EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

One of the largest bitcoin exchanges and wallets, Coinbase Inc., has suspended trading in the wake of an almost 35 percent drop in market value for the digital currency in the past 24 hours or so.

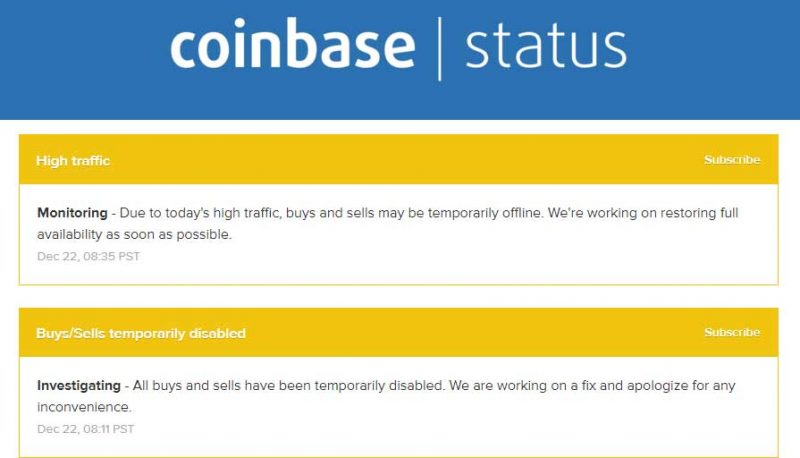

At approximately 11:11 a.m. ET, Coinbase said “all buys and sells have been temporarily disabled,” according to the exchange’s status page. The company also posted that it is currently investigating due to high traffic and volume, which is causing slowdowns on the site.

Bitcoin’s market price dropped significantly recently from a record high on Dec. 16, when the market value reached $19,700 per bitcoin, and has been falling rapidly since, briefly reaching prices as low as $12,712. That’s still up about 60 percent since last month, when the currency saw a massive price jump.

There was collateral damage as well to alternative cryptocurrencies. Ethereum saw its price drop as much as 36 percent and Litecoin fell by up to 43 percent, according to composite prices on Bloomberg. The volatility also could roil bitcoin futures exchanges, two of which launched in the past two weeks.

There was no apparent cause for the price plunge beyond investors potentially taking profits on worries by many that the nearly 20fold rise since the start of the year constituted a bubble that would eventually pop. It’s clear that speculators are diving into bitcoin and related technologies such as blockchain, sometimes blindly. But whether this is a popping of a bubble or yet another in a long string of price swings is not obvious yet.

Coinbase status page. Image: Coinbase

The current trading suspension follows a contentious rollout of trading for Bitcoin Cash, a digital currency that split from bitcoin’s own network protocol. Shortly after adding BCH on Wednesday following he launch of the currency on Coinbase’s sister exchange GDAX, trading was again immediately suspended. Coinbase temporarily disabled trading of bitcoins at 5:57 p.m. ET Thursday, but that issue was resolved in about 15 minutes.

Dealing with the recent surge in bitcoin price, and the subsequent recent drop in price, Coinbase has been struggling with higher volume and extremely high demand. Earlier this month, the exchange also temporarily disabled trading of Litecoin and Ethereum, resulting in trade suspensions no longer than an hour and a half.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.