AI

AI

AI

AI

AI

AI

Automation software provider Appian Inc. today posted third-quarter financial results that topped the consensus estimate across the board.

The company’s shares surged more than 30% on the strong earnings.

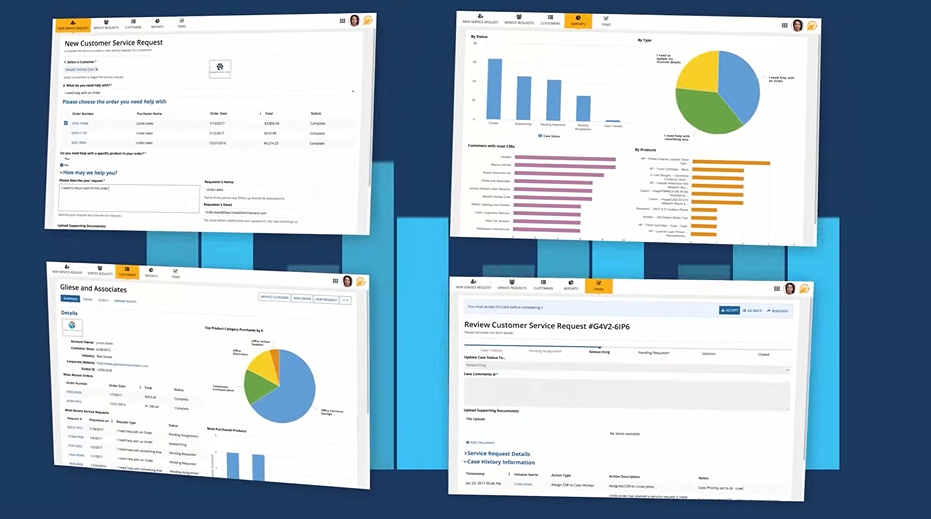

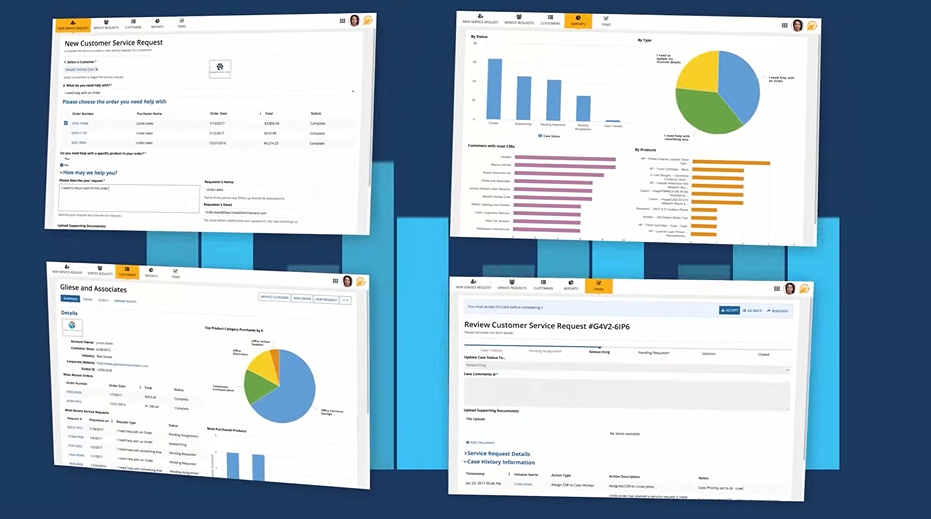

Appian provides a platform that can visualize how an organization’s employees perform routine tasks such as processing documents. It displays the steps involved in a task, the amount of time each step takes and related metrics. Companies can analyze that information to identify areas for improvement.

The platform makes it possible to automate labor-intensive aspects of employees’ work using artificial intelligence agents. Those agents can extract key details from documents, summarize the information and perform related tasks. Appian says its AI processes documents with accuracy of over 95%, which it says is about 35% better than legacy alternatives.

The company’s revenue grew 21% year-over-year in the third quarter, to $187 million. That’s about $13 million better than what analysts had expected. More than half the sum, or $113.6 million, was generated by the subscription-based cloud version of Appian’s platform.

The company also sells an on-premises edition via term licenses, which allow customers to use the software for a predetermined amount of time. Appian’s third major source of revenue is its professional services unit. The unit, which helps customers implement the company’s platform, outpaced its core subscription business with year-over-year sales growth of 29%.

Appian’s plan for sustaining its revenue growth places an emphasis on AI feature development. Chief Executive Officer Matt Calkins told investors today that the company plans to release a new AI automation tool, Agent Studio, in the next few days. It will enable users to create AI agents with natural language prompts.

Appian-powered agents access the information they need to complete requests using a tool called Data Fabric. It can aggregate information from multiple systems in one place to ease analysis. According to the company, the software speeds up application development by removing the need for software teams to manually organize datasets.

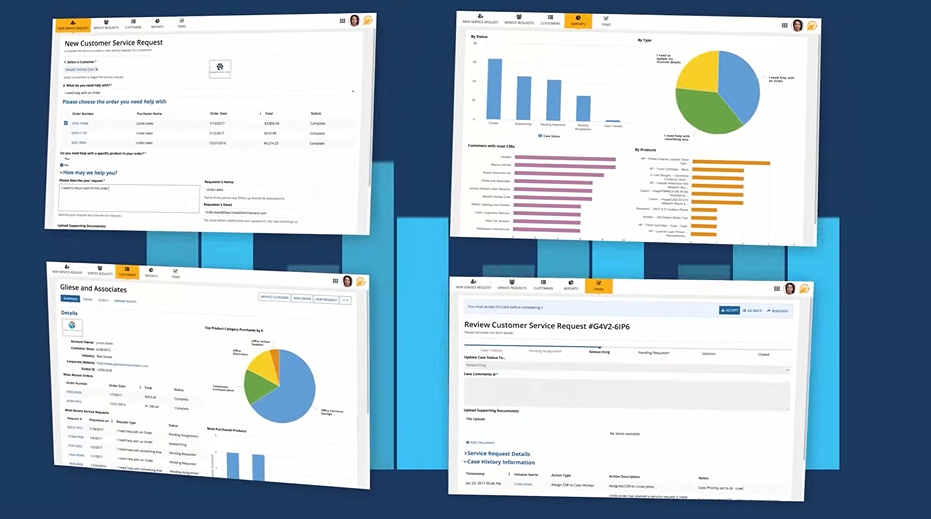

Some AI automation workflows include a user-facing interface. A contract processing agent, for example, might provide a form enables users to submit documents. Appian’s platform includes a tool that enables companies to create customer-facing applications such as document submission portals.

“Appian IDP agents can ingest a wide range of complex documents, from unstructured emails to medical reports and insurance claims,” Calkins said. “For example, one international insurer uses Appian IDP to optimize its underwriting processes and save millions of dollars a year.”

Appian’s sales momentum in the third quarter helped improve its profitability. The company’s adjusted EBITDA, or earnings before interest, taxes, depreciation and amortization, nearly tripled year-over-year, to $32.2 million. That enabled it to deliver adjusted earnings per share of 32 cents, more than six times what analysts had forecast.

During the current quarter, Appian expects to generate adjusted earnings of up to eight cents per share on between $187.0 million and $191 million in revenue.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.