CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Cloud-based subscription services startup Zuora Inc.’s shares shot up late today following its first quarterly earnings report since going public back in April.

The company reported a net loss of 43 cents per share on revenue of $51.7 million, or a loss of 32 cents before certain costs such as stock compensation. Wall Street had expected 40 cents a share.

Investors were clearly satisfied with Zuora’s performance, as the company’s share price rose by just over 7 percent in the after-hours trading session.

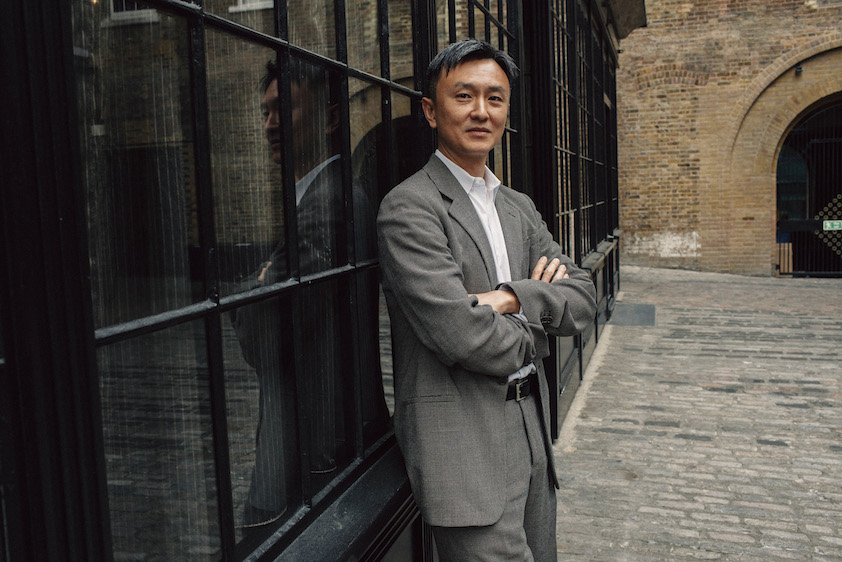

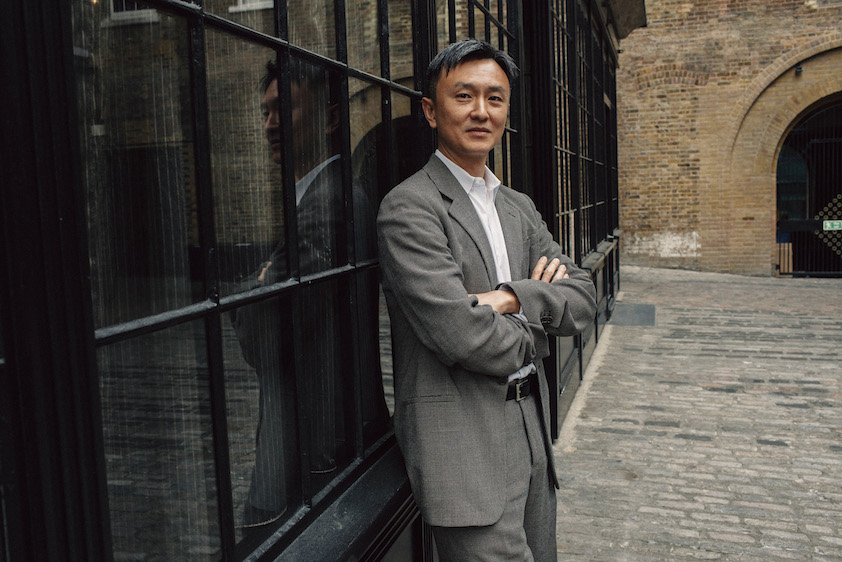

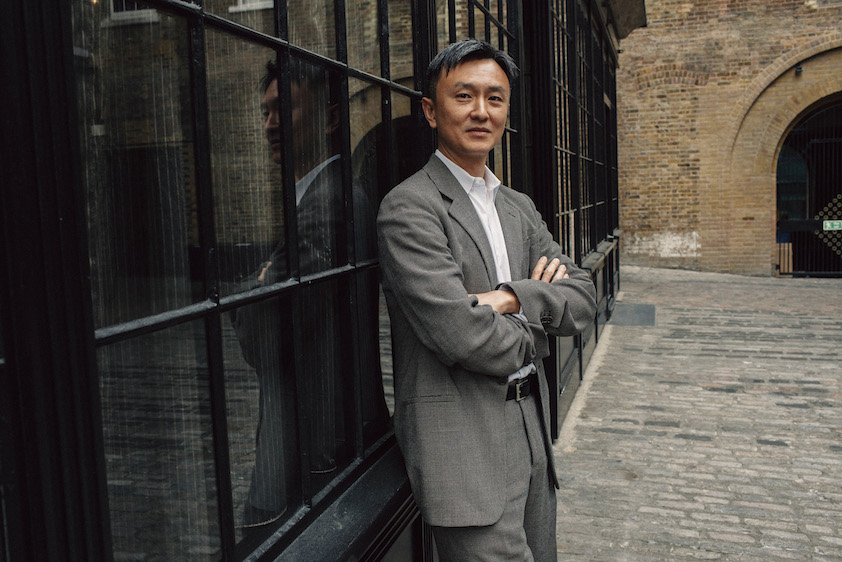

“We’re pretty pleased with the results of the quarter,” Zuora’s chief executive officer Tien Tzuo (pictured) told SiliconANGLE. “We are powering the entire subscription economy.”

Zuora offers a software-as-a-service platform that automates businesses’ subscription order-to-cash operations in real time. Businesses use its platform to launch new businesses, shift products to subscriptions, implement new pay-as-you-go pricing and packaging models, gain new insights into subscriber behavior and attempt to disrupt market segments based on new pricing methods.

The company boasts significant customers, including the likes of hyperconverged infrastructure provider Nutanix Inc., cloud computing services firm Pivotal Software Inc., Ford Motor Co. and General Electric Co.

Tzuo said the subscription business was taking off in a big way, driven in part by the preferences of younger consumers. He pointed to examples including Adobe Software Inc., which dropped its old software licensing business model in favor of a subscription-based service, and has seen tremendous results ever since.

Tzuo added that he sees a big opportunity for his company to grow in Europe, where many enterprises are still locked into legacy enterprise systems built by software companies such as SAP SE. He said that customers there are quickly realizing those legacy software systems are not suited for a modern service and subscription-based business.

“Whether you like it or not, it’s where the business is going,” Tzuo said. “Adobe and Parametric Technology have seen their stocks soar. We don’t see a lot of resistance.”

Zuora said it’s expecting an adjusted loss of 15 to 16 cents per share on revenue of $53.5 million to $54.5 million in the second quarter. Analysts expect a loss of 17 cents per share on revenue of $51.3 million.

With reporting by Robert Hof

THANK YOU