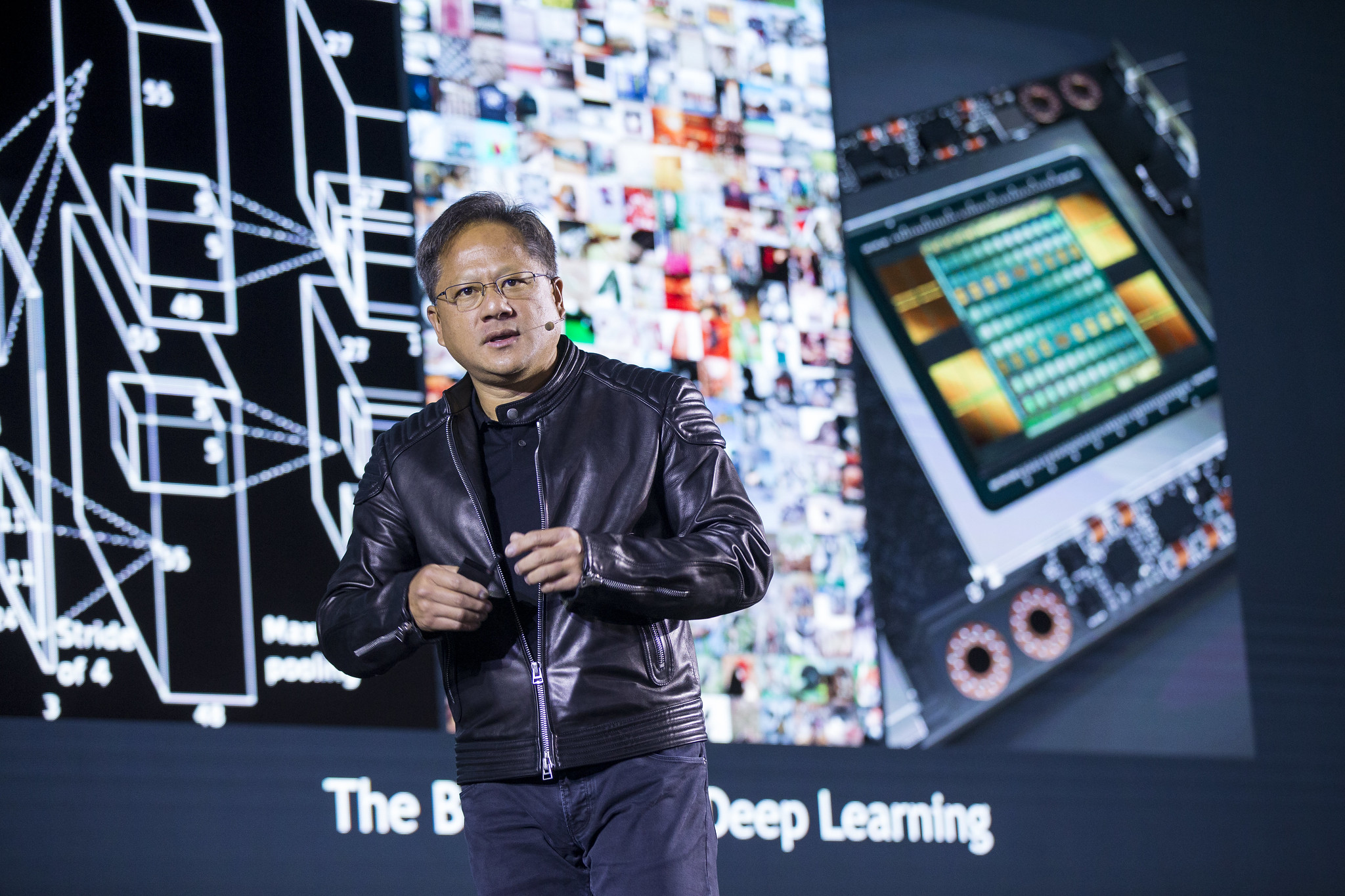

On the other hand, Nvidia continues to grow its revenue strongly and enjoys robust demand for its graphics processing chips, which are widely used in both gaming and artificial intelligence workloads in the cloud. Nvidia Chief Executive Jensen Huang (pictured) hailed the company’s performance in the first quarter.

“We delivered record results in data center and gaming against the backdrop of a challenging macro environment,” Huang said. “The effectiveness of deep learning to automate intelligence is driving companies across industries to adopt Nvidia for AI computing. Data Center has become our largest platform, even as Gaming achieved a record quarter.”

The company’s total sales grew 46% overall, with both of its core segments seeing a significant jump in revenue. Data center sales to cloud computing providers and enterprises rose by 83% in the quarter, to $3.75 billion.

That helped the unit surpass Nvidia’s gaming business, which sells graphics cards used in high-end gaming laptops and consoles. There, sales rose 31% to $3.62 billion. Huang said the gaming business got a boost from high-end chip sales to Nintendo Co. Ltd., which uses the company’s chips to power its new Nintendo Switch console.

The company also informed investors that its inventory of graphics chips has now “normalized,” which means that it’s struggling less with shortages than it was before. Last year, Nvidia’s chips had been difficult to find at times, resulting in a shortage of consoles such as Sony Corp.’s PlayStation 5 and Microsoft Corp.’s Xbox Series X. Given that the shortages have now been resolved, Nvidia said it expects gaming revenue to decline sequentially “in the teens” in the current quarter.

Nvidia’s smaller businesses saw mixed results. On the one hand, its professional visualization for workstations revenue rose 67%, to $622 million, but its automotive chip business revenue fell 10%, to $138 million.

Holger Mueller of Constellation Research told SiliconANGLE that after a string of successful quarters Nvidia is now finally facing headwinds from supply chain challenges that have affected various other players in the tech industry. It’s critical for the company to master this challenge, he added, because it has an extremely innovative chip lineup launching this year.

“The verdict on Nvidia’s full year will depend on whether or not it can deliver chips in the necessary numbers, or stumble due to parts shortages,” Mueller said. “For now it’s too early to tell, but it will be a critical development to watch.”

In its earnings release, Nvidia said its board of directors has approved an additional $15 billion to buyback shares through the end of next year. During the first quarter, it spent $2.1 billion on share buybacks and dividend payouts.

Nvidia also absorbed a $1.35 billion “termination charge” in the quarter, for its failure to close on its $30 billion-plus acquisition of the British chip design firm Arm Ltd.

THANK YOU