Dave Vellante

Latest from Dave Vellante

BREAKING ANALYSIS

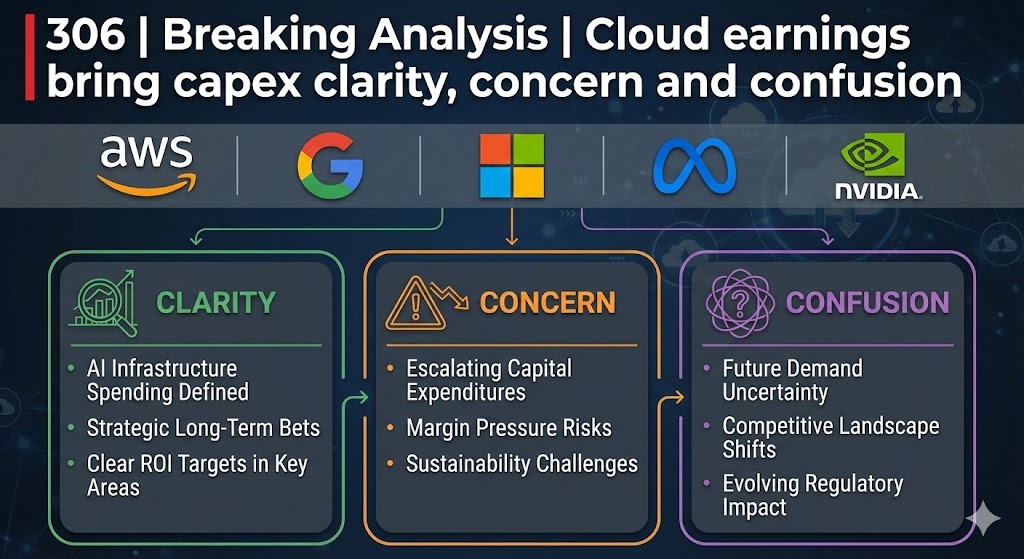

Cloud earnings bring capex clarity, concern and confusion

This winter’s 2026 hyperscale earnings prints from Meta Platforms Inc., Microsoft Corp,, Alphabet Inc. and Amazon.com Inc. made it quite clear that capital expenditures are accelerating. Combined, these four firms will spend more than $615 billion in capex this year, an increase of approximately 70% over what was already considered an inflated 2025. Despite strong fundamental artificial ...

BREAKING ANALYSIS

Microsoft investors fret as capital spending and Azure growth decouple

Microsoft Corp. last week delivered what looks on paper like a great quarter, with a beat of 1% and 5% on revenue and operating operating profit, respectively. But the two-day reaction from investors tells a different story, with the stock off double digits from its pre-earnings price. Last quarter, increased capital spending was interpreted as ...

BREAKING ANALYSIS

2026 data predictions: Scaling AI agents via contextual intelligence

More than eight years into the modern era of artificial intelligence, the industry has moved past the awe of generative AI 1.0. The novelty is gone and in its place is scrutiny. Enterprises are less impressed by demos and more impatient about outcomes. Market watchers are increasingly skeptical about vague narratives, and the commentary has ...

