NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Software companies are suddenly finding it tough to go public, and the situation isn’t likely to ease soon.

That’s especially true for the many companies building upon open source technologies such as Apache Spark, which are finally on the cusp of becoming the standard for enterprise computing.

“The sexiness of being a public company has gone down,” Lev Finkelstein, managing director in technology investment banking at Goldman Sachs, said at the venture capital firm Battery Ventures’ first Open Source Summit, featuring a series of software companies, bankers, corporate acquisition executives and large enterprise software customers. “M&A has become a much more viable option.”

No kidding. Only two software companies have gone public since January, the smallest number in at least seven years. Dell’s security spinoff SecureWorks priced below its anticipated price range and then fell more after its debut. Network security company Blue Coat Systems Inc. filed for an IPO on Thursday.

Update: Even that planned IPO didn’t last long. Late on June 12, Blue Coat instead said it would sell to Symantec for $4.65 billion–another apparent nail in the software IPO coffin.

Meantime, the past week has seen no fewer than three significant acquisitions. Data visualization company Qlik agreed to be acquired by private equity firm Thoma Bravo for $3 billion. Salesforce.com Inc. bought retail cloud company Demandware Inc. for $2.8 billion. And Vista Equity Partners scooped up marketing automation vendor Marketo Inc. for $1.8 billion.

What’s going on? In short, the software business has made a hard turn into consolidation mode. Some 739 software acquisitions and mergers valued at a total of $52 billion have been announced so far this year, according to Dealogic, putting the industry on pace to surpass last year’s record 1,526 deals.

