APPS

APPS

APPS

APPS

APPS

APPS

Shares in Autodesk Inc. were up over 4% in late trading today after the computer-aided software design company reported earnings and revenue beats.

For its fiscal second quarter ended July 31, Autodesk reported adjusted earnings per share of $2.15, up from $1.91 in the same quarter of the previous year, on revenue of $1.51 billion, up 12% year-over-year. Both figures were ahead of the $2 per share and revenue of $1.48 billion expected by analysts.

Autodesk’s total billings in the quarter were up 13% year-over-year, to $1.24 billion, and subscription plan revenue rose 11%, to $1.41 billion. By segment, Autodesk’s Design revenue came in at $1.26 billion, up 9% year-over-year, and Make revenue was up 25%, to $162 million.

Despite the positive figures, deferred revenue was surprisingly down 13%, to $3.69 billion, though there’s nothing in the earnings report that would suggest any downturn. Conversely, remaining performance obligations were up 12% to $5.86 billion.

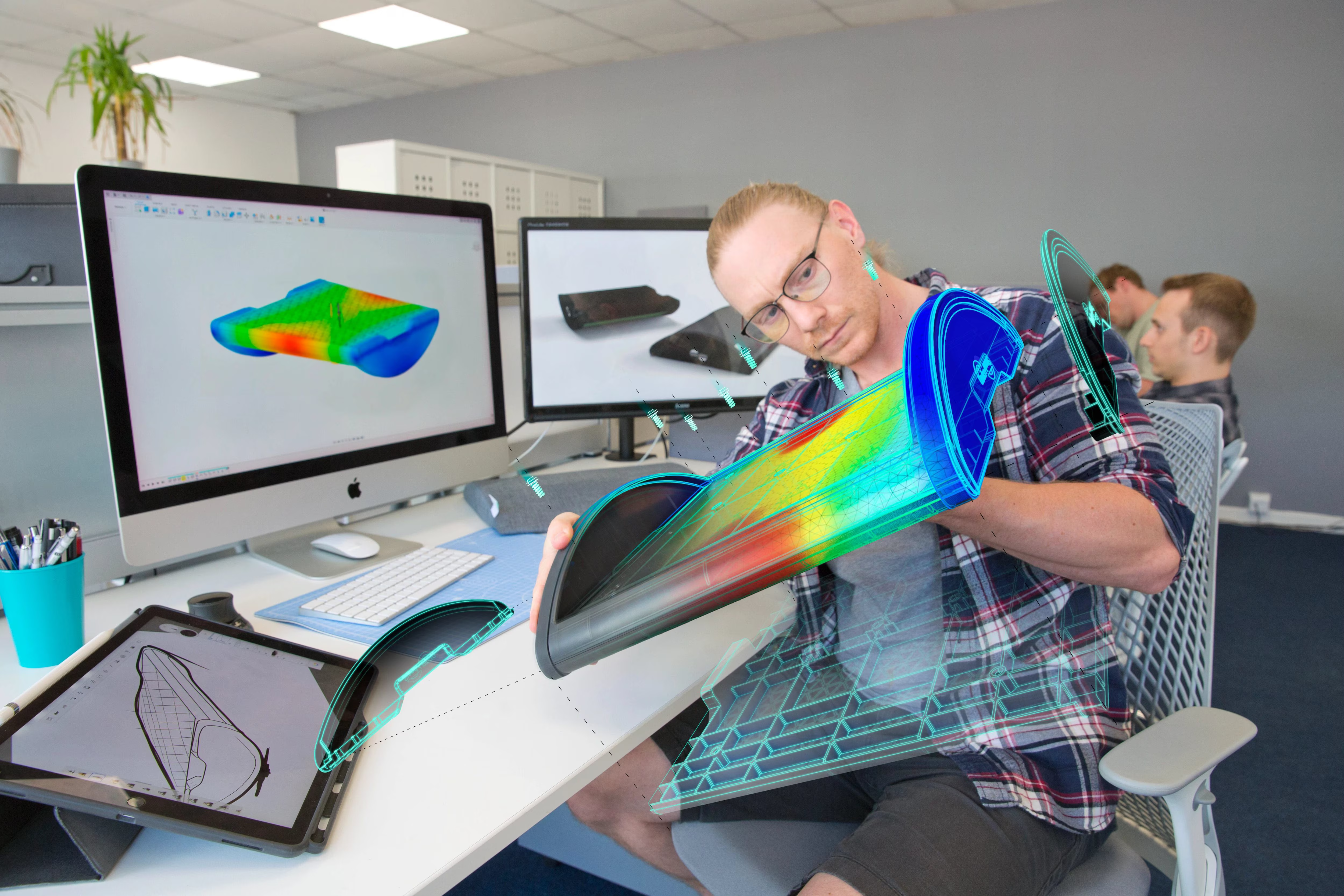

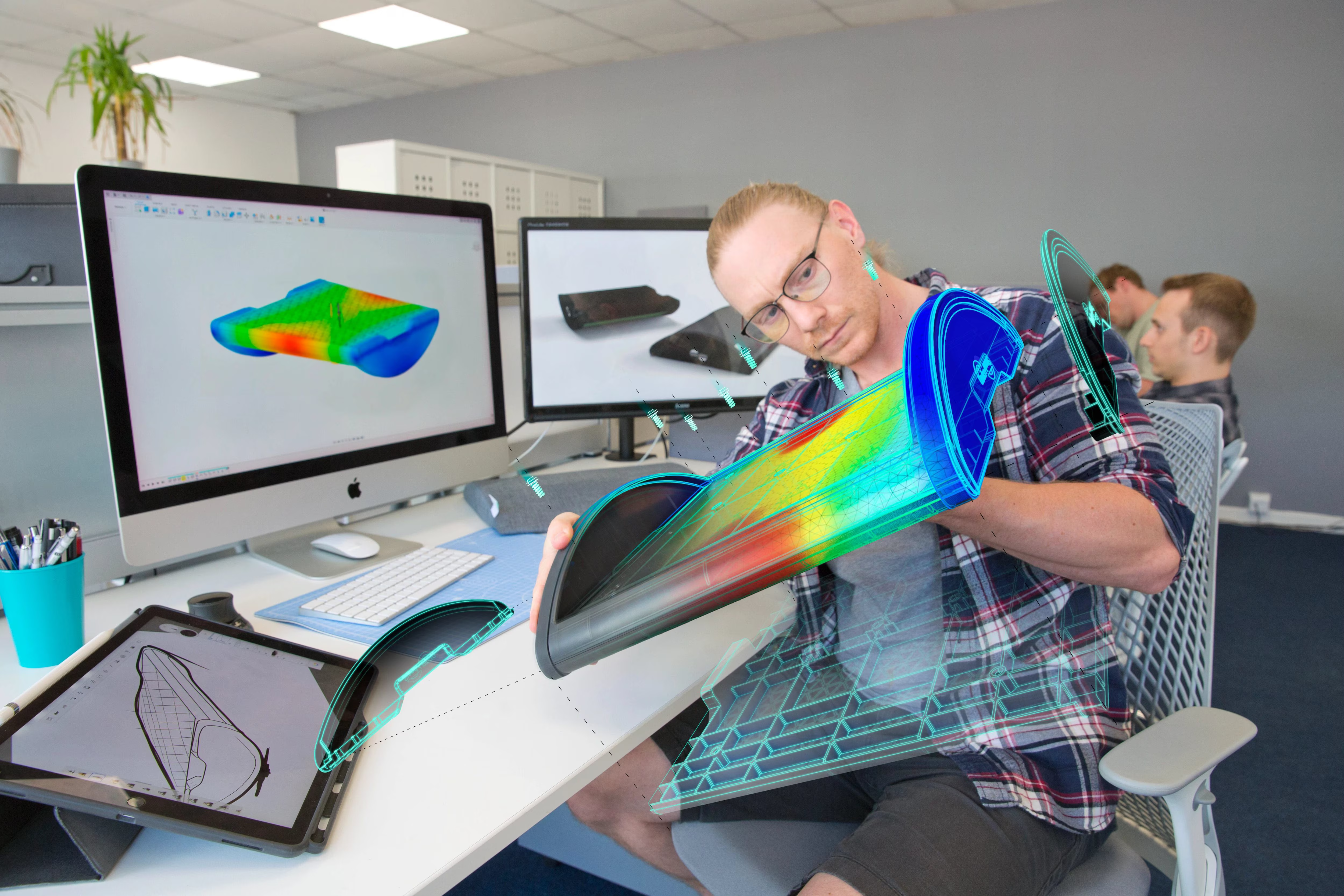

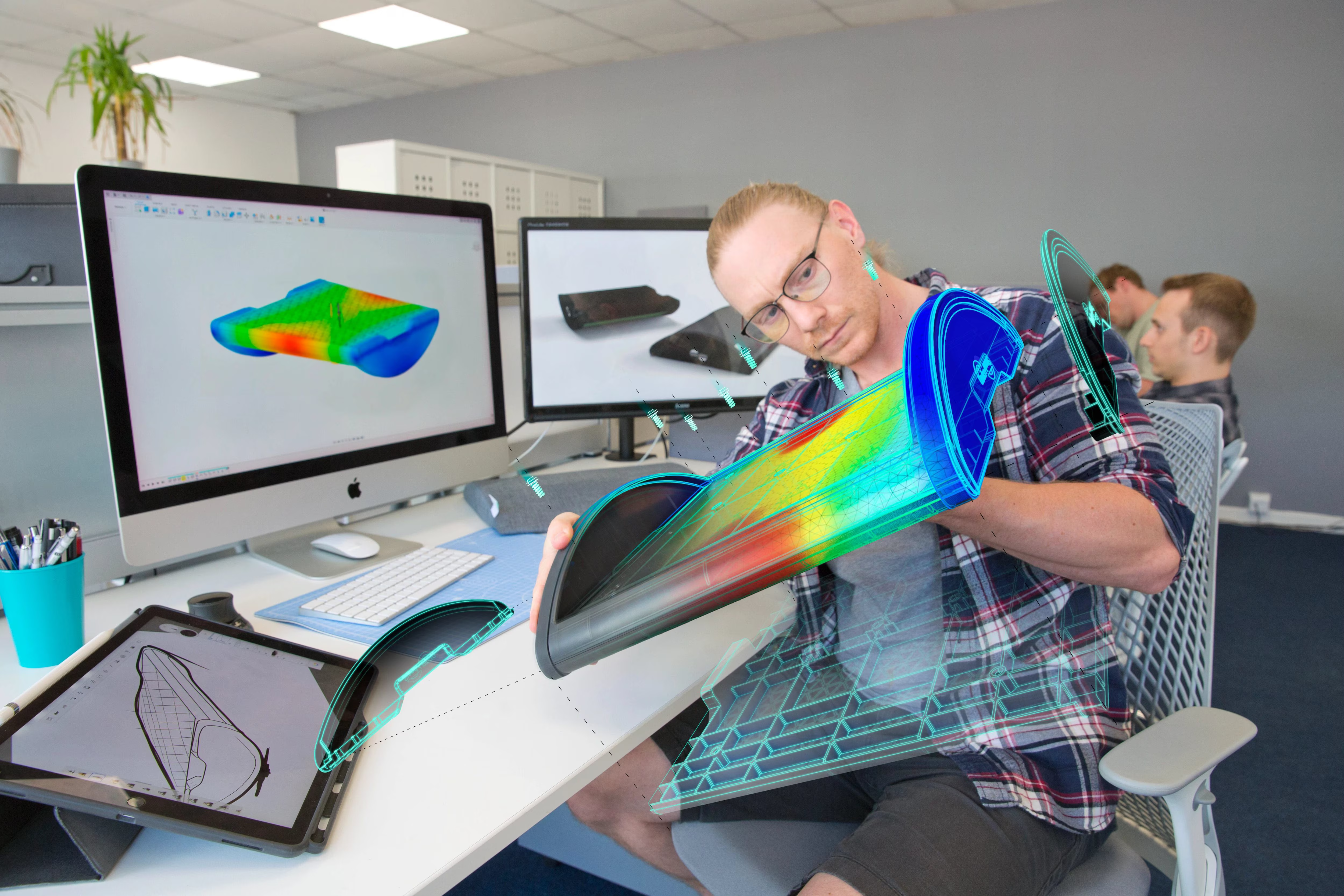

Highlights in the quarter included Autodesk’s continued embrace of a new transaction model that benefits customers and partners. The model is focused on data-driven interactions where customers have more personalized and relevant experiences with support and services tailored to their needs.

The model also includes self-service capabilities that are said to empower customers to manage their own transitions and allow partners to focus on providing value-added service. The model gives customers predictability through consistent pricing regardless of how they buy and partners benefit from a predictable financial model.

“We generated broad-based growth across products and regions in architecture, engineering and construction and manufacturing in the second quarter,” Betsy Rafael, interim chief financial officer of Autodesk, said in the company’s earnings release. “Overall, macroeconomic, policy and geopolitical challenges, and the underlying momentum of the business, were consistent with the last few quarters.”

For its fiscal third quarter, Autodesk expects adjusted earnings per share of $2.08 to $2.14 on revenue of $1.555 billion to $1.57 billion. At the midpoint, the earnings outlook was in line with the $2.11 expected by analysts, while the revenue outlook was ahead of an expected $1.55 billion.

For the full fiscal year, the company expects adjusted earnings per share of $8.18 to $8.31 — ahead of an expected $8.12, on revenue of $6.05 billion to $6.15 billion, ahead of the $6.05 billion expected by analysts.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.