BREAKING ANALYSIS

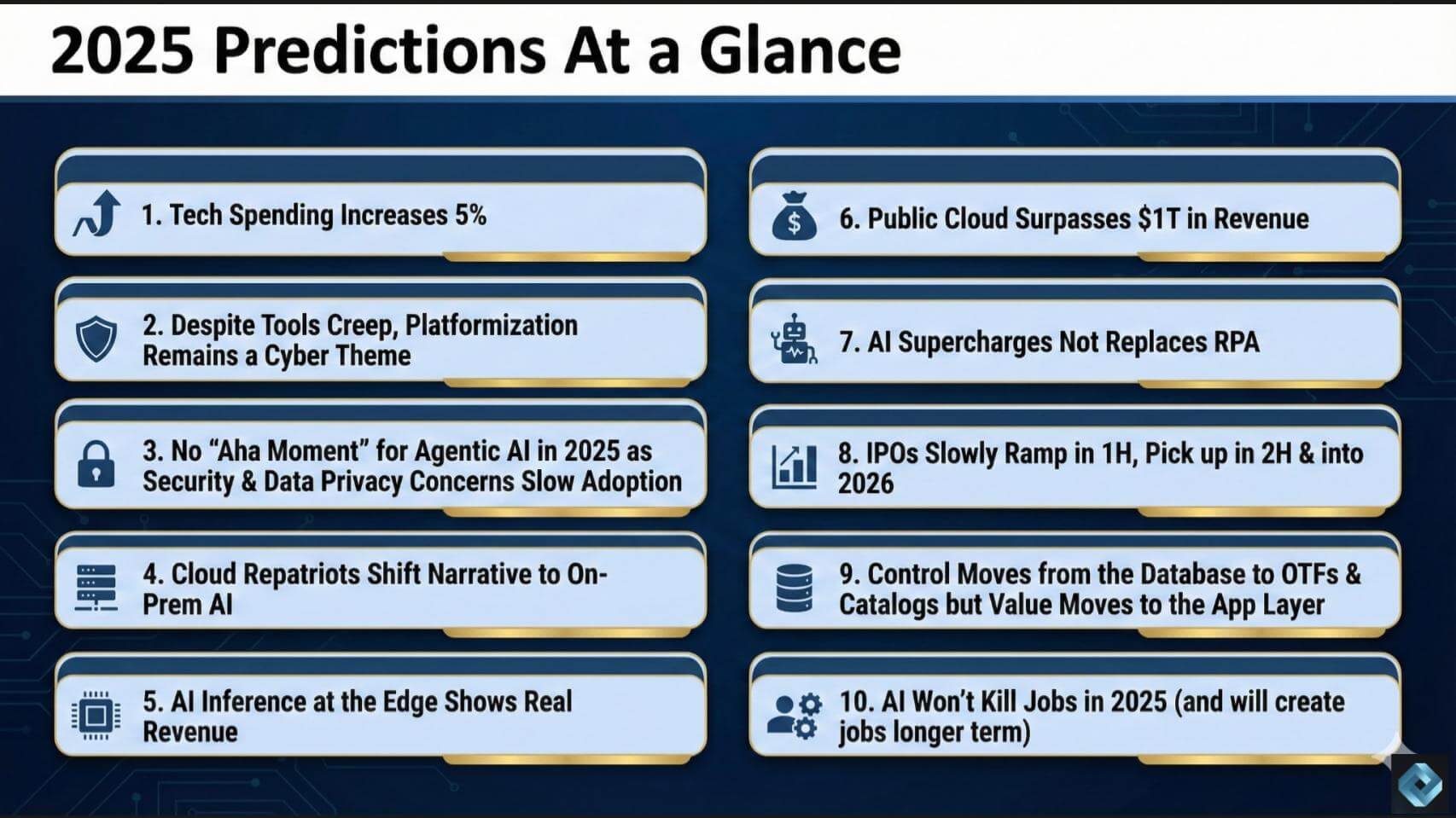

Grading our 2025 enterprise technology predictions

Welcome to this special Breaking Analysis, where we look back and grade ourselves on our 2025 enterprise technology predictions. This is the time of year when we get a flood of predictions from public relations and other thought leaders. As you know, we publish predictions every January: TheCUBE Research does a set, we do a set with ...

