EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

Japanese financial technology company Tech Bureau Corp. has raised $9 million in an initial coin offering for COMSA, a new service that will specialize in assisting other companies undertake ICOs.

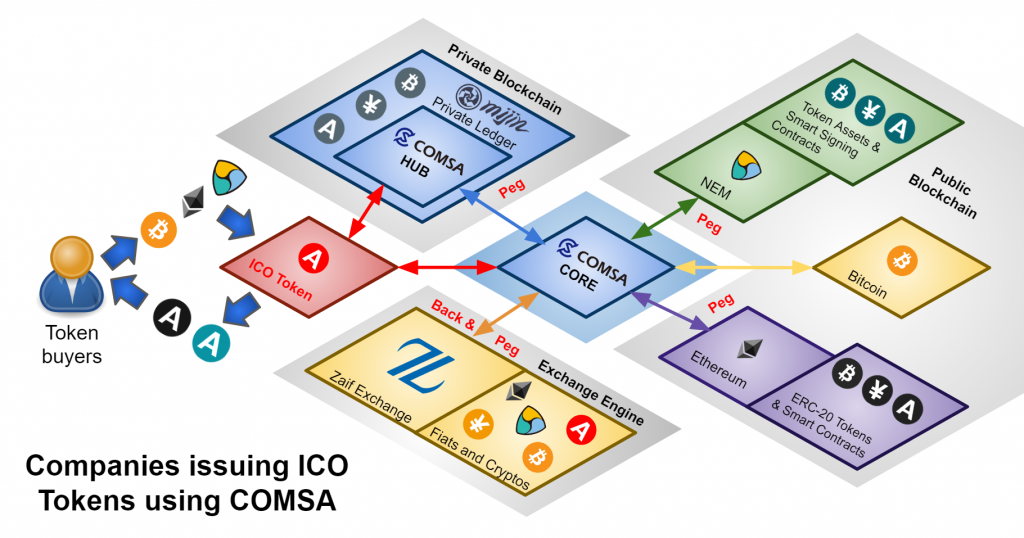

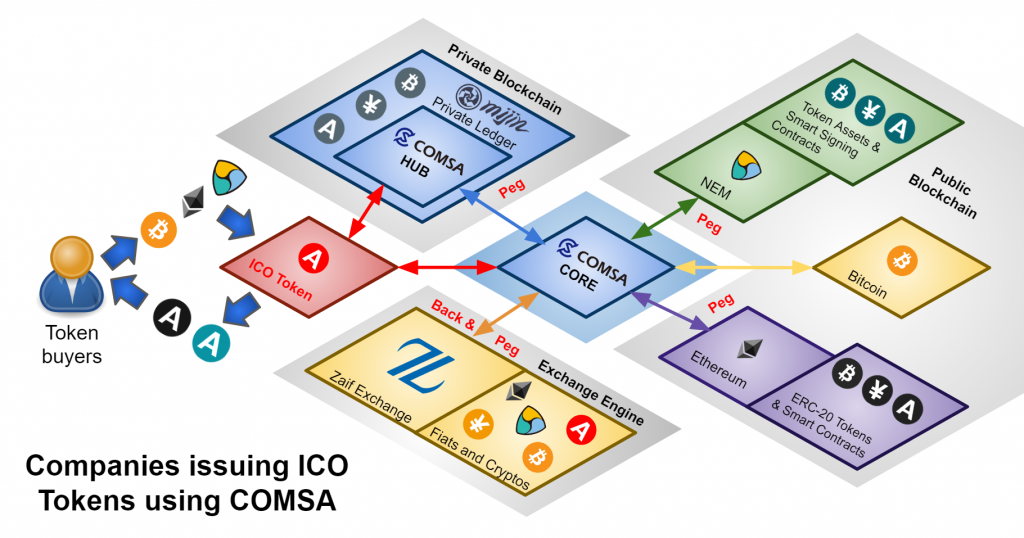

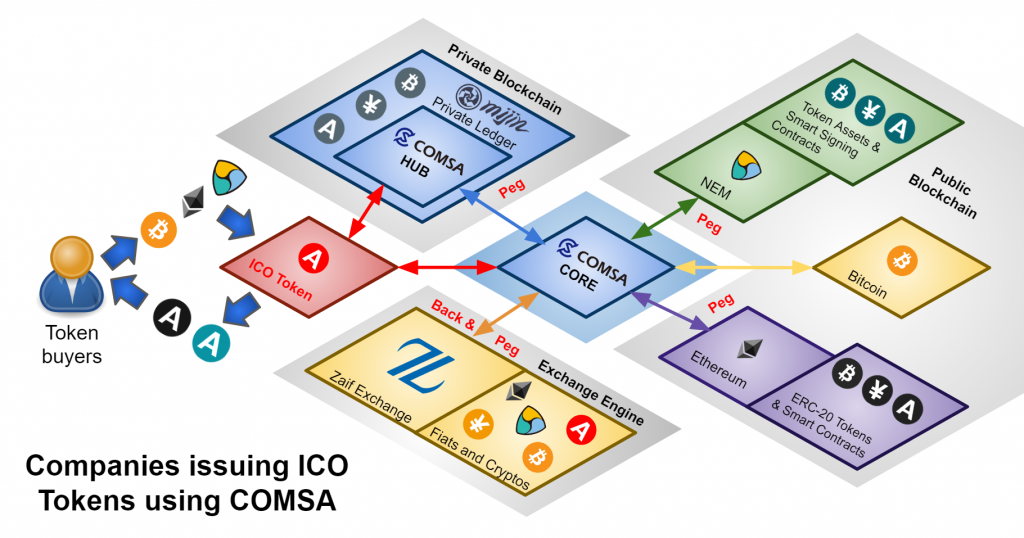

The new service’s fundraising and cross-chaining platform utilizes the NEM blockchain protocol, a custom-designed blockchain that not only caters to handling native currency tokens but also offers peer-to-peer tools such as payments and messaging.

“COMSA aims to address current uncertainties held by the ICO process,” the company explained to SiliconANGLE via email. “By working as a full-fledged ICO fundraising service, COMSA will exercise a completely streamlined process of token offering, sale and distribution, and subsequently listing on an exchange on one efficient platform.”

The initial ICO raise was not a traditional direct-to-the-public offering, instead more in the form of a traditional venture capital round with three VC firms investing: Nippon Technology Venture Partners, FISCO Capitals and ABBALab. Tech Bureau Chief Executive Officer Takao Asayama claims that their participation in the raise is “testimony of their trust in the acceptance and viability in raising capital using cryptocurrencies.”

If the part about the fact that the initial coin offering sounds like a VC round, it’s because it is — but with tokens instead of shares.

“With the development of the COMSA platform, we are now creating a whole new paradigm where capital can be raised with VC participation,” said Lon Wong, president of NEM.io Foundation and supporter of COSMA. “What we hope to see in the future is how Security Exchange Commissions of the world will learn from this initiative, recognize it, and allow securities to be listed using cryptocurrencies.”

That ICOs are taking the tech sector by storm would be a gross understatement, as ICO raises have already passed $1.2 billion this year with no sign of slowing down. That said, a ruling by the Securities and Exchange Commission in July that found that at least some ICOs are subject securities law could yet invite scrutiny to the market by regulators across the world.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.