CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Cloud computing may still be a small part of overall information technology spending, but don’t tell that to investors in Amazon.com Inc., Google LLC owner Alphabet Inc. and Microsoft Corp.

The technology giants derive most of their revenue respectively from e-commerce, advertising and software, but their latest quarterly reports out today shone a light once again on one of the tech industry’s driving forces, as investors pushed their shares higher based more on their cloud operations than their core businesses.

Amazon, whose Amazon Web Services Inc. unit is by far the largest provider of cloud services, reported a third-quarter net profit of $256 million, or 52 cents per share, about the same as a year ago. Analysts on average were expecting a profit of just 3 cents, according to Thomson Reuters. Overall revenue rose 34 percent from last year, to $43.7 billion. That included $1.3 billion from Whole Foods Market, which Amazon bought in late August. Without that and favorable foreign exchange rates, revenue would have risen 29 percent.

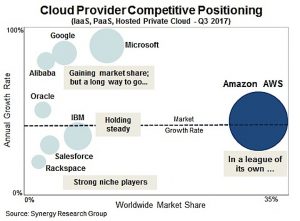

As usual, AWS was the star. Revenues rose 42 percent from a year ago, to $4.58 billion. Analysts were expecting 41 percent growth in AWS revenue. AWS’s growth has been slowing, perhaps simply because of its enormous size but also possibly because competitors such as Microsoft Azure and Google Cloud Platform are growing faster.

But by outpacing growth expectations even a little, Amazon is showing that its cloud remains a juggernaut. Indeed, Amazon on the earnings call said one reason for the revenue outperformance versus expectations was strong cloud momentum. Annualized revenues are now running at $18 billion, up $2 billion from the last quarter.

Moreover, AWS once again lifted Amazon overall into the black, with $1.17 billion in operating profit offsetting an $824 million loss in retail and other operations, all because of big losses in international. The cloud operating profit was up 36 percent from a year ago, indicating little problem with competition so far.

Amazon also issued a new fourth-quarter forecast of between $56 billion and $60.5 billion in revenue, up 28 to 38 percent compared with a year ago. That includes about an additional 1 percentage point from the Whole Foods acquisition. Operating income is expected to be between $300 million and $1.65 billion, compared with $1.3 billion a year ago. Analysts were forecasting $1.55 billion in operating profit and $58.94 billion in revenue.

Shares, which fell a tiny fraction of 1 percent in regular trading, to $972.43 a share, shot up nearly 8 percent in after-hours trading. Update: In trading Friday, shares were rising more than 12 percent. “The bottom line is that AMZN is firing on all cylinders,” Macquarie Capital (USA) Inc. analyst Ben Schachter wrote in a note to clients. “We continue to believe that it will be the largest company in the world (perhaps sooner than expected).”

As for Google Inc. owner Alphabet Inc., its cloud revenue remains a tiny part of its overall revenue, and it doesn’t break out numbers separately. But its “other revenues” category, which includes cloud, Google Play apps and hardware, rose 40 percent, to $3.4 billion.

As for Google Inc. owner Alphabet Inc., its cloud revenue remains a tiny part of its overall revenue, and it doesn’t break out numbers separately. But its “other revenues” category, which includes cloud, Google Play apps and hardware, rose 40 percent, to $3.4 billion.

“We continue to make progress winning over enterprise customers,” Google Chief Executive Sundar Pichai said on the earnings conference call. In one sign of the level of that effort, Google said the biggest increase in its headcount, which rose from just under 70,000 a year ago to a little over 78,000 today, came in the cloud business as the company hired more technical and sales talent.

“We are seeing strong momentum” in the cloud, he added. But he conceded that despite hiring more salespeople internationally, “the main area we need to get better is to scale our go-to-market.” Another way besides direct selling Google aims to do that is with partnerships, such as the one it announced Wednesday with Cisco Systems as well as earlier ones with Pivotal and VMware Inc. and SAP SE.

Overall, Alphabet’s revenue rose 24 percent from a year ago, to $27.77 billion. It earned a profit of $6.73 billion, up 33 percent, amounting to $9.57 a share. Wall Street analysts, 34 out of 40 of whom had buy ratings on the shares to six holds and one sell, were forecasting a profit of $8.34 a share on revenue of $21.95 billion.

Of course, the vast majority of those revenues stem from Google’s advertising business, both search and a surging YouTube. But that’s what allows Alphabet to invest in new growth businesses. “With these businesses driving that much growth, GOOGL is free to invest in Cloud, Play, hardware, and its Other Bets (combined they generate just 15 percent of revenue, growing at 40 percent),” Schachter wrote.

Some analysts expressed some worries about rising costs. “Content and data center costs are also continuing to rise faster than revenues, up by +25% in the quarter,” Pivotal Research Group senior analyst Brian Wieser noted in a report to clients.

Regardless, Alphabet’s shares rose more than 3 percent in after-hours trading after closing flat in regular trading at $991.42 a share. Update: Investors were even more enthusiastic, pushing shares up nearly 6 percent in Friday morning trading. The stock is up more than 25 percent on the year after hitting a record high of $1,016.31 last week.

Alphabet’s “Other Bets,” which includes Waymo and Google Fiber, among other things, grossed $302 million in revenue, up 53 percent. But it continued to lose big bucks, some $812 million on an operating basis, down somewhat from last year’s $861 million deficit.

Microsoft, whose fiscal first-quarter SiliconANGLE reported on separately, also saw the cloud increasingly drive its business. CEO Satya Nadella said the company’s commercial cloud revenue, as promised previously, is running at a $20 billion annual clip.

THANK YOU