INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. managed to turn in better-than-expected fourth-quarter results today, bolstered by the success of new data center processors and graphics chips.

The Sunnyvale, California-based company reported a fourth-quarter profit $61 million, or 6 cents a share, reversing a loss of $51 million, or 6 cents a share, a year ago. Profit before certain costs such as stock compensation and tax impacts were 8 cents a share, well above analysts’ 5-cent estimate.

Revenue rose 34 percent, to $1.48 billion, also beating analysts’ forecast of $1.41 billion. It even easily beat first-quarter estimates, forecasting revenue of $1.5 billion to $1.6 billion, compared with the $1.25 billion analyst reckoned.

Shares, which dropped 3.4 percent in regular trading, to $12.87 a share, on an ugly day for the overall market — the Nasdaq fell nearly a full percentage point — tanked in initial after-hours trading too, by as much as 6 percent, but recovered to rise by a little under 1 percent as the earnings conference call filled in details.

“AMD crushed their Q4 by beating on the past quarter, growing 34 percent, and beating on the outlook by around 6 percent with an estimated 32 percent growth,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy.

The results echo those of chipmaking rival Intel Corp. last week. With better-than-expected results, it also brushed back worries about the Spectre and Meltdown chip security flaws, reported just after the start of the new year, that affect millions of Intel processors going back many years as well as some other processors such as AMD’s. In a “cautionary statement,” AMD said that addressing the chip issue with one Spectre vulnerability may be “costly and may be partially effective or not successful at all.” AMD has said it doesn’t think its chips are affected by the Meltdown flaw.

In any case, AMD’s performance was better than the second-quarter report that sent investors fleeing. Despite reporting better-than-expected results that quarter too, shares plunged 11 percent as a lower-than-expected outlook on revenue growth spooked shareholders.

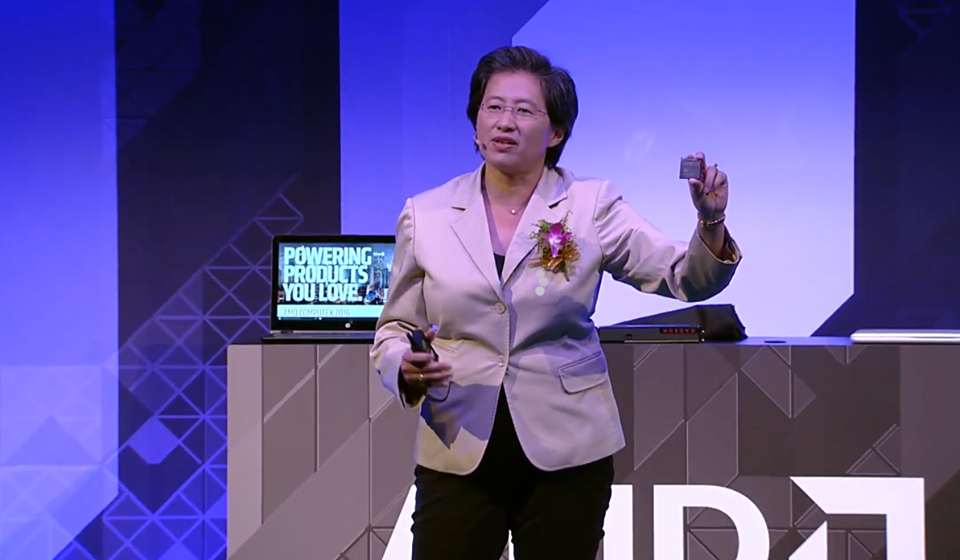

AMD Chief Executive Lisa Su (pictured) called out the company’s revenue growth, higher gross margin and full-year profitability. “2017 marked a key inflection point for AMD as we reshaped our product portfolio,” she said on the earnings call.

Indeed, new chips powered that growth. “The current quarter was driven by strength in Ryzen and Radeon Graphics and things seem to be clicking into gear as you would expect from the product value proposition,” Moorhead told SiliconANGLE. “Computing and Graphics was up an eye popping 60 percent.”

Su said on the conference call that blockchain — an apparent reference to mining of cryptocurrencies such as bitcoin, which uses lots of high-end processing power — accounted for a third of the $140 million growth in Computing and Graphics from the third to the fourth quarter, the rest from other applications.

“It is consuming a lot of GPUs,” she said. But she sounded a cautionary note, as other GPU makers such as Nvidia Corp. have in recent quarters. “Crypto is strong right now, but we do believe it is a very dynamic environment, so we have to watch.”

Moorhead noted that it usually takes about three quarters following product introductions for data center revenue growth to kick in, but already, “we are seeing evidence of Epyc and data center graphics hitting.”

Moorhead is predicting that AMD will perform even better this year as Ryzen mobile chips and Ryzen chips with integrated graphics become more readily available. In addition, Epyc and data center Radeon graphics will have yet another month to “bake,” which he thinks will produce bigger results in the next quarter.

Still, one overhang is the outlook for profit margins. “The generally good news was overshadowed by AMD’s projected gross margins of 36 percent-plus for 2018,” said Charles King, president and principal analyst at market researcher Pund-IT Inc. “That figure disappointed analysts, in part because it substantially lags the 63 percent gross margins that Intel reported.”

THANK YOU