BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Shares in Confluent Inc. jumped nearly 15% in late trading today after the data streaming software provider impressed investors with revenue and earnings beats in its fiscal third quarter and raised its outlook for the rest of the year.

For the quarter ended Sept. 30, Confluent reported adjusted earnings of 10 cents per share, up from two cents per share in the same quarter of last year, on revenue of $250.2 million, up 25% year-over-year. Both figures were solid beats, as analysts had expected a profit of five cents per share on revenue of $245.05 million.

Confluent’s strong figures were driven by subscription revenue, which came in at $239.9 million in the quarter, up 27% year-over-year. Revenue from the company’s cloud service also saw healthy growth, up 42% year-over-year at $130 million.

The company’s customers are notably sticking around, with Confluent reporting a dollar-based net retention rate of 117% in the quarter. The number of customers with spending more than $100,000 per year in annual recurring revenue also grew 14% year-over-year, to 1,346. Overall, the total number of Confluent customers rose 16%, to 5,680.

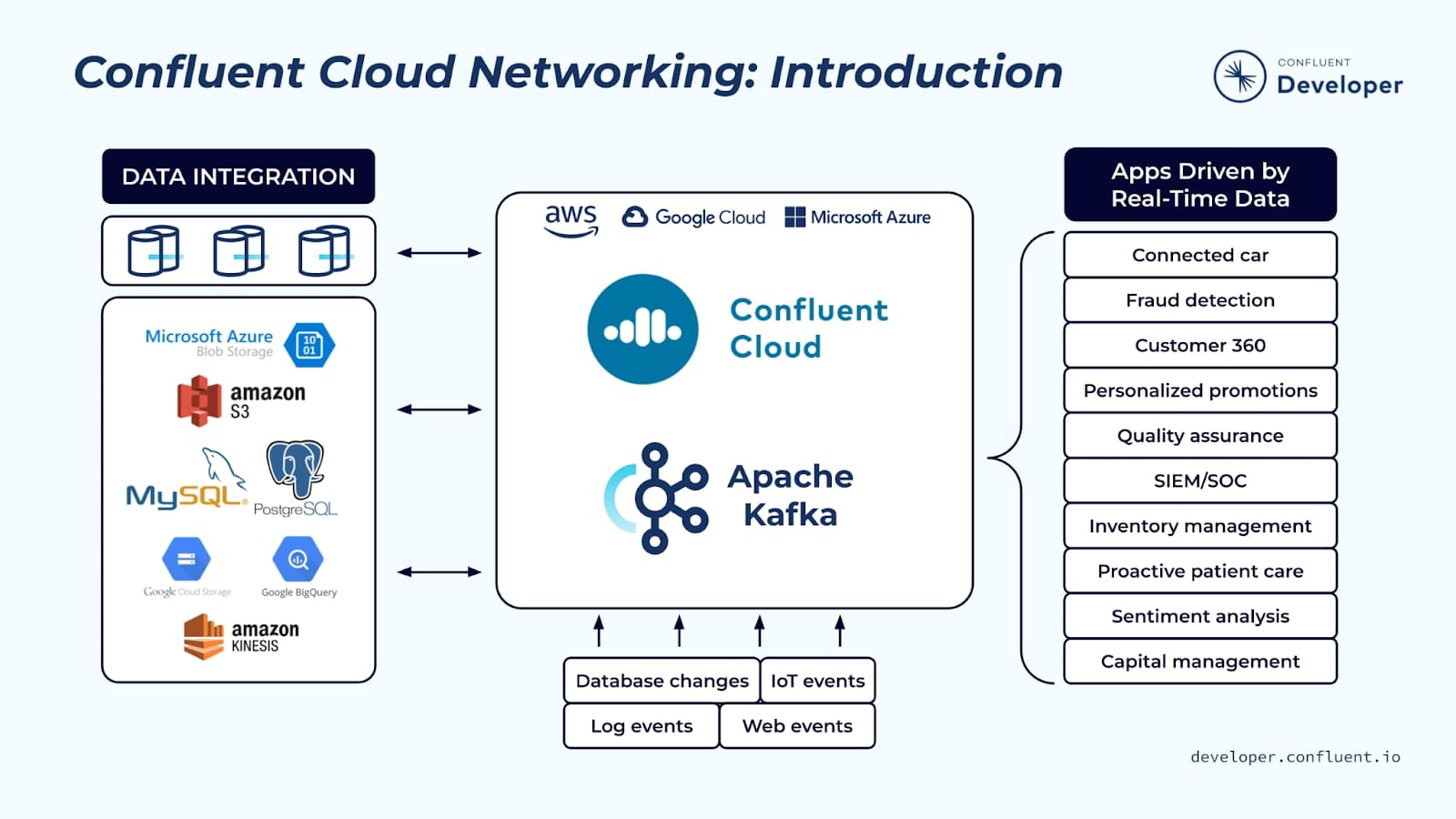

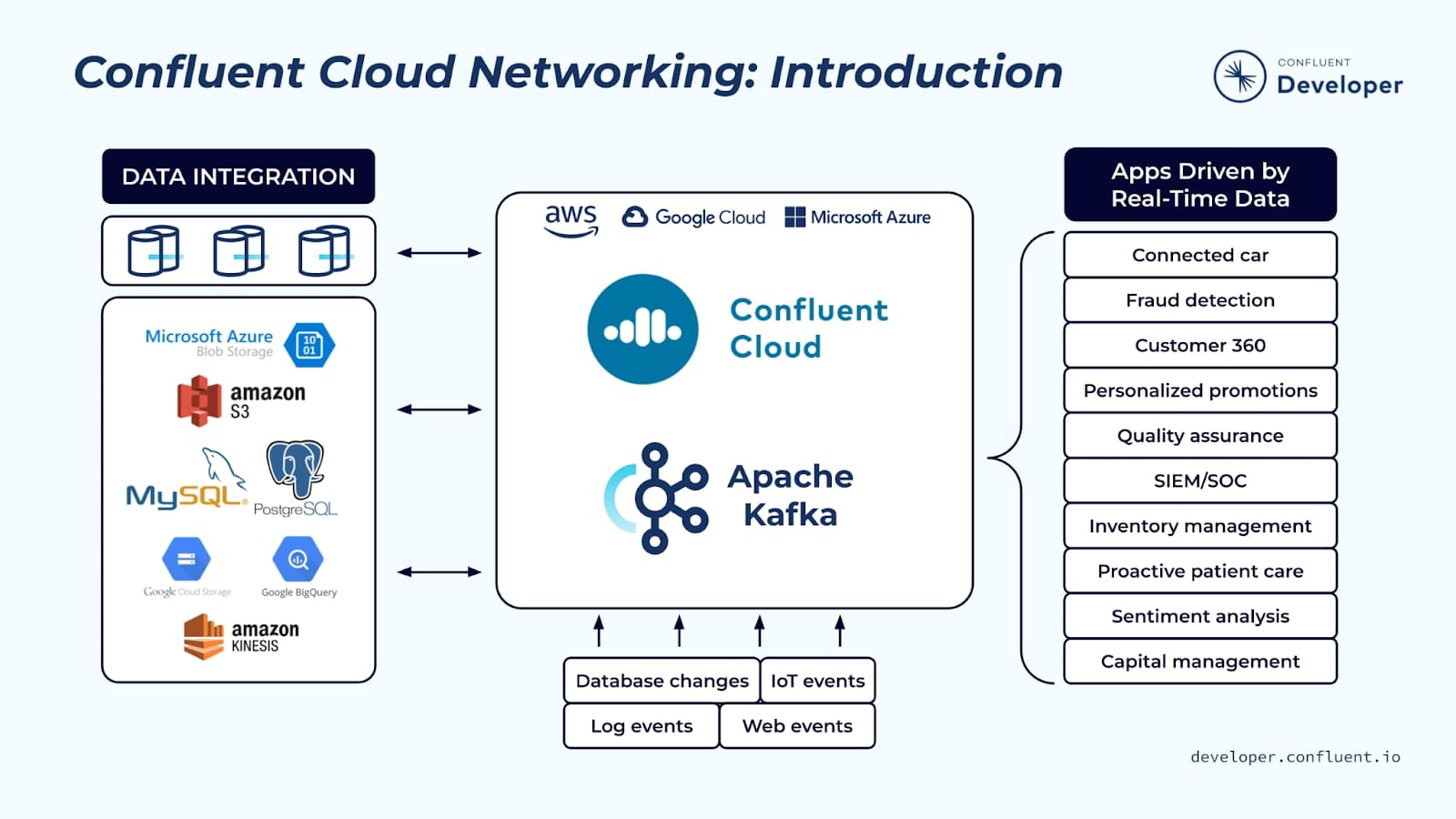

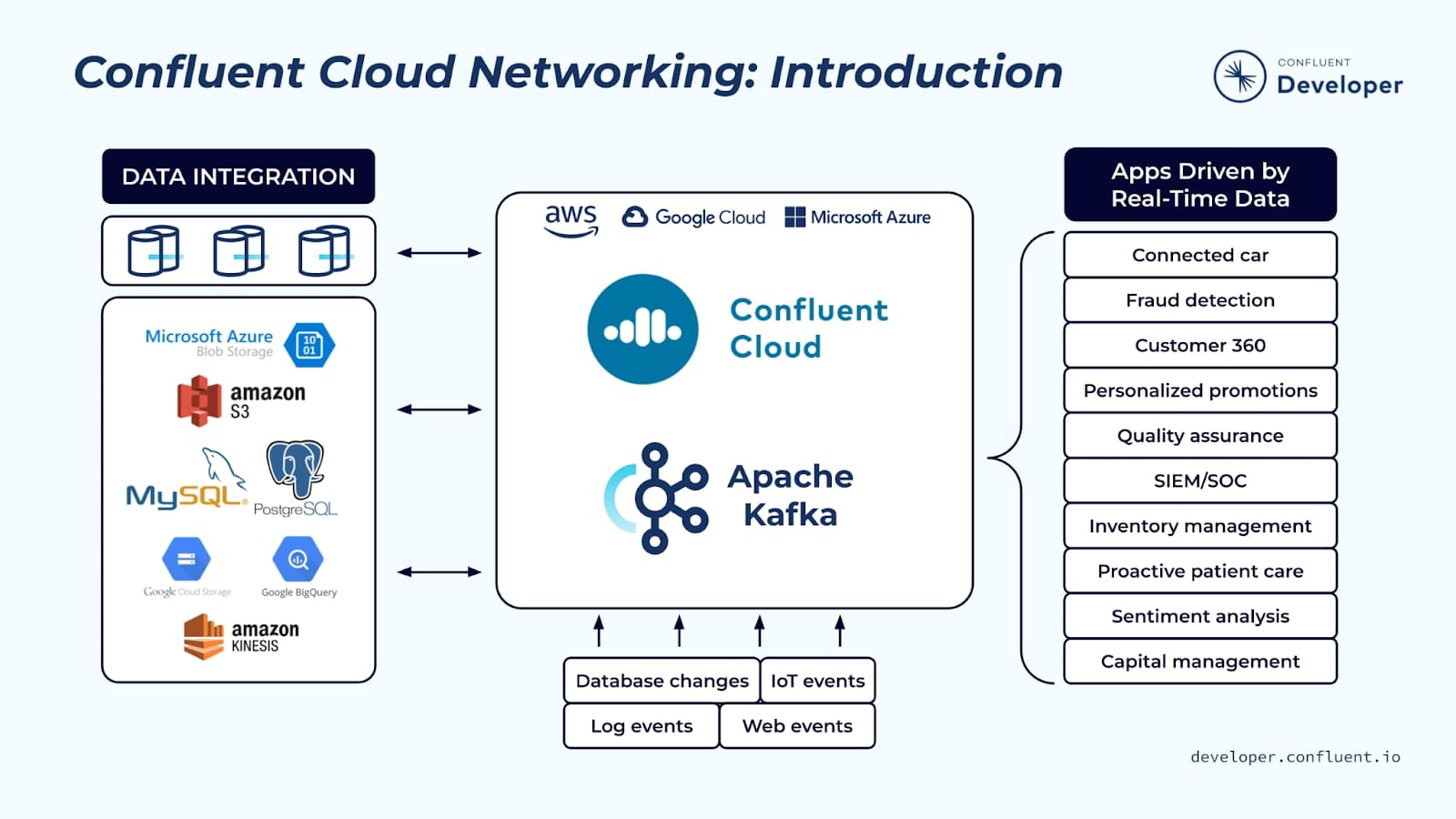

Recent business highlights include Confluent enhancing support for Apache Fink in the latest release of the Confluent Cloud on Sept. 17. New features in the release included support for Table API to make Apache Flink easier to use for developers working with the Java and Python programming languages. The release also included the addition of an extension for Visual Studio Code to support real-time development use cases, a private networking capability and client-side field-level encryption to safeguard sensitive data.

For its fiscal fourth quarter, Confluent expects to see adjusted earnings per share of five cents on subscription revenue of $245 million to $246 million. For the full year, the company expects adjusted earnings per share of 25 cents on subscription revenue of $916.5 million to $917.5 million.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.