APPS

APPS

APPS

APPS

APPS

APPS

Israeli fintech company Melio Solutions Inc. announced today that it has raised $150 million in a new late-stage funding round on a $2 billion valuation to fuel its growth through strategic partnerships and enhance its accounts payable and receivable platform for small and medium-sized businesses.

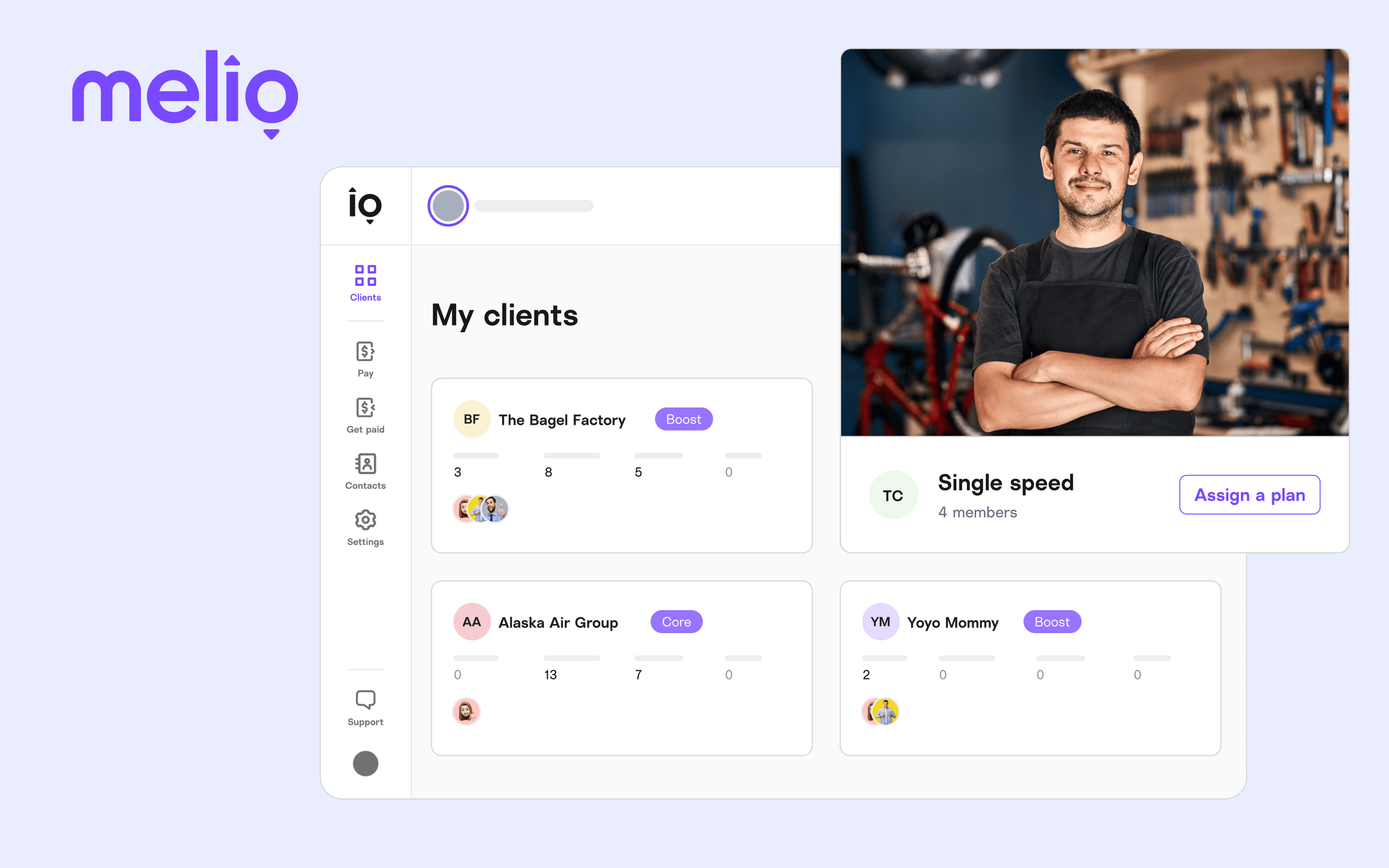

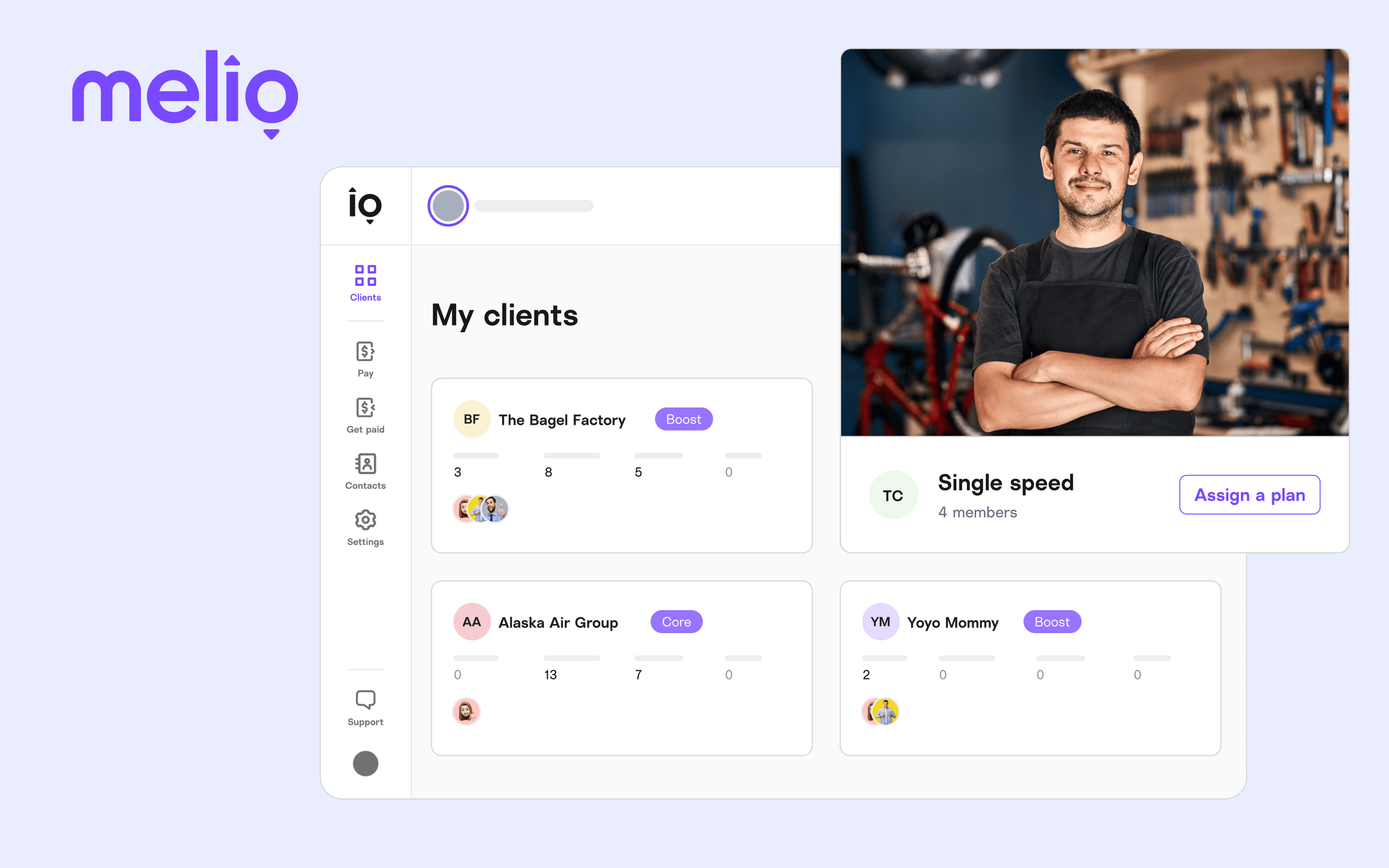

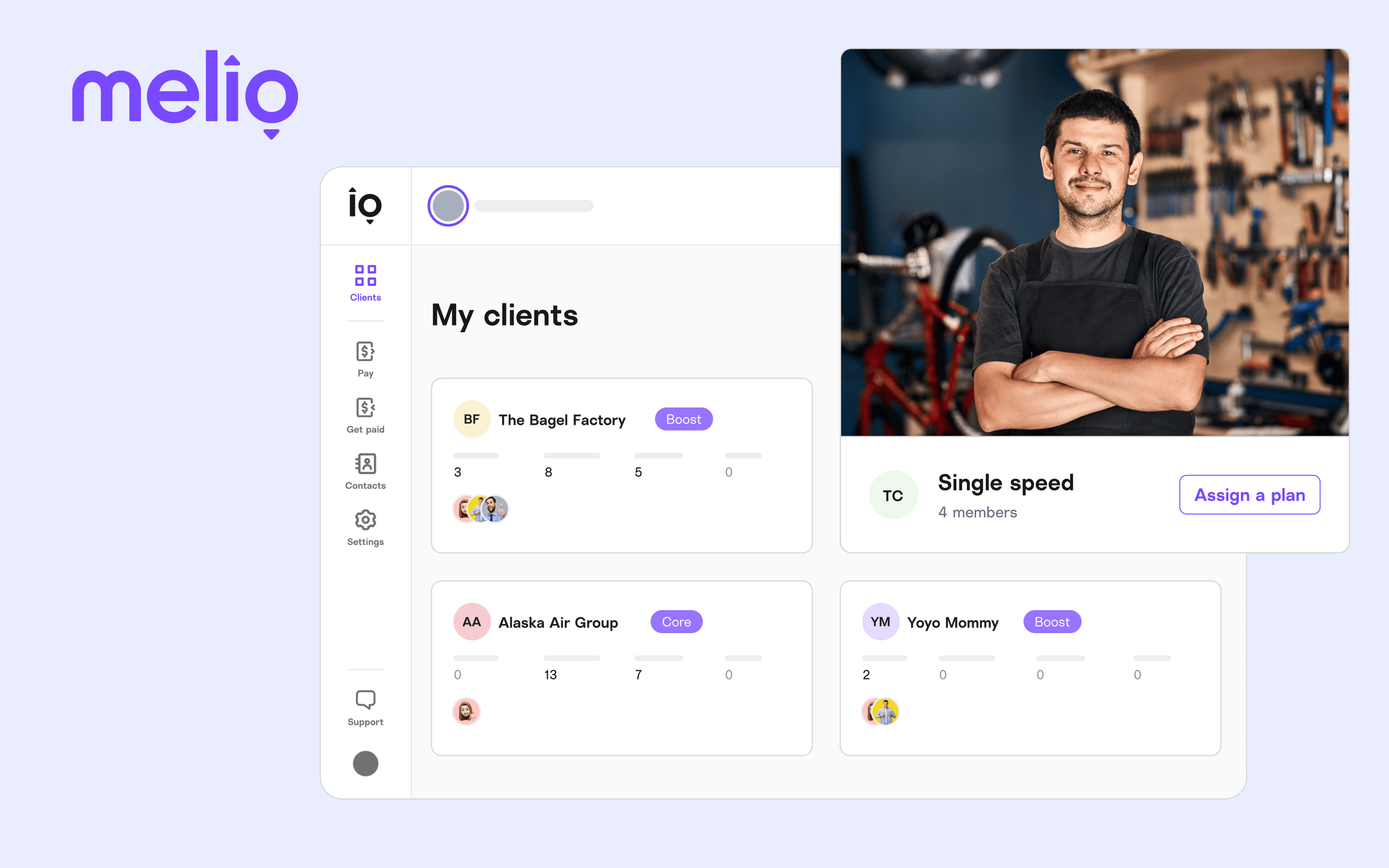

Founded in 2018, Melio offers a digital payment platform designed to simplify business-to-business transitions for small and medium-sized businesses. The platform allows businesses to manage both accounts payable and receivable through an easy-to-use interface and offers flexible payment options that help businesses optimize cash flow and improve vendor relationships.

Melio provides multiple payment options, including ACH bank transfers and credit card payments, allowing businesses to pay vendors even if the vendors don’t accept credit cards. Flexibility is a key to the company’s offering, supporting businesses in managing cash flow more effectively by letting them choose the most convenient payment method for their financial needs.

