Coinport makes transparency its business

![]() Before the demise of Mt.Gox, it was the most popular and widely used Bitcoin exchange, which makes what happened to it all the more surprising. Of course hackers were blamed for the collapse of its system, but there were reports that its CEO was living quite a luxurious lifestyle and was probably using his clients’ money to support this. The main point is, Mt.Gox collapsed because it lacked transparency.

Before the demise of Mt.Gox, it was the most popular and widely used Bitcoin exchange, which makes what happened to it all the more surprising. Of course hackers were blamed for the collapse of its system, but there were reports that its CEO was living quite a luxurious lifestyle and was probably using his clients’ money to support this. The main point is, Mt.Gox collapsed because it lacked transparency.

When you transact on exchange markets, you trust your money will be safe and protected. But what if other exchanges are as shady as Mt.Gox? Dipping their hands into funds they’re not supposed to access? After what happened in Mt.Gox, people might find it hard to trust exchange markets as they don’t really know what’s happening behind the curtains.

This uncertainly towards exchange markets and digital currencies is what Daniel Wang aims to diminish with Coinport, a new exchange market that promises complete transparency.

Coinport started as a cryptocurrecny exchange market catering to merchants but because of all the negativity Bitcoin was being tied to and the demise of Mt.Gox, the concept of a transparent exchange market was born.

“When I look at [existing Chinese exchanges], they are very big right now, their transactions are maybe over 10,000 BTC in China. But I doubt the numbers are true. They have a common problem, the problem is about trust. Why do I need to trust them? […] If they keep running smoothly, that’s probably fine. But there may be a problem one day. It’s just like something happening to Mt. Gox.”

Coinport recently launched, and is now catering to Bitcoin, Litecoin, Dogecoin, BlackCoin and DarkCoin, and Wang stated that fiat deposits will be introduced in two months.

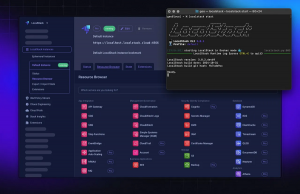

What makes it different from other exchange markets is that it offers a view a of the service’s funds, this means people will be able to see how much funds Coinport has in reserve as well as how much customer funds there are.

At the time of writing, customers’ Bitcoins were valued at 13.88, while Coinport’s reserve was 13.89. What this means is that if customers decided to withdraw all their funds simultaneously, Coinport’s reserve will be able to cover it all, and will still have some Bitcoins left.

Critics might scream that Coinport’s reserve could just be made up, but there is proof-of-reserves test that can be performed to satisfy anyone who’s concerned enough. Coinport aims to make the test one of its essential features, something that will make it more trustworthy to its customers.

Coinport also has a proof-of-reserves page where all its customers’ wallets, anonymized wallets, and transactions can be publicly viewed and updated every few hours.

When they introduce fiat deposits, Wang claims that Coinport will allow its customers to check on the company’s bank account’s balances using a public login to the bank’s system. Coinport will also publish a daily certificate endorsed by the bank showing its account balance. All of these measures will be put in place so people will have no problem in trusting it with their money.

Coinport is using a bank in Hong Kong as banks in mainland China are not very fond of Bitcoin, despite the government’s recent leniency towards it. Wang noted that even huge Chinese companies are not leaning towards accepting Bitcoin because of the mistrust coming from the Chinese banks.

Despite this, Wang believes that China will soon start to see Bitcoin and other digital currencies in a new light, especially when other countries are starting to utilize it more and accepts it as a viable form of currency.

“I believe China will follow the US, UK and Canada,” he said. “China will not say no to bitcoin if it is defined as legal property or currency in developed countries. We just need patience, we need time.”

photo credit: btckeychain via photopin cc

A message from John Furrier, co-founder of SiliconANGLE:

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU