NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

One of a series of articles analyzing the strategies the largest public cloud vendors are using to court enterprise customers. Previous installments looked at Amazon Web Services, Google and Oracle.

In contrast with most of its rivals in the upper tier of the public cloud, IBM’s strategy doesn’t center on overthrowing Amazon Web Services from its position at the top of the competitive food chain. Or at least not since losing a $600 million infrastructure contract with the CIA to the retail giant in a highly publicized bidding war two years ago. The lessons from the episode were deeply internalized at Armonk, which has changed its value proposition almost completely since.

In the two-plus years since it bought SoftLayer Technologies Inc., IBM has worked to expand its cloud footprint, vowing to open more than a dozen new data centers around the world to support its cloud business. But IBM focuses the bulk of its efforts higher up the stack than its direct infrastructure-as-a-service (IaaS) competitors. “From a public cloud infrastructure perspective, we may not be number one in market share, but that’s not necessarily the goal,” said

director of cloud marketing at IBM.

Rather, the company sees a major opening to apply its expertise from building on-premise data management systems to the new generation of services that organizations are deploying in the cloud, which make extensive use of analytics to understand and address user expectations. “We have everything from physical infrastructure to brokerage and everything in between,” Kiss said. “We want to help customers understand best how to apply cloud to their own specific situations.”

IBM also wants to be the cloud vendor of choice for hybrid cloud deployments, an area that is considered a weak point for Amazon Web Services. Kiss estimated that more than 90 percent of IBM’s enterprise cloud customers are deploying a hybrid model. Data analytics is another area that’s currently not being contested nearly as aggressively as IaaS. IBM has committed to not only making most – if not all – of its analytics platforms available in the cloud but also offering the capabilities for customers to package analytics services in containers for distribution around the world.

But that is not to say its rivals are sitting idly by. Amazon boasts an entire set of services for processing unstructured information, including a managed implementation of Hadoop and a real-time analytics engine, that are matched almost entirely by Microsoft’s Azure. And what Redmond lacks in processing options it makes up with data science tools.

But neither of the two cloud giants are investing in their analytics services to the same extent as Big Blue, which is betting the farm on the number-crunching enterprise applications of tomorrow. The past few months alone have witnessed the company commit a billion dollars to accelerating the development of Apache Spark, the popular companion/alternative to Hadoop, and shelled out more than twice that to acquire The Weather Company shortly thereafter in order to secure exclusive access to the company’s climactic data. The deal is one of the seven analytics-focused acquisitions that the company announced this year, the first six of which add an additional billion-plus dollars to the spending tally.