The company’s platform integrates with existing accounting software, such as QuickBooks, to make it easy for users to keep their books updated. The platform also offers an approval workflow feature that gives teams the ability to add multiple approvers, customize approval rules and reduce errors in the payment process, helping enhance internal control and accountability, especially for SMBs with growing financial needs.

In addition to its core payment solutions, Melio offers options for expedited payments, such as instant transfers and same-day payments, that allow businesses to meet urgent vendor deadlines. The feature is said by Melio to help companies maintain strong supplier relationships by ensuring that payments arrive on time, even in time-sensitive situations.

Fiserv Inc. led the Series E round, with Accel Partners Management, Bessemer Venture Partners LP, Coatue Management, Frontline Ventures Ltd., General Catalyst Group Management, Latitude Ventures LLP and Thrive Capital Management also participating.

Fiserv and Melio have a previous relationship, with the two having entered a partnership to integrate Melio’s payment capabilities within Fiserv’s Clover point-of-sale systems last year. The resultant product, called CashFlow Central, has allowed more than 3,500 financial institution clients of Fiserv to meet the payment operations and cash flow needs of their small and medium-sized business clients and members.

“Through our partnership with Melio, CashFlow Central is designed to create significant value for financial institutions and their business clients or members,” John Gibbons, head of the Financial Institutions Group at Fiserv, said in a statement. “We are excited to leverage our unique position at the intersection of financial institutions and businesses to deliver a comprehensive, integrated experience that enables our clients to compete and grow their portfolios with this important segment of their communities.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.