NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Distributed derivatives startup Velocity has debuted a demo of their new blockchain smart contract on price feeds platform.

Built using blockchain technology and Ethereum smart contracts, the platform aims to make derivatives trading more transparent, accessible and secure. The decentralized options platform provides support for users to enter into a collar option using a smart contract on the Ethereum blockchain, a move claimed by the company as making it the first platform that doesn’t rely on central servers or “middlemen” settlement processes to manage funds.

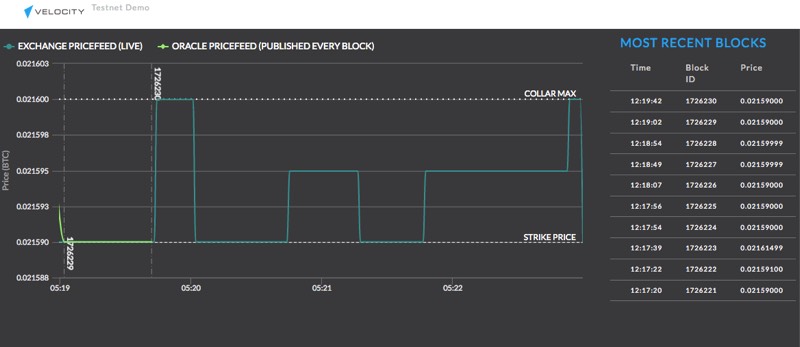

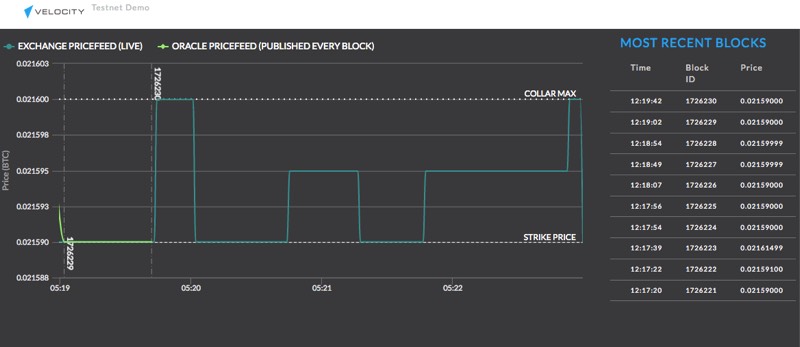

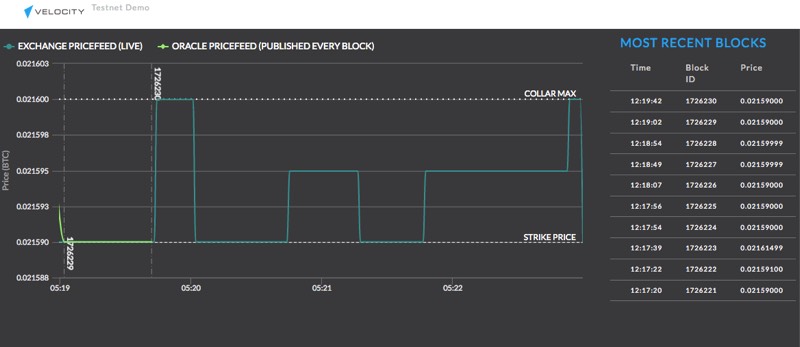

Using the platform, each party purchases a contract by sending a small amount of Ethereum (ETH) to the contract’s Ethereum address. Once the network has accepted the initial ETH, the contract on the system will fetch a starting price from the price feed, and run for a period of five blocks. Users are presented with a chart that displays time, price and block number for the most recent Ethereum blocks.

“The OTC derivatives market is worth $16 trillion in the U.S. alone, making derivatives integral to today’s financial landscape, in everything from insurance to portfolio management,” Velocity Chief Architect Vignesh Sundaresan said in a statement sent to SiliconANGLE. “Velocity provides advanced yet approachable blockchain technology to support cryptocurrency’s trend towards margin trading, and to further adoption of smart contracts on the blockchain.”

In the demo (available here), users are guided through a simple option contract based on the price feed that can also be used to get a feel for the sentiment of Ethereum’s price in comparison to bitcoin. Velocity has also developed a Twitter bot that provides spectators and those involved in the digital assets industry that shows when users are speculating whether prices will go up or down.

As well as providing transparency in the market with real time data, the removal of a middle man reduces both the time and cost involved in making trades, although Velocity doesn’t specify how it intends to make money from its platform once it finally goes into real world trading.

It’s not clear when Velocity’s platform will be developed for real-world trading, but the company is planning to raise funds through crowdfunding in the fourth quarter, indicating that final development may still be some time off.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.