BREAKING ANALYSIS

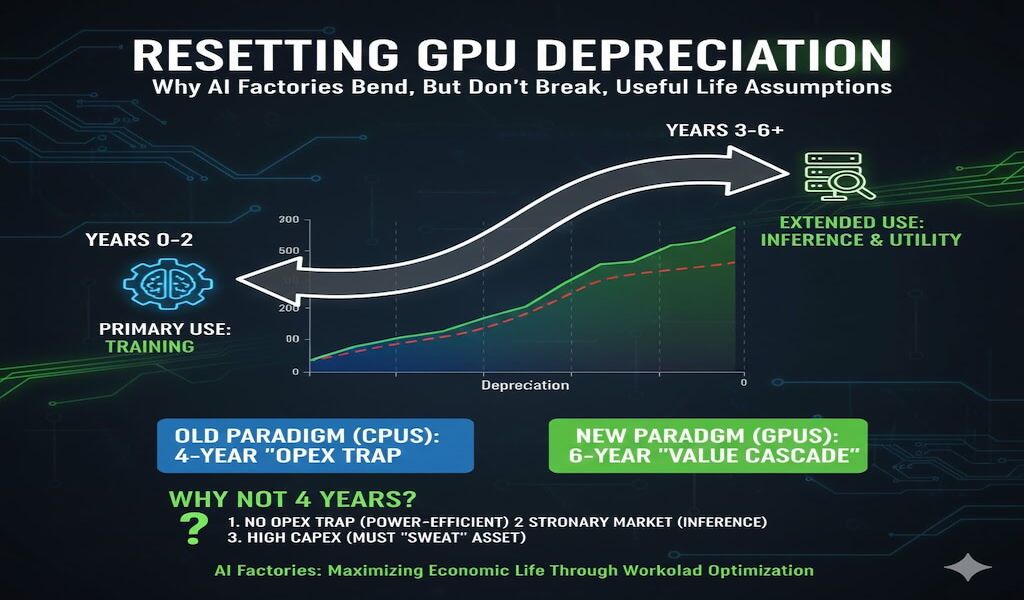

Resetting GPU depreciation: Why AI factories bend, but don’t break, useful life assumptions

Much attention has been focused in the news on the useful life of graphics processing units, the dominant chips for artificial intelligence. Though the pervasive narrative suggests GPUs have a short lifespan, and operators are “cooking the books,” our research suggests that GPUs, like central processing units before, have a significantly longer useful life than many claim. ...

BREAKING ANALYSIS

Dave Vellante’s Breaking Analysis: The complete collection

Breaking Analysis is a weekly editorial program combining knowledge from SiliconANGLE’s theCUBE with spending data from Enterprise Technology Research. Branded as theCUBE Insights, Powered by ETR, the program is our opportunity to share independent, unfiltered editorial with SiliconANGLE, theCUBE and Wikibon communities. The program and conclusions we produce are data-driven, tapping ETR’s proprietary spending data set. Episode 221 – ...

BREAKING ANALYSIS

From product to platform: How CrowdStrike navigates to durable growth

We believe CrowdStrike Holdings Inc. has re-established growth momentum while still working through the financial and reputational overhang of the July 19, 2024 global outage. The company recently delivered net new annual recurring revenue reacceleration ahead of expectations, showcased strong platform expansion across cloud, identity and next-generation security information and event management, and leaned on ...

BREAKING ANALYSIS

Broadcom vs. Nvidia: Not a zero-sum game

We believe the prevailing narrative that Broadcom Inc. and Nvidia Corp. are locked in a zero-sum battle for artificial intelligence data center dominance is misleading. The reality is these companies are playing very different games. Nvidia has built a vertically integrated compute and software platform that has become the engine of the AI factory era. Broadcom, ...

BREAKING ANALYSIS

Reframing Jensen’s Law: ‘Buy more, make more’ and AI factory economics

We believe the industry’s broad interpretation of Jensen’s Law — “Jensen’s Law accelerates Moore’s Law” — understates a fundamental economic reality of artificial intelligence factories. Nvidia Corp. Chief Executive Jensen Huang’s own language and Nvidia’s operating model point to a financial law of motion for AI factories: When power is the binding constraint and demand is elastic, performance per ...

ANALYSIS

Nvidia CEO Jensen Huang claims $600B in annual capital spending – wait, what?

Nvidia Corp. CEO Jensen Huang repeatedly stated during the company’s second-quarter 2026 earnings call this week that the top four hyperscalers (Amazon Web Services Inc., Google LLC, Microsoft Corp. and Meta Platforms Inc.) would spend around $600 billion in annual capital expenditures — a figure he said had doubled in just two years and was ...