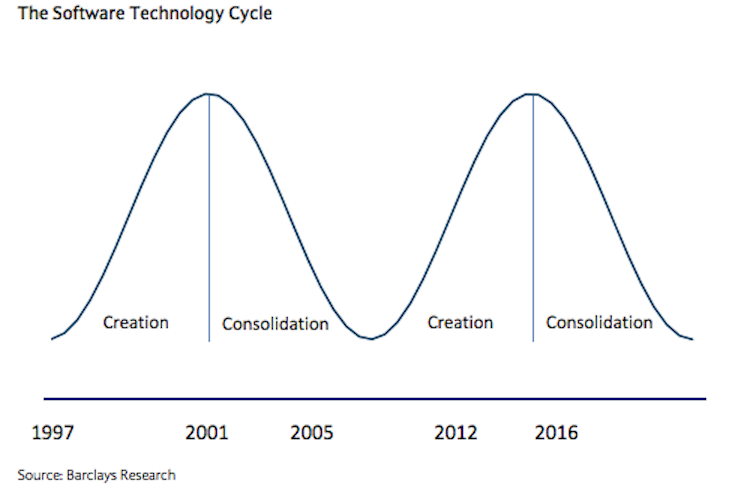

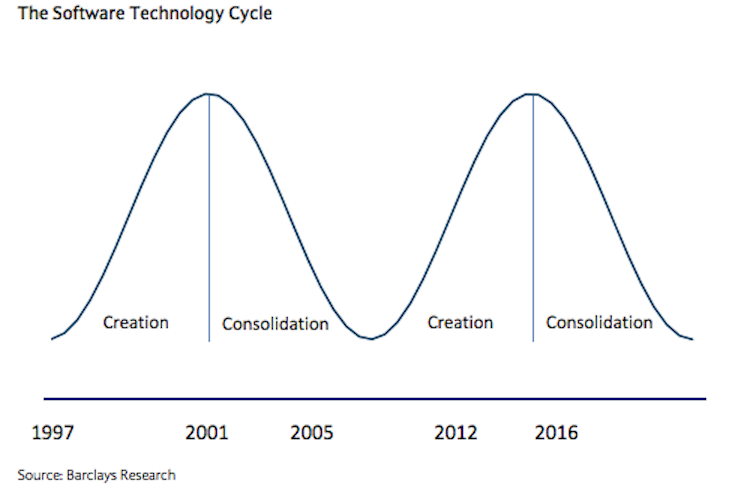

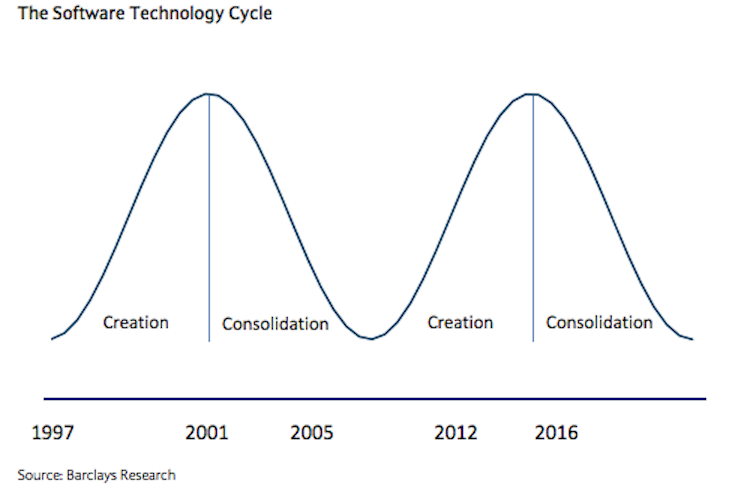

“We are now at a turning point” in the software technology and company development cycle, Barclays Research analyst Raimo Lenschow wrote in a note to clients today (see graph above).

None of this means that IPOs, traditionally the fuel for tech wealth creation, are completely dead. “Volumes will pick up in the second half of this year and especially next year,” said Melissa Knox, executive director of investment banking software at Morgan Stanley, who was involved with Blue Coat’s IPO filing.

But even Knox said most companies are going to wait until at least next year as they adjust their business models to show more emphasis on profitability than on revenue growth. That shift started to happen last fall, she said, as shares of growth companies such as FireEye, Workday and ServiceNow took a hit.

The new rules for a successful IPO candidate now are at least $100 million in revenues, preferably more. And there’s a new valuation metric known as the “rule of 40”–the combination of the percentage of revenue growth and the profit margin.

That means, for instance, that a company with $100 million-plus in revenues that are growing 20 percent with 20 percent margins is fine. So might a company that’s doubling its revenues but has a 60 percent negative margin. That one, though, might also need to prove it can be profitable on a cash basis within four to six quarters.

“Hypergrowth companies need to show favorable unit economics,” said Mark Baillie, managing director of software investment banking at investment banking firm Stifel Financial Corp. “A lot of them are ‘firing’ customers,” because they know only bigger-ticket purchases will be profitable.

One problem, of course, is that making money on or around software that’s given away remains as tough as ever. “It’s nearly impossible to make money on open source,” said Marten Mickos, chief executive of security software and services firm HackerOne and onetime CEO of MySQL.

And it’s not yet clear which services, tools, support or other businesses will be the sustainable models going forward. “In a few years, we’ll have a better idea of what models work best,” said Jim Frankola, chief financial officer of Cloudera.

For now, though, it’s still difficult for open source companies to strike a balance on what to give away and what to charge for, and when, because there’s a constant push and pull between building scale and making money.

“You should be kind of freaked out by how much you’re giving away,” said Barry Crist, chief executive of server management company Chef Software Inc. “If you’re not waking up sweating, you’re not going to build ubiquity.” There needs to be little friction for the customer to go back and forth between free and paid software and services, he added.

It’s not much easier for makers of proprietary software, though, because they’re on the downswing of the industry’s pendulum as far as their customers are concerned.

“Our mantra at Goldman Sachs is ‘Download, don’t buy,’” said Don Duet, head of the investment bank’s software division. “Our last resort is buying proprietary software,” not just because it might cost less but because there’s more flexibility and less vendor lock-in. In fact, Goldman itself is open sourcing some of the software it produces, just as Facebook, LinkedIn, Google and others have done.

The upshot is that it’s decision time for many software companies, especially those in open source: “Companies that are still private need to figure out if they can reach cruising altitude,” said Phil Kirk, director of corporate business development at Cisco Systems Inc. If they can’t, they need to find a place to land before they crash.

Graph from Barclays Research

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.