CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Microsoft Corp.’s new financial disclosures include changes to the way it reports Azure metrics. The company said the change was to better align Azure with consumption revenue and by inference, more closely aligning with how Amazon Web Services Inc., the leader in cloud computing infrastructure, reports its metrics.

The accounting change removed certain mature, slower growth revenue streams and consequently raised the growth rates for Azure. It also had the effect of increasing the artificial intelligence services contribution within Azure. Although this was reported and often applauded in the media and financial circles, what wasn’t widely discussed is that while such a change increases growth rates, by definition it reduces the size of the Azure business and its resulting revenue market share.

Regardless, in our view, Microsoft is comfortable that the future AI revenue contribution within Azure combined with both higher growth rates and a greater AI contribution will foster greater investor confidence and enthusiasm over time. They’re probably correct.

In this Breaking Analysis, we review the changes Microsoft made to its financial reporting with a special focus on Azure impacts. We share how it affects our cloud data and we’ll share some thoughts on Microsoft’s AI reporting.

By way of review, on Aug. 21, Microsoft released its Form 8-K, which included a link to an investor presentation.

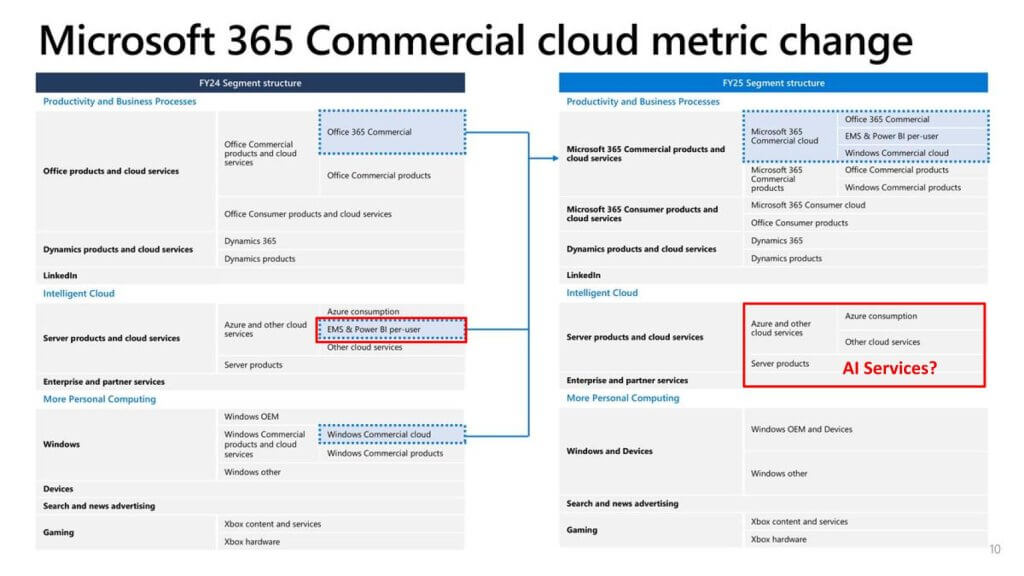

In the investor presentation, Microsoft revealed some significant changes to its reporting metrics. Our interest for today is on the Azure portion of Microsoft’s business, highlighted in red.

Microsoft made two important disclosures in this new mapping as it pertains to Azure. First, it is removing EMS, which stands for Enterprise Mobility and Security, and also Power BI per-user pricing. Previously, as shown on the left hand side of this chart, these products were included in Azure. On the right hand side is the new reporting.

Now we highlight AI Services because it’s missing. And later in this discussion you’ll see specific new guidance around AI Services and its contribution to Azure. So though certain AI services have always been included in Azure, Microsoft on its earnings calls specifically identifies the contribution within Azure of AI Services. So we felt it useful to shine a light on this fact.

