INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Artificial intelligence and gaming once again boosted the fortunes of Nvidia Corp. as the maker of graphics chips reported better-than-expected results for the eighth quarter in a row.

In its first fiscal quarter reported today, the company earned a profit of $507 million, or $533 million before certain expenses such as stock compensation, equaling 85 cents a share. That’s more than double a year ago. Revenue jumped 48 percent, to $1.94 billion.

Profits blew away forecasts. Analysts had expected the company, a leader in graphics processing unit chips and systems used in high-performance gaming personal computers and servers used in artificial intelligence, to post a 68-cent profit on revenue of $1.9 billion.

Nvidia also issued an outlook for the second quarter of $1.95 billion in revenue, give or take 2 percent. Gross profit margins are expected to be 58.4 percent, or 58.6 percent before certain expenses, both plus or minus a half-percentage point. For the first quarter, net margins were 59.4 percent.

Investors cheered at the news, pushing shares up more than 14 percent in after-hours trading. In early February, Nvidia’s shares hit an all-time high of $120.92, after leading S&P 500 companies last year by more than tripling in price. But in the weeks following its February earnings release, they fell to $95.17, since recovering somewhat. They closed up a fraction in regular trading today, to $102.94.

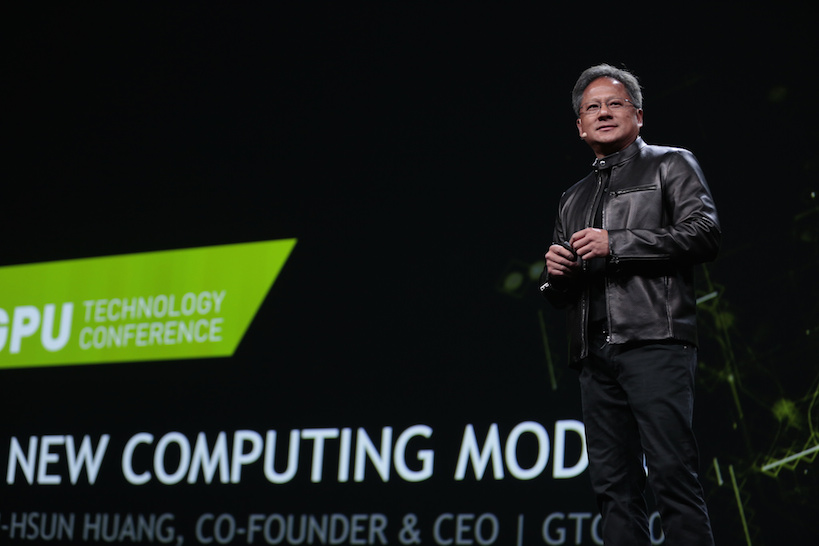

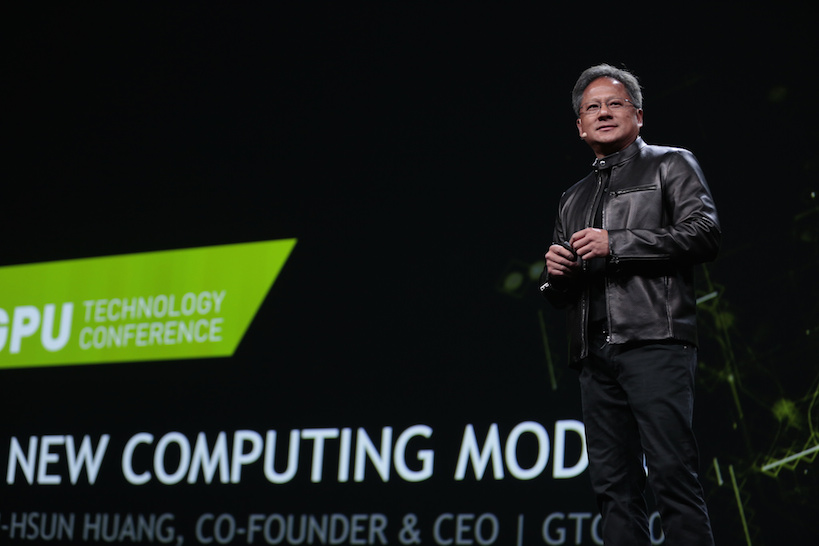

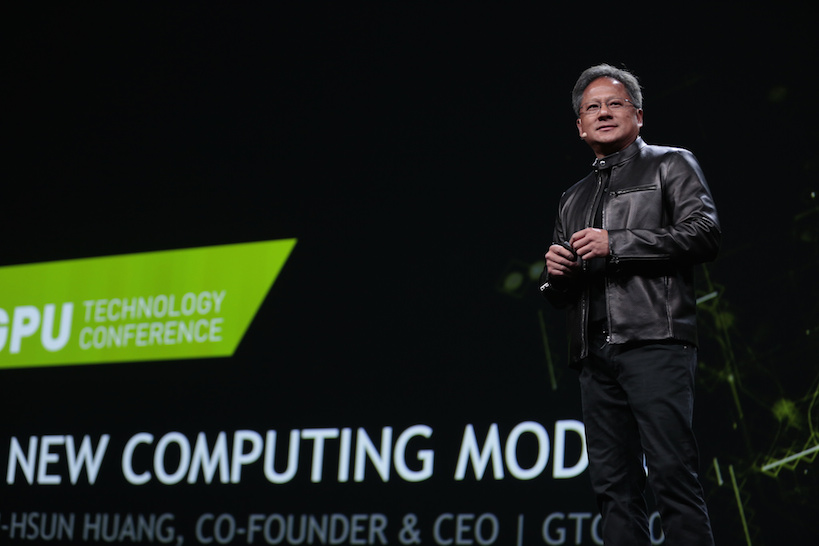

Chief Executive Jensen Huang (pictured) called out the “AI revolution” that continuing to accelerate. As a result, he said on the earnings conference call, “Our GPU computing business for data center is growing very fast, and it’s growing on multiple dimensions.” In data centers, they’re used by companies such as Google Inc. and Facebook Inc. for deep learning work and by cloud computing providers such as Amazon Web Services and Microsoft Azure. Deep learning in recent years has led to big breakthroughs in speech and image recognition, producing new innovations such as self-driving cars, language translation and intelligent assistants such as Amazon.com Inc.’s Alexa.

“Nvidia is strongly positioned to capitalize on the post-smart phone era, with the emergence of machine learning/deep learning-based intelligent systems,” Global Equities Research analyst Trip Chowdhry wrote in a note to clients.

