NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

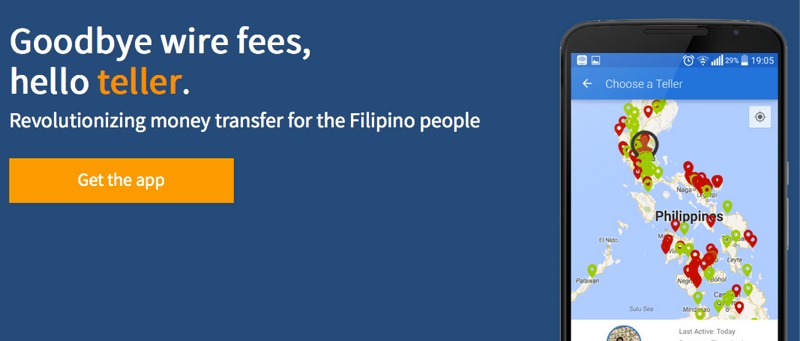

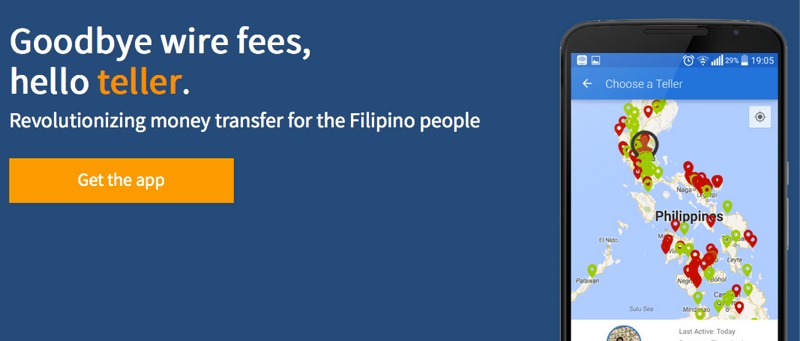

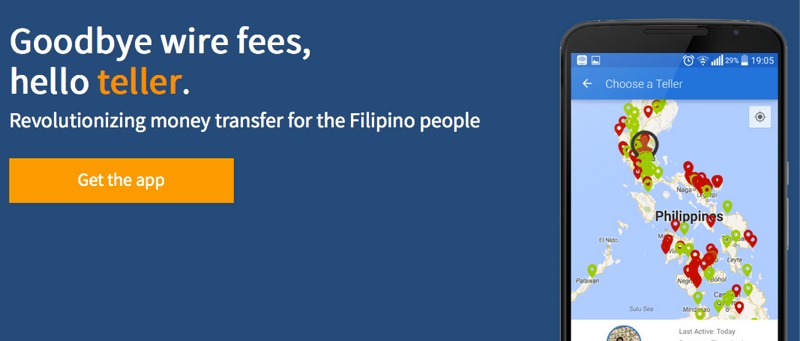

A new service from Philippine Bitcoin startup Coins.ph allows users to transfer money to other users without the need to have a bank account.

Called “Teller”, the system works by utilizing Coins.ph accounts and retailers who currently accept Bitcoin payments via the Coins.ph network to transfer actual fiat currency between two parties.

Person A installs the Coins.ph wallet and finds a “teller,” the retailer close by. Visiting that retailer they hand over the amount of cash they wish to transfer to Person B; it should be noted that the amount is capped at $50, which may not sound like a lot, but for transactions in a country with high poverty rates, it’s a significant amount locally.

The teller accepts the payment and then transfers the equivalent amount in Bitcoins into person A’s wallet for a small transaction fee.

Person A can then transfer that amount to Person B’s Coins.ph Bitcoin wallet.

Person B can then withdraw the amount in cash via a variety of methods including through bank deposits, cardless ATM withdrawals, door-to-door delivery by a number of logistics firms, or cash pick-up at partner pawnshops and remittance centers.

The only way to describe it is as a dead easy to use, low-cost money transfer service without the use of banks.

Coins.ph Chief Executive Officer Ron Hose explained to Tech In Asia that security of remittances were paramount with the new service, and that the service was rolling out first with existing money exchangers and retail establishments that are familiar with handling such transactions, and that these entities screen tellers, run identity checks on them, and train them.

Eventually, the technology will be extended to any retail store where Coins.ph does the screening and training.

From the western viewpoint it’s difficult to understand why this service is so clever because we’re used to simple bill payments and bank transfers, and even services like PayPal require a bank account or credit card to use them, but what needs to be understood is that in many countries banking services are not universally used, or even available.

While the Philippines isn’t exactly a full blown developing-nation failed state, it still has some incredibly high rates of poverty (among the highest in South East Asia) and the reality on the ground is that these people don’t have access to banks and bank transfers, and this is where Coins.ph’s teller steps in.

The solution is so simple, and yet so clever you can see it being applied across many other countries which need these sorts of services as well.

Founded in 2014, Coins.ph has received seed funding (amount unknown) previously from investors including Innovation Endeavors, AMAsia, Pantera, Digital Currency Group and Redbright Partners.

THANK YOU