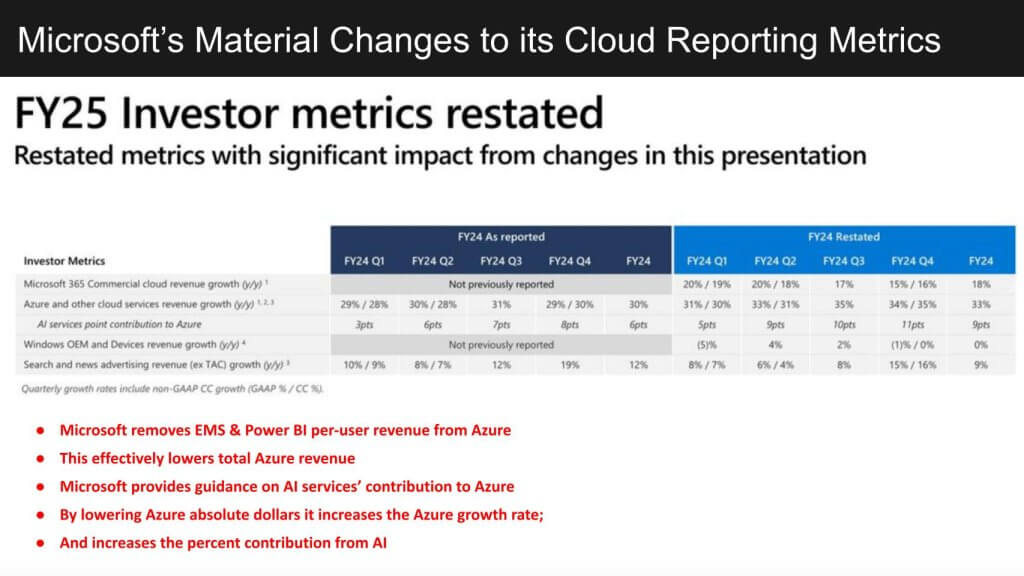

These changes are material to Azure, as shown below.

In particular, by removing EMS and Power BI per user revenue from Azure, its resulting growth rates increase. Note the second row under investor metrics, “Azure and other cloud services y/y revenue growth.” The line shows revenue and revenue in constant currency for FY 24 in dark blue and the restatement in lighter blue. Microsoft’s fiscal year ends in June, by the way. But note that, for example, the quarterly growth rates in FY and Q1 jump from 29/28% to 31/30%, respectively — and in FY and Q4 account for a five-point increase in Azure growth.

And note in the next line “AI services point contribution to Azure,” which jumps from three, six, seven, eight and six points on the left to five, nine, 10, 11 and nine points on the right. The last numbers on each side – 6% and 9% — represent full-year averages.

Now, as we said at the top, investors are excited by this new disclosure because it shows higher growth rates and a larger contribution from AI. But it also serves to lower Azure’s overall revenue because it removes those items we mentioned before.

So Azure estimates and its consequent market share reported by most analysts have been overstated.