Data center revenue, which had tripled last year, jumped 186 percent, to $409 million. That was also the seventh consecutive quarter of sequential sales increases. Buyers are mainly deep learning leaders with “hyperscale” data centers, such as Google, Facebook, Microsoft Corp., Amazon.com Inc. and IBM Corp., as well as cloud providers, including several of those same companies, selling access to GPU power online. “We basically have everybody,” Huang said. “Every hyperscaler in the world is using Nvidia.”

Karl Freund, senior analyst at Moor Insights & Strategy, noted that the data center business is now running at a $1.6 billion annual rate yet continuing to nearly triple year over year. “The data center business continues to accelerate growth, quarter in and quarter out,” he said.

The other star in the quarter was chips for gaming personal computers, Nvidia’s longstanding business. Gaming business revenue, by far the biggest segment, rose 49 percent, to $1.03 billion. That was driven partly by sales of its Tegra GPU modules for the Nintendo Switch video game console as well as esports.

“Nvidia repeated what it has done the last three quarters, that is, to keep driving gaming and data center growth,” said Patrick Moorhead, Moor’s president and principal analyst. “Gaming will be tough to grow without market growth, but that is happening.”

Automotive revenue rose 24 percent, to $140 million, thanks to processors and systems finding their way into infotainment modules in cars. Chief Financial Officer Collette Kress said Nvidia has 225 “engagements” in automotive, implying higher growth going forward. “Transportation is the atomic Internet, the physical Internet,” Huang said. “Every aspect of mobility and transportation and delivery will be augmented by AI.”

Other segments didn’t fare quite as well. Revenue from professional visualization for high-end rendering such as that used in virtual reality, was up 8 percent, to $205 million. The original equipment manufacturer intellectual property businesses collectively fell 10 percent.

The company is holding its annual Graphics Technology Conference this week in San Jose, California, for about 7,000 attendees. Huang is expected to introduce new products Wednesday morning.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.