NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Business intelligence vendors are embracing high-performance execution frameworks like Apache Spark en masse in a bid to address the growing demand for real-time analytics. But the data visualization subsegment is still largely stuck in the batch processing era, which is creating a rift that Zoomdata Inc. hopes to bridge with the help of the $25 million investors poured into its coffers this week.

Chief executive Justin Langseth said that much of the capital will be used to fund the development of new features for its namesake dashboarding platform. And more specifically, functionality requested by Goldman Sachs Group Inc., the main contributor to the startup’s new round. TechCrunch reports that the relationship between the two began eight months ago when representatives of the financial services giant spotted Zoomdata’s booth at Spark Summit 2015 in New York.

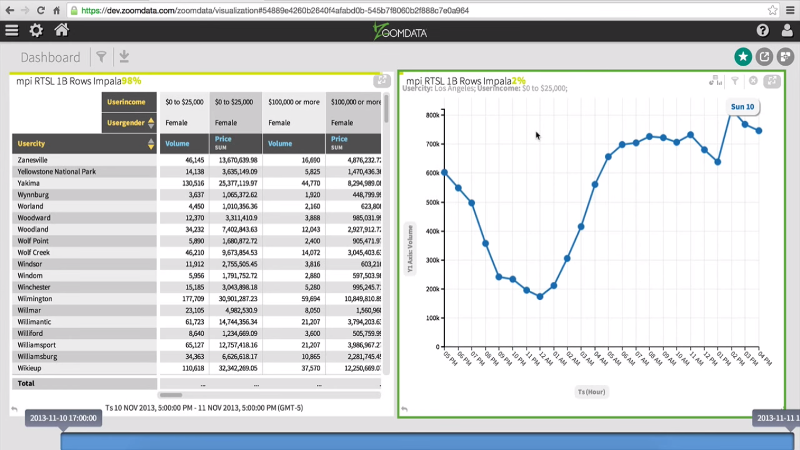

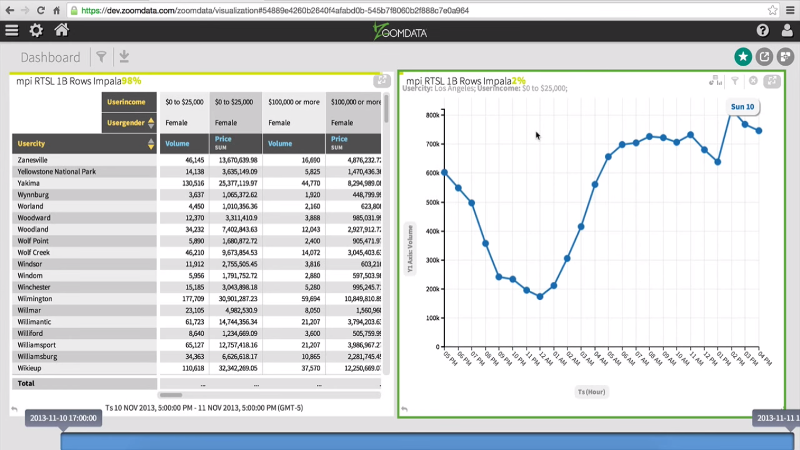

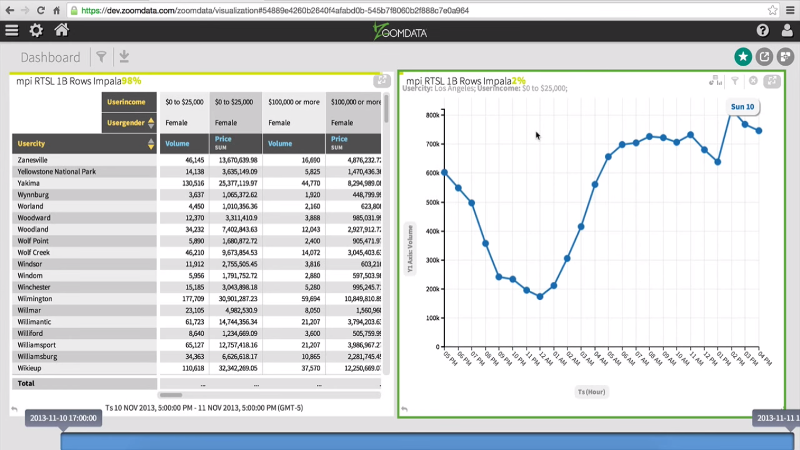

The startup was demonstrating the query execution technology at the heart of its platform, which handles business information similarly to how a browser deals with large images. Instead of trying to visualize a user’s entire dataset in one big swoop, Zoomdata processes one small subset at a time, slowly fleshing out the graph as more metrics are parsed. The approach removes the need to wait on an action to complete before proceeding to the next step of the analysis, a shortcut that can save an immeasurable amount of time for enterprises with a lot of records to work through.

Zoomdata’s focus on speed also makes its platform well-equipped to handle streaming data like social interactions. The software packs a dedicated workbench for processing such fast-moving information that enables analysts to see how their visualizations evolve in real-time and rewind the clock in order to trace trend lines. It’s even possible to change the speed at which the timeline progresses for easier viewing.

A few months after stumbling across Zoomdata’s booth, Goldman Sachs officially became a paying customer. It’s one of more than 30 organizations that adopted the startup’s platform in the past year, a roster that also includes other big names such as Cisco Systems Inc. and Deloitte Touche Tohmatsu Ltd. The new functionality that will be developed using the capital from this week’s funding round should help grow the list even further. Overall, the startup has raised $47.2 million in private investment to date.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.