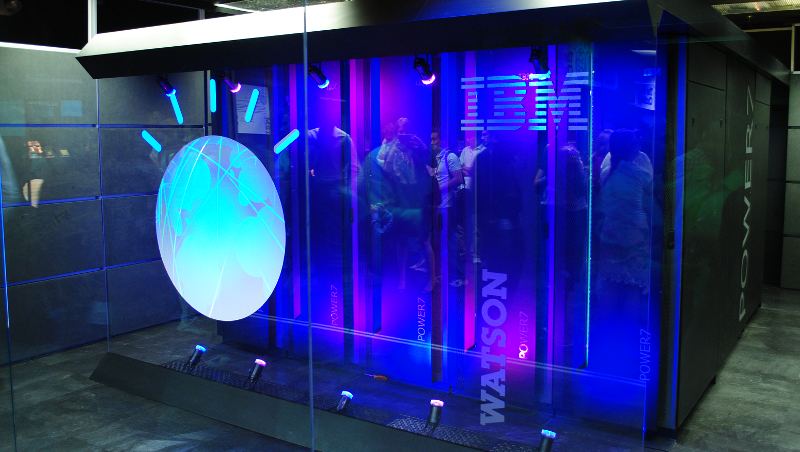

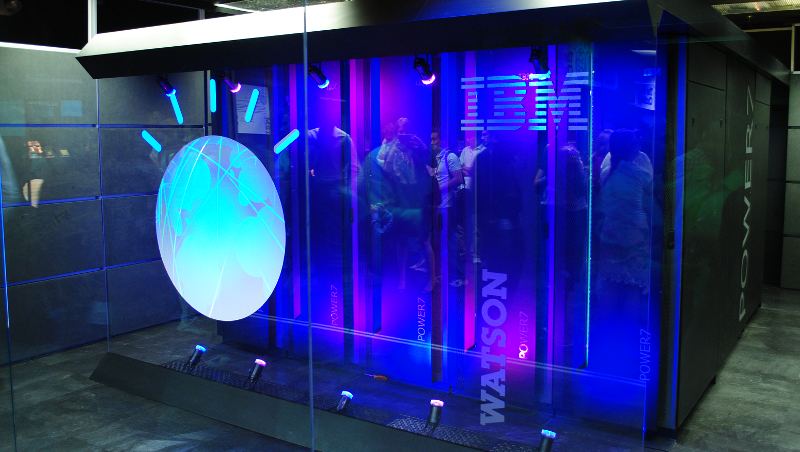

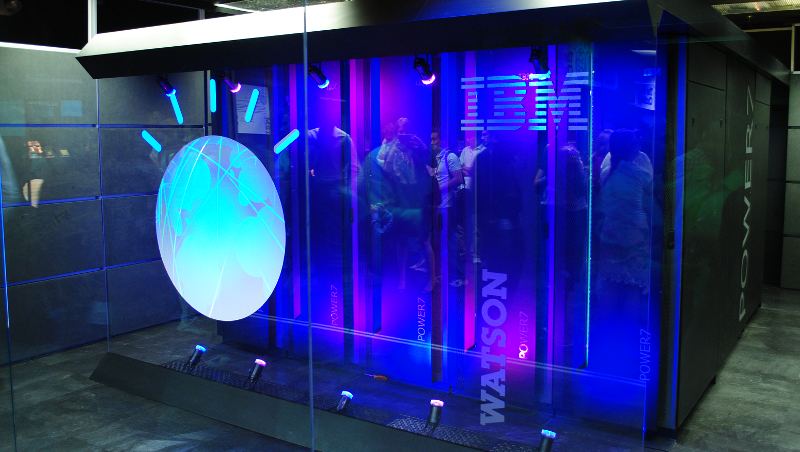

And that’s just from its non-organic investments. IBM also set aside $3 billion in March to build out its connected device business, which includes a significant cloud-based analytics component, and it continues to spend aggressively on the various incarnations of Watson. The Watson technology is a significant point of distinction because of its many potential applications and unique machine learning capability, Kiss said. “It’s not something that can be replicated easily. It’s a franchise that’s been built up over years.”

The fruit of the company’s combined efforts is a large and growing array of what Wikibon’s George Gilbert has described as “composable” data processing services he believes are more adaptable to evolving business requirements than traditional alternatives.

In a research paper published last month, Gilbert used the example of an car insurer that leverages IBM’s cloud platform to collect sensor logs from policyholders’ vehicles in order to understand their driving patterns and adjust pricing accordingly. That provider could now go a step further and use historical records from The Weather Company to improve its handling of damages claims that lay the blame on the elements. There are countless other such potential use cases spanning a myriad of key sectors from banking to healthcare that IBM is trying to address individually with tailored implementations of its analytics services.

The company unveiled a cloud-based version of Watson adapted to support medical care delivery earlier this year that is currently being piloted with Johnson & Johnson Services, Inc., and more recently introduced a series of industry-specific data processing workflows for the standard edition. It’s a direct counter to the one-size-fits-all strategy of bigger rivals such as Amazon and Microsoft. The niches IBM is targeting hold many billions of dollar in potential revenues.

Exactly how much of that opportunity the company will be able to capture remains to be seen, however. IBM generated $4.5 billion in revenue from its cloud division last quarter, an impressive 50 percent year-over-year increase that could soon put the unit on track to start offsetting the mounting losses in its legacy business lines. But that growth rate will invariably become much more difficult to sustain as the numbers get bigger and the competition starts coming to terms with the size of the opportunity at hand. The company’s response to the challenge will determine its future in the public cloud.

Enterprise Editor Paul Gillin contributed to this report.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.