NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

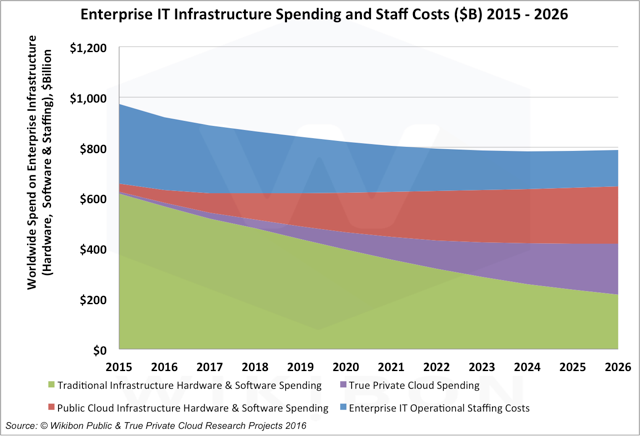

Public cloud infrastructure-as-a-service (IaaS) is 3.5 times the size of the true private cloud market, based on Wikibon’s recently released “Private Cloud Market Sizing and Forecast for 2015-2026” (premium subscription required for full report). Given that internal IT organizations increasingly compete with public sites such as Amazon Web Services LLC (AWS) and Microsoft Azure, why is the uptake of true private cloud happening so slowly? asks Wikibon Cloud Analyst Brian Gracely in his latest Professional Alert.

Gracely finds several reasons for the lag. First, some CIOs still confuse cloud with virtualization. Virtualization is important, but it’s focused on automating management of IT infrastructure and its ROI is basically from cost savings in the IT budget due to increased utilization of servers in particular and from freeing technicians from constant manual re-optimization of the infrastructure to focus on higher-value tasks.

Cloud, in contrast, provides developers and end-users with direct access to the IT services, including applications via software-as-a-service (SaaS), on demand. One of the reasons AWS has been so popular with developers, for instance, is that coders can dial up virtual machines in minutes on a credit card as they need them and then shut them down again when finished. SaaS is becoming the preferred location for stable applications largely because end-users can gain immediate access, eliminating the lengthy delays in implementing and managing those applications in-house. As a result shadow IT, a term that once meant power users helping fellow employees with PC applications, now has come to mean the wholesale replacement of internal business applications with SaaS contracted not by the CIO but by business leaders.

A second reason for the slow uptake of true private cloud is that many vendors do not yet provide a platform that can duplicate what is available in the public cloud. One reason is that cloud management is not a high-revenue business or a high-priority IT focus. The leading independent automation frameworks – Chef Software Inc., Puppet Labs Inc., etc. – generate $100 million or less in annual revenues, Gracely notes. Several cloud management startups have been acquired by larger players such as Red Hat Inc., EMC and Dell Inc., but because IT organizations haven’t made these tool sets a high priority, vendors haven’t either. One reason IT organizations are not excited by cloud management is because it requires development of a new set of skills. In contrast, these features are embedded in public cloud offerings, embedded behind self-service portals and programmable APIs.

Another problem is that many of the services offered to end-users by public cloud organizations, such as database-as-a-service, data management, elastic load-balancing and auto-scaling are managed internally by groups outside the IT organization. Therefore they haven’t been a priority for delivery as-a-service directly to users. The availability of such services in private clouds has been a significant factor in the expansion of shadow IT in many organizations.

Another problem is that IT organizations often focus their private cloud projects on common, standard business applications such as Oracle databases or Microsoft Sharepoint. But these mature core business applications are exactly the primary targets for software-as-a-service, which makes it difficult for internal IT to develop a ROI for keeping them in-house.

This leaves in-house software development as the primary value of private cloud, Gracely writes. But this puts internal IT in direct competition with the online platform-as-a-service providers, including AWS, Azure and IBM Bluemix. And most of that new software will be focused on public cloud implementation. That means that to compete, the private cloud has to provide services that duplicate those offered by the public cloud platforms.

User expectations for IT have shifted. Users now expect their internal IT organizations to be as flexible and responsive as SalesForce.com and AWS – available on demand when needed with the desired capabilities. When it isn’t, users are increasingly likely to get out their corporate credit cards and sign up for a public service that is. To compete, therefore, IT needs what Wikibon calls “true private cloud” which provides the same end-user focused services and direct availability that their users find in the public cloud.

CIOs and IT organizations building private clouds need to set the bar higher for services delivered to business users, Gracely writes. Wikibon’s true private cloud model stresses strong alignment with public cloud services. The true private cloud framework allows IT to reduce costs and focus less on non-differentiated infrastructure capabilities while allocating more time and resources to application-level services that can differentiate the business.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.