AI

AI

AI

AI

AI

AI

Shares of Arista Networks Inc. fell more than 6% in late-trading after the company delivered strong third-quarter earnings and revenue and offered guidance that came in above expectations.

The company reported earnings before certain costs such as stock compensation of $2.40 per share, while its revenue increased 20% from a year earlier to $1.81 billion. The results were much better than expected, with Wall Street analysts looking for earnings of just $2.08 per share on sales of $1.75 billion.

Net income for the quarter came to $747.9 million, up from $545.3 million in the year-ago period.

Arista is a rival to the much larger Cisco Systems Inc. in the computer networking industry, focused on selling premium gear such as high-speed switches that accelerate communications between racks of computer servers in corporate data centers. Its largest customers include so-called hyperscaler cloud service providers such as Microsoft Corp. and Facebook parent Meta Platforms Inc., though the company also has a solid footing in the enterprise market, with large companies, educational institutions and government agencies.

The company has delivered a string of impressive earnings and revenue beats over the last year, as hyperscalers and enterprises alike step up their spending on cloud computing and artificial intelligence-related infrastructure. AI applications need a rapid communications infrastructure to operate effectively, and that’s exactly what Arista provides with its high-end network switches and routers.

Arista’s rivals have also benefited from the interest in AI. Last week, Juniper Networks Inc., awaiting approval of an acquisition by Hewlett Packard Enterprise Co., delivered a similarly strong earnings and revenue beat, citing demand for AI. Arista said earlier this year it expects to generate about $750 million in AI-related revenue.

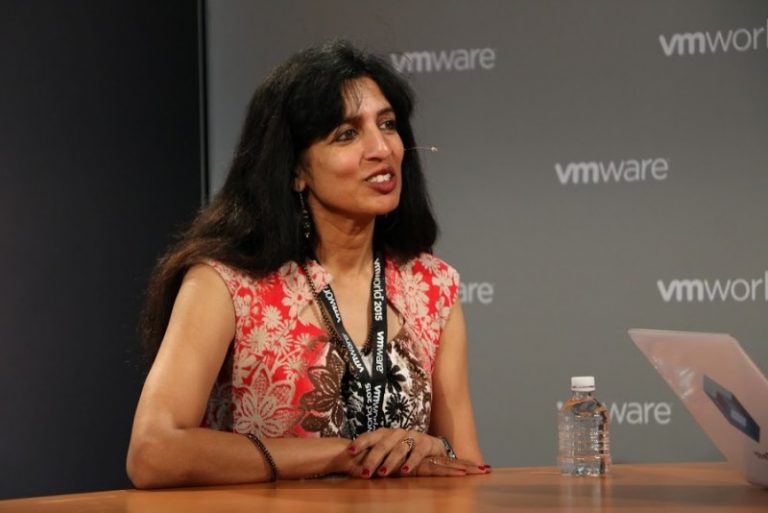

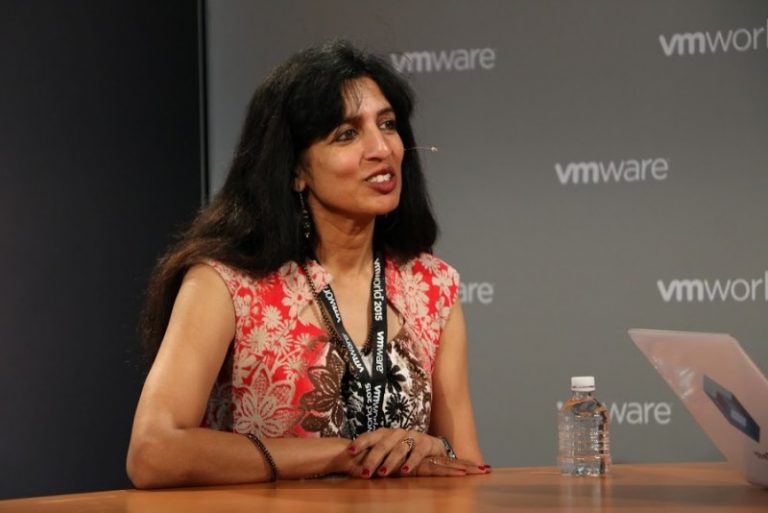

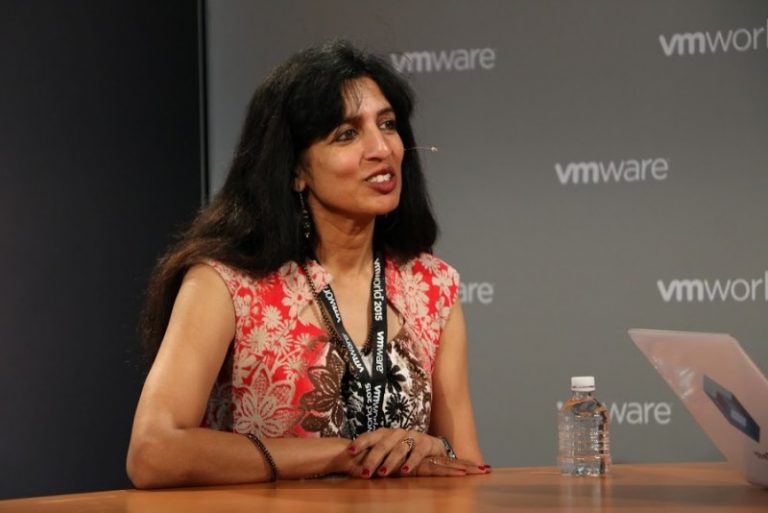

“Arista remains at the forefront of next generation centers of data across client-to-cloud and AI focused locations,” said Arista Chairperson and Chief Executive Jayshree Ullal (pictured). “Our Q3 2024 results once again demonstrate our continued commitment to customer priorities as well as delivering strong financial results.”

For the current quarter, Arista sees no sign of the AI demand letting up. It’s anticipating revenue of between $1.85 billion and $1.9 billion, well ahead of the Street’s forecast of $1.8 billion. It also forecast an adjusted operating margin of 44%, compared to the analyst forecast of 43.5%.

In addition to today’s results, Arista announced plans for a four-to-one stock split, which will g into effect at the close of trading on Dec. 3.

Holger Mueller of Constellation Research Inc. said investors will be encouraged to see Arista continues to grow its business, with 20% revenue growth being a very solid performance from a well-established company.

“It was conservative on the cost side, and that resulted in higher profitability and earnings per share, which are all things that investors appreciate,” the analyst said. “That said, the guidance for the current quarter was a tad conservative, and may have raised some concerns given that the AI market is generally growing at around 30% to 40%. Jayshree Ullal may be asked why Arista is not taking better advantage of this demand.”

The conservative guidance probably explains why Arista’s stock was down in extended trading, although it may also be due to simple profit taking by investors. Prior to today’s move, the shares had gained 83% in the year to date.

THANK YOU