NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

An employee of the now-defunct Bitcoin mining firm GAW Miners has been subpoenaed as part of an ongoing investigation as to whether the company, along with related entities, were nothing more than a Ponzi scheme.

The U.S. Securities and Exchange Commission (SEC) filed the subpoena August 14 targeting Carlos Garza, a former employee of GAW Miners and brother of Founder and Chief Executive Officer Josh Garza, to answer questions as part of its ongoing investigation.

Of note, one report suggests that the whereabouts of Josh Garza is also currently unknown, and the Feds may also wish to speak to Carlos Garza as to whether he knows where his brother may be currently hiding out.

The subpoena specifically requires Carlos Garza to answer questions in relation to the company’s activities, something he failed to do when appearing before SEC lawyers in Boston last week for 90 minutes of questioning.

According to Ars Technica, during that questioning Carlos not only refused to answer almost every question, but he provided the same answer, nearly verbatim each time:

I’m very scared. I don’t understand, these type of questions, this type of law at all. I want to help, but l’d have to have an attorney present. I can’t afford one at this time, but if I were to get appointed counsel, or retain counsel, then I’d absolutely come back and help.

Garza is still able to invoke his Fifth Amendment rights against self-incrimination, however if he fails to invoke those rights he will be required to respond to questions asked, whether he has a lawyer present or not.

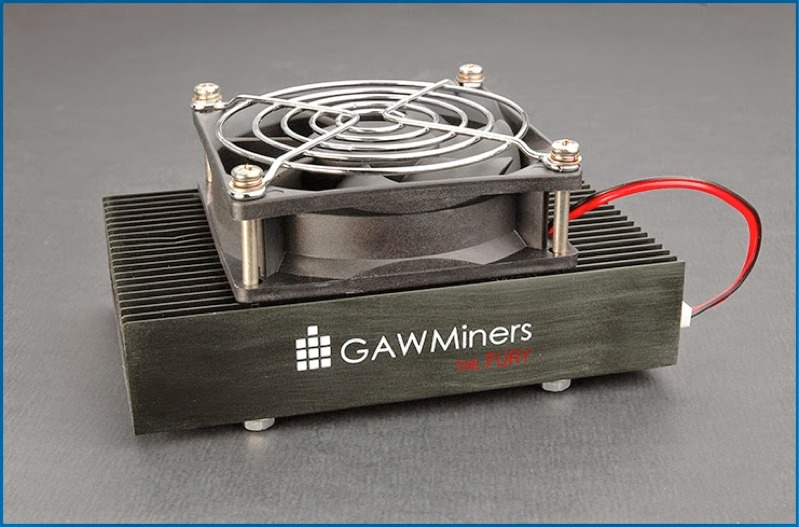

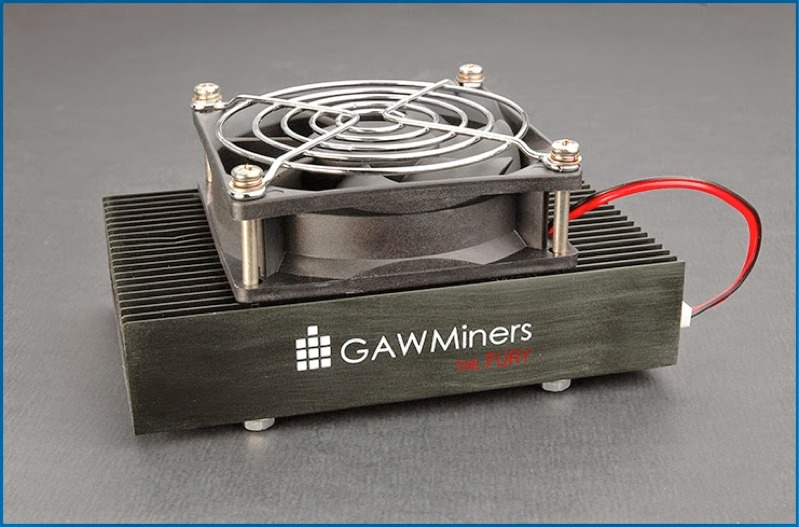

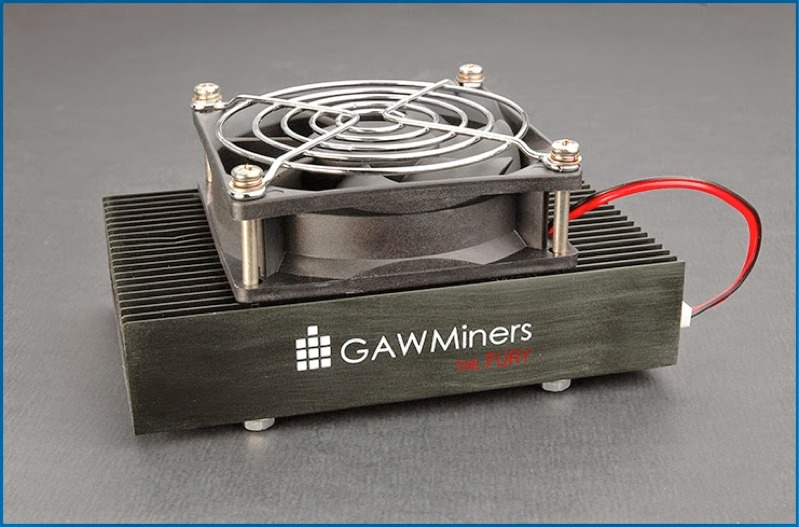

Issues with GAW Miners and related subsidiaries including Paybase and the altcoin Paycoin first emerged in January this year when it was reported that the SEC had launched an investigation into the firm.

By March, the company was in dire trouble, with Paybase ceasing withdrawals to customers.

As we noted at the time, Josh Garza was already in the spotlight for a range of dubious claims, including an allegation that GAW Miners lied about acquiring zenMINER for $8 million; that he had lied about having relationships with the likes of Amazon to accept Paycoin, and a long expose from Coinfire in early March uncovered a range of allegations about Garza personally and his network of companies.

Paycoin itself was launched with promises of greatness, but its value literally dived off a proverbial cliff despite a guarantee from the Paybase that they would guarantee a floor of $20 per Paycoin; when it ceased trading it had a market value of $0.002.

The SEC is claiming among other things that GAW Miners never actually undertook any Bitcoin mining, and initial returns from both its mining operation and Paycoin were all funded by customers buying into the scam.

A full copy of the SEC subpoena as follows.

Securities and Exchange Commission v Garza

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.