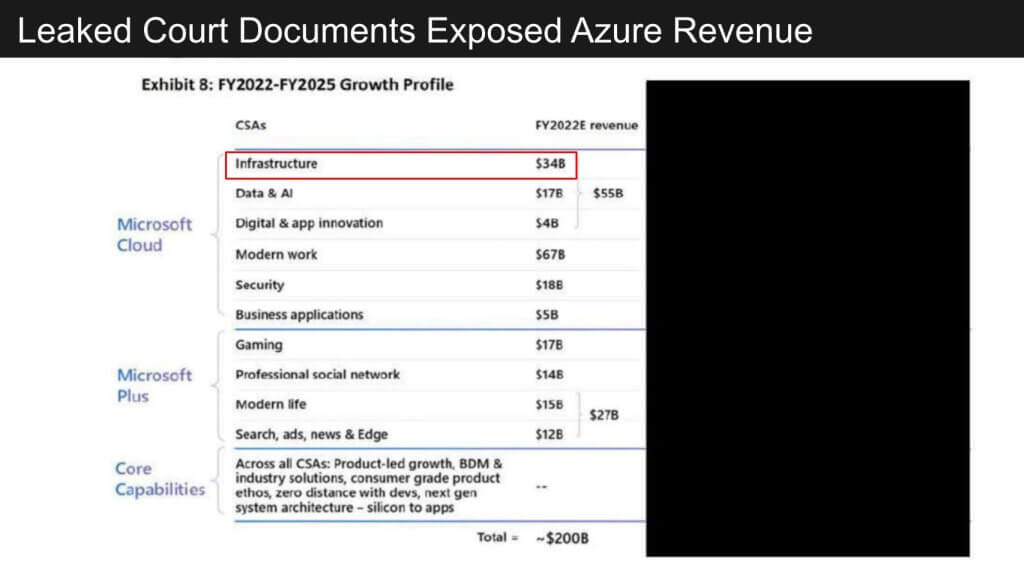

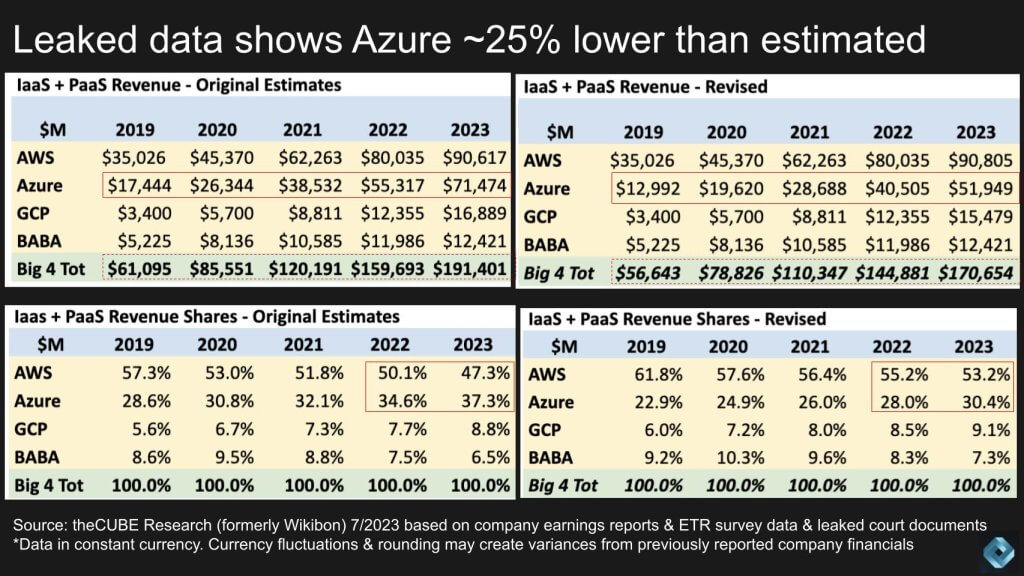

For those paying close attention, including theCUBE Research and others, let’s go back to June of 2023. Leaked court documents from the Activision trial suggested that Microsoft’s infrastructure-as-a-service business was significantly lower than people realized — shown here as $34 billion for FY 2022, ending in June 2023.

Many media outlets reported on this fact, but few firms adjusted their numbers to reflect this change.

You may recall that in July of that year, we dramatically lowered our Azure estimates and the resulting revenue share to reflect these changes. The reduction was significant, resulting in a 25% decrease in some years as shown here, highlighted in the red boxes.

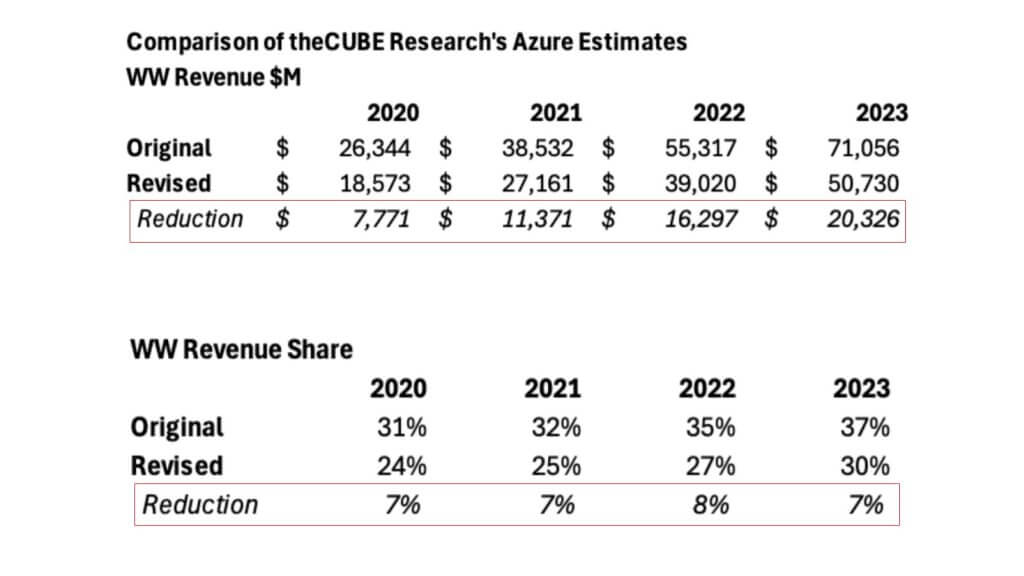

The impact over time of these changes was significant, as shown below.

For example, it took our historical Azure estimates from 2020 (which have been revised somewhat since last July), down nearly $8 billion and our 2023 figures down by more than $20 billion. This had the effect of lowering Azure’s market share by seven to eight points and, by extension, increasing AWS’ lead.

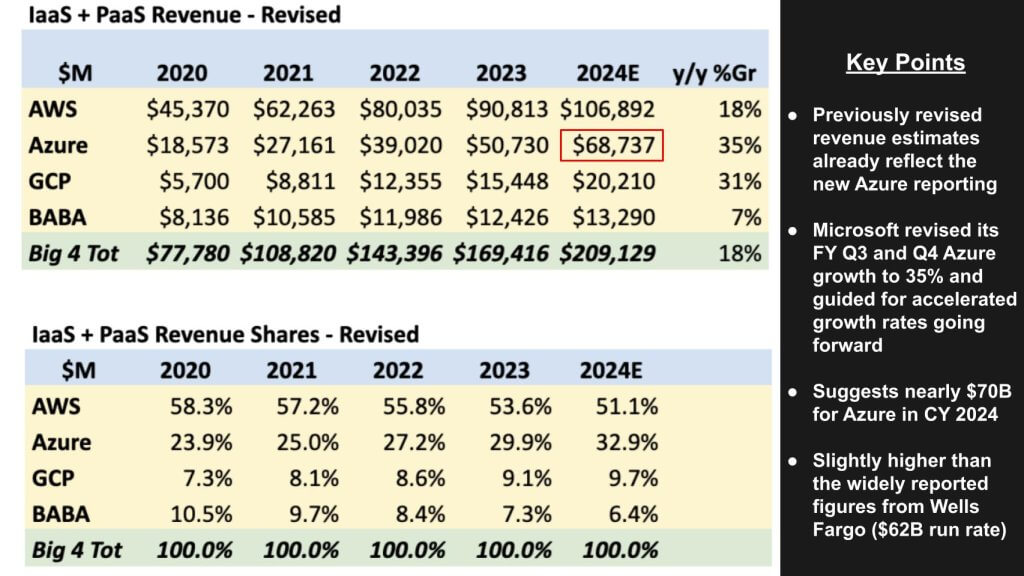

So when you look at this from a summary perspective, you can see that Azure is now the fastest-growing of the big four clouds. These figures reflect the revised metrics Microsoft provided in its disclosure including its expectation for accelerated growth in the second half of its fiscal year. This puts our Azure estimates at nearly $69 billion, higher than the Wells Fargo report, which had Azure’s run rate at $62 billion.

So let’s zoom out a bit and think about the impact here. Microsoft has removed some legacy businesses which juices its growth rates. We know that Azure is the engine of Microsoft’s platform, with AI making an increasingly important contribution to both its revenue and market capitalization. You may recall at one point we estimated that nearly $1 trillion of Microsoft’s market cap was AI-related.

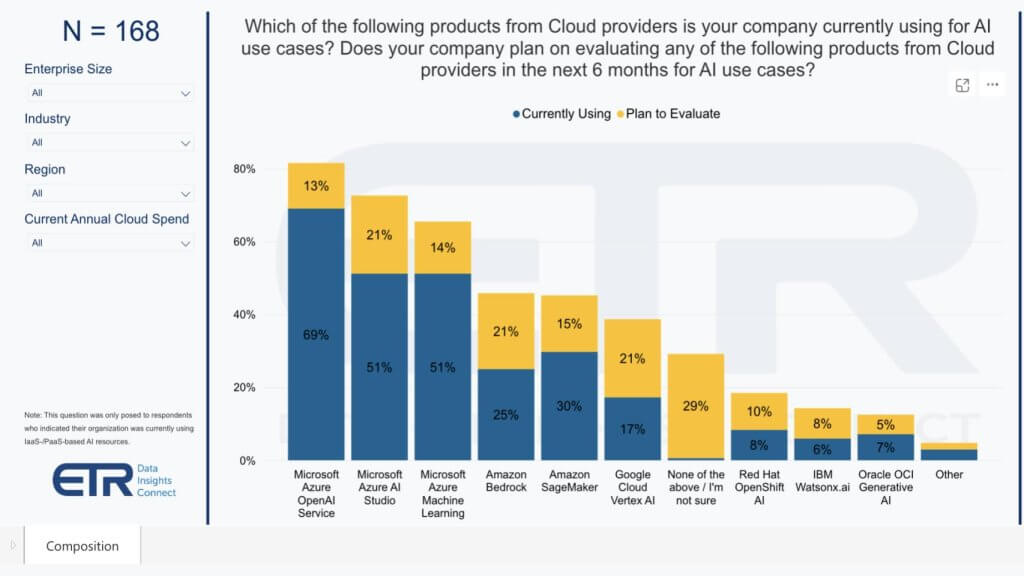

So let’s look at some Enterprise Technology Research data that measures account penetration of AI.

Above we show the major cloud players and their AI penetration within 168 accounts. Microsoft has a commanding lead with respect to account penetration. More than two-thirds are using the Azure OpenAI Service and more than half are using the Azure AI Studio and the Azure ML service. These three outpace all others.

Amazon Bedrock is showing penetration that is rapidly catching up to SageMaker in terms of accounts using the product in this sample, with a notable 21% planning to evaluate Bedrock. Google LLC’s Vertex AI is also showing strong intentions for evaluation at 21% and overall we see Google’s AI momentum closing the gap with AWS. This is largely thanks to the quality of its AI and data story. IBM Corp. is showing up in the survey with OpenShift AI and watsonx, with Oracle Corp. also showing strength.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.